On Monday, all three major US stock indexes rose for the second consecutive session, returning some of the losses incurred during the two previous weeks. The Dow Jones Industrial Average grew by 1.7% to 24601.00 points, the S&P500 - by 1.4% to 2,666.00 points, the Nasdaq Composite rose 1.6% to 6981.00 points.

Earlier in the US, and after and in all world stock markets, there was a sharp collapse in the indices. So, S&P500 lost over 5% last week due to signs of strengthening inflation and higher yields on government bonds, and the volatility index CBOE, or VIX, rose by almost 70% in the whole week, jumping to a mark of 50.00, a record high after the crisis of 2008.

The risks of a more rapid monetary policy tightening on the part of the Fed on the background of expectations of increased inflation provoked fluctuations in the stock markets over the past two weeks. Investors were also alarmed by the growth in the yield of US government bonds. Thus, the yield on 10-year US bonds on Monday reached new absolute highs near the 2.900% mark, the maximum values for the last four years. The increase in bond yields in early 2018 was one of the reasons for the decline in world stock markets. Profitability can grow even more on the background of the normalization of monetary policy and the further strengthening of the world economy. The growth of yield of government bonds facilitates the task of the Federal Reserve to raise interest rates. The stock market would quietly transfer one or two rate hikes. Last year, the former head of the Federal Reserve, Janet Yellen, stated that an increase in the interest rate alone is not enough to turn the bull stock market, but that would be another confirmation of the strength of the US economy.

Now buyers of risky assets of the stock market are confused, as a faster rate increase could slow or stop further growth of stock indices. Investors are still cautious after the sharp sales observed last week, and world stock markets are falling again on Tuesday.

Nevertheless, US stock indices are above critical support levels. Despite the fluctuations, last week created opportunities for profitable purchases, according to optimistic investors. The principle of "buy on the rumor, sell on facts", it seems, can work and this time. At least, it has already worked in part - "sell on facts".

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

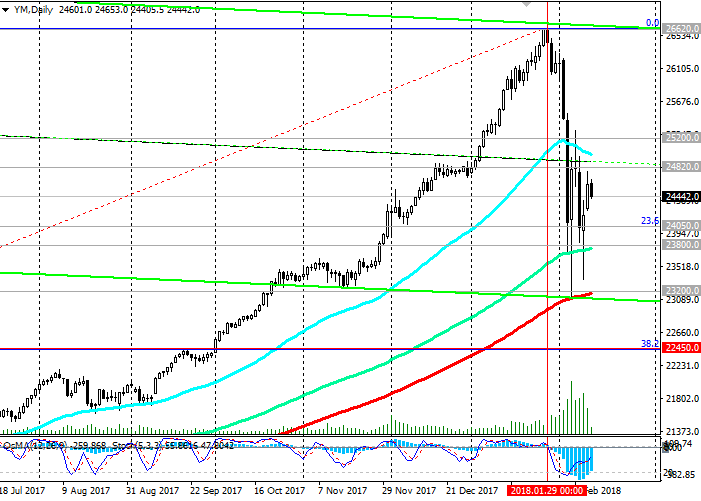

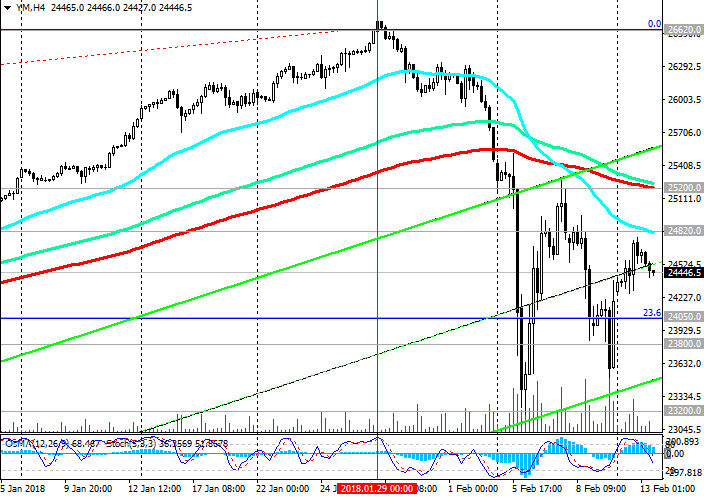

Support levels: 24050.0, 23800.0, 23200.0,

23000.0, 22450.0

Resistance levels: 24820.0, 25200.0

Trading Scenarios

Buy Stop 24970.0. Stop-Loss 24240.0. Take-Profit 25200.0, 26600.0

Sell Stop 24240.0. Stop-Loss 24970.0. Take-Profit 24050.0, 23800.0, 23200.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com