EUR/USD: The ECB is concerned about the strengthening of the euro

Despite the decline in the dollar, the pair EUR / USD remains under pressure (so far in the short term). Published on Thursday, the minutes of the July meeting of the ECB pointed out that the central bank is concerned about the strengthening of the single European currency this year.

"There were fears about the risk of excessive growth of the euro in the future", - so it was said in the minutes.

The strengthening of the Euro-currency negatively affects the economy of the Eurozone, as it makes European goods less competitive abroad. Weak rates of inflation in the Eurozone also contribute to the ECB's prolonging the stimulus program for the Eurozone economy for at least six months.

As you know, the program QE in the Eurozone ends in December. Despite the fact that the Eurozone economy shows signs of stable growth, which is also due to the ECB, which pursues an extra soft monetary policy, inflation is still far below the target level of the ECB just below 2.0%.

At the same time, the dollar also remains under pressure after the minutes published on Wednesday from the July Fed meeting. Investors continue to assess the prospects for an increase in the Federal Reserve's key interest rate in December with a probability of below 40%.

The leadership of the US central bank still can not unanimously decide to raise rates in conditions of slow inflation. And this is a negative factor for the dollar.

Thus, the EUR / USD pair is currently in the grip of the need to maintain a low interest rate in the Eurozone and the Fed's hesitancy in the matter of monetary policy, which makes both currencies vulnerable from this point of view.

The US dollar, meanwhile, declined during the Asian session and at the beginning of the European session.

If we consider that today is the last trading day of the week, then in the second half of the US session, we should expect some strengthening of the US currency against the background of closing short positions on the dollar and fixing profits.

The news background is calm today. Volatility may intensify at the beginning of the US trading session, when at 12:30 (GMT) the consumer price index (CPI) in Canada (for July) is published.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

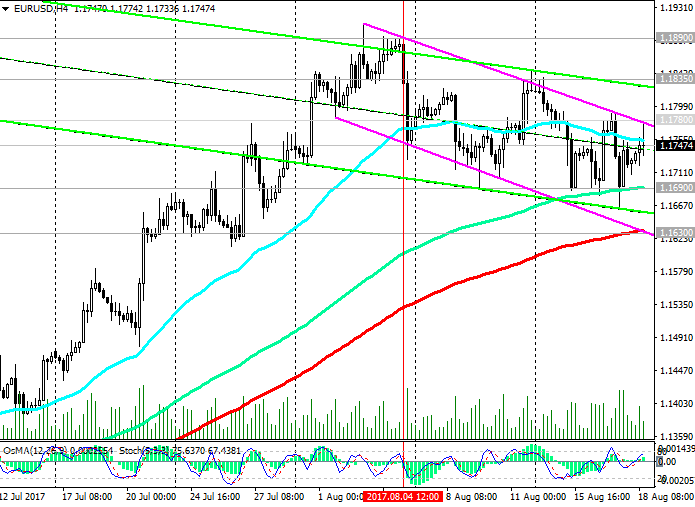

The pair EUR / USD is in a downward correction short-term trend since the beginning of August, when strong data was published from the US labor market.

Repeated attempts to test the support level 1.1690 (EMA144 on the 4-hour chart) have not yet led to its breakdown.

If the EUR / USD decline continues, the breakdown of the support level 1.1630 (EMA200 on 4-hour and weekly charts) will strengthen the risks of a return to the downtrend.

However, only in case of breakdown of the support level 1.1150 (EMA200 on the daily chart) will EUR/USD return to a downtrend.

Indicators OsMA and Stochastics do not give a clear signal.

In the alternative scenario and after the breakdown of the local resistance level 1.1780 (the Fibonacci retracement level of 38.2% of the corrective growth from the lows reached in February 2015 in the last wave of the global decline from 1.3900), the EUR / USD is likely to strengthen further. The growth targets will be the levels of 1.1835, 1.1890 (the highs of the year), 1.1950, 1.2050, 1.2180 (50% Fibonacci level).

Support levels: 1.1690, 1.1630

Resistance levels: 1.1780, 1.1835, 1.1890, 1.1910, 1.1950, 1.2050, 1.2180

Trading Scenarios

Sell in the market. Stop-Loss 1.1785. Take-Profit 1.1690, 1.1630, 1.1600, 1.1550

Buy Stop 1.1785. Stop-Loss 1.1710. Take-Profit 1.1835, 1.1890, 1.2000, 1.2050, 1.2100, 1.2180

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com