Trading recommendations

Sell in the market. Stop-Loss 0.7340. Take-Profit 0.7275, 0.7240, 0.7100, 0.7075, 0.6975, 0.6930, 0.6900

Buy Stop 0.7340. Stop-Loss 0.7290. Take-Profit 0.7380, 0.7485, 0.7550

Technical analysis

Against the background of high volatility in financial markets associated with the publication of the first results of the US presidential election, the US dollar fell sharply against European currencies and the safe-haven assets, but rose against the commodity currencies, including in the pair NZD / USD.

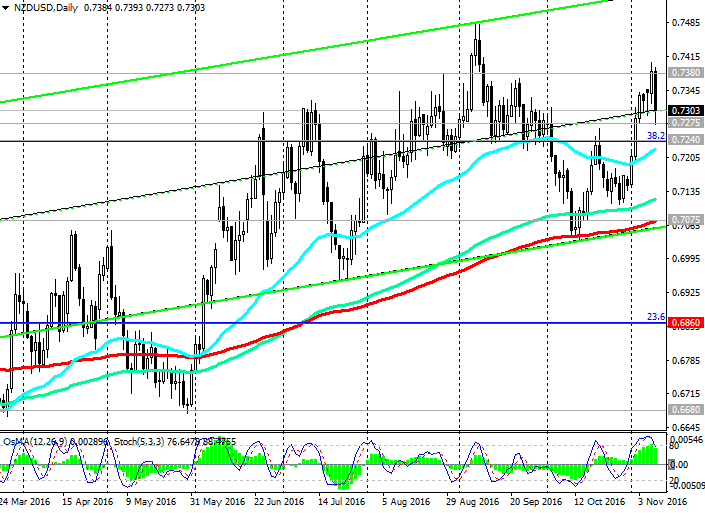

The pair NZD / USD declining today with the opening of the trading day by more than 110 points, finding support at 0.7275 (EMA200 the 1-hour chart, EMA144 on the weekly chart).

During the Asian session the pair NZD / USD slightly corrected, entrenched by about 30 points, and at the beginning of the European session, trading near the 0.7300 mark.

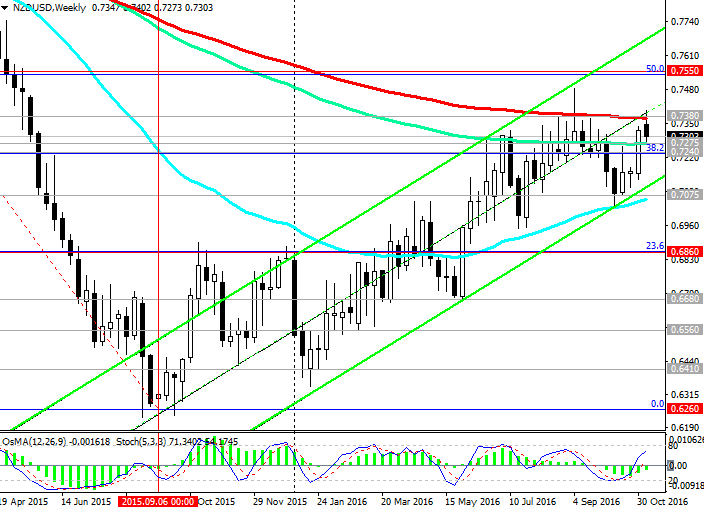

Earlier, at the beginning of the month against the backdrop of strong rising momentum generated by the positive macro data from New Zealand and improve the situation of dairy products on the world market, the pair NZD / USD rose sharply, breaking through key resistance levels 0.7240 (38.2% Fibonacci level of upward correction to the global wave reduction pair from the level of 0.8800, which began in July 2014), 0.7275 (EMA144 on the weekly chart).

Despite today's decline, the pair NZD / USD remains inside the rising channel on the weekly chart, the upper limit of passing above the resistance level 0.7550 (50.0% Fibonacci level).

OsMA and Stochastic indicators 1-hour, 4-hour and daily charts defected to the sellers.

If the price falls below 0.7275, there is likely to develop a downward correction to support level 0.7240 (38.2% Fibonacci level). Break of this level will increase the downward trend and send a pair NZD / USD support levels 0.7075 (EMA200 on the daily chart, EMA50 and lower line of the rising channel on the weekly chart).

In the case of a confirmed break of resistance level 0.7380 (EMA200 on the weekly chart) increase the risk of further growth of pair within the limits of the rising channel on the weekly chart. While the pair NZD / USD is above the support level of 0.7075, the pair rising dynamics preserved.

Support levels: 0.7275, 0.7240, 0.7195, 0.7100, 0.7075, 0.6975, 0.6930, 0.6900, 0.6860

Resistance levels: 0.7380, 0.7485, 0.7550

Overview and Dynamics

According to the first results of the US presidential election, the victory seems to have the upper Donald Trump. This candidate from the Republican Party won in key states like Florida, North Carolina and Ohio, achieving such success, which no candidate from that party did achieve from 2004.

Trump's victory in the three largest "fluctuating" states brings the chances of candidates.

The first results of the US presidential election rocked financial markets. In response to the information received US dollar fell to Euro-currency and safe haven, such as precious metals, yen, franc, but sharply appreciated against the commodity currencies.

Asian and US stock indexes fell sharply. Japanese Nikkei Stock Average fixed maximum percentage drop since June 24, and ended the day down 5.4% to 16,251.54 points.

The pair NZD / USD dropped to the first reports of a probable victory Trump more than 110 points to the opening of the trading day.

However, during the vote counting dollar is gradually regaining its lost ground against European currencies and the safe-haven assets.

Another important piece of news today will be the decision of the RBNZ interest rate in New Zealand. The decision will be published in the 23:00 (GMT + 3). Prediction - rate will be reduced by 0.25% to 1.75%. Earlier, the RBNZ stated the need for further easing of monetary policy. Current interest rate in New Zealand is 2.0%, is one of the highest in the world among countries with developed economies, which attracts investors and foreign investment in the form of trade "carry-trade".

Positive data

received recently from New Zealand, as well as commodity prices, especially

dairy products, reducing the likelihood that the Reserve Bank of New Zealand

can again reduce the official interest rate today, and perhaps in the 1st half

2017. If the RBNZ will refrain from lowering rates, it can cause severe

strengthening of the New Zealand dollar on the currency market. In any case,

the period of publication of the decision is expected to increase the

volatility of the financial markets, primarily - to trade the New Zealand

currency.

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.