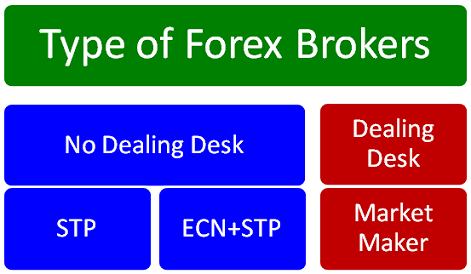

There are so many articles about brokers, market maker and ECN/STP brokers, and liquidity providers and… already published on this site. Although I believe novice traders can read those articles and learn about these important topics, still it seems one more article is needed to explain how to differentiate a market maker from an ECN/STP one.

In the past, most traders knew nothing about the market maker and dealing desk topics, and also true ECN/STP brokers. But now that traders have learned what these systems are, they insist to open their live accounts with true ECN/STP brokers. This has caused many of the market maker brokers to pretend to be an ECN/STP broker, whereas they are market makers behind the scene. How can you verify this before you open a live account with the broker?

Before I answer this question, please let me give a short explanation about market maker and ECN/STP systems.

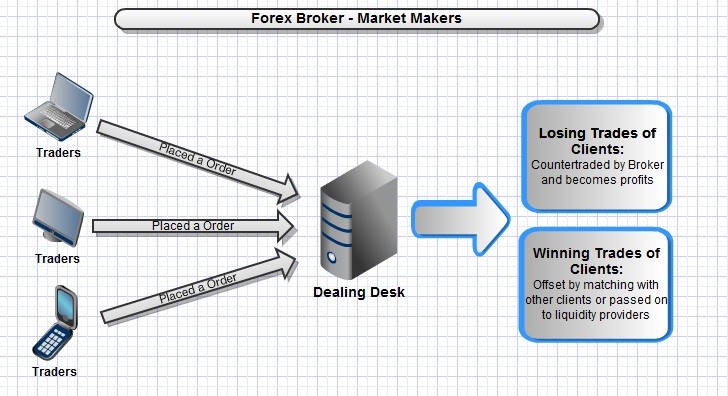

When you open a live account with a market maker broker, indeed you are trading with the broker, not with the real world wide currency market. The market is the broker itself. Although the currency pairs prices are almost the same as the other brokers, on a market maker platform, your orders never go beyond the brokers computers and you trade inside the brokerage firm. So, if you make profit, the broker has to pay it. And, the money you lose goes to the broker’s pocket. It means your profit is the broker’s loss, and vice versa.

Unlike market maker brokers, true ECN/STP brokers just route your orders to the banks that are also known as liquidity providers. They just connect the platform you install on your computer to the liquidity providers computers. They charge you some fees to do that, but they don’t make any money from your losses, nor do they lose if you make profit.

A market maker broker doesn’t become happy if you make profit. A consistently profitable trader is their biggest enemy, because the profit he makes has to be paid from their pocket. Although more than 95% of the traders lose on their own and the broker doesn’t have to make them lose, still most market maker brokers do their best to make the clients lose easier and earn harder.

Unlike market maker brokers, true ECN/STP brokers don’t bother to make the traders lose, because it doesn’t make any difference for them. Indeed, most of them even help their clients to make profit and grow their accounts, because they will stay with the broker longer and will make bigger positions, and this means more money for the broker too.

Therefore, traders prefer to open their accounts with true ECN/STP brokers, because they don’t want to be cheated by the market maker brokers. The problem is, nowadays many market maker brokers claim to be an ECN/STP broker. Some of them even transfer your orders to a so called liquidity provider, but the problem is the liquidity provider is either another market maker brokerage belonged to the same company or a sister company, or, it is a poor bank somewhere in the Pacific Ocean.

That is why I use the term “True ECN/STP” because there are “False ECN/STP” brokers too.

It is not bad and illegal to be a market maker broker. What is bad (or maybe illegal depend on who writes the rules) is trying to make the traders lose. Market maker brokers can make a decent amount of money because more than 95% of the traders lose on their own without having to make them lose. They even lose with the demo accounts too. However, the problem comes when market maker brokers get greedy and try to make more money within a shorter time. So they manipulate all traders’ positions, no matter if they are winning or losing traders. Of course, they do their best to stop the winning traders and make them close their account and leave. However, you are worried about the broker you will want to open your live account with, when you were ready to. Unfortunately, we don’t refer anybody to any broker.

The reason is that past performance is not a guarantee of future results. Even if a broker has been doing well for years, they can change overnight and start cheating their clients, and we will be accused as the referrer too. So, although it makes a lot of money, we prefer not to enter such a game at all. However, still we can educate people to enable them to distinguish between bad (market maker) and good (true ecn/stp) brokers, so they can easily choose a good broker to open their live accounts with, when they are ready to.

The Differences of Market Maker and True ECN/STP Brokers

Fortunately it is not that hard to distinguish between market maker and true ecn/stp brokers, even before opening a live account with them. There are some signs that you have to follow and come to this conclusion whether the broker is a market maker, false ECN/STP or true ECN/STP.

1. Spread:Traders like to pay less spread to make more profit. So, there is a competition among brokers to offer the lowest possible spread to attract more traders. Market maker brokers have full control on the spread. They can offer even zero spread, because everything can be set at their side. False ECN/STP brokers can do that also, because their liquidity providers are usually under their control too. True ECN/STP brokers have no control on the spread, because it is the liquidity provider that charges the spread. True ECN/STP brokers can add markups to the spread, but they cannot take it below what the liquidity provider’s offer.

Therefore, all the brokers who offer a fixed or zero spread are market makers. This is the first signal you have to notice. Spread cannot be fixed on the real currency market. Also, brokers that offer higher than usual spreads are market makers, because nowadays liquidity providers offer very low spread. For example, EUR/USD spread is sometimes even below 0.6 pips. So, a broker that offers the minimum spread of 2 pips or higher for EUR/USD, is either market maker or a cheater ECN/STP that has added to the spread without informing the clients. Commission is the only known legal way for the ECN/STP brokers to make money. Markups and adding to the spread is fraud.

2. Swap:Swap can also be fully controlled by market maker brokers. Indeed, market maker brokers can control everything, from the price, to spread, swap, and market open/close time and..If a broker is offering a swap free account, it is a market maker broker definitely. There is no real liquidity provider that doesn’t charge any swap. It is one of their sources of income that they cannot ignore, because they also have to pay it to the other dealer and organizations they are dealing with. Also, when swap is exceptionally high or low, the broker is market maker.Please note that although swap has a special formula that uses the same interest rate for calculations, different liquidity providers offer different swap, because they can control it.

3. Lot size:I have never seen a real, well-known and strong liquidity provider like Bank of America, Nomura, Goldman Sachs, Deutsche Bank, Citi Bank, JP Morgan, Royal Bank, HSBC and… that supports micro-lots (0.01). Therefore, brokers that offer micro-lots are either market maker, or false ECN/STP.

4. Leverage: 100:1 is the maximum leverage that well-known and strong liquidity providers support. Therefore, all brokers that offer a higher leverage are either market maker or false ECN/STP. Another thing about leverage is that some brokers lower the leverage on weekends. They say they do it to protect the client’s funds, whereas this is nonsense. They do it to make all the accounts that have negative positions, reach the stop out level and get wiped out. Any broker that changes the leverage is market maker or a false ECN/STP. Those are the most important factors that you have to check with the brokers. Hope I have not missed anything here. Please let me know if there is anything else that I have to explain.

5. Scalping: True ECN/STP brokers don’t care how you trade and make money and how early you close your positions. They allow you to scalp and you can do it if the markets allow you to. You can use scalping robots on your platform with true ECN/STP brokers. But market maker brokers are against scalping, because they don’t want you to make small profits. Therefore, they make limits on taking profit and closing the positions. They don’t allow you to close your positions too fast. When you see such limits, you should know that you are dealing with a market maker broker.

6. Stop Loss, Target and Trailing Stop Loss: Market maker brokers have limits on stop loss, target and trailing stop loss size. They don’t allow you to set them too tight. But true ECN/STP brokers don’t care about these things at all.

7. Bonus: Bonus is another important sign that the broker is a true market maker! I see that some brokers offer even a 50% bonus. Do you think a true ECN/STP broker who only makes money through commissions can afford to do this? They cannot afford it even if they make extra money through markups. Stay away from the brokers who offer free bonus. They do it to attract small retail traders who don’t have enough money to open a reasonable account. And, they know that greed will make these trader to lose all. Losing the bonus doesn’t hurt the broker, because it is nothing but a number for a market maker broker. It is only the trader who loses his capital.

8. Negative Balance Protection: It is another trick by some market maker brokers. A true ECN/STP broker deals with real money. If a huge and sudden price movement occurs like the 15th Jan CHF Tsunami, and traders accounts go to negative balance because of having no stop loss or because the stop loss orders could not be triggered, then it is the trader’s responsibility to pay for the negative balance. It is your account and you are the one who have lost money, because of the currency you have been trading.

However, I have never seen that brokers prosecute retail traders for their negative balance, because if they say in advance that it is the trader who has to pay for a negative balance, then no trader dares to sign up for an account, because not only you can lose your trading capital, but you have to pay extra for the negative balance. As far as I know, true ECN/STP brokers take the responsibility themselves and pay the negative balance to the liquidity providers. They have to shut down the brokerage if they cannot do it, and they are the one who will be prosecuted by the liquidity providers.

With the market maker brokers, a billion dollar negative balance on a live account is the same as a billion dollar loss on a demo account. Do you pay any money to the broker when you blow up your demo account? Definitely not. You just sign up for another demo account. Then why do some market maker broker offer “negative balance protection”?

This is to deceive the traders. They want the traders to feel safe. Traders don’t know what is behind the scene. So, they prefer to sign up for an account with a broker that offers negative balance protection, whereas they don’t know that such a broker is a market maker who makes them lose, but the other broker who cannot offer negative balance protection is a true ECN/STP that becomes even happier if the clients make money.

Good luck 🙂