USD/JPY Outlook Hinges on Fed Rhetoric; 104.20 Hurdle Remains Intact

18 October 2016, 17:59

0

107

USD/JPY Outlook Hinges on Fed Rhetoric; 104.20 Hurdle Remains Intact

Talking Points:

- NZD/USD Tackles Former Support Following New Zealand CPI, Rising Dairy Prices.

- USD/JPY Resilience Hinges on Fed Rhetoric; 104.20 Hurdle Remains in Focus.

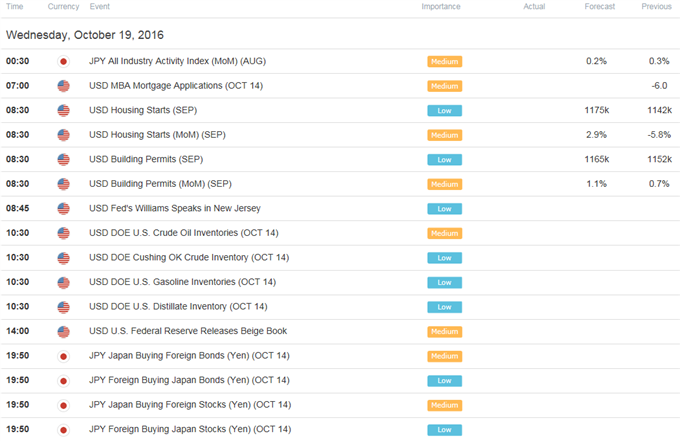

Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

NZD/USD | 0.7200 | 0.7214 | 0.7130 | 66 | 84 |

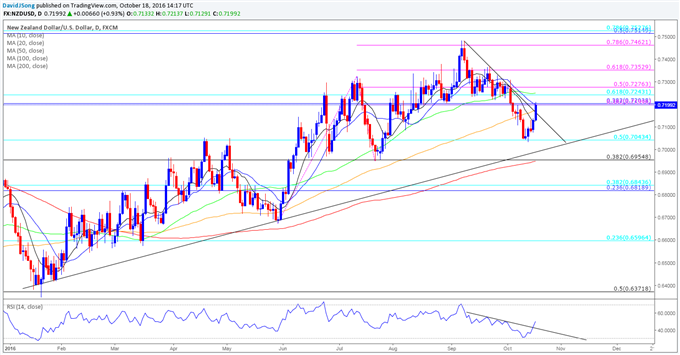

NZD/USD Daily

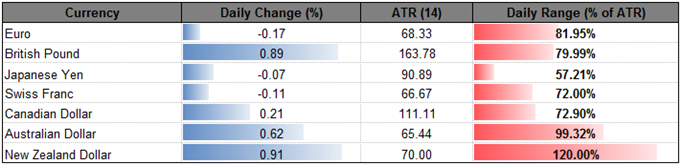

- TheNew Zealand dollarcontinues to outperforms its major counterparts following the region’s stronger-than-expected 3Q Consumer Price Index (CPI), while Whole Milk Powder prices increased 2.9% at the Global Dairy Trade Auction; may see NZD/USD extend the advance from earlier this month as price & the Relative Strength Index (RSI) appear to be breaking out of the bearish formations carried over from September.

- Despite the uptick in price growth, it seems as though market participants are unconvinced the CPI reading will alter the course for monetary policy as Overnight Index Swaps (OIS) highlight an 80% probability for a rate-cut at the Reserve Bank of New Zealand’s (RBNZ) last 2016 interest rate decision on November 10.

- A close back above former support around 0.7200 (38.2% retracement & expansion) may open up the next topside target coming in around 0.7240 (61.8% expansion) followed by 0.7280 (50% expansion), with near-term support siting at 0.7040 (50% retracement).

Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

USD/JPY | 103.98 | 104.2 | 103.68 | 9 | 52 |

USD/JPY Daily

- The narrowing range in USD/JPY may ultimately give way to a larger advance as the pair preserves the upward trend carried over from the previous month, but the string of failed attempts to close above the 104.20 (61.8% retracement) hurdle raises the risk for a larger pullback as the near-term resilience in the exchange rate appears to be getting exhausted.

- Even though Fed Funds Futures continue to highlight a greater than 60% probability for a December Fed rate-hike, fresh comments from San Francisco President John Williams, Dallas Fed PresidentRobert Kaplan, New York Fed President William Dudley and Fed Governor Jerome Powell may boost the appeal of the greenback as central bank officials appear to be taking a more collective approach in preparing U.S. household and businesses for higher borrowing-costs, but the downward revisions in the growth outlook may lead to a further reduction in the long-run interest rate forecast especially as the committee warns ‘survey-based measures of longer-run inflation expectations were little changed, on balance, while market-based measures of inflation compensation remained low.’

- Need a close above 104.20 (61.8% retracement) to open up the next topside target around 105.40 (50% retracement), but a move below 102.70 (38.2% retracement) paired with a break of trendline support would raise the risk of seeing a move back towards the September low (100.08).

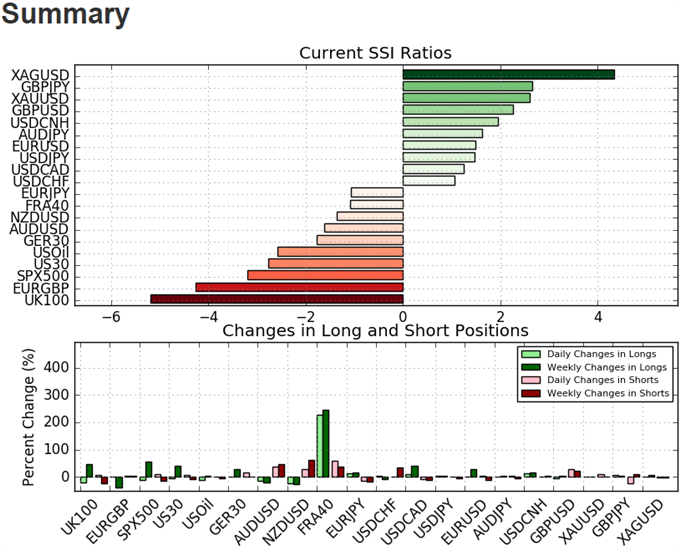

- The DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-long USD/JPY since July 21, with the ratio hitting a 2016 extreme of +6.03 in September, while traders have flipped net-short NZD/USD following New Zealand’s 3Q CPI report.

- NZD/USD SSI currently sits at -1.38 as 42% of traders are short, with short positions 49.9% higher from the previous week, while open interest stands 1.1% above the monthly average.

- USD/JPY SSI currently sits at +1.47 as 59% of traders are long, with long positions 6.8% higher from the previous week, while open interest stands 10.0% below the monthly average.

- Will keep a close eye on market participation as open interest remains rather light.