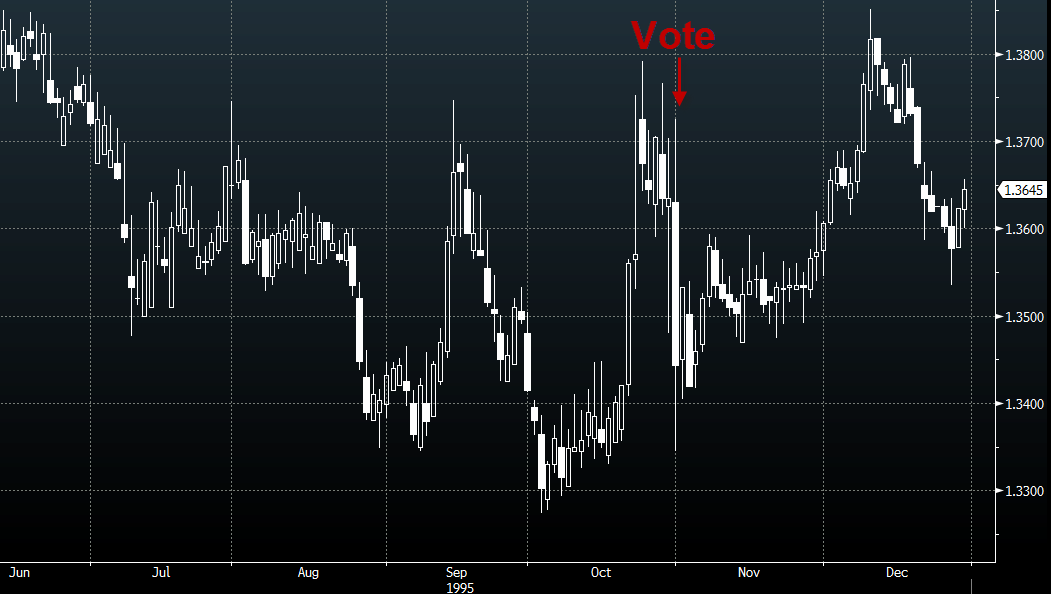

Another referendum shows how the FX market has completely morphed in the past 20 years

In 1995, Canada's referendum hardly budged the currency market

Picture this:

Imagine Brexit referendum polls had shown a massive swing towards the Leave side in the final two weeks of the campaign. Two weeks earlier the Remain side was comfortably ahead but then the Leave side surged ahead 47% to 41%.

Then picture watching television and the votes starting to come in and showing the Leave side ahead, fractionally. They remain ahead with more than 60% of the votes counted. Then as the final numbers roll in, the Remain side ekes out a 50.58% to 49.42% win, which was in dispute for hours.

That's exactly what happened in the Quebec separatism referendum.

Separatists were in the lead midway through the vote.

Yet despite all the twists and turns in those two weeks, the low-to-high swing in USD/CAD was about 3%, not even half of the Brexit volatility.

The economic consequences would have been hardly imaginable. Quebec was 25% of GDP population and would have made a huge hole in the middle of the country.

What has changed?

The EU referendum is hugely overrated. Even if Britain files an Article 50 notice tomorrow, there is a two year negotiation period on leaving and all the trade treaties would be renegotiated in that period and left largely unchanged, despite the threats from EU countries.

Yet the FX volatility is huge and if anything resembling a Leave vote emerges at any point, the moves would be breathtaking.

The big changes are liquidity, easy access to markets and information. Anyone around the world can open a forex account and trade GBP with the click of a mouse. Everyone can get the news as quickly as someone in London. That kind of access is touted as a cure-all but when fear and uncertainty are swirling, the negatives can outweigh the positives.