Current trend

The GBP/USD strengthened significantly, supported by strong labor market statistics, released in the UK on Wednesday. From May to July, Average Earnings including Bonus grew by 2.9%, compared to the same period last year. It is the highest growth for the last 6-1/2-years. Analysts, in their turn, expected a slowdown from 2.6% to 2.5%. Unemployment Rate declined from 5.6% to 5.5%.

Weak US macroeconomic statistics also supported the GBP: Consumer Price Index declined by 0.1% in August.

Support and resistance

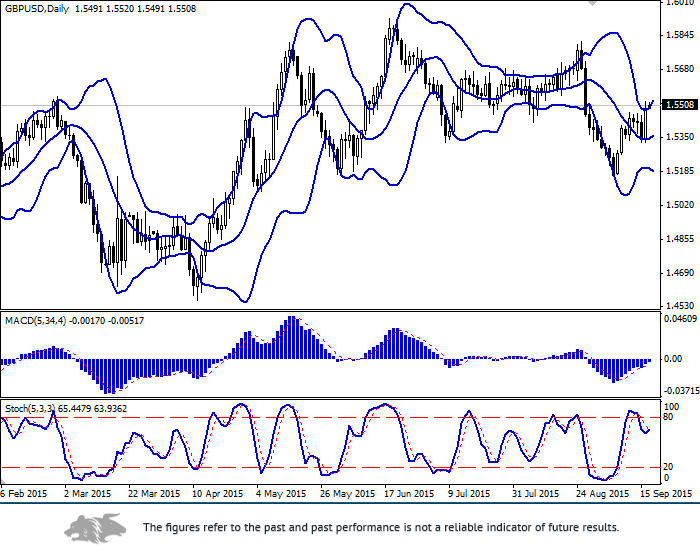

Bollinger Bands on the daily chart is turning up. The price range is widening, however, the price is at the upper MA what indicates a possible decline during a correction at the end of the week.

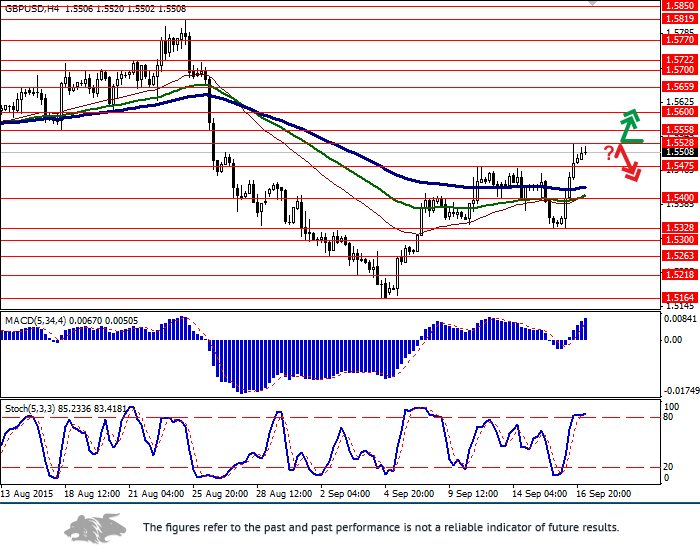

MACD is growing and keeping a strong buy signal. Stochastic is turning up near the border of the overbought zone.

According to the indicators, long positions are preferable; however, a possibility of a decline during a correction should not be overlooked.

Support levels: 1.5475 (used to be a strong resistance level near 10 September high), 1.5400, 1.5328 (15 September local low), 1.5300, 1.5263, 1.5218, 1.5164 (4 September low).

Resistance levels: 1.5528 (16 September high), 1.5558, 15600, 1.5659, 1.5700, 1.5722, 1.5770, 1.5819 (25 August high), 1.5850.

Trading tips

Long positions can be opened after the breakout of the level of 1.5530 with the first target at 1.5600, the second one at 1.5750 and stop-loss at 1.5490.

Short positions can be opened when the pair turns down at the level of 1.5528 with the target at 1.5430 and stop-loss at 1.5540.