Current trend

This week the EUR/USD pair continued moving down amid the recovering demand for the US currency after the Yuan devaluation. During the week, no important macroeconomic publications are expected from the eurozone, thus, the pair dynamics is likely to be determined by US statistics and the situation in Chinese economy and further decline of the Yuan.

On Monday, macroeconomic releases caused a mixed reaction. Thus, positive dynamics in EU Trade Balance (21.9 bln from 21.3 bln euros earlier) failed to support the single currency.

At the same time, negative US statistics were also ignored. NY Fed Empire State manufacturing index dropped from 3.86 to -14.92 against the expected growth to 5.00 points.

Support and resistance

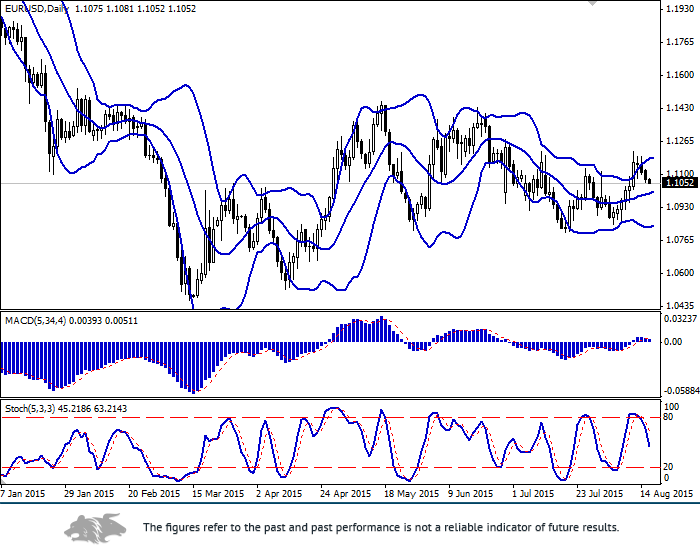

Bollinger Bands on the daily chart continue growing despite the recent downward dynamics. The current decline fits within the “bearish” signal. MACD has turned down and is approaching the zero line. The histogram is below the signal line giving a sell signal. Stochastic is also declining.

The indicators recommend keeping and opening short positions in the short and very short run.

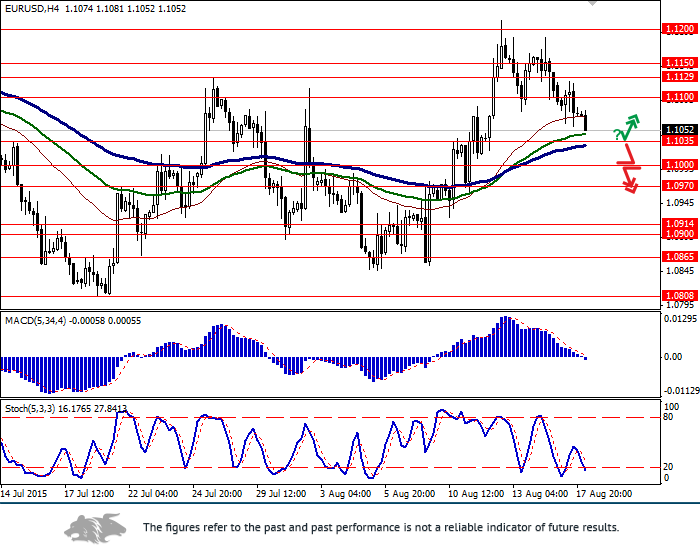

Support levels: 1.1035 (the nearest target), 1.1000 (strong psychological level), 1.0970, 1.0914/00, 1.0865 и 1.0808 (20 July low).

Resistance levels: 1.1100 (the nearest mark), 1.1129, 1.1150 и 1.1200 (near current 12 August highs).

Trading tips

Opens long positions when the pair rebounds from the current suppert levels near 1.1035 (with appropriate indicators signals). Set take-profit at 1.1100, 1.1129, 1.1150 and stop-loss at 1.0970.

Open alternative short positions when the pair breaks down the level of 1.1000 with the target at 1.0900 and stop-loss at 1.1050.