Current trend

On Friday, the AUD managed to strengthen against the USD and reached the local high near the level of 0.7428. The reason for a rising dynamics was poor data on the NFPR from the US and the RBA statement.

At the press conference on Friday, the Reserve Bank of Australia lowered its unemployment level and GDP growth forecasts. The regulator expects the GDP to grow in 2015 by about 2.5-3.5%, against its previous forecasts of 2.75-3.75%. Inflation would stand at 2-3%. In general, despite lowering its forecasts the regulator remains optimistic and considers current monetary policy effective. It also stated that the weakening in the AUD has positive effects on the economy.

Support and resistance

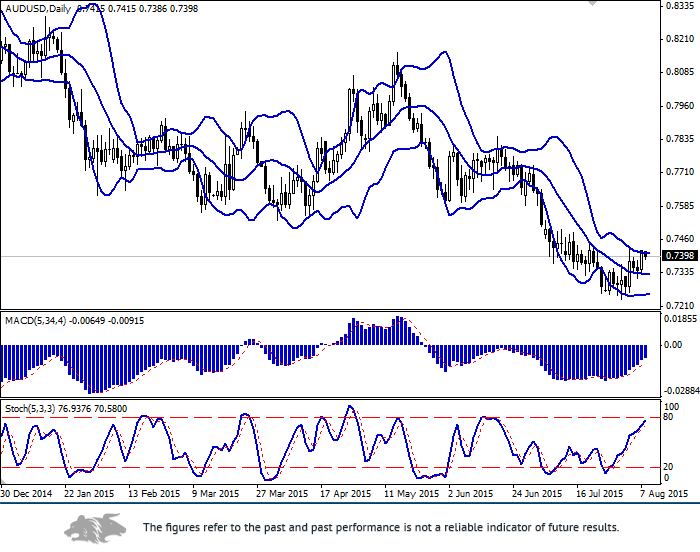

Bollinger Bands on the daily chart remains horizontal and points out to a possibility of the downward correction as the price left the top border of the range. MACD is growing and giving a buy signal. Stochastic is also growing but is reaching the overbought zone, which may indicate the downward correction.

Support levels: 0.7366, 0.7327 (6 August lows), 0.7300, 0.7259, 0.7234 (31 July low).

Resistance levels: 0.7400 (local high), 0.7448 (21 July high), 0.7500, 0.7534 (6 July high), 0.7586, 0.7620.

Trading tips

Open long positions after the breakout and consolidation above the level of 0.7400 (with the appropriate indicators signals) with the target at 0.7500 and stop-loss at 0.7327.

Short positions can be opened after the breakdown of the level of 0.7327 with target at 0.7259, 0.7234 and stop-loss at 0.7400.