Current trend

The pair USD/JPY consolidated near local highs at 124.50.

The USD continues weakening amid approval by the Greek parliament of the reforms needed to continue receiving financial help from the Eurogroup.

On the other hand, the Yen found a support in positive macroeconomic data. On Thursday, Trade Balance stats were published in Japan, which showed a reduction in trade deficit. In May, trade deficit amounted to 69 billion yen, while a month before the deficit stood at 200 billion yen. The pace of exports growth in Japan remains the highest for last half of the year. In May, exports grew by 9.5% against 2.4% for the previous month.

Support and resistance

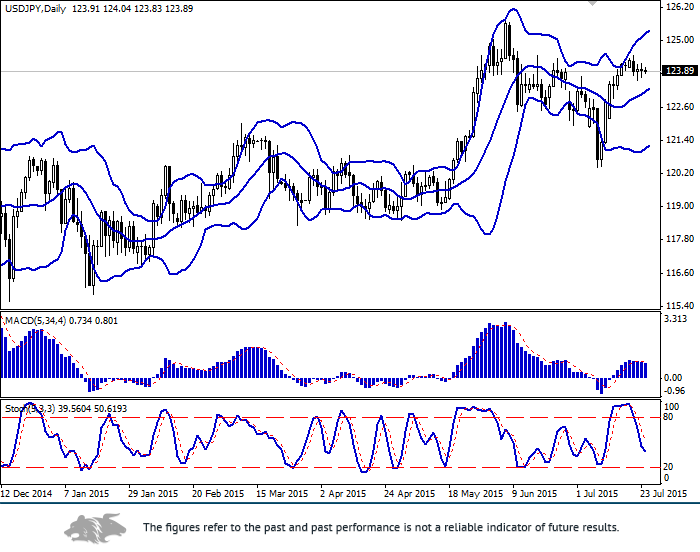

Bollinger bands are facing up. However, the indicator formed a small bearish signal, when the price broke down the lower border on 16 July. MACD is ready to turn down and form a sell signal. Stochastic is signaling sales, but is approaching the oversold zone.

Support levels: 123.56 (lower border of a short-term flat), 123.00, 122.60, 122.00 (psychologically important level), 121.57 (local low), 121.00 and 120.41 (8 July lows).

Resistance levels: 124.00 (local high), 124.17 (upper border of the short-term flat), 124.47 (21 July high).

Trading tips

Open short positions below the level of 124.00 (with appropriate indicators signals) with targets at 123.00, 122.60 and stop-loss at 124.47.

Long positions can be opened after the breakout of the level of 124.47 with the target at 125.50 and stop-loss at 123.56.