Icahn to CNBC: Market extremely overheated. Analysts' data suggests the same

"I think the public is walking into a trap again as they did in 2007," activist investor and chairman of Icahn Enterprises Carl Icahn told CNBC.

"I think it's almost the duty of well-respected investors, like myself I

hope, to warn people, to tell people, that really you are making

errors."

The current market situation resembles the

pre-recession days, in his opinion, when mortgage-backed securities were being widely

sold.

"It's almost deja vu," he said. Many companies are selling at huge

multiples and reporting earnings that are "sort of fudged" due to

various accounting methods, he said.

A few days earlier, Bloomberg reported that bond funds were now holding about 8 percent of their assets as cash-like securities, the highest proportion since at least 1999.

“We’re as defensive as we’ve been since pre-crisis,” commented Jerry Cudzil, head of U.S. credit trading at TCW Group Inc., Los Angeles-based money manager, which oversees almost $140 billion of U.S. debt.

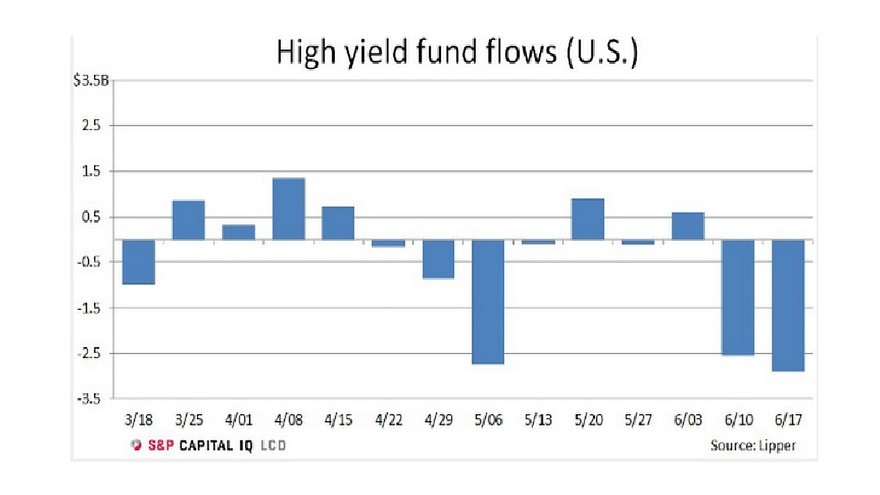

According to S&P Capital IQ, investors withdrew $2.9 billion from high-yield funds for the week ended June 17 — the biggest redemption in six weeks — on top of another $2.6 billion that pulled out the week before.

Extremely loose monetary policy backed by thin interest rates has been the main stimulus for investors to buy so-called junk bonds, which promise to offer richer yields than, say, Treasurys. But the risks in junk debt also are much greater than the typical, higher-quality government bonds, says MarketWatch.

But yield spreads between high-yield bonds and Treasuries have contracted over the first half of 2015 - suggesting that yield-starved investors are taking higher risks for lower returns.

The average yield spread holds near 4.5%:

As Carl Icahn suggested, markets are going to have a dramatic pullback and certain

things may happen. In order to prevent this, Icahn would like to see the authorities and regulators look at the way earnings and guidance are

reported by firms.

The activist investor said he doesn't understand why someone would buy a high-yielding bond that is significantly riskier than a corporate bond, which could bring in 3 percent over seven years.

Even if the U.S. central bank starts lifting rates, those high yields are very suspect now, he thinks.

Icahn added, however, that the economy is gaining momentum, though "I'm not sure how much of that is artificial because of low interest rates."

"The longer you wait to take the patient off the medicine, the harder it will be to curtail inflation, and it [inflation] will come," he cautioned.