Sure! Here's the English translation of the text:

The VWAP (Volume-Weighted Average Price) is a technical indicator that calculates the average price of a financial instrument over a specific period, considering the trading volume. VWAP is primarily used by day traders to determine the average price of a security during the trading day, making it especially useful for short-term trading strategies.

VWAP Calculation:

The VWAP is calculated using the following formula:

-

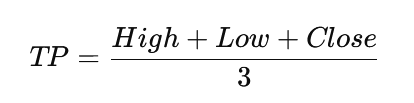

Calculate the Typical Price: The typical price (TP) for each trading period (e.g., every minute or hour) is calculated as the average of the high, low, and closing prices of the security:

-

Volume Weighting: The VWAP for each period is then calculated by multiplying the typical price by the trading volume of that period. This gives the weighted price:

-

Cumulative Calculation: The VWAP is accumulated over the entire period. The current VWAP is derived by summing the weighted prices over all periods and dividing by the total trading volume for the same period.

Meaning of VWAP:

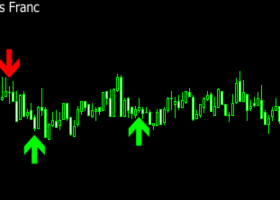

- Market Trend Identification: If the price is above the VWAP, this can be interpreted as a bullish signal (i.e., the market is considered stronger). If the price is below the VWAP, it indicates a bearish market environment.

- Price Discovery: The VWAP is particularly helpful in determining the "fair" price of a security, as it takes volume into account. Prices with higher volume have more influence on the VWAP than those with lower volume.

- Trading Strategies: Many traders use the VWAP to make trading decisions. For example, they might enter a long position when the price breaks above the VWAP, and a short position when the price breaks below the VWAP.

The VWAP is often displayed as a reference line on charts and can act as support or resistance.

You can buy the indicator here: https://www.mql5.com/en/market/product/128278