Diego Bonifacio / Профиль

- Информация

|

10+ лет

опыт работы

|

4

продуктов

|

0

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

Diego Bonifacio

CHOOSE THE CONSTANCY DO NOT RUSH TO GAIN BECOUSE IT MEANS LOSING ALL YOUR MONEY!!! As many traders for a long time I tried a trading signal that would allow me to have a steady profit...

Diego Bonifacio

USD/CAD Forecast for 11-15 April 2016 Long Position 1° Size Area: 1,2925 / 1,2900 2° Size Area: 1,2875 / 1,2850...

Diego Bonifacio

what are the prospects for oil??? With two months of the year before the accident down the accusations, PetroChina, now fluctuate less than $ 40 shocked the international list, but the scene is facing a new actor, Iran...

Diego Bonifacio

CHOOSE THE CONSTANCY DO NOT RUSH TO GAIN BECOUSE IT MEANS LOSING ALL YOUR MONEY!!! As many traders for a long time I tried a trading signal that would allow me to have a steady profit...

Поделитесь в соцсетях · 1

127

Diego Bonifacio

what are the prospects for oil???

With two months of the year before the accident down the accusations, PetroChina, now fluctuate less than $ 40 shocked the international list, but the scene is facing a new actor, Iran. Now, all eyes are on April 17 in Doha (Qatar) summit, but the long-awaited agreement to freeze production of crude oil seems to Saudi Arabia after the decision not to attend the summit, lopsided.

Then, the scene re complex, making the task of economists to predict a more difficult area.

On the one hand, there are like Robert Ryan, financial reporting BCA Research Goods and Energy Strategy, headquartered in Canada, who believe that in the next few years in short-term fluctuations in 2017 between $ 40 to $ 60 cover charge oil experts should be moved range. On the other side there are black bears, including Gary Shilling, Wall Street economists later his prediction from the packaging, it was concerned that prices until the $ 10-20 threshold.

With two months of the year before the accident down the accusations, PetroChina, now fluctuate less than $ 40 shocked the international list, but the scene is facing a new actor, Iran. Now, all eyes are on April 17 in Doha (Qatar) summit, but the long-awaited agreement to freeze production of crude oil seems to Saudi Arabia after the decision not to attend the summit, lopsided.

Then, the scene re complex, making the task of economists to predict a more difficult area.

On the one hand, there are like Robert Ryan, financial reporting BCA Research Goods and Energy Strategy, headquartered in Canada, who believe that in the next few years in short-term fluctuations in 2017 between $ 40 to $ 60 cover charge oil experts should be moved range. On the other side there are black bears, including Gary Shilling, Wall Street economists later his prediction from the packaging, it was concerned that prices until the $ 10-20 threshold.

Diego Bonifacio

USD/CAD

Long Position

1° Size Area: 1,2925 / 1,2900

2° Size Area: 1,2875 / 1,2850

Stop Loss: 1,2800

TP1: 1,3030

TP2: 1,3100

TP3: 1,3200

Time Frame: H4

Segnale Operativo: Bullish Bytterfly

Long Position

1° Size Area: 1,2925 / 1,2900

2° Size Area: 1,2875 / 1,2850

Stop Loss: 1,2800

TP1: 1,3030

TP2: 1,3100

TP3: 1,3200

Time Frame: H4

Segnale Operativo: Bullish Bytterfly

Diego Bonifacio

After skiing and Brent crude oil last Thursday amended the day, the rally this week sounded the third positive session. Rally drove through the night began Brent trading just above $ 40bbl, with less than 1% of the positive performance, while the WTI $ 38bbl score standing encouraging + 1.30...

Поделитесь в соцсетях · 2

85

1

Diego Bonifacio

Market analysis Oil prices continued to rise, pushing US stocks and the collapse of the meeting April 17 large major manufacturers, during the production of frozen consultations...

Поделитесь в соцсетях · 1

52

Diego Bonifacio

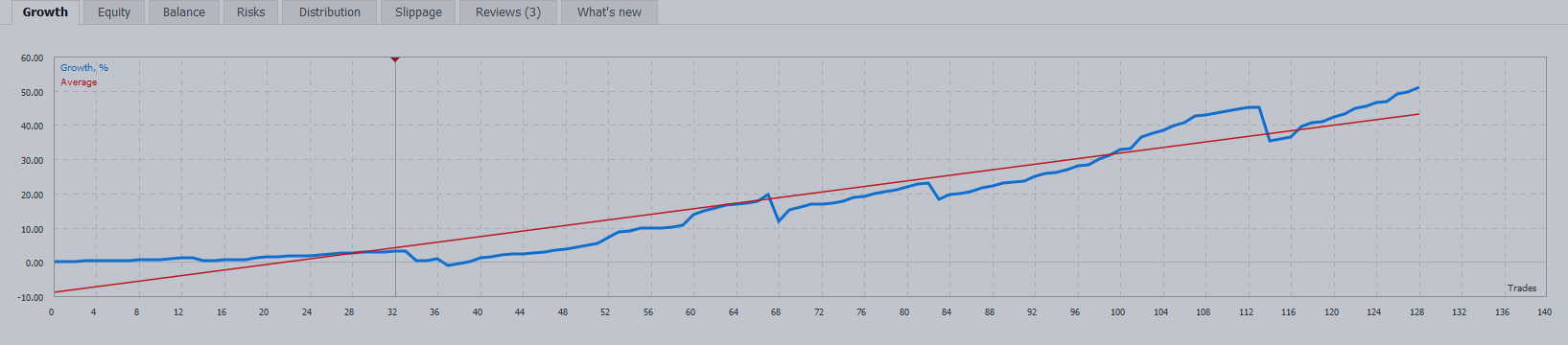

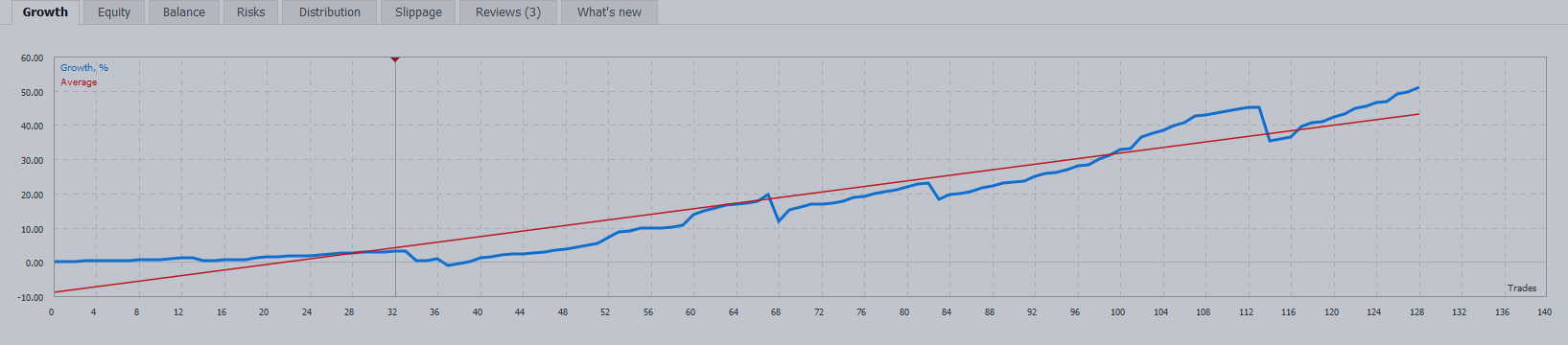

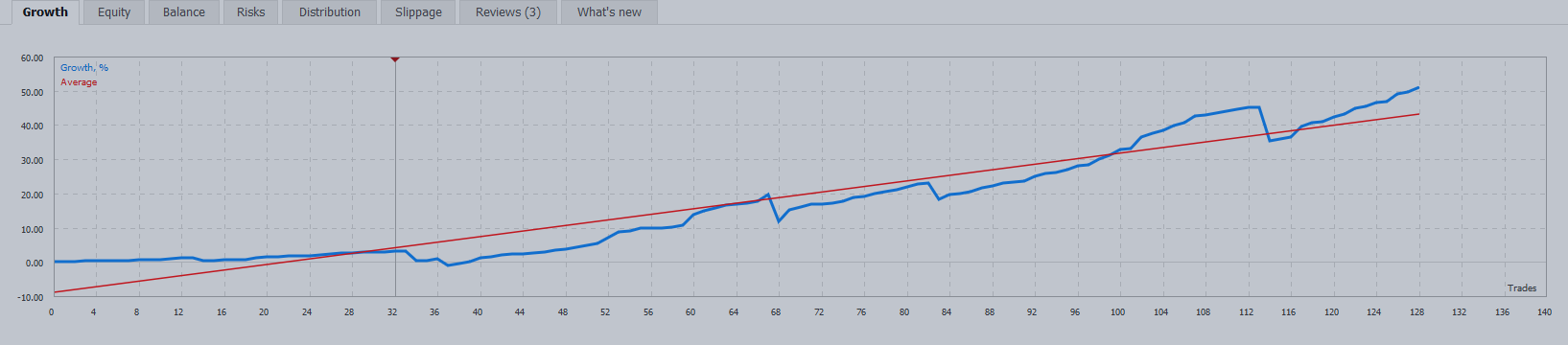

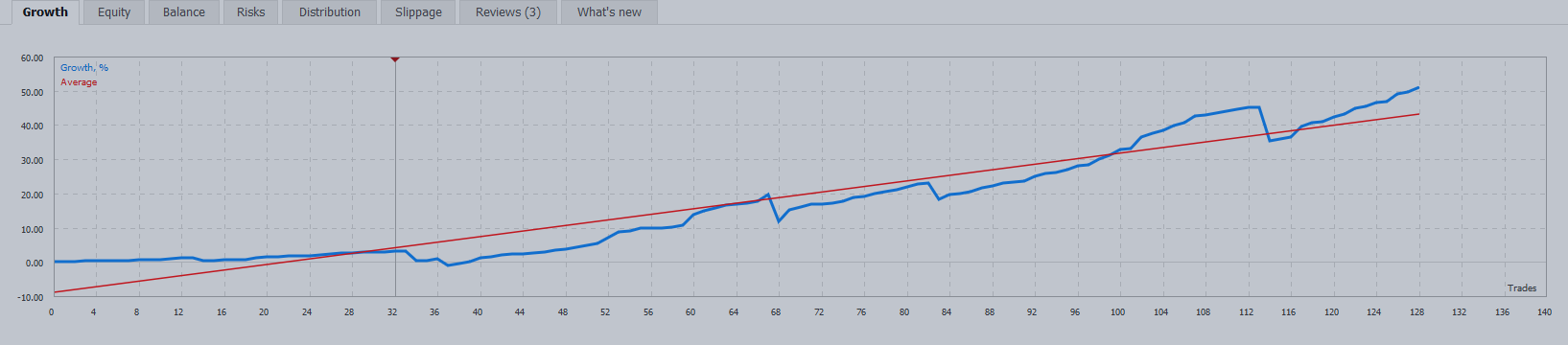

Our automated trading system called "Moon", which also gives its name to our trading signal, arises from the need to find a valid operational tool that generates a steady return over time without jeopardizing the initial capital...

Поделитесь в соцсетях · 2

79

Diego Bonifacio

S&P rivede a negativo l’outlook sul merito di credito della Cina

3 апреля 2016, 18:39

Il PMI manifatturiero cinese ha sorpreso in forte rialzo, suggerendo che gli effetti delle varie tornate di allentamento introdotte dalla PBoC, oltre agli stimoli fiscali del governo, hanno davvero aiutato l’economia ad adeguarsi alla nuova “normalità” rappresentata da una crescita più lenta...

Поделитесь в соцсетях · 1

72

1

Diego Bonifacio

Il rapporto Tankan riferito al primo trimestre ha mostrato una flessione costante nel sentiment del mercato rispetto a tre mesi fa...

Поделитесь в соцсетях · 1

60

Diego Bonifacio

Oil futures fell sharply on Friday, after the Saudi deputy crown prince said the kingdom will not cap output unless Iran and other major producers do so, casting doubts over whether a highly awaited production freeze will happen...

Поделитесь в соцсетях · 1

92

Diego Bonifacio

Diego Bonifacio

IL FATTORE PSICOLOGICO NEL TRADING Nella teoria di Gann l’aspetto psicologico riveste una grande importanza. La volatilità e l’imprevedibilità dei mercati finanziari richiedono agli operatori nervi saldi e continua analisi critica delle loro azioni...

1

Diego Bonifacio

IL FATTORE PSICOLOGICO NEL TRADING Nella teoria di Gann l’aspetto psicologico riveste una grande importanza. La volatilità e l’imprevedibilità dei mercati finanziari richiedono agli operatori nervi saldi e continua analisi critica delle loro azioni...

Поделитесь в соцсетях · 1

90

Diego Bonifacio

for more information visit our page: https://www.facebook.com/Trading-Room-31-338866186298943

Diego Bonifacio

FTSE MIB Settimana dal 04 al 08 Aprile Trading da manuale sul nostro Indice di Borsa!!! Al di là di tutte le voci di corridoio e al di là degli aspetti di Carattere Geo-Politico o Fondamentale che spesso e volentieri fuorviano gli operatori, noi di Trading Room 3...

Поделитесь в соцсетях · 1

158

Diego Bonifacio

Following the Janet Yellen's speech in recent days, we have witnessed a fall in the US dollar against all major currencies. Yellen has made it clear that a rise in interest rates is excluded, at least in the near future, and the markets have taken place rapidly...

Поделитесь в соцсетях · 1

56

Diego Bonifacio

Oro (in USD) L'oro si sta deprezzando all'interno di un canale ribassista. Supporto posizionato a 1208 (28/03/2016). Resistenza individuata a 1260 (22/03/2016 max). In caso di rottura ribassista del livello 1182 (08/02/2016 min) il trend di fondo verrebbe ripristinato. Oro...

Поделитесь в соцсетях · 1

49

: