The downward reversal of the stock market coincided with a rather interesting event

14 мая 2021, 07:55

0

86

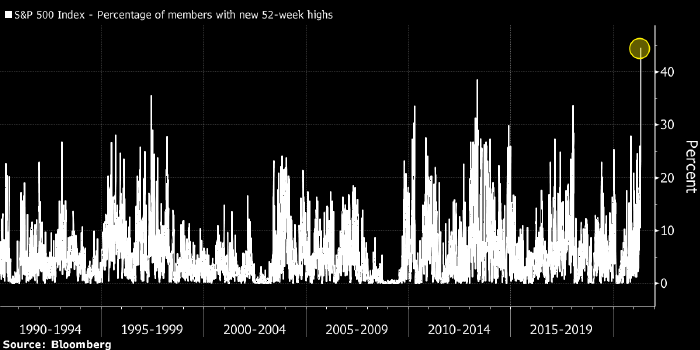

On Monday, the US stock market began to decline from record levels. At the same time, the percentage of S&P 500 stocks that reached a new 52-week high was 45%, which is a record high in the entire history of such statistics, since 1990.

The percentage of S&P 500 stocks that hit a new 52-week high. Source: Bloomberg

On Monday, the US stock market began to decline from record levels, which continues for the third day in a row. And this reversal coincided with a rather interesting event.

On Monday, the percentage of S&P 500 stocks hitting a new 52-week high was 45%, a record high in the history of such statistics since 1990, according to Bloomberg data.

On the one hand, this can be seen as a final short squeeze that often precedes a market reversal. On the other hand, the strong dynamics of the “market breadth” indicator, which is the difference between the number of rising and falling securities, is usually considered a bullish signal for the market.

It looks like the broad market rally ahead of the reversal remains the main encouraging factor for buyers in the face of a noticeable deterioration in the technical picture after the decline in recent days.