Fivos S. Georgiades / Perfil

Only the Market provides a plethora of programs for MetaTrader - everything from sophisticated artificial intelligence robots to simple indicators. Anyone who wants to improve the level of knowledge and find out new trading ideas, will like the wide variety of financial magazines and books.

https://www.mql5.com/en/blogs/post/618375

1. Now, you can open demo accounts in a single click for convenience. You do not need to specify your registration information when opening such an account.

2. The internal chat has been optimized to offer improved message synchronization and design.

3. Support for 64-bit architecture improves the application performance on the new Apple devices (starting with iPhone 5s and iPad Air).

4. The Ask line has been added to the charts at the requests of the users.

5. The process of sending a trade request has been accelerated.

6. The display of the financial news content has been improved. Also, the option for automatic news line filtration by language has been added.

https://download.mql5.com/cdn/mobile/mt5/ios?hl=en&utm_campaign=MQL5.community

O terminal cliente MetaTrader é perfeito para a automação de estratégias de negociação. Ele possui todas as ferramentas que os desenvolvedores de robôs de negociação necessitam - Uma poderosa linguagem de programação em MQL4 / MQL5, baseada em C++, um conveniente ambiente de desenvolvimento chamado MetaEditor e um testador de estratégia multi segmentado (multi-threaded) que suporta a computação distribuída MQL5 Cloud Network. Neste artigo, você irá descobrir como mover o seu terminal cliente para o ambiente virtual com todos os elementos personalizados.

https://www.mql5.com/ru/forum/37453#comment_1161693

http://www.applewealthsecurities.com/pdf/MetaTrader-5.pdf

September 25th, 2014

(EconomicCollapseBlog) - When is the U.S. banking system going to crash? I can sum it up in three words. Watch the derivatives. It used to be only four, but now there are five “too big to fail” banks in the United States that each have more than 40 trillion dollars in exposure to derivatives.

Today, the U.S. national debt is sitting at a grand total of about 17.7 trillion dollars , so when we are talking about 40 trillion dollars we are talking about an amount of money that is almost unimaginable.

And unlike stocks and bonds, these derivatives do not represent “investments” in anything. They can be incredibly complex, but essentially they are just paper wagers about what will happen in the future. The truth is that derivatives trading is not too different from betting on baseball or football games. Trading in derivatives is basically just a form of legalized gambling, and the “too big to fail” banks have transformed Wall Street into the largest casino in the history of the planet. When this derivatives bubble bursts (and as surely as I am writing this it will), the pain that it will cause the global economy will be greater than words can describe.

If derivatives trading is so risky, then why do our big banks do it?

The answer to that question comes down to just one thing.

Greed.

The “too big to fail” banks run up enormous profits from their derivatives trading. According to the New York Times , U.S. banks “have nearly $280 trillion of derivatives on their books” even though the financial crisis of 2008 demonstrated how dangerous they could be…

American banks have nearly $280 trillion of derivatives on their books, and they earn some of their biggest profits from trading in them. But the 2008 crisis revealed how flaws in the market had allowed for dangerous buildups of risk at large Wall Street firms and worsened the run on the banking system.

The big banks have sophisticated computer models which are supposed to keep the system stable and help them manage these risks.

But all computer models are based on assumptions.

And all of those assumptions were originally made by flesh and blood people.

When a “black swan event” comes along such as a war, a major pandemic, an apocalyptic natural disaster or a collapse of a very large financial institution, these models can often break down very rapidly.

For example, the following is a brief excerpt from a Forbes article that describes what happened to the derivatives market when Lehman Brothers collapsed back in 2008…

Fast forward to the financial meltdown of 2008 and what do we see? America again was celebrating. The economy was booming. Everyone seemed to be getting wealthier, even though the warning signs were everywhere: too much borrowing, foolish investments, greedy banks, regulators asleep at the wheel, politicians eager to promote home-ownership for those who couldn’t afford it, and distinguished analysts openly predicting this could only end badly. And then, when Lehman Bros fell, the financial system froze and world economy almost collapsed. Why?

The root cause wasn’t just the reckless lending and the excessive risk taking. The problem at the core was a lack of transparency. After Lehman’s collapse, no one could understand any particular bank’s risks from derivative trading and so no bank wanted to lend to or trade with any other bank. Because all the big banks’ had been involved to an unknown degree in risky derivative trading, no one could tell whether any particular financial institution might suddenly implode.

After the last financial crisis, we were promised that this would be fixed.

But instead the problem has become much larger.

When the housing bubble burst back in 2007, the total notional value of derivatives contracts around the world had risen to about 500 trillion dollars.

According to the Bank for International Settlements , today the total notional value of derivatives contracts around the world has ballooned to a staggering 710 trillion dollars ($710,000,000,000,000).

And of course the heart of this derivatives bubble can be found on Wall Street.

What I am about to share with you is very troubling information.

I have shared similar numbers in the past, but for this article I went and got the very latest numbers from the OCC’s most recent quarterly report . As I mentioned above, there are now five “too big to fail” banks that each have more than 40 trillion dollars in exposure to derivatives…

JPMorgan Chase

Total Assets: $2,476,986,000,000 (about 2.5 trillion dollars)

Total Exposure To Derivatives: $67,951,190,000,000 ( more than 67 trillion dollars )

Citibank

Total Assets: $1,894,736,000,000 (almost 1.9 trillion dollars)

Total Exposure To Derivatives: $59,944,502,000,000 ( nearly 60 trillion dollars )

Goldman Sachs

Total Assets: $915,705,000,000 (less than a trillion dollars)

Total Exposure To Derivatives: $54,564,516,000,000 ( more than 54 trillion dollars )

Bank Of America

Total Assets: $2,152,533,000,000 (a bit more than 2.1 trillion dollars)

Total Exposure To Derivatives: $54,457,605,000,000 ( more than 54 trillion dollars )

Morgan Stanley

Total Assets: $831,381,000,000 (less than a trillion dollars)

Total Exposure To Derivatives: $44,946,153,000,000 ( more than 44 trillion dollars )

And it isn’t just U.S. banks that are engaged in this type of behavior.

As Zero Hedge recently detailed, German banking giant Deutsche Bank has more exposure to derivatives than any of the American banks listed above…

Deutsche has a total derivative exposure that amounts to €55 trillion or just about $75 trillion. That’s a trillion with a T, and is about 100 times greater than the €522 billion in deposits the bank has. It is also 5x greater than the GDP of Europe and more or less the same as the GDP of… the world.

For those looking forward to the day when these mammoth banks will collapse, you need to keep in mind that when they do go down the entire system is going to utterly fall apart.

At this point our economic system is so completely dependent on these banks that there is no way that it can function without them.

It is like a patient with an extremely advanced case of cancer.

Doctors can try to kill the cancer, but it is almost inevitable that the patient will die in the process.

The same thing could be said about our relationship with the “too big to fail” banks. If they fail, so do the rest of us.

We were told that something would be done about the “too big to fail” problem after the last crisis, but it never happened.

In fact, as I have written about previously , the “too big to fail” banks have collectively gotten 37 percent larger since the last recession.

At this point, the five largest banks in the country account for 42 percent of all loans in the United States, and the six largest banks control 67 percent of all banking assets.

If those banks were to disappear tomorrow, we would not have much of an economy left.

But as you have just read about in this article, they are being more reckless than ever before.

We are steamrolling toward the greatest financial disaster in world history, and nobody is doing much of anything to stop it.

Things could have turned out very differently, but now we will reap the consequences for the very foolish decisions that we have made.

This article first appeared here at the Economic Collapse Blog. Michael Snyder is a writer, speaker and activist who writes and edits his own blogs The American Dream and Economic Collapse Blog. Follow him on Twitter here.

http://dprogram.net/2014/09/25/5-u-s-banks-40-trillion-dollars-exposure-derivatives/?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+wordpress%2FBcwy+%28Dprogram%29

MetaFintech will be carrying out sales and technical support for all products of MetaQuotes Software - trading platforms MetaTrader 4 and MetaTrader 5 as well as the system of business automation “TeamWox". The company will be targeting the South Asian region. All brokers and banks, operating there, will be potential clients.

http://www.metafintech.com/

British Forex Trader Magazine has appeared today in MetaTrader Market. Thus, any MetaTrader platform user can now download up to eight different financial publications from the Market. The

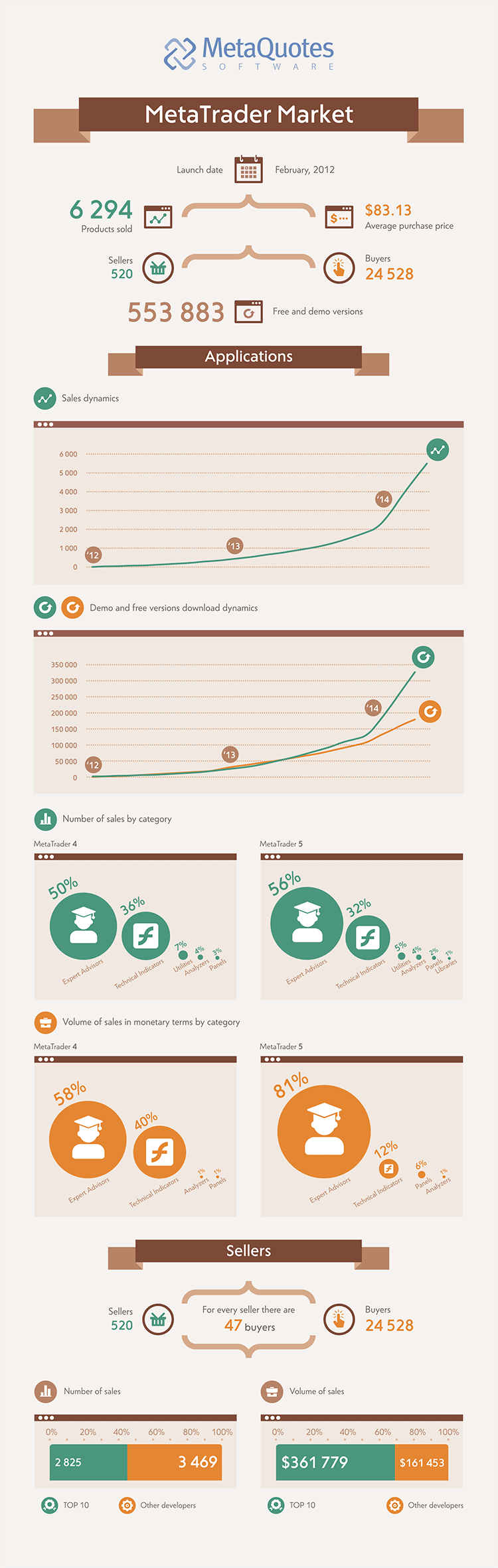

MetaTrader Market (https://www.mql5.com/en/market) was officially released in February 2012. The store of trading applications has come a long way since then. Initially the Market was introduced in MetaTrader 5. Then, the Market section was also launched for MetaTrader 4. The range of products has been expanded as well, from offering trading applications to provide also financial magazines and books.

The evolution of the Market increased the sales turnover: by July 2014, about 6 300 products worth a total of more than $522,000 have been sold in the Market, while 520 sellers and 24 500 buyers have already passed through the application store. This increase in sales has given rise to the emergence of the significant number of successful developers making $10,000 or more per month. Check the Market infographic below for more interesting statistical data on the Market service results.

The competition is open to everyone. Participants are required to sign up, open a trading account with XP Investimentosand deposit 5 000 Brazilian reais to it. According to the contest rules, participants will trade BM&FBovespa mini-indexes within 4 weeks. The traders with the highest profit from initial deposit win the contest.

You can find the competition rules here http://portal-rs.xpi.com.br/email/regulamento.pdf

How are duties distributed among the team members? What technical tools do they use? Why do they call themselves John Paul? And finally, how have common gamers from Indonesia become providers of the top signal on MQL5.com? Find out all that in the interview https://www.mql5.com/en/articles/1045

MQL5 Freelance é um serviço online onde desenvolvedores criam aplicativos de negociação para traders em troca de remuneração. O serviço funciona com sucesso desde 2010: até o momento, mais de 100.000 trabalhos foram realizados, totalizando $7 milhões. Como podemos ver, há bastante dinheiro em circulação aqui.

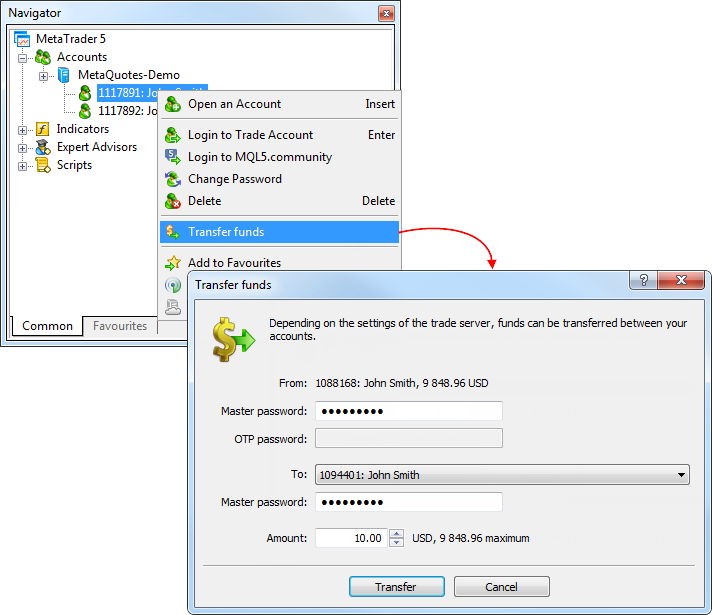

MetaTrader 5 trading platform now features two-factor authentication, one-time passwords for which are created in the iPhone-version of the terminal. This mechanism is simple: a one-time password (OTP) is requested every time a user authenticates in the desktop or tablet terminal. The OTP is generated in MetaTrader 5 iPhone based on the secure hash algorithm HMAC SHA256.

The latest version of the mobile terminal now supports the VoiceOver function. VoiceOver is a screen reader, which provides spoken descriptions of the user's actions in the terminal. The feature is designed to increase accessibility for low-vision traders.

DOWNLOAD https://download.mql5.com/cdn/mobile/mt5/ios

Hoje vamos aprender a ligar um terminal MetaTrader 5 com o Twitter para que você possa "tuitar" os sinais de negociação de seus EAs. Estaremos desenvolvendo um Sistema de Apoio à Decisão Social em PHP com base no serviço web RESTful. Essa idéia vem de um conceito específico da negociação automatizada chamada de negociação assistida por computador. Nós queremos as habilidades cognitivas dos traders humanos para filtrar os sinais de negociação, que de outra maneira eles seriam colocadas automaticamente no mercado pelos Expert Advisors.