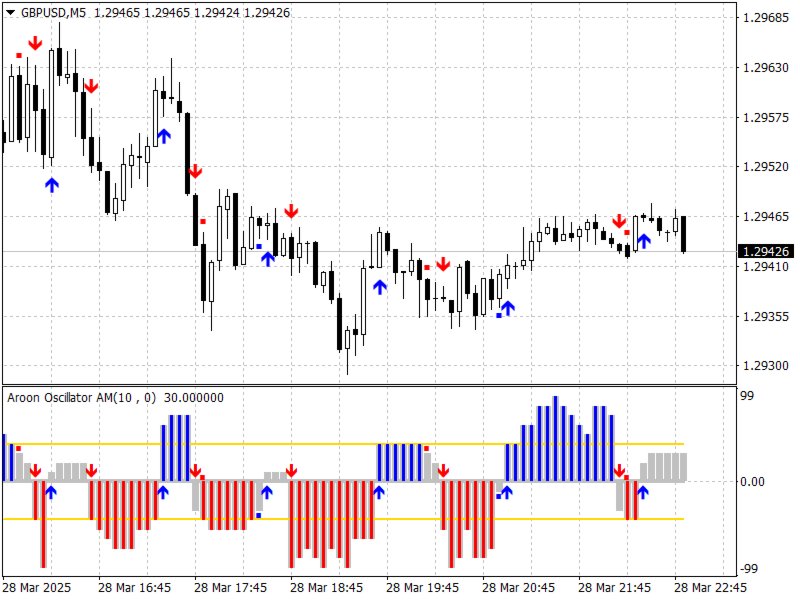

Aroon Oscillator AM

- 지표

- Andriy Matviyevs'kyy

- 버전: 10.0

The presented indicator is the author's implementation in the oscillator format of the classic Aroon indicator.

The Aroon indicator was developed in 1995 by the Indian trader Tushar Chande.

Chand's origin played a role in choosing an unusual name for the oscillator.

"Aroon" is translated from Sanskrit as "Light of the morning dawn".

The formula for calculating the classic Aroon indicator:

- Aroon-Up = ((specified number of periods) – (number of periods since the maximum was formed)) / (specified number of periods) * 100.

- Aroon-Dn = ((specified number of periods) – (number of periods since the minimum was formed)) / (specified number of periods) * 100.

Thus, with a continuous upward trend, the Aroon-Up value will be 100, and Aroon-Down, respectively, 0.

With a continuous downward trend - vice versa.

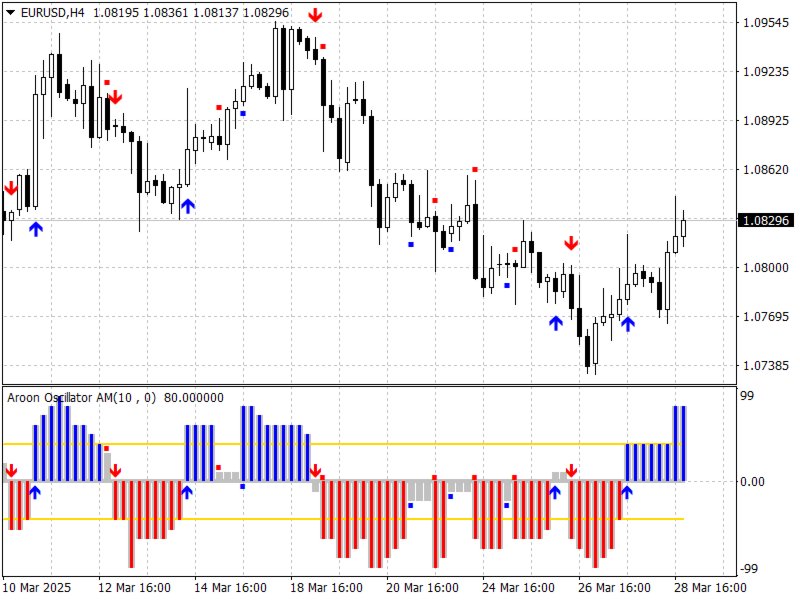

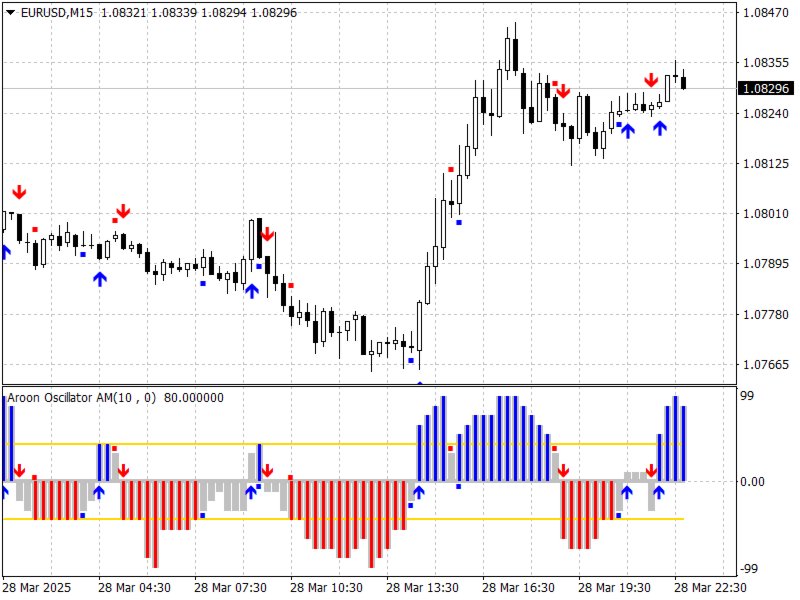

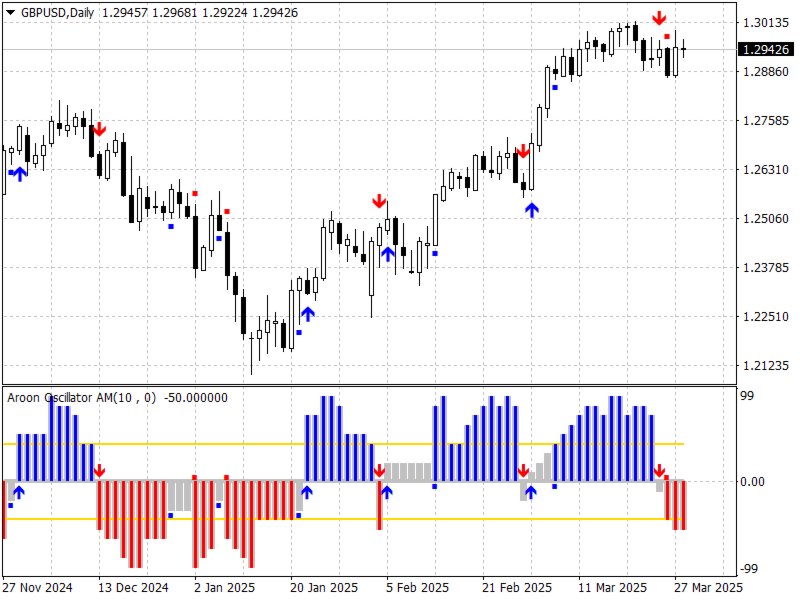

In the proposed version, the indicator is displayed as a familiar oscillator whose values oscillate around zero.

This result is achieved by subtracting the Aroon-Dn values from the Aroon-Up values.

The indicator allows you to select the calculation method (based on the closing price or maximum / minimum price values).

The indicator also allows you to set up a signal line to identify points of strengthening or weakening the current trend.

Thus, the indicator signals both a change in trend direction and local changes in trend strength.

Indicator signals:

- A signal about a change in trend direction is given after the oscillator crosses its zero value;

- A signal about strengthening / weakening the current trend is given after the oscillator crosses the signal line.

The indicator does not repaint on fully formed bars.

The indicator signals are sent after the bar on which the signal appeared has finished forming.

The signals are marked both in the oscillator window and on the price chart.

The indicator allows you to set up notifications about your signals to your mobile terminal and email.

Customizable parameters:

- Aroon_Period - period of data for indicator calculation;

- Aroon_Factor - a parameter that affects the sensitivity of the indicator (cannot be greater than (Aroon_Period - 2));

- Aroon_Type - price type for indicator calculation;

- Threshold_Value - the threshold value, when exceeded by the indicator values, signals the beginning of a trend;

- Number_of_bars_calculated - number of bars on which the indicator will be calculated and displayed (> 300);

- M_Signal_on_Oscillator - display of the main signal on the oscillator;

- A_Signal_on_Oscillator - display of the additional signal on the oscillator;

- M_Signal_on_Chart - display of the main signal on the price chart;

- A_Signal_on_Chart - display of the additional signal on the price chart;

- Alerts - the indicator displays a dialog box containing information about the indicator signal;

- Send_Notification - the indicator sends a notification to mobile terminals whose MetaQuotes ID is specified in the settings window on the "Notifications" tab;

- Send_Mail - the indicator sends an email to the address specified in the settings window on the "Mail" tab.

Attention:

Please note that any market is constantly changing and there is no guarantee that methods that have been effective in the past will show the same results in the future.

To minimize potential losses, you should regularly optimize the product parameters, study the results of its work and withdraw part of the profit received.

It is recommended that before using the product on a real account, you test its work on a demo account in the same market and with the same broker where you plan to trade.

With respect and best wishes,

Andriy Matviyevs'kyy

P.S.

If you liked this product, I would be grateful for a fair assessment - positive user reviews motivate the author, and reasonable criticism allows us to make products better.

I suggest visiting my page where you will find many unique author's works that are the result of many years of studying exchange trading and FOREX trading.