거래 로봇을 무료로 다운로드 하는 법을 시청해보세요

당사를 Facebook에서 찾아주십시오!

당사 팬 페이지에 가입하십시오

당사 팬 페이지에 가입하십시오

스크립트가 마음에 드시나요? MetaTrader 5 터미널에서 시도해보십시오

- 조회수:

- 42

- 평가:

- 게시됨:

- 업데이트됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

주요 기능

누적 델타: 시간 경과에 따른 집계된 매수 및 매도 거래량을 추적합니다.

순 델타: 각 바의 매수 및 매도 압력 차이를 표시합니다.

세션재설정: 일중 분석을 위한 사용자 지정 세션 시작 시간을 허용합니다.

스무딩: 더 깔끔하고 가독성 높은 델타 곡선을 위한 EMA 스무딩을 포함합니다.

목적:

복잡한 다중 차트주기 계산 없이 주문 흐름 역학, 거래량 불균형, 가격과 델타 간 차이를 모니터링하려는 트레이더에게 이상적입니다. 가볍고 빠르며 필수적인 델타 메트릭에 집중합니다.

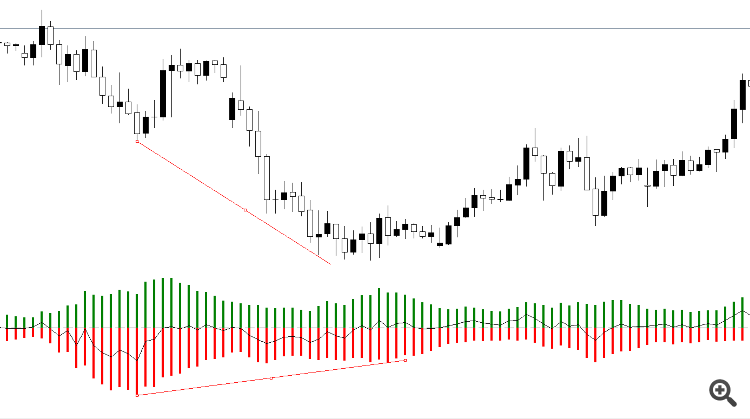

델타퓨전 라이트로 감지할 수 있는 차이의 예:

강세다이버전스

가격은 새로운 저점을 기록했지만 순 델타가 더 높은 저점을 보임 → 매도 압력이 약화되고 있으며 강세 반전 가능성.

가격은 새로운 고점을 기록하지만 순 델타가 더 낮은 고점을 보임 → 매수 압력이 약해져 약세 반전 가능성.

히든 다이버전스가격은 고점을 높이고 누적 델타는 저점을 낮추는 경우 → 상승 추세가 지속됨을 확인합니다.

소진 다이버전스델타에서 확인되지 않은 강한 가격 움직임 → 참여도가 낮고 향후 조정 가능성이 있음을 나타냅니다.

MetaQuotes Ltd에서 영어로 번역함.

원본 코드: https://www.mql5.com/en/code/66864

AML 적응형 시장 수준

AML 적응형 시장 수준

적응형 시장 수준 - 시장 가격의 현재 기준 수준을 표시합니다. 이 레벨은 추세 가격 변동이 있는 경우에만 이동합니다.

X프로퍼터오버레이

X프로퍼터오버레이

X프로퍼터오버레이 인디케이터는 추가 가격 변동선을 보여줍니다.