당사 팬 페이지에 가입하십시오

- 조회수:

- 9566

- 평가:

- 게시됨:

- 업데이트됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

Basics:

The Laguerre RSI indicator created by John F. Ehlers is described in his

book "Cybernetic Analysis for Stocks and Futures".

This version:

Instead

of using fixed periods for Laguerre RSI calculation it is using ATR

(average True Range) adapting method to adjust the calculation period.

It makes the RSI more responsive in some periods (periods of high

volatility), and smoother in order periods (periods of low volatility). Also this version adds an option to have smoothed values. The smoothing method used is adding minimal lag (see the "big picture" example) and does not affect too much the result, but helps in making less signals, which will reduce false signals as a result.

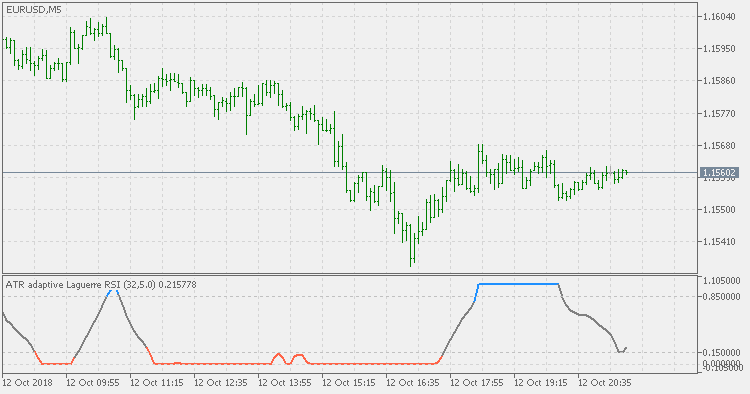

Usage:

You can use it (in combination with adjustable levels) for signals when color of the Laguerre RSI changes.

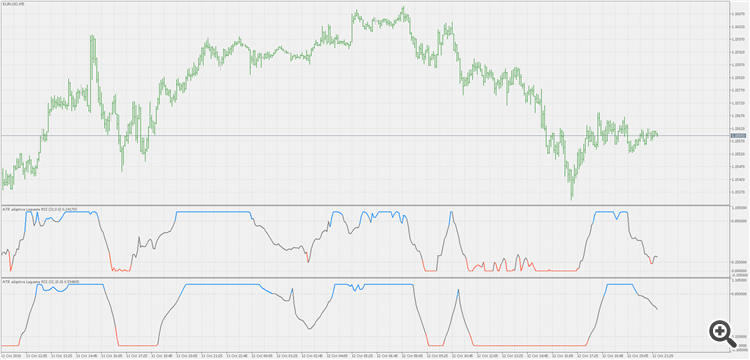

The "big picture" example:

Comparing the non-smoothed (upper) and what usually should produce significant lag (since the smoothing period used in the example is 15) and as it can be seen, the lag is all in all acceptable.

ATR adaptive Laguerre RSI

ATR adaptive Laguerre RSI

ATR adaptive Laguerre RSI

Efficiency ratio directional with levels

Efficiency ratio directional with levels

Efficiency ratio directional with self adjusting levels

ATR adaptive smooth Laguerre RSI (dlvl)

ATR adaptive smooth Laguerre RSI (dlvl)

ATR adaptive smooth Laguerre RSI with dynamic levels

Four clicks to draw an arc-shaped channel

Four clicks to draw an arc-shaped channel

A quick way to draw an arc-shaped channel in 4 mouse clicks.