거래 로봇을 무료로 다운로드 하는 법을 시청해보세요

당사를 Telegram에서 찾아주십시오!

당사 팬 페이지에 가입하십시오

당사 팬 페이지에 가입하십시오

스크립트가 마음에 드시나요? MetaTrader 5 터미널에서 시도해보십시오

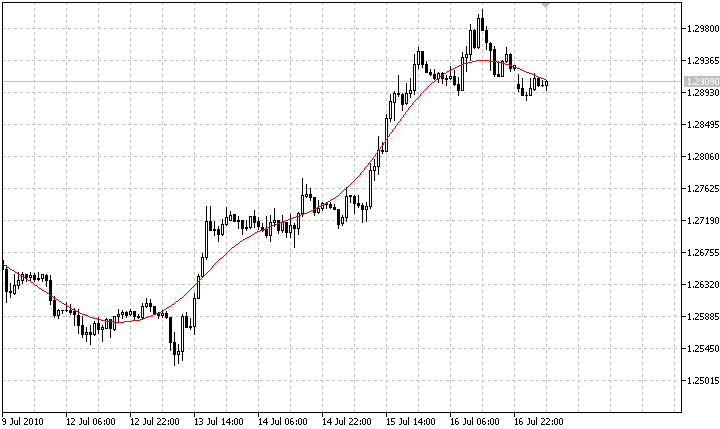

호드릭-프레스콧 필터는 계절적 변동과 추세를 파악하기 위해 재무 계열을 평활화하는 데 자주 사용됩니다. 이 필터는 한눈에 보기에도 지연이 없습니다. 모든 필터의 공통적인 단점인 지연 없이 마지막 값이 다시 그려집니다.

저는 이 필터를 가격 채널 구축, 추세 변화 지표로 사용 등 다양한 목적으로 적용해 보았습니다. 그러나 모든 경우에서 이 필터는 EMA, LWMA 또는 AMA에 비해 큰 장점이 없었습니다.

또한 이 필터로 평활화된 가격은 주성분 분석(PCA)의 주성분 벡터에 매우 가깝다는 것을 알 수 있었습니다. 호드릭-프레스콧 필터와 PCA 사이에는 수학적 연관성이 있는 것 같습니다. 필요한 분들을 위해 이 필터를 여기에 올렸으니 비판은 하지 마세요. 저는 직접 사용하지는 않지만 사용 가능성에 대한 아이디어를 주시면 감사하겠습니다.

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/143

T3 Moving Average

T3 Moving Average

T3 지표는 6개의 지수 이동 평균을 결합한 고급 이동 평균으로, 기존 이동 평균에 비해 지연을 줄이면서 더 부드러운 가격 움직임을 제공합니다.

Multi-Day Dynamic VWAP

Multi-Day Dynamic VWAP

여러 날에 걸쳐 평균화할 수 있는 동적 VWAP 수준