당사 팬 페이지에 가입하십시오

k-NN(최인접 이웃) 알고리즘은 현재 패턴과 가장 유사한 과거 패턴(이웃)을 k개 검색하고 해당 이웃의 가중치 투표를 기반으로 미래 가격을 계산합니다. 현재 지표는 가장 가까운 이웃을 하나만 찾습니다. 따라서 본질적으로 1-NN 알고리즘입니다. 현재 패턴과 모든 과거 패턴 사이의 피어슨 상관 계수를 두 패턴 사이의 거리 측정값으로 사용합니다.

인디케이터에는 다음과 같은 입력 매개변수가 있습니다:

- Npast - 패턴의 과거 막대 수입니다;

- Nfut - 패턴의 미래 막대 수(<Npast여야 함).

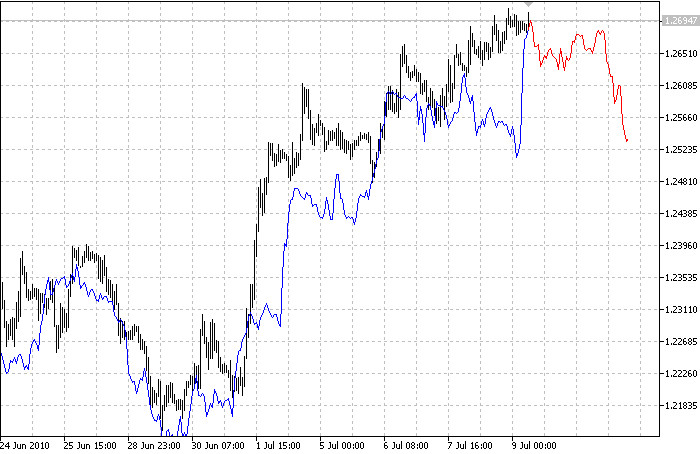

인디케이터는 두 개의 곡선을 표시합니다. 파란색 곡선은 가장 가까운 이웃의 과거 가격을 나타내고 빨간색 곡선은 같은 패턴의 미래 가격을 나타냅니다. 가장 가까운 이웃은 이 패턴과 현재 패턴 사이의 선형 회귀 기울기에 따라 스케일이 조정됩니다. 또한 인디케이터는 가장 가까운 이웃의 시작일과 현재 패턴과의 상관 계수에 대한 정보를 인쇄합니다. 예를 들어

가장 가까운 이웃 (EURUSD,H1): 가장 가까운 이웃의 시작 날짜는 2003.08.26 23:00:00이고 현재 패턴과의 상관관계는 0.9432442047577905 입니다;

이미지:

MetaQuotes Ltd에서 영어로 번역함.

원본 코드: https://www.mql5.com/en/code/133

Price prediction by Nearest Neighbor found by a weighted correlation coefficient

Price prediction by Nearest Neighbor found by a weighted correlation coefficient

이 지표는 최근 가격이 더 큰 가중치를 갖는 가중 상관 계수를 사용하여 가장 가까운 이웃을 찾습니다. 가중치는 가격 패턴 내에서 최신 가격에서 이전 가격으로 선형적으로 감소합니다.

알파트렌드

알파트렌드

시장의 추세, 지지 및 저항 수준을 결정하는 데 사용되는 지표입니다. 거래량 데이터를 사용할 수 있는 경우 MFI를 사용하여 계산하고, 그렇지 않은 경우 RSI를 사용하여 계산합니다. 모멘텀: RSI 및 MFI 변동성: ATR