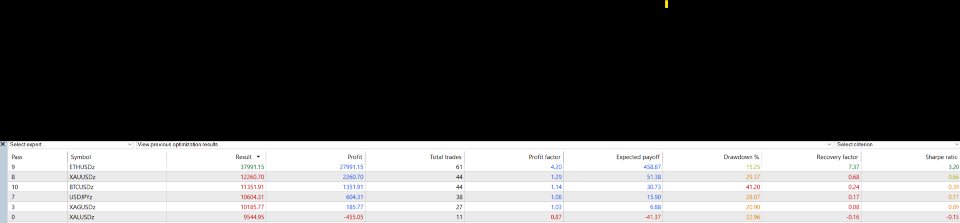

Ethereum Donchian Price Action EA

- エキスパート

- Martin Jonathan Kleinbooi

- バージョン: 2.10

- アクティベーション: 5

Donchian Confluence EA for Ethereum

Multi-timeframe Donchian breakouts with smart Price Action filters (Engulfing + Fair Value Gaps), adaptive risk and clean execution — purpose-built for ETH, designed to run on the Daily (D1) timeframe.

— Why traders choose this EA —

• ETH-focused logic: tuned for the 24/7 nature and volatility structure of Ethereum markets (ETHUSD, ETHUSDT, broker suffixes supported).

• Confluence engine: classic Donchian breakout only fires when price action confirms — bullish/bearish Engulfing and Fair Value Gap (FVG) checks boost quality and avoid obvious traps.

• Daily timeframe edge: fewer, higher-quality trades; reduced noise; more robust to intraday manipulation.

• Multi-timeframe awareness: optional higher-timeframe trend filter and lower-timeframe PA scan for precision.

• No Martingale. No Grid. No Arbitrage: straightforward, risk-first execution with partials and trailing.

• Friendly to backtesting & forward-testing: deterministic signals and clear parameters.

— How it works (in plain English) —

-

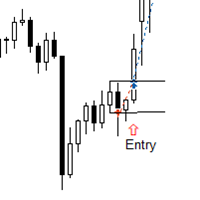

Detect the breakout: a Donchian channel close beyond the prior range forms the raw signal.

-

Check context: optional higher-timeframe EMA trend must agree with the direction.

-

Confirm with price action:

• Engulfing filter — if a recent opposite engulf printed, the trade is skipped; you can optionally require an aligned (same-direction) engulf as confluence.

• Fair Value Gaps — require a same-direction FVG near price and/or avoid taking trades into a nearby opposite FVG that often rejects price. -

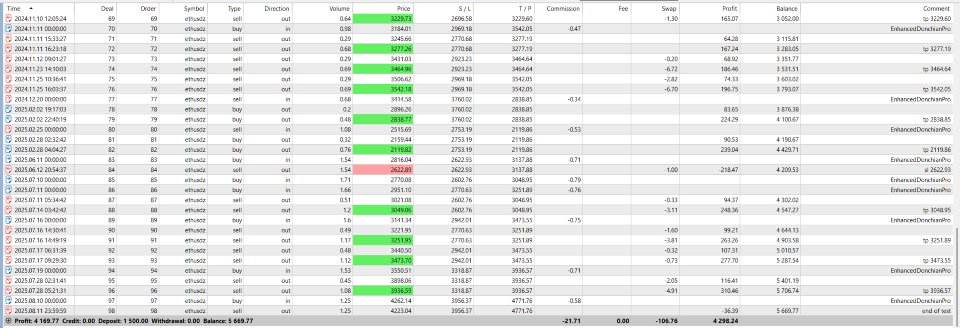

Risk-aware entry: position size derives from account risk %, ATR-based SL distance, and broker tick value.

-

Trade management: partial profits at configurable R-multiples, ATR + structure trailing, and a daily risk cap.

— Best market & timeframe —

• Symbols: ETHUSD / ETHUSDT (any broker mapping). The EA is symbol-agnostic but optimized for ETH.

• Timeframe to run: D1 (Daily) — recommended and used in internal testing.

• Session filters: crypto trades 24/7; session filters can remain off unless your broker pauses on weekends.

— What’s inside (strategy components) —

• Donchian Breakout Core — configurable channel length, confirmation bars, and minimum breakout strength.

• Trend Context — higher-timeframe EMA check (e.g., D1 or W1) to avoid counter-trend entries.

• Volatility & Momentum — ATR regime filter; ADX + DI for trend quality; adaptive RSI banding in strong trends.

• Price Action Filters —

◦ Engulfing: body-to-body engulf with minimum body ratio. Rejects entries after fresh opposite engulfs; optionally require an aligned engulf.

◦ Fair Value Gaps (FVG): three-candle imbalance detection with ATR-scaled minimum size. Require same-direction FVG near price and/or avoid opposite FVG within a user-set ATR distance.

• Risk & Money Management — fixed risk %, optional Kelly cap, daily risk ceiling, partials (two stages), ATR/structure trailing, position limits.

— Recommended presets for ETH on D1 —

• Attach the EA to: ETHUSD or ETHUSDT, timeframe D1.

• HTF_Trend: D1 (strict) or W1 (very conservative).

• MTF_Signal: H4 — scans engulf/FVG with more candles while D1 creates the trade signal.

• AvoidOppositeFVG: true (recommended).

• RequireFVGConfluence: optional (start false; turn on for maximum selectivity).

• BaseRiskPct: 1.0% (starter); MaxDailyRisk: 3–5% per tolerance.

• Exits: default SL 1.5×ATR and TP 2.5×ATR work well for ETH D1.

• Partials: 30% at 1.5R, 50% at 3R; trailing activates from 2.0R.

— Inputs & Parameters (grouped) —

Core Strategy

• DonchianPeriod — channel length (default 20).

• DonchianConfirm — extra bar confirmation (default 5).

• MinBreakoutStrength — minimum normalized breakout strength (0.3).

• RequireVolumeConfirm, VolumePeriod, VolumeMultiplier — optional volume gate.

Multi-Timeframe

• HTF_Trend — timeframe for trend EMA (D1/W1 recommended for ETH D1 trading).

• MTF_Signal — timeframe for PA scan (H4 recommended).

• EMA_Fast, EMA_Slow, EMA_HTF — EMA periods for trend/context.

Smart Filters

• UseVolatilityFilter, VolatilityPeriod, VolatilityThreshold — ATR regime check.

• UseMomentumFilter, MomentumPeriod — optional momentum gate.

• UseMarketStructure, StructurePeriod — swing-based structure reference.

Technical Filters

• UseAdvancedADX, ADX_Period, ADXMin, ADXTrending — trend quality and DI alignment.

• UseAdaptiveRSI, RSI_Period, RSI_Oversold, RSI_Overbought — adaptive RSI windowing.

Price Action (ETH-centric)

• UseEngulfFilter — enable engulfing logic.

• EngulfLookback — bars to look back on the PA TF (default 2).

• EngulfMinBodyRatio — body size ratio vs previous candle (default 1.0).

• RequireAlignedEngulf — demand same-direction engulf as confluence (optional).

• UseFVGFilter — enable FVG logic.

• FVGLookback — bars to scan on the PA TF (default 15).

• MinFVG_ATR_Mult — minimum FVG size as ATR multiple (default 0.20).

• RequireFVGConfluence — require same-direction FVG near price (optional).

• AvoidOppositeFVG — avoid entries into nearby opposite FVG (recommended ON for ETH D1).

• FVGMaxDistanceATR — how near is “near” (default 0.75 ATR).

Risk Management

• BaseRiskPct, MaxRiskPct — account risk per trade and cap.

• UseKellyCriterion, KellyFraction — optional Kelly-based adjustment (guard-railed).

• MaxPositionSize, MaxDailyRisk, MaxConcurrentTrades — portfolio safety rails.

Exit Management

• UsePartialProfits; PartialExit1_R / _Pct; PartialExit2_R / _Pct — two-stage partials by R-multiple.

• UseSmartTrailing, TrailingStart_R — ATR + structure trailing once in profit.

• UseStructureStops, MaxStopDistance — blend structure with ATR for protective stops.

Sessions & System

• UseSessionFilter, session hours — crypto is 24/7; leave off unless your broker restricts hours.

• AvoidNewsEvents — not typically required for ETH but available.

• Magic number, comment tag, logging, slippage, retries.

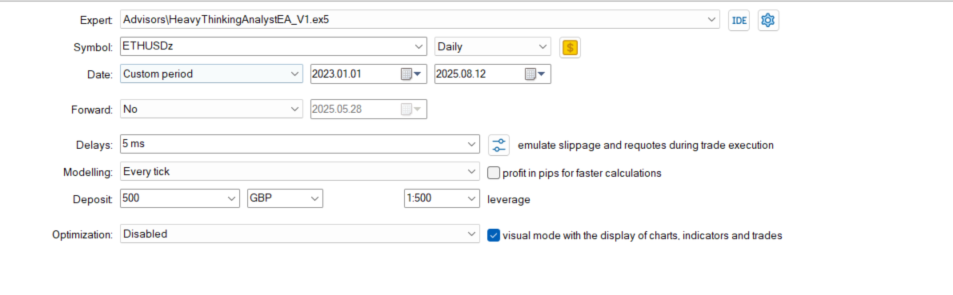

— Installation & first run —

-

In MetaTrader 5, ensure your ETH symbol (e.g., ETHUSD) is visible and ticking.

-

Open an ETHUSD D1 chart and drag the EA onto it. Allow algo trading.

-

Apply the recommended presets above.

-

Click OK. The EA evaluates on bar close and manages any open positions.

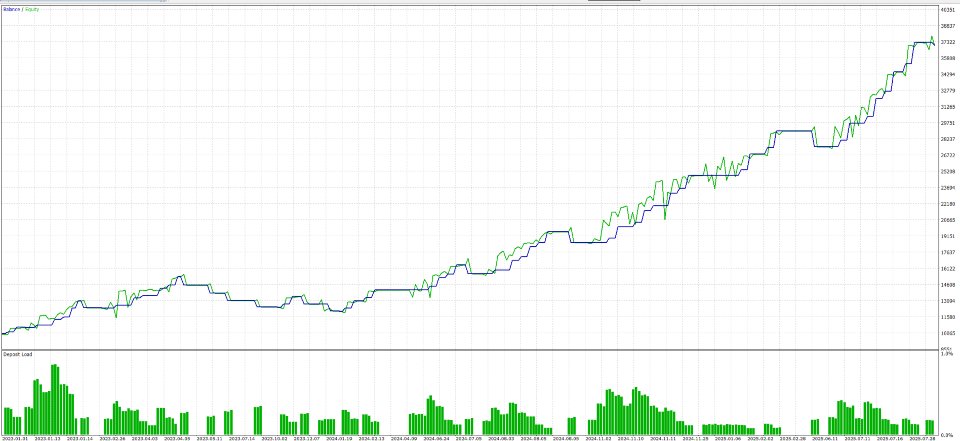

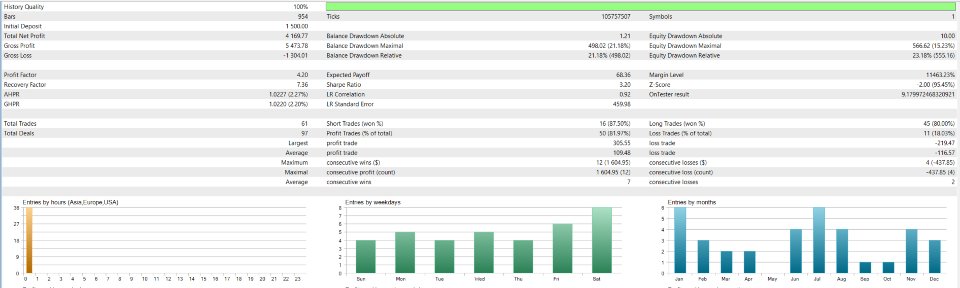

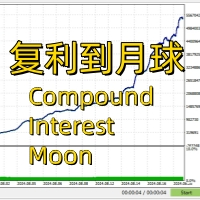

— Backtesting guide (ETH) —

• Mode: “Every tick based on real ticks” if your broker offers crypto tick history; otherwise 1-minute OHLC.

• Symbol: ETHUSD (or your broker’s mapping), timeframe D1.

• Costs: set realistic spread/commission for crypto (spread 5–25 ticks, commission per contract as per broker).

• Date range: at least 2–4 years to include multiple volatility regimes.

• Optimization: you may tune DonchianPeriod (15–55), FVG thresholds, and ATR multipliers — always keep out-of-sample data for validation.

— Tips specific to ETH —

• ETH often shows momentum continuation after daily breakouts, but strong opposite FVGs frequently reject price. Keeping AvoidOppositeFVG = true filters many fakeouts.

• Partials help lock in progress during extended volatility bursts.

• Broker weekend downtime can create synthetic gaps; trailing once the trade reaches 2.0R helps secure gains.

— FAQ —

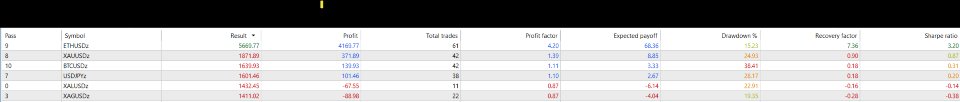

Q: Can I run it on other coins or FX?

A: Yes. The logic is generic, but parameters are curated for ETH. For other assets, re-optimize Donchian/FVG thresholds.

Q: Does it open multiple trades?

A: It respects MaxConcurrentTrades and won’t open an opposite trade while one is active.

Q: Does it use Martingale or Grid?

A: No. Fixed-risk entries, ATR-based stops, partials, and trailing only.

Q: Minimum deposit?

A: Depends on broker contract size. Sizing is risk-based and will scale down to SYMBOL_VOLUME_MIN.

Q: Which brokers?

A: Any MT5 broker offering ETH with tradeable hours. Ensure tick size and tick value are correctly reported for the symbol.

— Changelog (highlights) —

• v2.10 — Added Engulfing & FVG filters (including opposite-FVG avoidance and near-price confluence), centralized PA pass before execution, improved logs, clarified ETH D1 presets.

— Support —

Questions or set-files? Message via the Market or author profile. Please include your broker symbol name (ETHUSD vs ETHUSDT) and timeframe.

— Risk Disclaimer —

Trading involves risk. Past performance does not guarantee future results. Crypto assets are highly volatile; use position sizing and daily risk limits. This product is not affiliated with or endorsed by Ethereum or the Ethereum Foundation.