YouTubeにあるマーケットチュートリアルビデオをご覧ください

ロボットや指標を購入する

仮想ホスティングで

EAを実行

EAを実行

ロボットや指標を購入前にテストする

マーケットで収入を得る

販売のためにプロダクトをプレゼンテーションする方法

MetaTrader 5のためのエキスパートアドバイザーとインディケータ - 297

The indicator helps to enter a trade following the trend, at the same time, after some correction. It finds strong trending movements of a currency pair on a given number of bars, and also finds correction levels to this trend. If the trend is strong enough, and the correction becomes equal to the one specified in the parameters, then the indicator signals this. You can set different correction values, 38, 50 and 62 (Fibonacci levels) are better. In addition, you can set the minimum trend lengt

4 copies left at $100 Next price - - > $150

**Leave a 5-star review and get a second EA for free** Introduction: Are you tired of losing you money with curve fitted experts or so called holy grails which promise thousands of dollars every day? Did you spent hours of

This bot is an attempt to create a scalpel for working with real ticks. Which is quite difficult because as a rule, scalpels in real work do not stand up to the test. This development only works with real ticks. Of course, the bot needs to be optimized for the story and the tool. Optimization is in the screenshots, and the file for optimization is provided in the discussion. The screenshots show one setting but with different risk and deposit. The larger the deposit, the less risky, this is set

Sweet Apple Pro Max 2.1 - Long term profit

Please read before using:

Gaining 30 40 50 even 100% profit within a day and then lose all, have you ever in that situation, or you ever saw someone still in that endless loop, x2 x3 profit then they have nothing. Hey my friend, stop thinking like that anymore, we will never be alive in this market if you are still thinking that you can become a millionaire quickly. Therefore, I am here to tell you these things We can not make profit con

Instead of sticking to the Charts,let's use ALL IN ONE KEYLEVEL Announcement: We are pleased to announce the latest version 14.02 of the One In One Keylevel product. This is a reliable product that has been upgraded with many new features and improvements to make your work easier and more efficient. Currently, we have a special promotion for this new version. The current discounted price is $500, and there are only 32 units left. After that, the price will increase to $1000, and will continue to

A machine translation from English product description was used. We apologies for possible imprecisions. 英語の製品説明からの機械翻訳が使用されました。 不正確な可能性があることをお詫び申し上げます。 お気に入りのろうそく足の価格アクションパターンの視覚化システム。 アタッチされると、インジケーターはチャート上の次のパターンを自動的にマークします。 ピノキオバー - 長い「鼻」を持つ小さなボディのバー、非常によく知られている逆のパターン。 内側のバー - 範囲が前のバーの範囲内にあるバー。 それは市場の不確実性を表しています。 外側のバー - 範囲が前のバーの範囲を超えるバー。 それは市場の不確実性を表しています。 レールパターン - ほぼ等しく、より大きなボディを持つ 2 つの結果として生じる反対側のバー。 逆のパターン。これは、より高い時間枠のピノキオバーパターンと実際に一致します。 マスターキャンドル パターン - キャンドルの 5 つ、後続の 4 つのキャンド

Hello Traders

I have created this indicator to Catch SPIKES on Crash1000, Crash500 and Crash300. Follow the below mention instruction for better Result

1. When Red arrow pop up on the Chart, Take a Sell entry

2. Stay in trade until price break below from entry

3. Do not hold trades after all trades went in Blue

4. Keep adding position until spike cross below from intial entry

See Example for more assistance

There are a lot of high-quality signals on the MQL5 website, and learning them is a great way to broaden your mind and improve yourself. The trading history of the signal can be downloaded and saved in csv file format, but analyzing this textual information is difficult.

Signal Analyzer has 2 usage options: 1. You can import the downloaded csv files and display each trading history in the MT5 chart window. 2. Use the Strategy Tester for historical backtesting. *** SignalAnalyzer is used as foll

Trade Informer HVZ is a utility that allows you to display trading results (open and closed positions) using filters for trading instruments and Magic Numbers of Expert Advisors. The results are displayed as a horizontal or vertical table or as separate blocks. Full list of displayed parameters:

List of analyzed instruments List of Magic Balance of open positions Result of closed positions for today The result of closed positions for the previous day

The result of closed positions for the c

**************************************************************************** このインジケーターの役割はただ一つ、HLCバー(建値のないバー)としてチャートを表示することです。

また、このバーには2つの特徴があります。

バーの色は、現在のバーの終値と前のバーの終値を比較して決定されるため、価格のギャップ(隙間)による混乱が生じないようになっています。この状況の例をスクリーンショットに示します(標準的なローソク足が表示されているバーと比較しています)。 バーの色や太さを編集することができます。 ****************************************************************************

Indicator - HotKeys allows you to make your work in the MT5 terminal more comfortable

Indicator features: - Calling the creation of an object on the chart with keyboard shortcuts - Enable/disable auto scroll - Quick switching between main custom templates

Preset keyboard shortcuts: - Rectangle - Q - Fibo - E - Horizontal level - R - Cut - T - Auto Scroll - A

You can assign other keyboard shortcuts (capital letters of the English alphabet only)

Important: The indicator does not allow you

EasyScalp is a fully automated Expert Advisor with no use of martingale. fully automated EA designed to trade FOREX and Spot Metals. Expert showed stable results with low drawdown . EA designed to trade on 1H (One Hour) and 30M (Mints) Chart. Try not to change default sitting . just set on the right chart find the best from 5M to H1 . Trading strategy that indirectly measures the price velocity, and filter that confirms its possible signals. T he objective of the test is to clarify the over

This indicator is based on ParabolicSAR. This indicator does not change the trend easily and does not change the trend until it receives a clause and approval. This indicator can be used for trail stop or trend detection.

MT4 Version

benefits:

Works on all instruments and time series,

Does not redraw its results,

Comparison depth is adjustable,

Works well with any popular strategy,

The power of the areas is adjustable,

We assure you that we welcome any

MT4 Version Wave Trend MT5 Wave Trend is an oscillator, which helps identifing in a extremely accurate manner market reversals. The Oscillator being obove the overbought level and a cross down of the fast into the slow MA usually indicates a good SELL signal. If the oscillators is below the oversold level and the fast MA crosses over the slower MA usually highlights a good BUY signal. The Wave Trend indicator can be also used when divergences appear against the price, indicating the current move

Binance Trade Manager — is an utility that allows you to transmit trade orders from your MetaTrader 5 to the Binance exchange. It will suite you if you want to use your favorite MetaTrader 5, getting all the benefits of trading cryptocurrencies directly on the exchange (low commission, high liquidity, absolute transparency, etc.) Binance Trade Manager can work in two modes: copying trades from a demo-account , which your MetaTrader 5 is connected to (cryptocurrencies must be available on this ac

The Advanced BreakOut Scalper is an effective trading system with predetermined Take Profit, Stop Loss, and Trailing Stop settings. As the name implies, its strategy is trading breakouts. It is professionally coded and runs quickly in backtesting or optimization mode.

It does not employ grid, martingale, averaging, or any other risky money management strategies.

It is recommended to use a tight spread broker, preferably an ECN broker with good liquidity. For a list of brokers that work well wi

· MAX En este producto se utiliza una estrategia de trading con uno de los indicadores comúnmente utilizados en el mercado, esto en conjunto con otro indicador no tan utilizado en el mercado, pero al utilizarlo en conjunto con el primer indicador entrega resultados que podrá ver a continuación. Los indicadores de los que hablamos son SMMA y ADX. Por otro lado, el Take Profit, así como el Stop Loss serán fijados en ciertos pips que pueden ser modificados por el usuario si este así lo

Indicator that shows you at any time the current number of closed deals as well as profit and loss totals of the closed deals of the account that you're logged into for a configurable period.

To do this, it is best to load Deals and "Complete history" in the account history in the terminal and then enter the desired period in the indicator (e.g. 2022.01.01-2023.01.01 would be for calendar year 2022).

Input options:

- Period (Attention: corresponding data must be loaded into the account hist

Ronal Cutrim has been a dedicated mathematician for 14 years and has more than 10 years of experience in the financial market.

The concept of the theory is simple, find imbalance between buyers and sellers. Which makes a lot of sense, because nothing goes up forever, nothing falls forever. When you find an asset with a mathematical probability of unbalanced equilibrium, it is a great way to get into trading: TUTORIAL: Turn on the subtitles, the video is subtitled

口座履歴の通貨を他の通貨に両替して出力できるスクリプトです。多通貨対応ですので、USD, JPYの相互変換をはじめ EUR, GBP, AUD等、その他マイナー通貨まで両替可能です。 特に確定申告の際には、円以外の運用口座の場合当日の相場で円換算した金額を申告する必要があるため、膨大な労力が必要となります。しかしCurrency Exchangerは一回実行するだけで他通貨へ即座に変換が可能ですので、誰でもかんたんに両替できます。 面倒な作業はCurrency Exchangerにお任せください! 口座履歴から両替した結果をhtml、またはcsv形式にてレポート出力可能。 両替レートはMetaTraderのヒストリカルデータ、またはWebより取得。 レポート出力する期間や両替のタイミングを細かく指定可能。 レポート出力項目を変更可能。 両替を行わない通常のレポート出力も可能。 レポートの言語は英語、及び日本語対応。 MT4製品版はこちら : Currency Exchanger MT4 入力項目説明 General(全般設定) Currency of after exchange :

Trade Bollinger Bands combining Trend, RSI, MACD

1. Trend trading combining the Bollinger and MACD bands is done in the following sequence: - Use MACD to identify trends - Determine the potential entry point by re-checking the MA 20 of the price to see if it is in line with the trend.

2. Trade Trends with Bollinger Bands - The mid-line of bollinger bands is simply a moving average of 20 SMA20 periods, known as the Bollinger Bands' average line. - The bottom line is, when the market is in a st

稼ぎと研究のためのツール。 トレーディングシグナルと戦略の中核は、価格予測パターンを形成するための著者のアルゴリズムに基づいています。どんな楽器にも使えます! MA「九尾の狐」に基づく制御システムが追加され、市場、機器、および作業期間に合わせて信号を可能な限り正確に更新および調整します。 対象:すべての市場のすべての商品(例外があります)。 対象者:ヘッジファンド、ファンドおよび資産運用会社、投資運用会社、投機家、投資家および利害関係者。 .................................................................................................................................................................................

One of the best tools category for an Expert Advisor is the Filtering System . Using a filter on your entries will take your metrics to the good side. And even when you trade manually a filtering system is more than welcome. Let us present a commonly used filtering system based on Exponential Moving Averages - in fact, you can choose the type of the MAs as you wish and also mix them all up - we called this indicator Filter Trend MA . We present this indicator as a colored strip you can use at th

Night scalping using Le Chatelier's principle of dynamic balance. Accounting for the features of real accounts. No risky strategies. All trades are protected by a stop loss. It is possible to work with a minimum initial deposit of $10. Strategy. The trading strategy is based on the principle of dynamic balance, formulated by the French scientist Le Chatelier. According to this principle, a system that is in a state of stable equilibrium, under external influence, tends to return to a state of eq

You can watch Backtest videos https://youtu.be/IOKUVGpVmcQ https://youtu.be/NeyRg0rKDj0 https://youtu.be/jeYHXRlslfk

Flecha Scalper EA is a fully automated system, which work with multi-currency pairs but it is especially effective in trading on five symbols: EURUSD, GBPUSD, EURGBP, USDCHF, and AUDCAD. It’s better to use this system due night hours (default settings). Don’t forget to watch the three included videos of Back-testing in this page, Good luck. Features: 1. Multi symbols (recomm

Scalpel Regeneration – универсальный бот-скальпель нового поколения. Может работать на любых типах счетов. На любых инструментах без исключения. Бот работает на реальных тиках. Корректирует все значение связанніе с ценой (пипсами) относительно волатильности. Поскольку бот необходимо оптимизировать для каждой валютной пары, то вы должны понимать, что это необходимая процедура перед запуском бота. Оптимизировать необходимо на реальным тикам. Пример оптимизации в обсуждении продукта. Также еще он

A smart, next-generation Analyst STD robot. Taking into account all imaginable pitfalls when testing and working in real mode. The bot can be optimized by opening prices, and work on all ticks without problems. The bot has two versions, it can successfully work both on mt4 and mt5, both on netting and hedging accounts. For those who bought one of the versions of the bot, the second one will be half price. The EA handles errors correctly and works reliably on the market. The EA uses the foll

fully automated EA designed to trade FOREX only. Expert showed stable results with low drawdown . EA designed to trade on 1H (One Hour) Chart. use of support or resistance as stop lose , by using different time frame can give a bigger stop lose. support or resistance levels are formed when a market’s price action reverses and changes direction, leaving behind a peak or trough (swing point) in the market. Support and resistance levels can carve out trading ranges. Renko designed to filter out

This indicator is based on the same famous fractal indicator with a slight difference:

MetaTrader version 4 click here

Advantages:

Works on all instruments and time series,

Does not redraw its results,

Comparison depth is adjustable,

Works well with any popular strategy,

Adjust the power of fractals

Input settings:

Number of comparisons - The number of candles that each side selects for comparison.

Marker distance from the candlestick

You can contact us v

This tool is very helpful when trading and increasing the profits by placing certain trades (defined in the settings) with equal distances when you place Buy / Sell orders. It helps in securing the account by using the layering method. Once the price hits the first TP, the EA will move the SL to the entry level, then once the price hits the 2nd TP, the EA will move the price to the first TP level. All the TP and SL generated by the EA can be manually adjusted on the chart itself. It works on any

Ilan Universal is an automatic advisor (trading robot) used for trading in all financial markets. It is in demand among beginners and experienced traders due to such advantages as the exact execution of the trading rules of the chosen strategy, the reduction in the number of subjective errors, and the release of the user's time. The recommended deposit is $10,000. The great value of this algorithm is the possibility of optimizing by opening prices and correctness after such optimization of work

Sunrise on Mars - it is a Secure Automated Software for trade Forex market and indices.

The system operates market breaks, with correction and trend-following algorithms, the algorithms optimize the risk-benefit ratio, to minimize the risks of margin call. The system uses multiple lot depending on the algorithm, the initial lot is double the one marked as the minimum lot and is used as a reference in the algorithm. The architecture is a Fully Automatic Autonomous Robot Expert capable of indepe

This is an advanced Trend Indicator, specifically designed to detect market trends, This MT5 indicator can be used on any symbol . It draws two types of Clouds Buyers & Sellers. A New Trend is then plotted in a break from an older trend. This Powerful indicator is an excellent tool for scalpers or swing Traders. it does not redraw nor Repaint, it's Most reliable when applied on higher timeframes... Tried and Tested on Volatility 75 Index https://t.me/ToyBoyLane

GAPSインジケーターメタトレーダー5

指数、株式、その他の資産で使用される戦略の一部では、通常、各ローソク足のギャップが測定されますが、これを手動で実行する場合、計算エラーが発生する可能性があります。

このため、「GAPインジケーター」が作成されました。これは、各キャンドルの間に提示された各GAPSのPIPS値を自動的に表示し、オプションがアクティブになっている場合、それらが表示されたときにアラームを生成します。 GAPSインジケーターメタトレーダー5

指数、株式、その他の資産で使用される戦略の一部では、通常、各ローソク足のギャップが測定されますが、これを手動で実行する場合、計算エラーが発生する可能性があります。

このため、「GAPインジケーター」が作成されました。これは、各キャンドルの間に提示された各GAPSのPIPS値を自動的に表示し、オプションがアクティブになっている場合、それらが表示されたときにアラームを生成します。

finally coming to MT5 too: AGS Scalper 2 is a powerful and versatile trading robot with very customizable risk/gain ratio Trading strategy : identification of overbought and oversold conditions of the market, and checking for trend reverse

Just look at the first screenshot . I’ve made 264% profit per month! First month u sing this EA, I achieved win ratio 100% with maximal DD 18%. It was just from one pair, this EA can run on more pairs, maximizing profit and minimalizing risk . It w

MetaTrader のニュース パネルは、MetaTrader 取引プラットフォーム内の経済カレンダー データを表示するツールです。このツールは、金融ニュース Web サイトやデータ プロバイダーなどの外部ソースから経済ニュースやデータ リリースを取得し、読みやすい形式で表示します。 このツールを使用すると、トレーダーはソース、タイムゾーン、影響レベル、通貨、通知方法ごとにニュースリリースをフィルタリングできます。また、ユーザーが手動でデータを更新し、最新の情報を利用できるようにするための [更新] ボタンも含まれています。 ニュースパネルのインストールと入力ガイド ニュース パネルがソースからニュース データをロードできるようにするには、データ ソースの URL を [オプション] -> [エキスパート アドバイザー] -> [リストされた URL の WebRequest を許可する] に追加する必要があります。 (スクリーンショットを参照)。 MT4のバージョン https://www.mql5.com/en/market/product/77300 MT5のバー

New to Binary Options Trading? You are not able to win while trading binary options? Need help with your trading? You have come to the right place! This indicator provides Put (SELL) and Call (BUY) signals for binary options on the M1-M15 timeframes.

Advantages Ability to easily recognize impulsive moves. Effective and flexible combination to different trading strategies. Advanced statistics calculation following the entry point. Signals strictly on the close of a bar. Works in all symbols and

Indicador que calcula o volume real e a porcentagem da agressão vencedora num determinado período de tempo. Podendo o usuário escolher entre as opções : 3 vezes por segundo ; 2 vezes por segundo ; 1 vez por segundo ; 1 vez a cada 2 segundos ; Exemplo 1: Se o usuário optar pela opção 2 vezes por segundo, o indicador vai mostrar na tela 2 vezes em um segundo a quantidade de contratos negociados (volume real) e quantos por cento a agressão vencedora foi superior a perdedora nesse período. Ou seja,

In this product, a trading strategy is used with one of the indicators commonly used in the market, this in conjunction with a solid experience of the market in which the change in trend is observed with a respective crossover of the indicators. The price in turn has to be aligned with the indicators in such a way that everything is accommodated. In turn, this strategy has a trailing stop set at 100 pips. PARAMETERS: inp5_VolumeSize: Its use is recommended at 0.1 for accounts that operate full l

Cycle Sniper MT5 Cycle Sniper MT4 Version and definitions : https://www.mql5.com/en/market/product/51950 Important Notes: MT5 Version does not include Breakout Mode and Late Entry Mode Features.

MT5 Version does not include RSI and MFI filter. **Please contact us after your purchase and we will send you the complimentary indicators to complete the system.**

This indicator does not send any signal without a reason...You can observe and analyze the indicator and the signals it sends Cycle Sni

The Bridge indicator displays potential entry points on the chart as signals (points of absolute trend reversal).

The Bridge forex indicator algorithm was created on the basis of the original indicators for searching for extremes, the indicator is well suited for determining a reversal or a large sharp jerk to one side, thanks to it you will know when this happens, it will notify you with the appearance of a blue dot to buy red to sell. The indicator, according to a certain algorithm, qualifie

Currency Power System – Smart Currency Strength Indicator Trade smarter by following the money. The Currency Power System helps you identify the strongest and weakest currencies in real time, allowing you to make more confident and data-driven trading decisions. Core Idea Buy strength. Sell weakness.

The indicator shows you whether a currency pair is moving due to one currency gaining strength or the other losing it. With this insight, you can select the most optimal pair for trading or r

It will perfectly complement your working Expert Advisor or manual trading with up-to-date information.

There is a sound notification of exceeding the established profit and loss limits of open SELL and BUY orders.

Moreover, for each currency pair EURUSD, GBPUSD, XAUUSD, and others, various sound alerts are activated in English.

Indicators are displayed on a special panel on the chart from the moment the indicator is activated: Elapsed time

Fixed profit

Current profit Maximum drawdown Current d

The advantage of working on the Special Agent signal indicator is that the trader does not need to independently conduct a technical analysis of the chart. Determining the market trend is an important task for traders, and the tool gives ready-made signals in the form of directional arrows. This tool is an arrow (signal).

Special Agent is a trend indicator, a technical analysis tool that helps to determine the exact direction of the trend: either up or down price movement for a trading pair of

With the help of the Elephant Forex indicator algorithm, you can quickly understand what kind of trend is currently developing in the market. The indicator indicates on the chart the main trend at the current moment in the market. A change in direction, in terms of market fundamentals, means a shift in trading interest towards sellers or buyers.

If you do not take into account speculative throws, which as a result do not affect the overall trend, then the moment of a real “reversal” is always

The main purpose of the Deathly indicator is to evaluate the market. Red dots indicate that the priority should be to open SELL positions. The blue color indicates that it is time for BUY trades. Using the indicator is very convenient and easy. The indicator is universal. It is applied at any time intervals. You can use the indicator to trade different assets. The tool is perfect for Forex trading. It is actively used for trading in commodity, commodity and stock markets.

The indicator impleme

GM Grid MT5 is a fully automated/semi-automatic trading robot based on Price Action. The EA's unique trading strategy has a high probability of winning.

GM Grid is optimized for use with low spread currency pairs. GM Grid MT4 : https://www.mql5.com/en/market/product/82998 Signal ICmarkets : https://www.mql5.com/en/signals/1605843 Info:

Working symbol XAUUSD, EURUSD, GBPUSD, USDJPY,.... Working Timeframe: M1, .....(The larger the timeframe, the more stable the signal) Min deposit $125 with

The main application of the Rwanda indicator is to generate buy and sell signals. Displays the Rwanda indicator signals on the price function chart using a mathematical approach. The indicator determines the long-term and short-term trend. The best result is given by the combination of the indicator with fundamental news, it can act as a news filter, that is, it can show how the market reacts to this or that news.

With this indicator, you can predict future values. The indicator is designed to

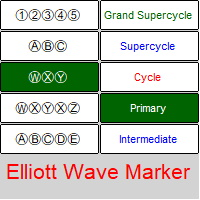

Elliott Waves Marker is a panel for marking up a chart based on Elliott waves.

The utility allows you to quickly mark the graph (mark up, edit and delete).

Input parameters: Font : Ewapro, Arial, ElliottWaveMine. download fonts : https://disk .yandex.ru/d/Pxwg7cI_cYh6_Q the second "X" in triple combination ("X" or "XX") colors for wave levels (Grand Supercycle, Supercycle, Cycle, Primary, Intermediate, Minor, Minute, Minuette, Subminuette)

For convenience, implemented: quick sele

The intelligent algorithm of the Godfather indicator accurately determines the trend, filters out market noise and generates entry and exit levels. The indicator will help in finding entry points when analyzing the price chart. The program first receives a "snapshot" of the graph, then analyzes it. The results are reported to the trader in the form of signals. The main purpose of this indicator is to determine the moments of entries and exits from transactions, so the indicator displays only th

Trade Copier Agent は、複数の MetaTrader(4/5) アカウント/端末間で取引をコピーするように設計されています。 このツールを使用すると、プロバイダー (ソース) または受信者 (宛先) として機能できます。すべての取引アクションは、遅延なくプロバイダーからレシーバーにコピーされます。 このツールを使用すると、0.5 秒未満の超高速のコピー速度で、同じコンピューター上の複数の MetaTrader ターミナル間で取引をコピーできます。 Trade Copier Agent インストール & 入力ガイド コピーを開始する前、または注文がないうちに、プロバイダー アカウントで設定を適用してください。

注文中の変更は、受取人のアカウントに影響します。 例: プロバイダー アカウントが買い注文を適用し、その後、受信者アカウントのすべての買い注文を無効にすると、決済されます。

EA追加URL( http://autofxhub.com )MT4端末(スクリーンショット参照) に関する通知を受け取りたい場合 。 MT5 バージョン https://www

A professional expert analyzes the market using the relative strength index. The basic principle is that the bot takes the indicated prices for a certain period of time and calculates the strength and amplitude of the price. This can show when the trend will lose strength and reverse. The signal from the exit from the overbought/oversold zones is analyzed, the levels of these zones will be the levels with LEVEL_MAX and LEVEL_MIN values. We buy when the signal first falls below a certain level (

Welcome to the MT 5 Candle Bot Simply set the Indicator Filter as you want and the Robot does the Job for you. This Robot works on all frames time frames and all pairs, the bot places entry positions. Features: - Magic Number - Spread Filter - Take Profit - Stop Loss - Bar Shift - Exit at opposite Signal - Filter (adjustable) - Trailing (adjustable) - Martingale (adjustable) and many more. Please feel free to download it and trade 24/7. If you need help setting it up please feel free to contac

This long-term trading system works on 10 pairs and M5 timeframe. It uses various trading systems, such as trend trading, countertrend trading and others. This increases the chances of sustained growth and reduces exposure to a single pair or individual operations. The risk is very controlled. The settings are very simple, there is no need to change them. Optimization is not required as well. Realistic management of internal adjustments. Instead of trying to find the exact values that fit the h

DESVIO DE MARCON (Desvio Dinâmico de VWAP) O Desvio de Marcon é um indicador desenvolvido com o intuito de fornecer ao TRADER uma ferramenta capaz de antecipar pontos relevantes de suporte e resistência através de canais de desvios de VWAP traçados no gráfico. Mas qual a diferença entre o Desvio de Marcon e os canais de desvio padrão da VWAP já existentes? O Desvio de Marcon utiliza um algoritmo estatístico desenvolvido por Luiz Antonio de Sousa Marcon, que lhe dá a capacidade de se auto calib

Intraday diagonal grid trading, development of Gan and Murray trading techniques. Relying on cyclical volatility, the Expert Advisor makes optimal inputs. Very easy to use - the main parameter is the minimum daily range. Additionally, you can set the parameters of averaging and profit taking.

Every day, the ADVISER displays a diagonal network of lines forming a semblance of the Ing rune

The BUY trading signal is the price crossing of the descending construction lines

The SELL trading signal

Fully automatic forex bot for GBPUSD. Fully automatic EA, developed for the GBPUSD pair on H1 timeframe by machine learning software. EA was tested with robustness tests, ensuring longterm reliability of the algorithm. You can see the results from live trading here: https://www.fxblue.com/users/37021617/stats?filtercomment=Bot%20for%20all%203& ;rx=1642767709982#ea

Benefits for you - Easy to use: you don't have to study or optimize anything, this product is finished and ready to use. - Eve

価格アクションインジケーターMT5は、指定された(デフォルトでは8)過去のろうそくの純粋な価格アクションデータに基づいて、任意のシンボル/楽器の売買力レベルのバランスを計算します。これにより、インジケーターのパネルで利用可能な32のシンボル/商品の価格アクションを監視することにより、可能な限り最も近い市場センチメントが得られます。 60%を超える売買力レベルは、特定のシンボルを売買するための非常に堅実なレベルを提供します(デフォルト設定を使用)。価格アクションインジケーターMT5には、価格アクションへの標準、高速、または低速の近接に使用できる3つの計算モードがあり、リアルタイムの動きにシャープまたはスムーズに適応するために調整可能な数の価格アクションキャンドルも提供します。

価格アクションインジケーターMT5は、あなたが注目し、最も取引したいペアを追加することにより、あなたの個人的な好みに合わせて32のシンボルボタンを構成するオプションを提供します。このようにすると、チャート上の現在の市場センチメントの全体像を一目で確認できるため、チャンスを逃すことはありません。さらに、現在の時間

New Version Launch special offer, ONLY 150$ ! Live monitoring account (Real Account / Zero Spread / Default Settings / Recommended pairs)

https://www.mql5.com/en/signals/1375120 Night Glory is a multi-currency expert advisor. It works finding possible reversal patterns in quiet market hours.

Key features: Multi-currency: trade unlimited pairs with only one chart setup Configurable money management (Auto or Manual) Proprietary trailing Take Profit and Stop Loss in every position No grid, no ma

I know, you have an idea for an EA and would like to develop your own without the need of a programmer? Then LT Sandbox EA will help you with that! As the name says (sandbox), you can configure it the way you want (within your limitations, of course). With it you can use up to 13 indicators, including an external indicator (from a third party), being able to make dozens of combinations! Available indicators: Moving Average (two of them) RSI Stochastic Oscillator MACD Bollinger Bands Parabolic S

MAXMINZA is a channel indicator showing the maximum and minimum values on any timeframe for a certain period (number of candles). This indicator creates a channel that predicts where the price will tend to reach (the opposite side of the channel). The indicator is multi-timeframe, it can consider the spread for plotting. The indicator does not redraw. This indicator goes well with another channel indicator TB5 Channel . Values: The number of candles is the period for which the channel is calc

It's a multi-currency grid system that can trade all input pairs from one chart. The expert will close all orders for each pair using a profit level. Trade on 16 pairs.

Please use expert only on a hedge account!!!

Information Chose a broker with fast execution and low spreads for effective results. Please make some tests on a demo account to see how the expert works before using it on a real account. For 0.01 minimum lot size and account leverage 1:500, you need an initial balance of at least

In this product, a trading strategy is used with some of the indicators commonly used in the market, this in conjunction with a solid experience of the market in which the structural change is observed with a respective crossing of the indicators at a certain level, depending on which be the indicator in question. The indicators of which they speak are; Relative Strength Index (RSI). Commodity Channel Index (CCI) Stochastic Oscillator. In turn, this strategy has a trailing stop which will mean t

This Expert Advisor adjusts to changes in the movement of the currency pair on history and automatically optimizes some parameters to follow the changes in the market. It calculates which candles, levels and indicator readings are most suitable for a given period of history and finds the parameters for opening a position at the moment. This allows you to optimize the parameters manually less often and trade longer without losses despite market changes. However, not all parameters are automatica

A professional expert analyzes the market using the relative strength index. The basic principle is that the bot takes the indicated prices for a certain period of time and calculates the strength and amplitude of the price. This can show when the trend will lose strength and reverse. The signal from the exit from the overbought/oversold zones is analyzed, the levels of these zones will be the levels with LEVEL_MAX and LEVEL_MIN values. We buy when the signal first falls below a certain level (

An customize Indicator by which you can have Triple moving averages at close prices and send push notification on each crossing. This indicator is especially useful when you are doing manual trading. Notes: Cation: forex trading is a very risky business,... don't invest the money you cannot bear to lose. the probability of losing is high ... more high aaaand exponentially high.... something like EMA enjoy losing with us...

The main purpose of this indicator is to determine the moments of entry and exit from transactions, therefore, the Calc Revers indicator will display only the trend line and entry points, that is, displays the places to enter the market.

Despite the apparent simplicity of the indicator, inside it has complex analytical algorithms with which the system determines the moments of inputs. The indicator gives accurate and timely signals to enter and exit the transaction that appear on the curre

The Creative expert system is a high-speed scalpel, and, accordingly, works with ticks, which should be taken into account when testing the system, is a universal scalper. The expert system works with small spreads and on a fast Internet channel. The settings are quite simple and easy to adjust.

The expert system works on any type of accounts: netting, hedging and does not use the history stored in the database for work. For his own needs, he uploads historical data online, creating his own da

ここに、デリバティブmt5取引プラットフォームでのBOOM合成インデックスによる取引に革命をもたらす指標があります。

ゴッドスパイクブーム。

主な特徴:

BOOMインデックスでのみ機能します。 トレンドフィルターがあります。 市場が上昇しているときにのみアラートを送信します。 サウンドアラート。 あなたはモバイルにアラートを送ることができます。

使い方:

m1とm5の一時性に適用します。 サウンドアラートを待ちます。 強い傾向があるか、それがすでに始まっていることを分析します。 トレンドの終わりに警戒しないでください。 合理的な毎日の利益を見つけます。 保有する資本に対して適切なリスク管理を行う。 レバレッジをかけすぎないでください。

詳細についてはお問い合わせください:

WhatsApp:+5930962863284

Professional robot Bot Classic, which implements the classic two moving average trading strategy. When two moving averages cross each other, a signal to buy or sell is formed. The direction of the signal is set in the settings and depends on which of the moving averages is smaller and which is larger, and also on whether the inversion is enabled. This adviser works with any forex pair. For cyclic re-optimization, optimization is performed for one week on a minute chart, the predicted run time b

MetaTraderマーケットはトレーダーのための自動売買ロボットやテクニカル指標を備えており、 ターミナルから直接利用することができます。

MQL5.community支払いシステムはMetaTraderサービス上のトランザクションのためにMQL5.comサイトに登録したすべてのユーザーに利用可能です。WebMoney、PayPal または銀行カードを使っての入金や出金が可能です。

取引の機会を逃しています。

- 無料取引アプリ

- 8千を超えるシグナルをコピー

- 金融ニュースで金融マーケットを探索

新規登録

ログイン