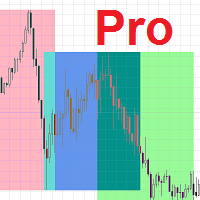

Malaysian SnR Pro: Advanced Multi-Timeframe Support & Resistance Indicator

Professional Support & Resistance Detection with Top-Down Analysis

Malaysian SnR Pro is a comprehensive support and resistance indicator that implements advanced price analysis techniques used by institutional traders.

Using a sophisticated multi-timeframe approach, it identifies key market levels with precision and filters out market noise to reveal the most significant trading opportunities.

Key Features

• Six Different Level Types: Detect all major market structures:

- Classic Support & Resistance swing points

- Order Blocks (institutional accumulation zones)

- Fair Value Gaps (FVG) showing market imbalance

- Flipped Levels (S/R role reversal zones)

- Gap Levels between candles

- Psychological Round Numbers

• True Multi-Timeframe Analysis: Includes W1, D1, H4, H1, M30, and M15 timeframes with complete higher-to-lower timeframe mapping

• Advanced Level Refinement: Aligns support/resistance levels to exact candle bodies from original timeframes for pinpoint accuracy

• Smart Level Recognition: Detects institutional footprints through order blocks and fair value gaps that retail traders often miss

• ATR-Based Dynamic Zones: Automatically adjusts zone size based on market volatility

• Visual Clarity: Color-coded by timeframe with customizable display options (lines or zones)

• Performance Optimized: Uses intelligent caching to run smoothly without lag even on multiple charts

Technical Advantages

• Precision Level Alignment: Unlike conventional indicators that use simple highs and lows, Malaysian SnR Pro maps to exact open/close prices of the original candles that created each level

• Intelligent Confluence Detection: Automatically identifies and highlights where multiple timeframe levels overlap, revealing the strongest trading zones

• Fresh vs. Unfresh Classification: Clearly marks which levels have been tested and which remain untouched for better trade selection

• Smart Level Filtering: Uses proprietary algorithms to identify and eliminate noise, showing only the most significant levels based on:

- Price reaction count analysis

- Body vs. wick touch evaluation

- Multi-timeframe confluence

- ATR-based zone spacing

• Custom Strength Calculation: Each level's opacity is determined by analyzing multiple factors including timeframe importance, reaction strength, and touch count

Designed for Serious Traders

• Top-Down Analysis: See the complete market structure from weekly timeframe down to M15, exactly as professional traders do

• Clean Chart Experience: Customize exactly which level types and timeframes to display based on your trading strategy

• Institutional Trading Edge: Identify key liquidity zones, order blocks, and institutional support/resistance levels that most retail traders miss

• Objective Decision Making: Remove subjective guesswork by having precise, quantifiable support and resistance levels

Practical Applications

• Position Trading: Identify major weekly and daily levels for long-term position entries and exits

• Swing Trading: Find key reversal zones on H4/D1 timeframes with confirmation from lower timeframes

• Day Trading: Pinpoint precise entry and exit points using H1/M30/M15 structure

• Scalping: Use confluences between multiple timeframes for high-probability short-term trades

Complete Customization

Tailor the indicator to your exact preferences with extensive settings for:

• Specific timeframe selection

• Level type filtering

• Color customization for each level and timeframe

• Zone opacity and width control• ATR-based volatility filtering • Drawing style options (lines or rectangles)