Unisciti alla nostra fan page

- Visualizzazioni:

- 82

- Valutazioni:

- Pubblicato:

-

Hai bisogno di un robot o indicatore basato su questo codice? Ordinalo su Freelance Vai a Freelance

Autore: Andrey N. Bolkonsky

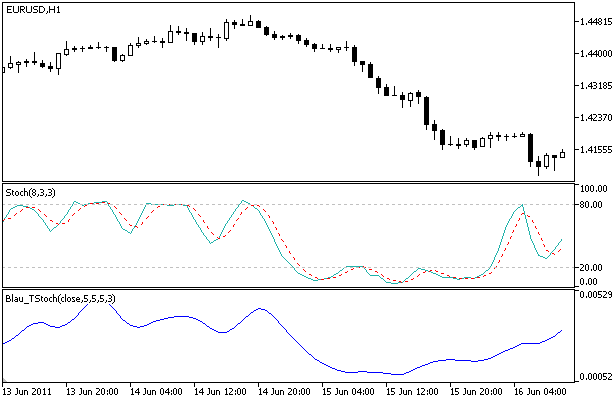

Indicatore stocastico (stocastico a q-periodo; stocastico a q-periodo smussato) William Blau, descritto nel libro Momentum, direzionalità e divergenza.

Lo stocastico è la distanza tra il prezzo di chiusura del periodo corrente e il punto più basso dell'intervallo di fluttuazioni dei prezzi nei q periodi precedenti. Il valore dello stocastico del q-periodo indica quanto il prezzo è spostato rispetto al punto basso dell'intervallo di fluttuazione dei prezzi del q-periodo. I valori dello stocastico del q-periodo sono positivi o pari a zero.

Maggiori dettagli nell'articolo Indicatori e sistemi di trading in MQL5 di William Blau. Parte 1: Indicatori.

- WilliamBlau.mqh deve essere collocato nel catalogo terminal_data_terminal\MQL5\Include\.

- Blau_TStoch.mq5 deve essere collocato nella directory dei dati del terminale\MQL5/Indicatori\.

Indicatore stocastico Blau_TStoch

Calcolo:

La formula stocastica del periodo q:

stoch(price,q) = price - LL(q)

- prezzo - il prezzo [di chiusura] del periodo corrente;

- q - numero di periodi del grafico dei prezzi coinvolti nel calcolo stocastico;

- LL(q) - il valore minimo del prezzo più basso degli ultimi q periodi per il periodo q.

Formula dello stocastico lisciato a q periodi:

TStoch(prezzo,q,r,s,u) = EMA(EMA(EMA( stoch(prezzo,q),r),s),u)

- prezzo è il prezzo [di chiusura] - il prezzo base del grafico dei prezzi;

- q - numero di periodi di tempo del grafico dei prezzi che partecipano al calcolo stocastico;

- stoch(prezzo,q)=prezzo-LL(q) - stocastico a q periodi;

- EMA(stoch(prezzo,q),r) - primo smoothing - media mobile esponenziale (esponente) di periodo r applicata allo stocastico di q periodi;

- EMA(EMA(...,r),s) - secondo smoothing - esponente del periodo s applicato all'esponente del periodo r;

- EMA(EMA(EMA(...,r),s),u) - terzo smoothing - esponente del periodo u applicato al risultato del secondo smoothing.

Parametri di ingresso:

- q - periodo in cui viene calcolato lo stocastico (q=5 per impostazione predefinita);

- r - periodo del 1° EMA, applicato allo stocastico (per impostazione predefinita r=20);

- s - periodo del 2° EMA, applicato al risultato del primo smoothing (s=5 per impostazione predefinita);

- u - periodo del 3° EMA, applicato al risultato del secondo smoothing (per default u=3);

- AppliedPrice - tipo di prezzo (per impostazione predefinita AppliedPrice=PRICE_CLOSE).

Limitazioni:

- q>0;

- r>0, s>0, u>0. Se r, s o u sono uguali a 1, non viene eseguito lo smoothing sul periodo EMA corrispondente;

- dimensione minima dell'array di prezzi =(q-1+r+s+u-3+1).

Tradotto dal russo da MetaQuotes Ltd.

Codice originale https://www.mql5.com/ru/code/363

Oscillatore ergodico Blau_Ergodic

Oscillatore ergodico Blau_Ergodic

L'oscillatore ergodico di William Blau.

Indice di forza reale Blau_TSI

Indice di forza reale Blau_TSI

L'indicatore True Strength Index di William Blau.

Tuyul GAP

Tuyul GAP

Trading Gap Weekend, è redditizio?

Indice stocastico Blau_TStochI

Indice stocastico Blau_TStochI

Indice stocastico di William Blau (stocastico normalizzato lisciato a q-periodi).