A Guide On How To Optimize The Expert Take Profit EA

This advanced system of intelligent trading consists in the opening of positions in the ideal zones and the automatic change of the take profit to increase the odds of winning.

This bot can be used in forex, commodities, metals, cryptocurrency, CFDs, index and stocks. You just need to configure the parameters for the pair you wish to us, preferably on instruments with an up trend.

Expert Take Profit is an EA that has 6 parameters to configure that can be optimized for any pair in which you wish to operate.

A short description on how to find the parameters for the pair you wish to operate is given bellow.

3 basic steps to find the optimization parameters

- Initial configuration of the Strategy Tester to find the zone to optimize the selected pair.

- Secondary configuration of the Strategy Tester to find the optimum parameters of the Expert Take Profit in the selected pair.

- Selecting the optimum parameters.

Initial configuration of the Strategy Tester to find the zone to optimize the selected pair.

A) Click on the VIEW tab, scroll down and click again in STRATEGY TESTER (Ctrl+R).B) A window will appear. Click on SINGLE.

C) In the next window, click on SETTINGS.

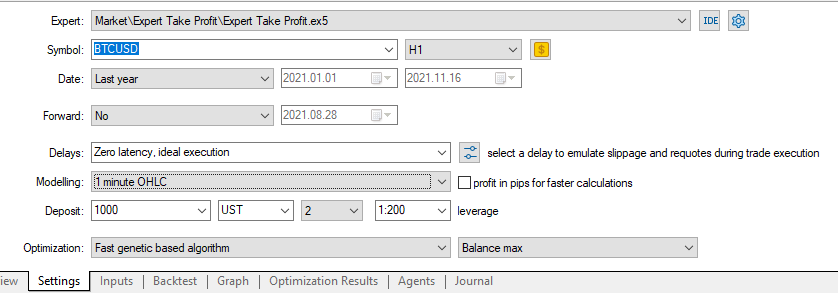

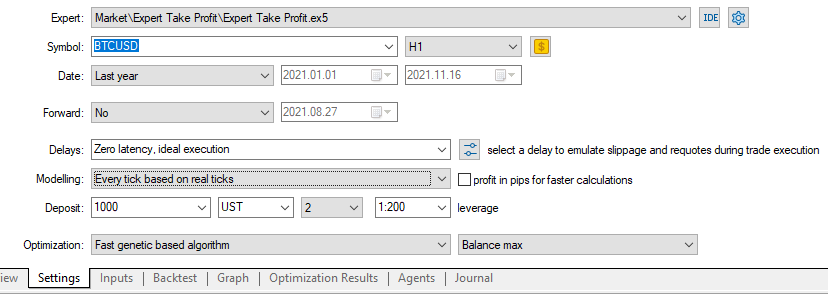

Configuration of the SETTINGS tab.

- Select the symbol you wish to optimize.

- Select the timeframe: H1.

- Select the period of time. (I recommend one year).

- To make it more simple, leave FORWARD on NO.

- DELAYS: Zero latency, ideal execution.

- MODELLING: 1 minute OHLC.

- Uncheck the box PROFIT IN PIPS FOR FASTER CALCULATIONS.

- DEPOSIT: Amount of money you wish to operate with the bot.

- LEVERAGE: Put the leverage used by your broker.

- OPTIMIZATION: Fast genetic based algorithm.

- MARK: Balance max.

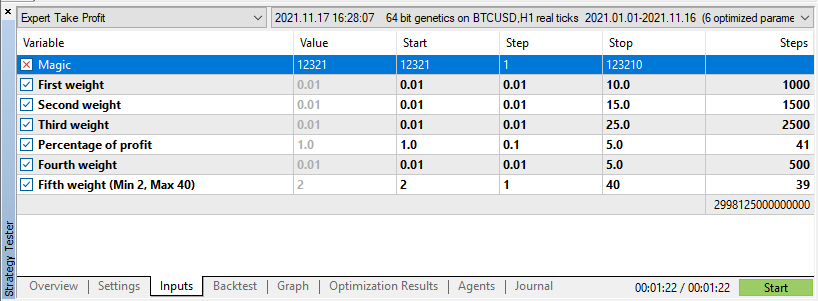

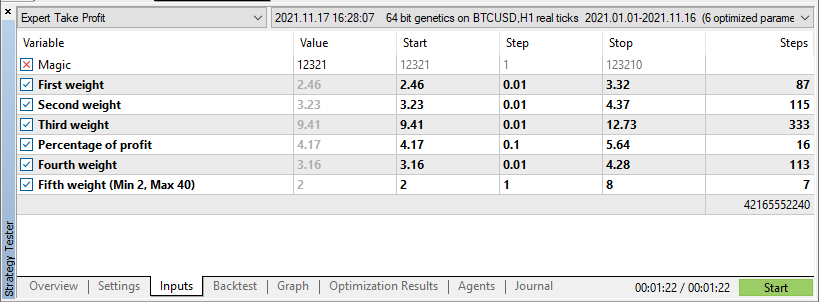

D) In the next window, click on INPUTS and fill in the table as shown on the image.

We start the search by pressing the START button (located at the end of the row).

It will start a search looking for the optimum zones for the selected pair.

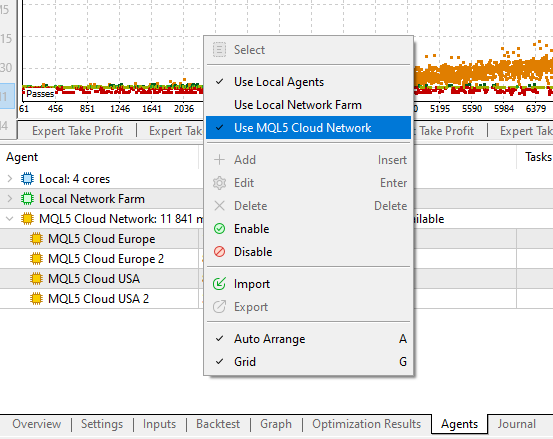

This search can take a few minutes depending on the quantities of the variables and period of time selected. To make the searches more quickly, MQL5 offers a paid service called MQL5 Cloud Network (located in the tab AGENTS).

The cost in finding optimum parameters using the MQL5 Cloud Network service can be less than 5 USD.

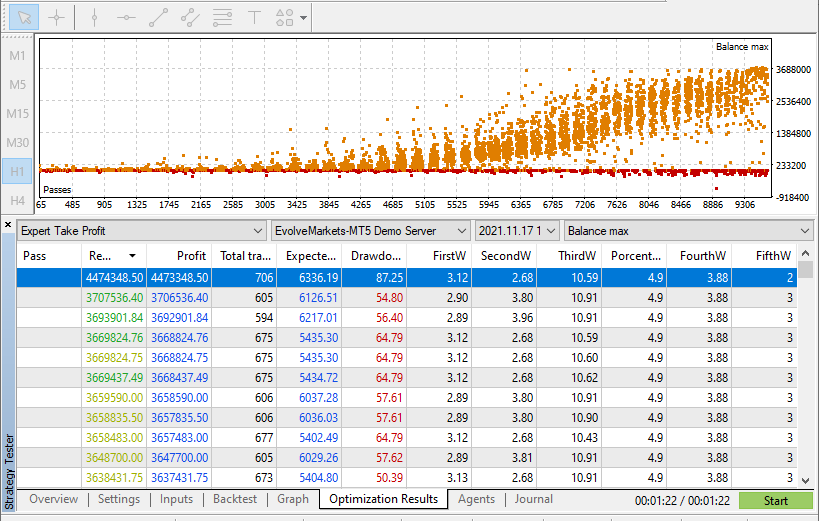

As the optimizer progresses, it will form a cloud of dots explaining the values obtained for different parameters of entry. At the beginning, the parameters will be aleatory, minutes later, the optimizer will find valid solutions. At the end, it will show something like this:

This image shows the optimum zones that the MQL5 optimizer has found. For example, the first zone generates a profit of 4.473.348 USD, with 706 trades executed during the last year, with a drawdown of 87.25%. The setting would be:

| First W | Second W | Third W | Perentage | Fourth W | Fifth W |

|---|---|---|---|---|---|

| 3.12 | 2.68 | 10.59 | 4.9 | 3.88 | 2 |

Secondary configuration of the Strategy Tester to find the optimum parameters of the Expert Take Profit in the selected pair

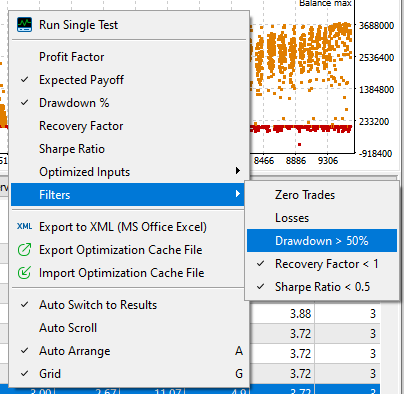

To decrease the risks, I recommend to filter the results showing only the zones where the drawdown is less than 50%.

When applying this filter, select the zones that best suit your risk level. For this example, we will use the following zone:

![]()

| First W | Second W | Third W | Perentage | Fourth W | Fifth W |

|---|---|---|---|---|---|

| 2.89 | 3.80 | 11.07 | 4.9 | 3.72 | 3 |

Now, we repeat the process but doing the following changes:

Click the SETTINGS tab:

On the MODELLING box, select Every tick based on real ticks. This selection is more precise because the taken history will be the real ticks the broker generated in the specified period of time.

On the INPUTS tab, we are going to determinate the starting point (on the START column) as the 75% of those values minus the Fifth W variable, in which the minimum will be 2.

| First W | Second W | Third W | Perentage | Fourth W | Fifth W |

|---|---|---|---|---|---|

| 2.89 * 0.75 | 3.80 * 0.75 | 11.07 * 0.75 | 4.9 * 0.75 | 3.72 * 0.75 | 2 |

For the STOP column, we will add a 25% minus the variable Fifth W, which we will add 5.

| First W | Second W | Third W | Perentage | Fourth W | Fifth W |

|---|---|---|---|---|---|

| 2.89 * 1.25 | 3.80 * 1.25 | 11.07 * 1.25 | 4.9 * 1.25 | 3.72 * 1.25 | 3 + 5 |

Note: All the values must be higher to 0.01 and the Fifth W variable must be equal or higher than 2.

Selecting the optimum parameters.

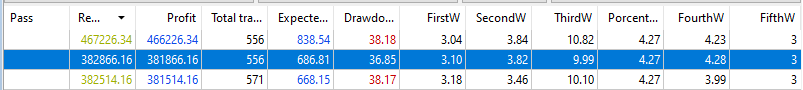

After searching again for the optimum parameters, analyzing the results and taking the parameters of the results that best suit your risk level, remember to take those values that have more than 100 trades. For this example, the optimum value selected is:

| First W | Second W | Third W | Perentage | Fourth W | Fifth W |

|---|---|---|---|---|---|

| 3.10 | 3.82 | 9.99 | 4.27 | 4.28 | 3 |

Remember, this is a basic optimization guide that works as a starting point to find the optimum parameters in order to configure our Expert Take Profit EA.

The pass success does not guaranty future development, this is why is not recommended to risk more money than you are willing to lose.