BECAUSE I HAVE TO USE CURIOSITY (https://youtu.be/3oBtPfD3RuE)

Option of trade serie curiosity: (VIDEO MANUAL INPUT : https://youtu.be/S4rpJczmmto)

HOW TO USED CURIOSITY:(https://youtu.be/i3D_VCc2_nM)

HOW TO TEST CURIOSITY: (https://youtu.be/sbgwMgU5YD8)

- Magic Number: magic number of the EA, which allows it to distinguish its positions from others. Must have different values for every chart.

- Indicator option: Option of the indicator used in the version of curiosity, have explain in the indicator Mars whit same number of curiosity.

- Option Entry: (https://youtu.be/KTfIupo8ZWU)

- 1) Entry Direction Indicator: Entry follow signal of indicator

- 2) Entry Contra Direction Indicator: Entry contra follow signal of indicator

- 3) Entry Trend Direction: Entry in trend

- 4) Entry Contra Trend Direction: Entry in contra trend

- 5) Random entry: Random entry sell o buy for test algorithm chose (Useful to test the nature of your

operative curiosity) (

https://youtu.be/k0vT9h6fIJw)

- 6) Manual entry: Manual entry for one unit cycle of manual trading (https://youtu.be/vhigcY827D0)

- 7) Entry with classic indicator: select only classic indicator for entry (https://www.mql5.com/es/blogs/post/728285)

- 8) Entry whit levels: 9 diferent algorithm to entry in the market.(https://youtu.be/X1b8XnRucrI)

- a) Cero levels: Based in round nunbers

b) Support Resistance: Based in near support and resistance

c) Fibo level: Based in near fibo level

d) Pivot level: Based in near clasicc pivot level

e) Fivo pivot level: Based in near fibo pivot level

d) DeMark Pivot level : Based in near DeMark pivot level

e) Camarilla Pivot level: Based in near Camarilla pivot level

f) Murrey level: Based in near Murrey level

g) Trend Line: Based in cross trend line in trend direccion grip

- Order Type Manual: Select the type order of manual entry (buy, sell, Buy limit Sell limit, Buy stop, Sell stop)

- Price entry Manual: price entry for manual trade mode in pending order.

- Power trend: Used for regulate power of trend entry in option entry 3 and 4

- Time Factor Trend: Used for regulate Timeframe of trend entry in option entry 3 and 4

- Exit indicator: Used exit folow indicator signal only in profit rade and only in nor mal Operative mode.

- Configuration of Trade Mode: (https://youtu.be/6wh22miKLEA)

- 1) STOP_ORDER_BREAK. :Using pending order for the entry in BREAK direction

- 2) MARKET_ORDER_BREAK: Using market order for the entry in BREAK direction

- 3) STOP ORDER PULLBACK: Using pending order for the entry in pullback direction

- 4) MARKET_ORDER_PULLBACK. Using market order for the entry in pullback direction

- 5) OCO PULLBACK.Using OCO order for the entry in pullback direction

- 6) OCO_BREAK. Using OCO order for the entry in BREAK direction

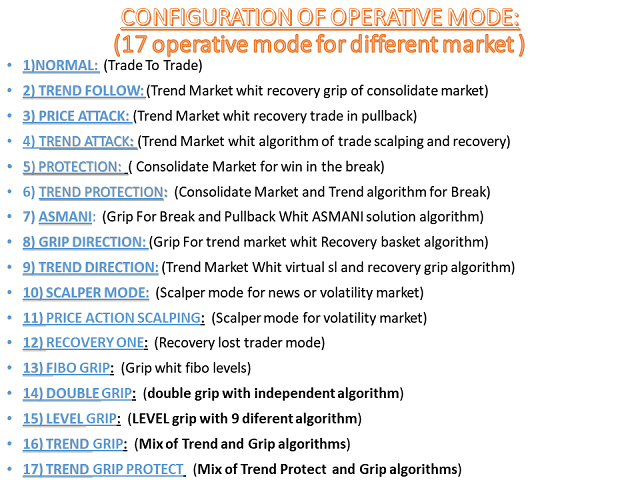

- Configuration of Operative mode: (17 operative mode for different market ) ( https://youtu.be/1DKiF-VORjc))

- 1)Normal: (Trade To Trade)

Do not use operative option. This is the option to trade-to-trade, the exit is for indicator signal, tp, sl, break event o tl, remember configure the exit.

- 2) Trend Follow: (Trend Market whit recovery grip of consolidate market)

Use Trend Follow operative. This operative does not use sl, tp, tl configure distance trend and Distance Grip. if the trend is correct detect the exit is for trend entry, whit trend algorithm , if the entry change, initial recovery algorithm .

(No configure activate the sl,tp,tl, be and spread correct)

https://www.youtube.com/watch?v=9hjejoNgWMM

- 3) Price Attack: (Trend Market whit recovery trade in pullback)

Aggressive mode. Used virtual sl,tp and tl. Configure Distance Trend for control the mode. This mode is good for trend market, no indicated if the marked is consolidate, if the initial trade is good the exit is for change of trend, no algorithm trend attack, if the exit is bad initial contra trend direction entry, configure protection lot for select the lot of the contra trend entry.

(No configure activate the sl,tp,tl, be and spread correct)

https://www.youtube.com/watch?v=vEljBeuBltM

- 4) Trend Attack: (Trend Market whit algorithm of trade scalping and recovery trade in pullback )

Use mode Price attack in lost an trend follow in profit (Used virtual sl, tp and tl. Configure Distance Trend for control the mode ) This mode is the same in contra trend direction that price attack, but have algorithm of trend, if the trend is correct the EA apply one algorithm for trend whit good benefit, ideal for trend market, no recommended in consolidate market.

(No configure activate the sl,tp,tl, be and spread correct)

https://www.youtube.com/watch?v=tfnvPjMcahc

- 5) Protection: ( Consolidate Market for win in the break)

Use one algorithm mode of protection ( Used virtual sl, tp and tl) This system protect the bad entry, if the entry is good the system win in one only trade, if the entry is bad initial recovery advanced protection mode whit exit whit benefit, ideal in consolidate market. Configure distance trend, and distance entry. In consolidate market is important activate the filter of entry.

(No configure activate the sl,tp,tl, be and spread correct)

https://www.youtube.com/watch?v=WICjsBmx8EU

- 6) Trend Protection: (Consolidate Market and Trend algorithm for scalping Break)

Use one mix to trend follow and algorithm mode of protection (Used virtual sl, tp and tl) if the entry is good, apply trend algorithm , if the entry is bad apply protection algorithm . Is my favorited mode: no more aggressive, win in trend, and consolidate market.

(No configure activate the sl,tp,tl, be and spread correct)

https://www.youtube.com/watch?v=yPLfvsxBavA

- 7) ASMANI: (Grip For Break and Pullback Whit ASMANI solution algorithm )

Use ASMANI mode to solved lost trade (Used virtual sl and tp) Configure ASMANI max order, ASMANI RSI PERIOD, ASMANI RSI Top Value, ASMANI RSI Bottom Value and ASMANI Profit Per Basket. If the trade is good exit whit profit per basket, is the entry is bad exit used algorithm ASMANI for exit. Configure protection lost lot for the algorithm.

(No configure activate the sl,tp,tl, be and spread correct)

https://www.youtube.com/watch?v=ew1c4ClX5yM

- 8) GRIP DIRECTION: (Grip For trend market whit Recovery basket algorithm )

Use GRIP to solvet lost trader (Used virtual sl and tp) Configure Distance Grip and GRIP Profit Per Basket

If the trade is good exit whit profit per basket, is the entry is bad exit used algorithm grip for exit. Configure protection lost lot for the algorithm.

(No configure activate the sl,tp,tl, be and spread correct)

https://www.youtube.com/watch?v=xMDNn25YX6s

- 9) TREND DIRECTION: (Trend Market Whit virtual tp ans sl and recovery grip algorithm )

Trading for range market (Used virtual sl) Configure Distance Grip and GRIP Profit Per Basket and distance entry used trend low profit and grip for recovery entry, ever in the market, ever buy and sell order open.

(No configure activate the sl,tp,tl, be and spread correct)

- 10) SCALPER MODE: (Scalper mode for news or volatility market)

Trading for breaking market (Used virtual sl and tp) Configure lot mode, and Protection loss is important for this mode configure virtual trailing and sl for correct exit. For more security, entry activated the entire filter in the "Configuration of Entry Point".

(No configure activate the be and spread correct)

- 11) PRICE ACTION SCALPING: (Scalper mode for news or volatility market Whit pending and volatility algorithm)

Trading for breaking market (no used signal of the indicator, used virtual tp) Configure Lot mode and Protection loss (false recommended) is important for this mode. Configure virtual trailing and sl for correct exit. Recommended false in all filter. Used parameters of Bollinger Bands period PAS and RSI period PAS.

(No configure activate the tp , sl be and spread correct)

- 12) RECOVERY ONE: (System to recovery lost trader whit recovery algorithm).

This system used the distance to sl in the ea for initial recovery algorithm, this system close one part of loses trader, whit algorithm recovery. (Need configure Tp for exit trade, Needs used sl for pip, for algorithm recovery, need configure lot, the lot recovery is a factor o lot used in the entry recommended used 0,1 for lot and 0,01 for recovery lot). No recommended used Protection lost, no used trailing stop o break event option.

(No configure activate the tp , sl be, tl spread correct, and protection lost)

- 13) Fibo Grip: (System to grip whit fibo levels).

This system used the distance of FIBO to make a GRIP. Use GRIP to solver lost trader (Used virtual sl and tp) Configure GRIP Profit Per Basket

If the trade is good exit whit profit per basket, is the entry is bad exit used algorithm grip for exit. Configure protection lost lot for the algorithm.

(No configure activate the sl,tp,tl, be and spread correct)

- 14) Double Grip: (System to double independent algorithms grip).

Use Double GRIP to solvert lost trader (Used virtual sl and tp). Double Grip, uses a double grip with independent algorithms, which allow to keep profits in one of the branches while the other recovers the trade with its grip.Configure Distance Grip and GRIP Profit Per Basket. If the trade is good exit whit profit per basket, is the entry is bad exit used algorithm grip for exit. Configure protection lost lot for the algorithm.

(No configure activate the sl,tp,tl, be and spread correct)

- 15) Level grip: (System based in 9 level algorithms for control the grip).

Use Level GRIP to solvert lost trader (Used virtual sl and tp). level Grip, uses a double grip with independent algorithms in 9 diferent types of level, which allow to keep profits in one of the branches while the other recovers the trade with its grip.Configure Distance Grip and GRIP Profit Per Basket. If the trade is good exit whit profit per basket, is the entry is bad exit used algorithm grip for exit. Configure protection lost lot for the algorithm. Chosse one of the 9 diferent types of level:

a) Cero levels: Based in round nunbers

b) Support Resistance: Based in near support and resistance

c) Fibo level: Based in near fibo level

d) Pivot level: Based in near clasicc pivot level

e) Fivo pivot level: Based in near fibo pivot level

d) DeMark Pivot level : Based in near DeMark pivot level

e) Camarilla Pivot level: Based in near Camarilla pivot level

f) Murrey level: Based in near Murrey level

g) Trend Line: Based in cross trend line in trend direccion grip

(No configure activate the sl,tp,tl, be and spread correct)

- 16) Trend grip: (Mixed of trend and grip algoritm ).

- Trend Grip Mode Mix of Trend and Grip algorithms. Get both algorithms work together and in harmony, managing to improve the gains in trend and eliminate the losses in the wrong entries.Use GRIP to solvet lost trader (Used virtual sl and tp) Configure Distance Grip,Distance trend and GRIP Profit Per Basket

-

If the trade is good exit whit profit per basket, is the entry is bad exit used algorithm grip for exit. Configure protection lost lot for the algorithm. The Trend algorithm. This operative does not use sl, tp, tl configure distance trend and Distance Grip. if the trend is correct detect the exit is for trend entry, whit trend algorithm .

-

(No configure activate the sl,tp,tl, be and spread correct)

- 17) Trend Grip Protect: (Mixed of trend protect and grip algoritm ).

- Trend Grip Protect Mode Mix of Trend Protect and Grip algorithms. Get both algorithms work together and in harmony, managing to improve the gains in trend and eliminate the losses in the wrong entries.Use GRIP and Protect to solvet lost trader (Used virtual sl and tp) Configure Distance Grip, Distance protect, distance trend and GRIP Profit Per Basket

-

If the trade is good exit whit profit per basket, is the entry is bad exit used algorithm Protect and grip for exit. Configure protection lost lot for the algorithm. The Trend algorithm. This operative does not use sl, tp, tl configure distance trend and Distance Grip. if the trend is correct detect the exit is for trend entry, whit trend algorithm .

-

(No configure activate the sl,tp,tl, be and spread correct)

Other entry option:

- Auto Distance: In true the algorithm calculated automatic the Distance (entry. protect, trend and grip)

- Distance entry: SECURITY MARGIN FOR ENTRY (CONFIGURE IN OPERATIVE MODE: 5)

- Distance protect: SECURITY MARGIN FOR PROTECCTION ALGORITHM (CONFIGURE IN OPERATIVE MODE: 5,6,17)

- Distance Trend: Pip to activate ALGORITHM of TREND (CONFIGURE IN OPERATIVE MODE: 2, 3,4,6,8,16,17)

- Distance Grip: Distance to GRIP DIRECTION (CONFIGURE IN OPERATIVE MODE: 2,8,9,14,15,16,17)

- Asmani max order. Number of max order in Asmani mode. (CONFIGURE IN OPERATIVE MODE: 7)

- Asmani RSI period: Period of RSI for Asmani mode (CONFIGURE IN OPERATIVE MODE: 7)

- Asmani RSI top value: Top value of RSI for Asmani mode (CONFIGURE IN OPERATIVE MODE: 7)

- Asmani RSI botton value: Bottom value of RSI for Asmani mode (CONFIGURE IN OPERATIVE MODE: 7)

- Auto_Basket:( https://youtu.be/vIhmJK5kthc)

- With Auto Basket, the exit for benefits is adhered to the initial lot of the cycle, the value in the ASMANI_ProfitPerBasket and GRIP_ProfitPerBasket fields becomes the profit of the minimum symbol lot and from there the profit is progressively increased proportionally to the lot used at the beginning of the cycle (CONFIGURE IN OPERATIVE MODE: 2 ,7, 8,9,13,14,15,16,17)

- Asmani Profit per Basket: Profit for Asmani mode (CONFIGURE IN OPERATIVE MODE: 7)

- Grip Profit per Basket: Profit for Grip mode (CONFIGURE IN OPERATIVE MODE: 2 ,8,9,13,14,15,16,17

- Bollinger Bands period PAS (CONFIGURE IN OPERATIVE MODE: 11 )

- RSI period PAS: (CONFIGURE IN OPERATIVE MODE:11 )

- Modes for Recovery One: (https://youtu.be/gumH5gI8Oao) (CONFIGURE IN OPERATIVE MODE:12)

- Mode 1 Aggressive No Block: Aggressive mode, no block original order in the sl.

- Mode_2 Conservative No Block: Conservative mode, no block original order in the sl.

- Mode_3 Aggressive Block: Aggressive mode, whit block original order in the sl.

- Mode_4 Conservative Block: Conservative mode, whit block original order in the sl

- Lot For Recovery: (CONFIGURE IN OPERATIVE MODE:12) Recommended user realtion 1/10 to Lot parameters, for example lot 0.1 recovery lot 0.01.

- Modes for Protection and protection trend: (https://youtu.be/q8ocahoBi-Q) (CONFIGURE IN OPERATIVE MODE: 5 6Y 17)

- Mode 1 For no consolidate Market

- Mode_2 For Little consolidate Market

- Mode_3 For consolidate Market

- Mode_4 For Big consolidate Market

- Mode_5 Personalize Factor Protection

- Factor_proteccion: VALUE FOR MODE 5

- Modes for grip: (https://youtu.be/BvCOMmRPXcA)

(CONFIGURE IN OPERATIVE MODE: 2 ,8,9 14,15,16,Y17 )

- Mode 1 Constant Grip

- Mode_2 Adding distance Grip

- Mode_3 Exp distance Grip

- Mode_4 Personalize Factor GRIP

-

- Factorgrip: VALUE FOR MODE 4

- Modes for FIBO grip: (https://youtu.be/BvCOMmRPXcA)

(CONFIGURE IN OPERATIVE MODE: 13, 16 Y 17 )

-

- 1) Mode 1 23% fibo

- 2) Mode 2 38.2% fibo

- 3) Mode_3 50% fibo

- 4) Mode_4 76.8% fibo

- 5) Mode_5 100% fibo

- 6) Personalized fibo

- Personalized_Factor_Fibo_grip: VALUE FOR MODE 6

Mode Level Grip (https://youtu.be/3mtRm3Pqlgw)

(CONFIGURE IN OPERATIVE MODE: 15,16 Y 17 )

- Cero level

- Support Resistance

- Fibo level

- Pivot level

- Fibo_Pivot level

- DeMark Pivot level

- Camarilla Pivot level

- Murrey level

- Trend Line

- GRIP Direction

- Fibo grip

- Double grip

- Level Grip

- Cero level

- Support Resistance

- Fibo level

- Pivot level

- Fibo_Pivot level

- DeMark Pivot level

- Camarilla Pivot level

- Murrey level

- Trend Line

- GRIP Direction

- Fibo grip

- Double grip

- Level Grip

- Configuration of Entry Point

- 1) Size: Size of de entry.

- 2) Margin exit: margin security of exit.

- 3) Margin entry: margin security of entry

- 4) Margin box: margin size of box break

-

- Filter range: Activate Impulse filter.

-

- 1) Distance filter: Distance Impulse filter.

- 2) Impulse Entry: Activate Impulse filter in the entry.

- 3) Impulse Exit: Activate Impulse filter in the exit for Pending Order.

- 4) Impulse Power: Power of the Impulse.

- 5) Impulse Time: Time of the Impulse.

- 6) Impulse Filter: Filter of the Impulse.

- 7) Volume Filter: Volume filter for entry in Market Order entry

- 8) Pair Filter: Activate pair filter only in market entry no test in back test mode.

- (This filter, which can only be used on the market and is automatically deactivated in the tests. Allows filtering the

entries in favour of the market. If for example we select EURUSD, it filters the power of the last hour the 28 values of

the forex. In which this the EUR and the USD and if the EUR has more power than the USD enters only buying. If the USD has more power

than the EUR enters only selling. You can filter a different pair than you can by selecting the one to filter in the next field

(Symbol Pair))

Symbol Pair= Symbol used for Pair filter

- USED FILTER WHIT 23 CLASSIC INDICATOR SEE THE INFO HERE (https://www.mql5.com/es/blogs/post/728285)

- SEE VIDEO TUTORIAL HERE ((https://youtu.be/hm9byAay_0E))

- FILTER WHIT:

- Bill Williams' Accelerator/Decelerator oscillator (https://youtu.be/QmRD73ZC1KA)

- Accumulation/Distribution indicator ( https://youtu.be/2QD-4wXsMCE)

- Average Directional Movement Index indicator(https://youtu.be/jc6OxsJTOZY)

- Awesome oscillator ( https://youtu.be/yL1VT1wp9ic)

- Average True Range indicator( https://youtu.be/DoG-O3It81k)

- Bears/Bulls Power indicator ( https://youtu.be/YnxLKeenTrw)

- Bollinger Bands indicator (https://youtu.be/MyZkSpqYJzE)

- Commodity Channel Index indicator ( https://youtu.be/JjyR0IVjDSo)

- DeMarker indicator(https://youtu.be/WUHzBS9zXQA)

- Envelopes( https://youtu.be/mZ_YH-b7j2I)

- Force Index indicator( https://youtu.be/xo6DGcQ4Auw)

- Momentum indicator( https://youtu.be/XMAKmHGnVMY)

- Money Flow Index indicator( https://youtu.be/veA98ljlKbs)

- Moving Average indicator( https://youtu.be/fPJ_mkUj4SQ)

- Moving Averages Convergence/Divergence indicator ( https://youtu.be/IN_XWWTrNxw)

- On Balance Volume indicator ( https://youtu.be/yFN3mIvv1hE)

- Parabolic Stop and Reverse system indicator( https://youtu.be/VvvC7e9hbr0)

- Relative Strength Index indicator ( https://youtu.be/amP_9eHLNhk)

- Relative Vigor Index indicator( https://youtu.be/B9yls1gIrJI)

- Standard Deviation indicator( https://youtu.be/u7g3d7daJE4)

- Stochastic Oscillator( https://youtu.be/nVuIUfmMhWE)

- Volume( https://youtu.be/Ga8N8q2lcnY)

- Larry Williams' Percent Range( https://youtu.be/SdLZjyVxpaw)

- Configuration of Position

- close_by_line: Use this field to close whit the 2 blue line, can move the line in the screen to place in your select, only avaible for normal operative mode, recomended used no sl an no tp for correct configuration

SL mode: Select stop loss model:

- 1) Auto SL: Stop loss automatic

- 2) Use Pip SL: Stop loss in Pip

- 3) Hidden SL: Stop loss in function of support and resistance

- 4) No SL: No used Sl

Sl: Pip for Stop loss

TP mode: Select Take profit model

- 1) Auto TP: Take profit automatic

- 2) Use Pip TP,: Take profit in pip

- 3) Hidden TP: Take profit in function of support and resistance

- 4) No TP: No used Take profit

Tp: Pip for Take profit

Spread Correct: Use correction of spread in stop loss and take profit.

Money Management

- Configuration of Lot

Lot mode: Option of the lot of initial trade. (https://youtu.be/nhFYni-dwd0)

- 1)Auto LOT: Lot automatic

- 2) Equity Lot: Lot in function of Equity

- 3) Stop Lot: Lot in function of distance of Stop Loss

- 4) Fixed Lot: Lot Fixed

- 5) Lot For sl: Calculate the lot for the stop Loss

Fixed LOT: Value of fixed lot

Base Lots: Lot initial of the algorithm

Base Equity: Equity for lot

Risk mode: Risk used in automatic lot.(https://youtu.be/GUgWZjZCmUo)

- 1) Conservative: Conservative algorithm

- 2) Standard: Standard algorithm

- 3)Aggressive: Aggressive algorithm

- 4) Super Aggressive: Super Aggressive algorithm

- 5) Personalized: Personalized risk

Percentage Lots: For Personalized lot

Protection lost: Activate algorithm of protection lost

Protection mode: Select mode of protection loss

- 1)Exponential,: Exponential algorithm

- 2) Adding Factor: Adding Factor algorithm

- 3) Adding: Adding algorithm

EXP: Value of exponential algorithm of protection mode

ADD Factor: Value of adding factor algorithm of protection mode

ADD: Value of Adding algorithm of protection mode

- Configuration of exit ( https://youtu.be/eQ0aGTJUyuI)

- Compensation: On/off compensation option. Compensation searches and compares orders with losses and gains, compensating both entries ( https://youtu.be/RHhBFdoo9q0)

- Use_TP_Percent: Activate Tp for Percent

- Percent_Profit: Value of Percent Profit

- Use_SL_Percent: Activate Sl for Percent

- Maximum_Loss: Maximun loss permet

- Used_TargetEquity: Used Equity for target

- TargetEquity: Value of Target Equity

- Configuration of Partial_Close (https://youtu.be/56hA1ufgFc4)

- Partial_Close: Activate Partial Close.

- value_of_partial_close: Nunber of partial close 1 to 10.

- tp_partial: Activate tp in partial close.

- sl_partial: Activate sl in partial close.

- tp1-tp10: Value tp 1 to 10.

- sl1-sl10: Value sl 1 to 10.

- Configuration of breakeven(https://youtu.be/X63Vpm8OgFo)

- BreakEven: Activate Break Event

- BreakEvenAt: initial Value of Break Event

- BreakEvenTo: Vaule of moving of Break Event

- Configuration of Trailing(https://youtu.be/1z3AA3taWis)

- Trailing: Activate Trailing

- TrailingStop: Value of Trailing Stop

- TrailingStep: Value Of Trailing Step

- AllPositions: Trailing in all positions.

- ProfitTrailing: Trailing only in profit trade.

- parameters_trailing:

- 1) by ATR indicator

- 2) by Parabolic indicator

- 3) by MA indicator

- 4) by profit %

- 5) by extremums of candle

- 6) by fractals

- 7) by points

- Stop loss movement step

- Minimal profit of trailing stop in points

- Trailing from breakeven point

- Offset from the stop loss calculation level

- Information output color

- Percent of profit (method 3)

- Parabolic Step (method 4)

- Parabolic Maximum (method 4)

- MA period (method 5)

- Averaging method (method 5)

- Price type (method 5)

- ATR period (method 6)

- Configuration of Time to Trade (https://youtu.be/gdTMxC8YeoA)

- Hours for operative EA (true/false).

- Open Hour: Hour Open time (0-23).

- Open Minute: Minute Open time (0-59).

- Close Hour: Hour Close time (0-23).

- Close Minute: Minute Close time (0-59).

- Hour to Close Trade: Hour for close open trade of the EA (true/false).

- Close Trade Hour: Hour to close trade (0-23).

- Close Trade Minute: Minute to Close trade (0-59)

- Information in the Screen

- Information: Show Information of Cycle can set to "true" or "false". If "true", the information panel of cycle and balance of the open and close trade will displayed on the chart of the traded pair.

- Commentary: Show Information of expert in the screen can set to "true" or "false". If "true", the information panel of count and rich control will displayed on the chart of the traded pair.

- Line: Show Line of break in the screen can set to "true" or "false". If "true", the line help displayed on the chart of the traded pair.

SYMBOL NAME OF YOUR BROKER. In this group of input can change the name user for your broker for the different pair used in filter pair, this option is only for market entry no activated in test.

DONWLOAD SET CONFIGURATION FOR CURIOSTY HERE (https://www.mql5.com/es/blogs/post/726352)