Jason Smith / Profile

- Information

|

1 year

experience

|

22

products

|

14

demo versions

|

|

2

jobs

|

0

signals

|

0

subscribers

|

The best algorithmic developers aren't just programmers - they're traders who code.

Friends

101

Requests

Outgoing

Jason Smith

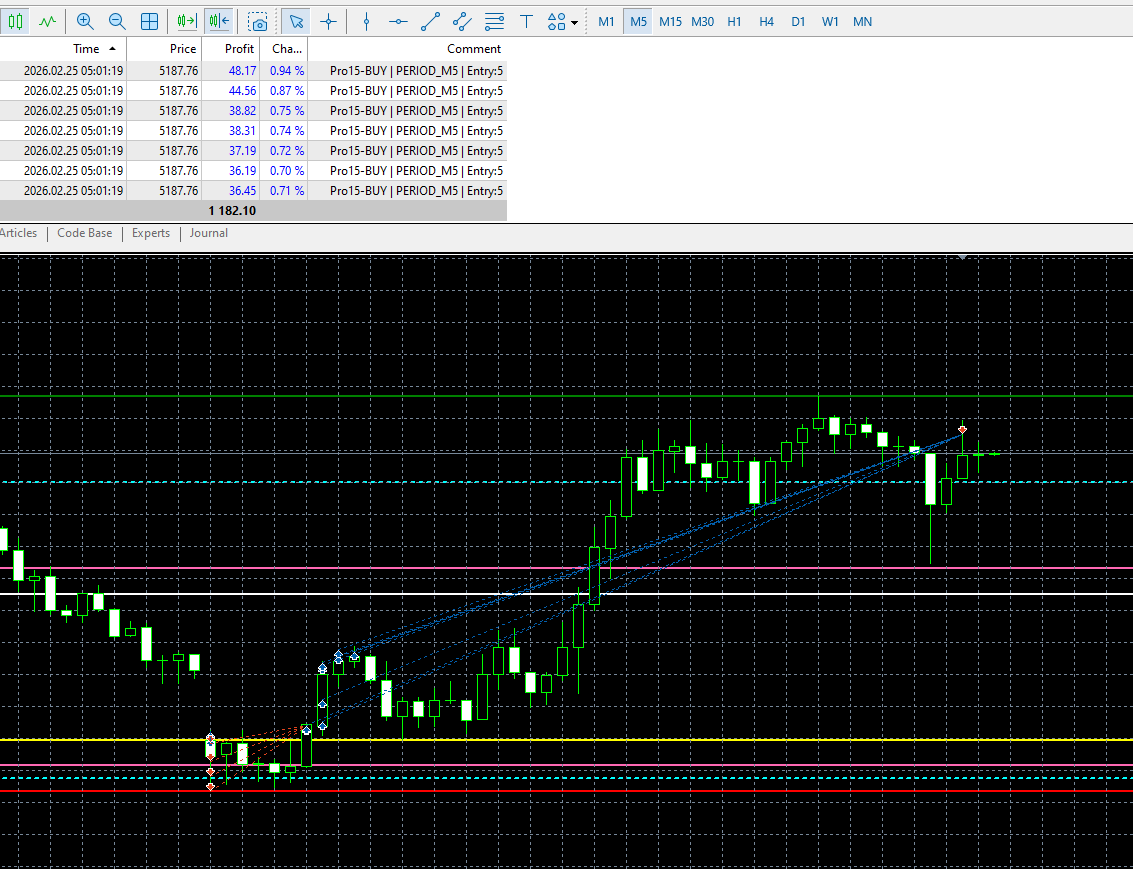

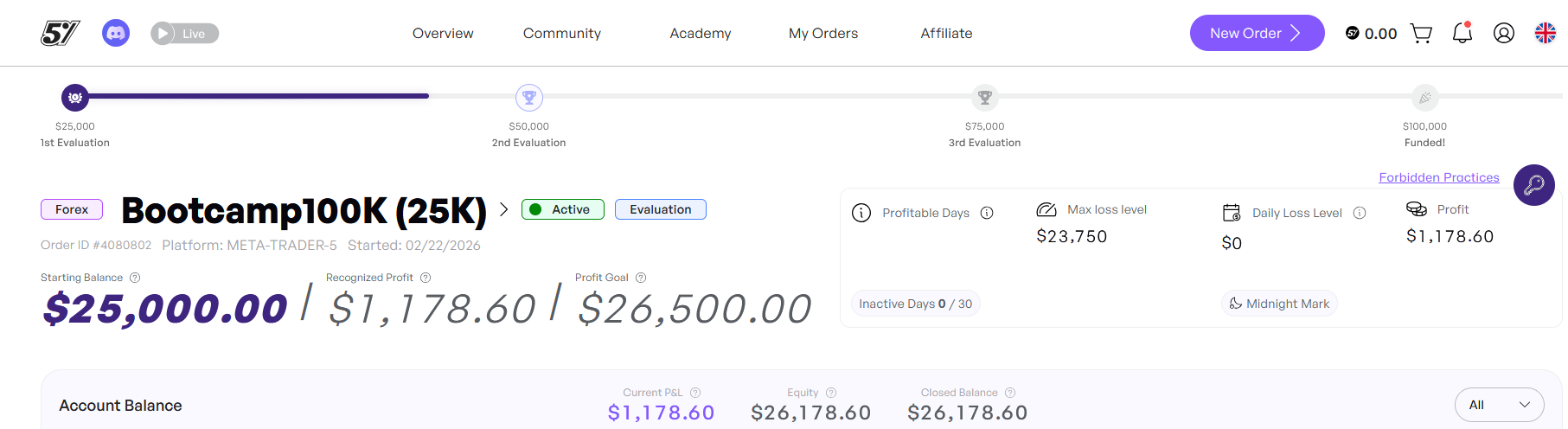

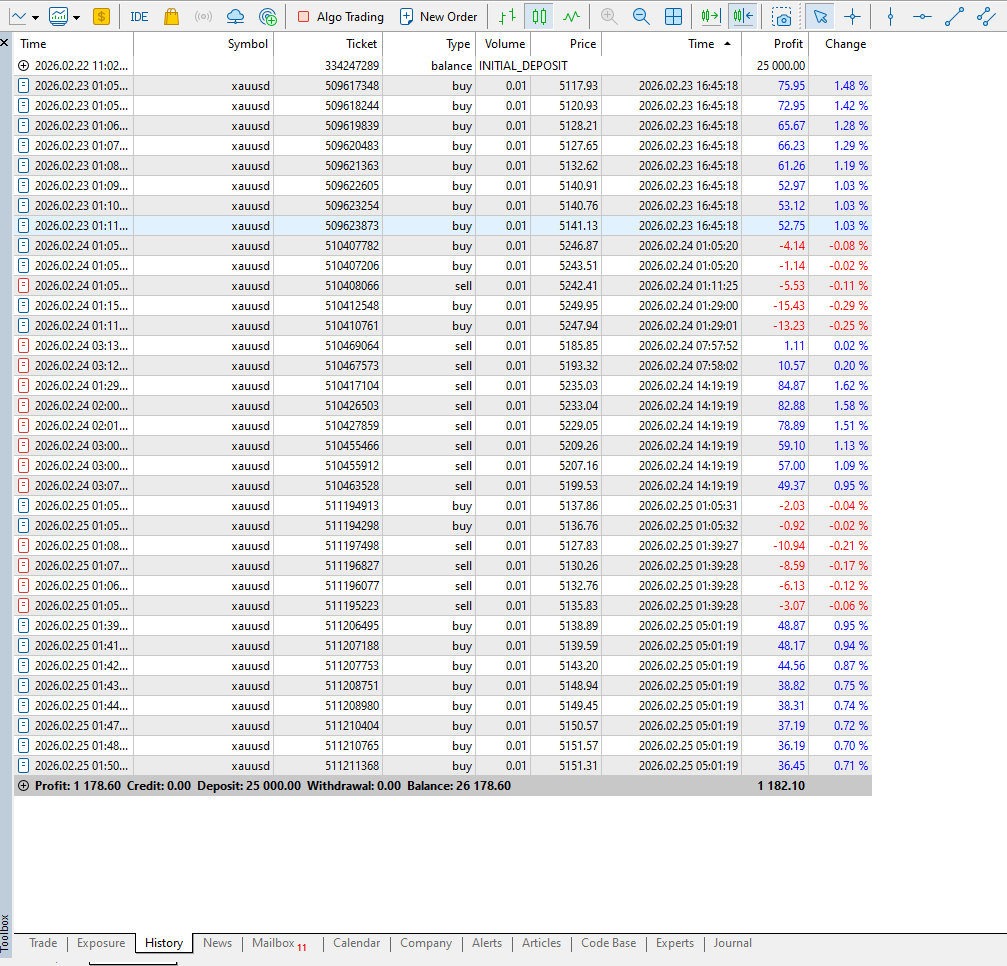

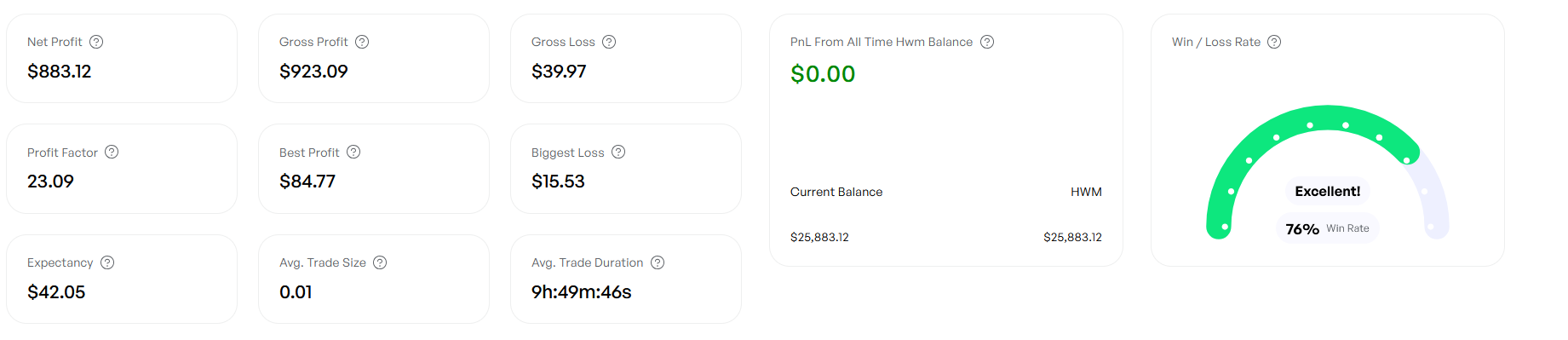

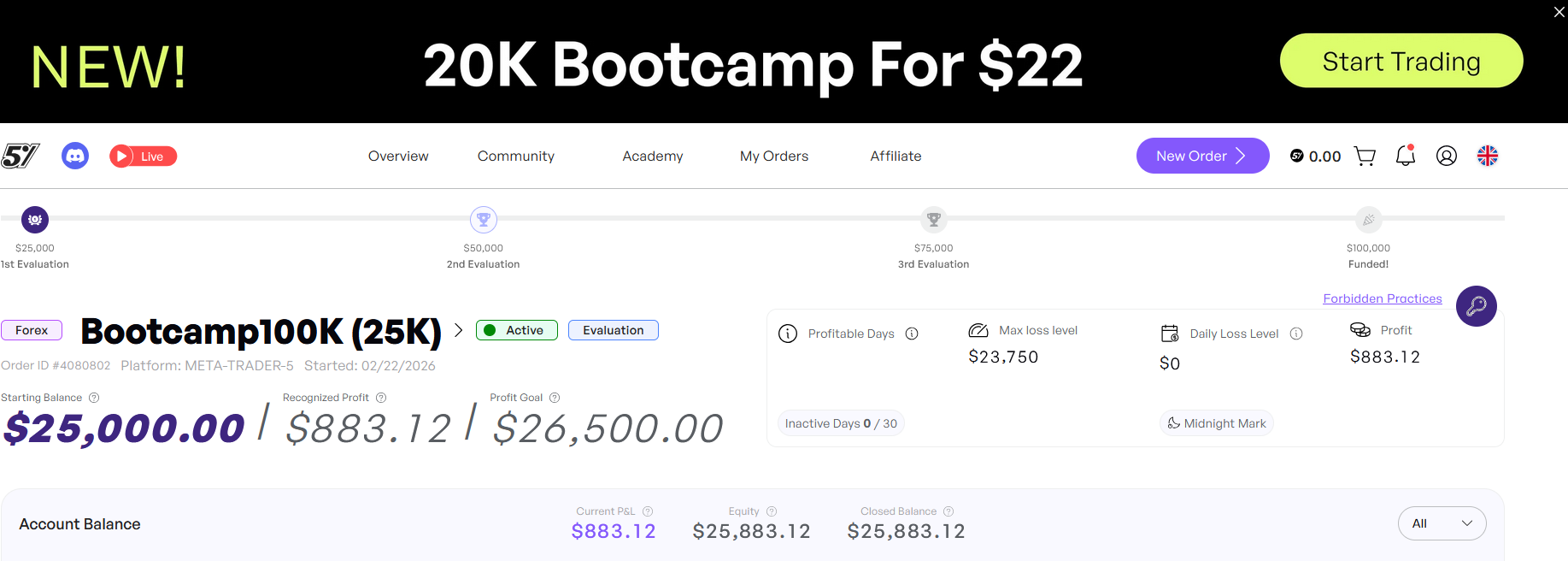

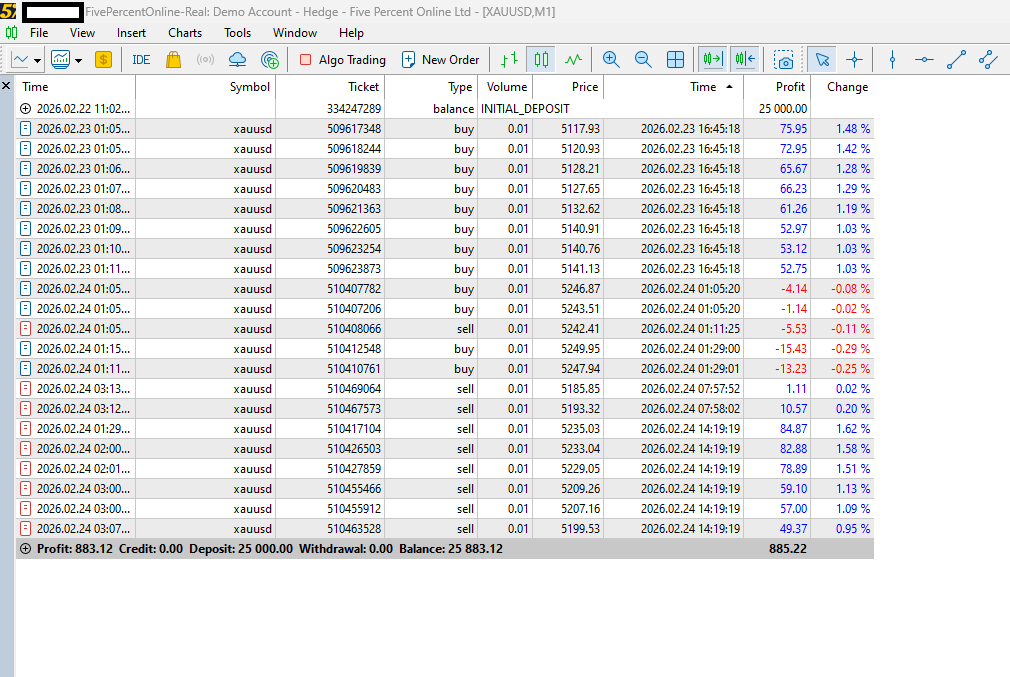

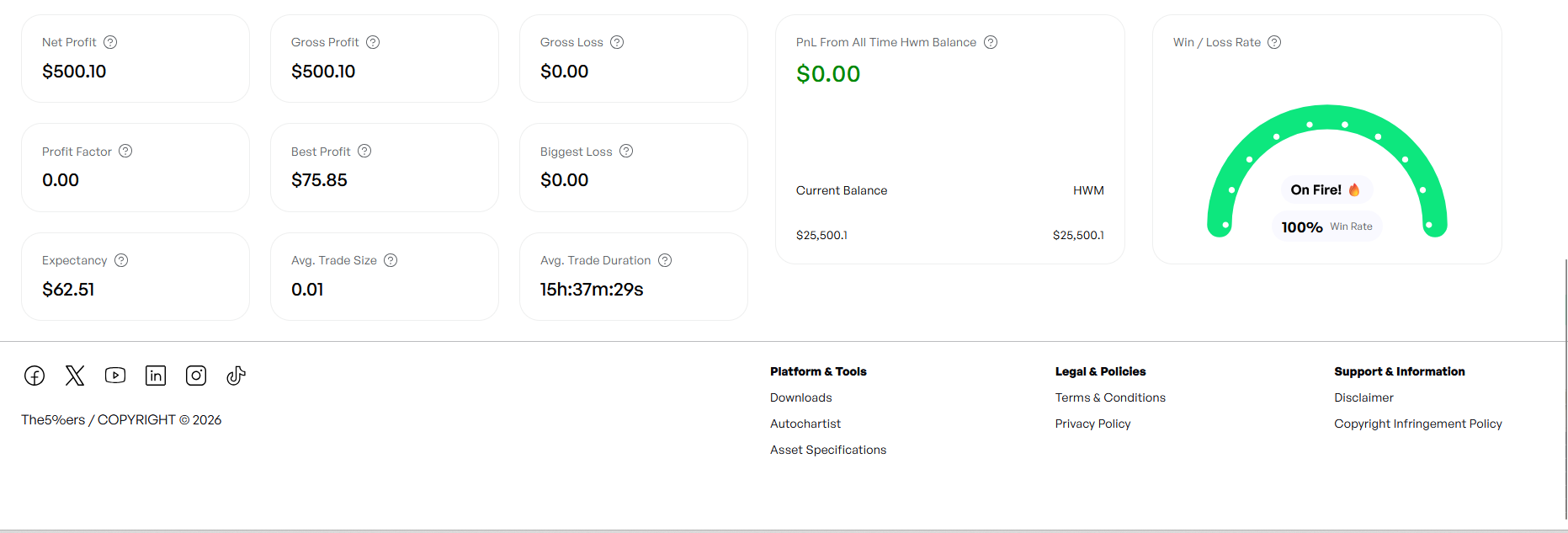

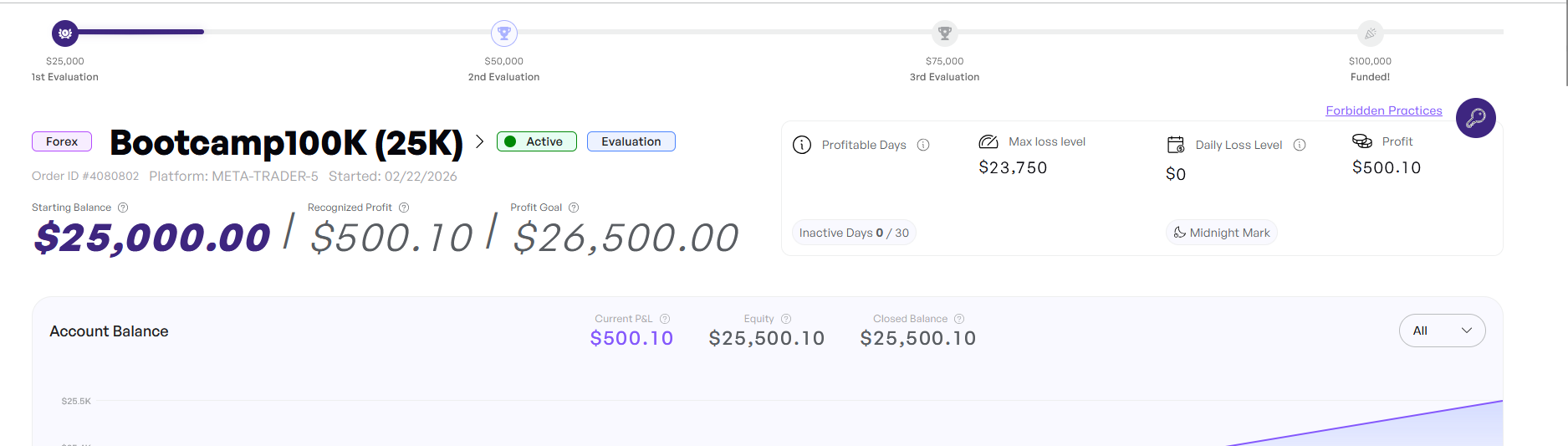

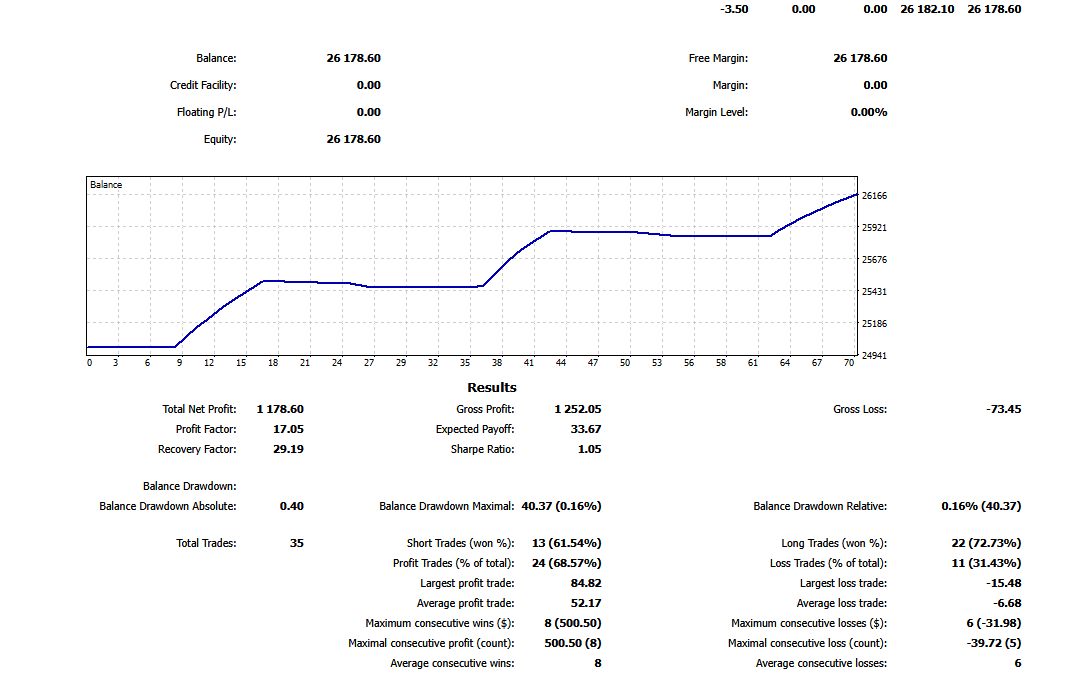

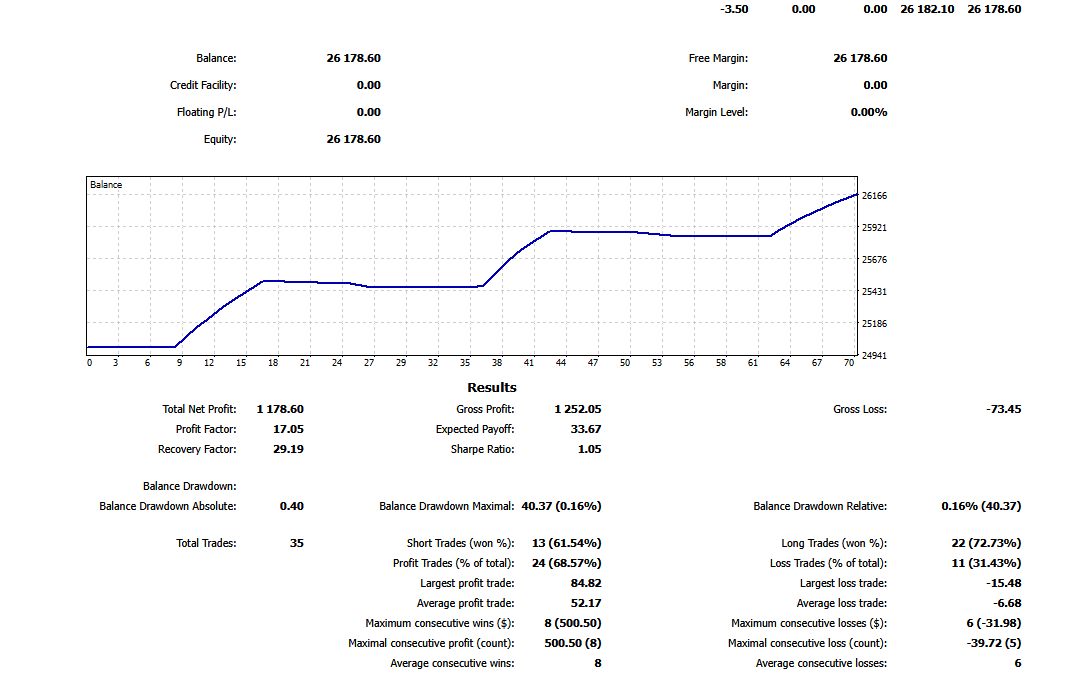

MT5 Report – 3-Day Pro15 Trading Bootcamp ($100K Account).

3 stages. 25 K - 50 k - 75 k --> 100 k funded

3 stages. 25 K - 50 k - 75 k --> 100 k funded

Jason Smith

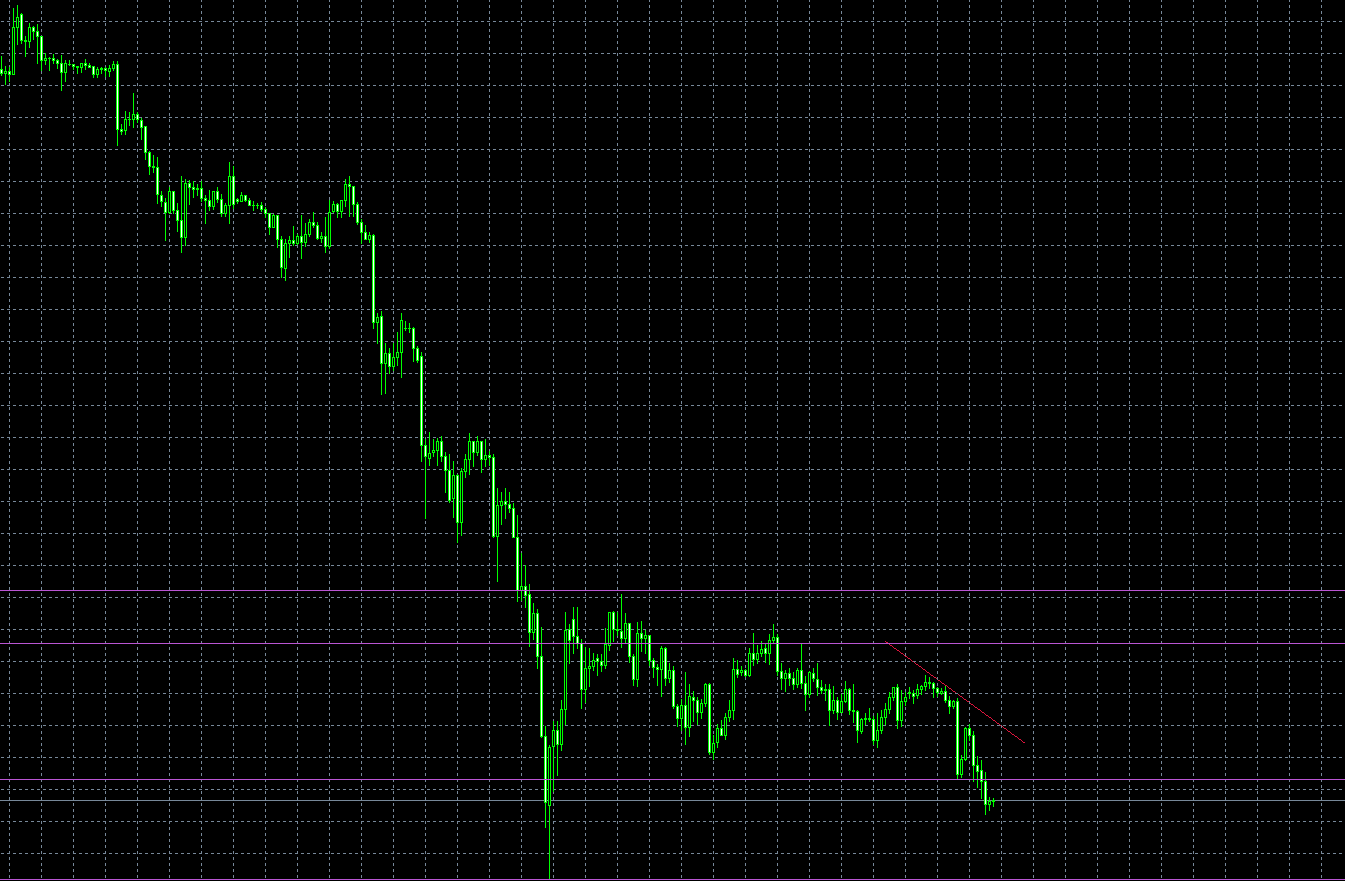

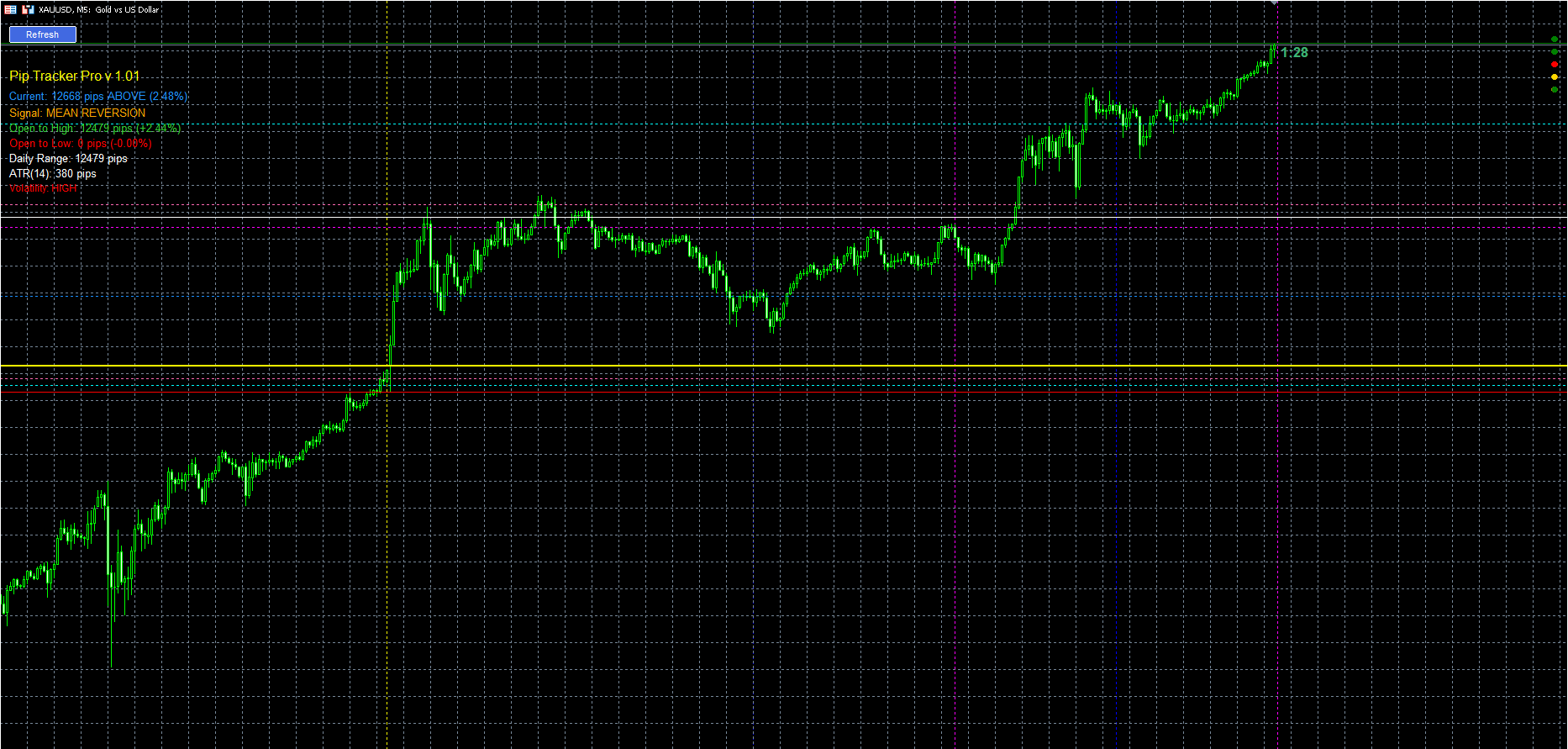

Gold Battle Map – Price Action

This professional-level trading indicator is now available for sale.

https://www.mql5.com/en/market/product/150284?source=Site+Market+My+Products+Page

This professional-level trading indicator is now available for sale.

https://www.mql5.com/en/market/product/150284?source=Site+Market+My+Products+Page

Jason Smith

“Cogito, ergo sum.” – “I think, therefore I am.”

The foundation of self-awareness and rational thought.

The foundation of self-awareness and rational thought.

Jason Smith

Monday

The reading of all good books is like a conversation with the finest minds of past centuries.

Learning from others’ ideas connects you with timeless wisdom.

Learning from others’ ideas connects you with timeless wisdom.

Jason Smith

Thought of the day:

It is said, that the superior man upon seeing another’s distress has compassion, while the mean man rejoices in it.

It is said, that the superior man upon seeing another’s distress has compassion, while the mean man rejoices in it.

Jason Smith

Monday

Junzi (Superior man) → guided by righteousness, benevolence, compassion.

Xiaoren (Small/mean man) → guided by self-interest, envy, and profit.

Xiaoren (Small/mean man) → guided by self-interest, envy, and profit.

Jason Smith

Traders, if you’re interested in Pro15 but can’t afford it, DM me — I might rent it to you for 1–3 mnths.This lets you make some profits now and potentially purchase the full bot later, without any trial restrictions.

Jason Smith

Monday

This feature is available on the MQL5 Marketplace.

I never bothered in the past to set trial periods, but it makes a lot of sense here since the bot is expensive

I never bothered in the past to set trial periods, but it makes a lot of sense here since the bot is expensive

Jason Smith

Monday

I’m taking on the tough three-step challenge to really put Pro15 through its paces, and it should give me some solid data on drawdown and other key metrics

Jason Smith

Monday

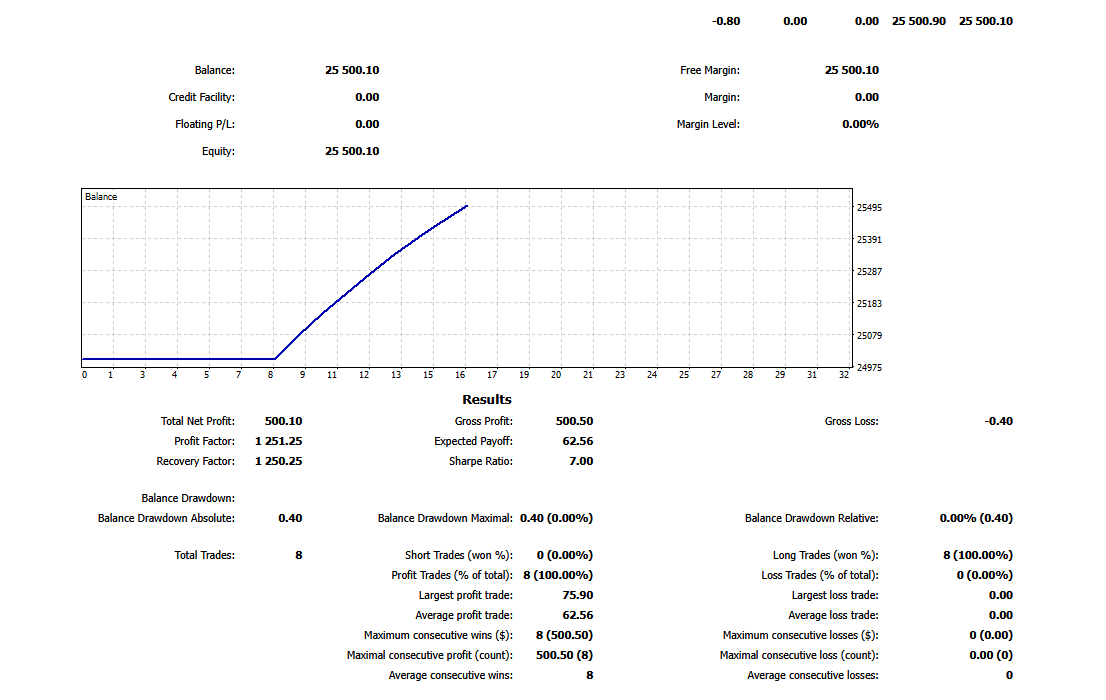

Remember, we already have the data from Magic 66 — nearly 90 days of trading 0.01 lots with a maximum open interest of 8 trades, and it’s up $10K. Anyone is welcome to INSPECT this data.

Jason Smith

Jason Smith

Monday

3 stage Challenge. Need to win the stages.One by one. Total Profit over the 3 stages to get is $7,500

: