Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.03.07 09:08

Who Can Trade a Scalping Strategy? (based on dailyfx article)

- Scalpers look to trade session momentum

- Scalpers do not have to be high frequency traders

- Anyone can scalp with an appropriate trading plan

The term scalping elicits different preconceived connotations to different traders. Despite what you may already think, scalping can be a viable short term trading methodology for anyone. So today we will look at what exactly is scalping, and who can be successful with a scalping based strategy.

What is a Scalper?

So you’re interested in scalping? A Forex scalper is considered anyone that takes one or more positions throughout a trading day. Normally these positions are based around short term market fluctuations as price gathers momentum during a particular trading session. Scalpers look to enter the market, and preferably exit positions prior to the market close.

Normally scalpers employ technical trading strategies utilizing short term support and resistance levels for entries. While normally fundamentals don’t factor into a scalpers trading plan, it is important to keep an eye on the economic calendar to see when news may increase the market’s volatility.

High Frequency Trading

There is a strong misconception that all scalpers are high frequency traders. So how many trades a day does it take to be considered a scalper? Even though high frequency traders ARE scalpers, in order for you to qualify as a scalper you only need to take 1 position a day! That is one of the benefits of scalping. You can trade as much or as little as you like within a giving trading period.

This also falls in line with one of the benefits of the Forex market. Due to the 24Hr trading structure of Forex, you can scalp the market at your convenience. Take advantage of the quiet Asia trading session, or the volatile New York – London overlap. Trade as much or as little as you like. As a scalper the choice is ultimately yours to make!

Risks

There are always risks associated with trading. Whether you are a short term, long term, or any kind of trader in between any time you open a position you should work on managing your risk. This is especially true for scalpers. If the market moves against you suddenly due to news or another factor, you need to have a plan of action for limiting your losses.

There are other misconceptions that scalpers are very aggressive traders prone to large losses. One way to help combat this is to make scalping a mechanical process. This means that all of your decisions regarding entries, exits, trade size, leverage and other factors should be written down and finalized before approaching the charts. Most scalpers look to risk 1% or even less of their account balance on any one position taken!

Who can Scalp?

So this brings us to the final question. Who can be a scalper? The answer is anyone with the dedication to develop a trading strategy and the time to implement that strategy on any given trading day.

=================

Trading examples

Metaquotes demo

- MT5 statement is here

- Updated statement is here

- More trading updates

- Updated MT5 statement

- More updates

- 811 dollars for 3 trading days and final statement for scalping

GoMarkets broker, initial deposit is 1,000

- statement (77 dollars in less than 1 hour)

Alpari UK broker initial deposit is 1,000

- statement (517 dollars for one day)

RoboForex broker initial deposit is 1,000

- first statement

- updated statement (257 dollars in 2 days)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Exp_JBrainSig1_UltraRSI:

Exp_JBrainSig1_UltraRSI Expert Advisor uses the values of JBrainTrend1Sig and UltraRSI indicators to analyze the market state

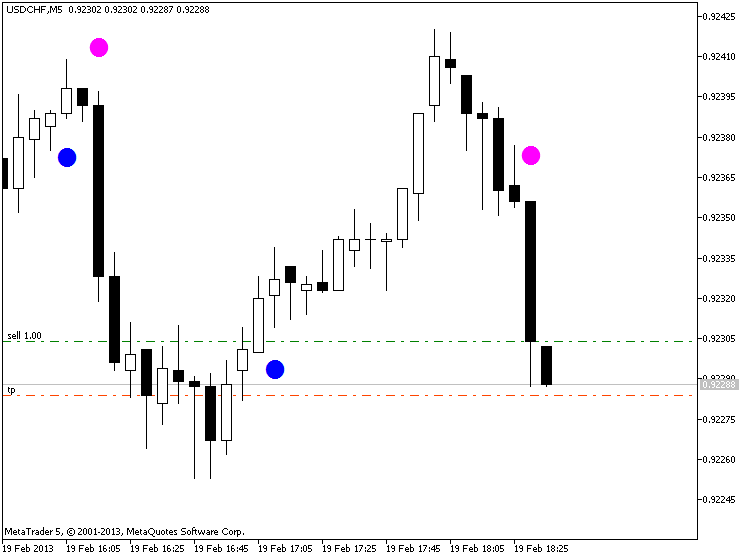

Fig. 1. The instances of history of deals on the chart.

Author: Nikolay Kositsin