This is very short video of 3 minutes 17 seconds: Why Watching the News Can Hurt Your Trading by Alexander Elder - trader and author, explains why he feels business TV can be detrimental to one's trading and believes standing aside can sometimes be the best approach.

Who is Alexander Elder? read this article Interview with Dr. Alexander Elder: "I want to be a psychiatrist in the market"

You may have heard about Fibonacci, the man who discovered a set of numbers who that have a major affect on the market. So who is this Fibonacci fellow, and why are his findings so important in the market place?

The mathematical findings by this thirteenth century Italian man has yielded a useful technical analysis tool which is used in technical analysis and by scientists in a large array of fields. Born Leonardo of Piza, he is better known in the trading community as Fibonacci. Fibonacci's best known work is Liber Abaci which is generally credited as having introduced the Arabic number system which we use today.

Fibonacci introduced a number sequence in Liber Abaci which is said to be a reflection of human nature. The series is as follows: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144 and on to infinity. The series is derived by adding each number to the previous. For example, 1+1=2 , 2+1=3, 3+2=5, 5+3=8, 8+5=13, and so on.

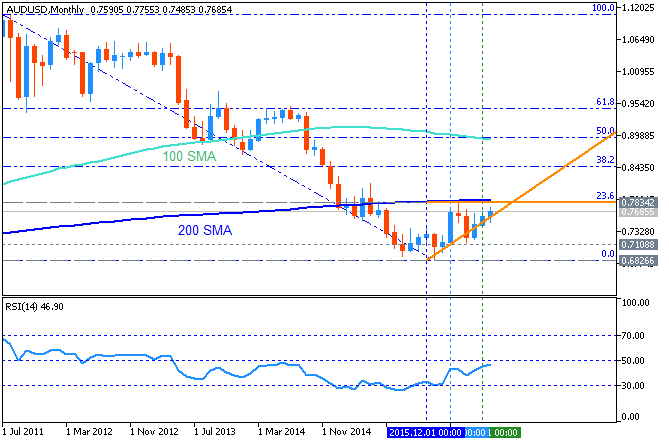

Fibonacci retracements show where support and resistance might come into the market. It is also useed to enter or add onto a position.

Renko Bar |Day Trading | What are Renko Bars | How do Renko Bars Work | Part 1

Renko Bars can be viewed as merely a different way to reflect price on a chart; in my opinion, I feel they paint the clearest picture of price available.

Here are my top 6 reasons of why I choose Renko Bars and charts:

- They REALLY help filter the noise

- They help smooth Indicators

- They can provide better entries

- They may help to provide smaller stops

- In my opinion they are just “cleaner”

- They help to filter noise and may help, keep us out of the chop.

This lesson describes the ADX with the DI+ and DI- Directional Indicators, and also shows how they are commonly use

VIDEO LESSON - Introduction to Australian Dollar

Like Canada, Australia's economy is a service based economy, with over

68% of GDP coming from the service sector. Although agriculture and

mining account for only 4.7% of Australian GDP, they account for over

65% of the country's exports. This makes the currency highly sensitive

to increases or decreases in the price of commodities, especially gold,

as Australia is the world's 3rd largest exporter of gold.

While

the country and currency are similar to Canada in many ways, a primary

difference is the trade relationships that Australia has developed with

Asia, and in particular Japan and China, which represent its two largest

export markets. This gives the currency a unique exposure to Asia,

which generally does not exist with the other non Asian currencies we

have studied up to this point.

As Kathy Lien points out in her

book 'Day Trading the Currency Market', the Australian economy was able to

whether the Asian financial crisis relatively well, so while there is

exposure there, it is also important to keep a watch on the country's

historically strong domestic consumption, in times of global economic

slowdowns.

The last major factor to keep in mind about the

Australian Dollar, is that Australia has one of the highest interest

rates in the developed world, currently at 7.25% as of this lesson. This

has made the currency one of the primary beneficiaries of carry trade

flows, which we learned about in my 3 part series on the carry trade, in

module 3 of this course. These flows, combined with the facts that many

commodities that Australia exports are at all time highs, and the

Australian economy has remained relatively strong through the current

crisis, has moved the AUD/USD to 25 year highs as of this lesson.

VIDEO LESSON - Introduction to New Zealand Dollar

According to Wikipedia.org, New

Zealand has a 2008 estimated population of around 4.2 million people,

which is the first important fact for us to understand for two reasons.

Firstly, as New Zealand's domestic market is so small, it must rely

heavily on exports to drive economic growth, making the country

especially susceptible to growth or decline in the global economy. This

is particularly true when looking at the health of its main trading

partners, the largest of which is Australia, followed by the United

States, and Japan. Secondly, unlike other countries with a larger

population, as the population of New Zealand is small, migration of

people into and out of the country can have a significant effect on its

economy, and therefore the currency. As Kathy Lien points out in her

book Day Trading the Currency Market, strong population migration into

New Zealand has contributed significantly to the performance of its

economy, because as the population increases, so does domestic

consumption.

Like Canada and Australia, New Zealand is a country with vast natural

resources, making the economy and therefore currency heavily reliant on

exports of commodities such as Wool,

food and dairy products, wood and paper products. As Australia is the

country's main export market and as the Australian Dollar is also

heavily influenced by commodity prices, changes in

commodity prices can have a particularly potent affect on the New

Zealand Dollar. Although this correlation has broken down somewhat in

recent months, as you can see from this chart, the NZD/USD and AUD/USD

currency pairs are highly correlated as a result of these factors:

Chart Showing NZD/USD and AUD/USD Correlations:

Kathy Lien on Her Approach to Forex Trading

Key points from the video:

- Kathy got her start in forex trading in 1999. She started at JP Morgan in a rotational program that gave her introduction to many markets, which is how she realized currencies is something she wanted to focus on.

- Kathy identifies herself as both an intraday trader and a swing trader. She is in and out of positions in the same day for many of her trades; for some of her swing trades she will hold positions for a few days, but rarely more than 5.

- Kathy focuses less on risk/reward and more on identifying high probability trades.

- She always places a stop and a limit.

- She trades EURUSD the most for her intraday trading, but uses other cross pairs for her swing trades.

- She develops a fundamental view, based on how she sees things shaping up over the next week or 2 months, then looks for technical signs that give her the okay to enter.

- She is a breakout trader, looking to follow momentum.

- She believes news events can serve as the catalyst that validate her fundamental viewpoint, and thus will place trades in anticipation of market reactions to news events that validate her thesis.

- She pays close attention to data from China, as it can have a big impact on currency markets. She does not believe China is in for a hard landing.

- Kathy views open-ended QE in a positive light, believing it is helping to fortify financial markets and avoid a crash.

An Introduction to Stock Trading

A Trader's Introduction to the Euro, Part I

1. The major powers in Europe had been battling each other for hundreds of years prior to World War II. Nothing like the decimation that the World Wars brought to Europe had ever been seen before however, so after World War II, there was a realization that a drastic reordering of the political landscape was needed, in order to put nationalistic rivalries to bed once and for all. Also as a result of World War II, the world's power structure had shifted, and the major European countries who were once the superpowers of the world, were replaced by two new superpowers. The United States and The Soviet Union were now the unrivaled superpowers of the world, and as a result there was a keen awareness among the former world powers of Europe, that banding together was the only way for Europe to have comparable clout on the world stage. It was primarily as a result of these two factors that the European Coal and Steel Community (which eventually became the European Economic Community, the predecessor to the European Union) was founded in the 1950's with the general goals of:

2. Lowering trade barriers and facilitating economic cooperation for the benefit of the member nations.

3. Increasing Europe's clout on the world stage

4. Integrating the economies of the major countries in Europe to the point where they were too reliant on one another to go to war again. During the next several decades many things happened from a diplomatic and trade standpoint that are very interesting, and which can be read about by doing a search on google for the history of the European Union. The next important event for us as traders however, came with the ratification of something which is known as the Maastricht Treaty in the 1990's. Up to this point, the idea of a tie up between nations in Europe was primarily focused on removing trade barriers and promoting economic cooperation. With the Maastricht treaty, member countries moved from a simple economic cooperation, to the much grander ambition of political integration between member nations.

This is important to us as traders as it was here that plans for a single currency to be used among member nations was introduced, and therefore here that the basic fundamentals of the Euro were laid out. There were three steps outlined in the Maastricht treaty that had to be completed before the currency could be released which were:

1. Free circulation of capital among member countries.

2. The second, and most important step for us as traders to understand, was the coordination of economic policies. Once the Euro was introduced, each of the member countries would be bound by the monetary policy as set by the European Central Bank. With this in mind, you could not have countries with extremely different levels of inflation and interest rates, replace their currency with the Euro, without undermining the credibility and fundamentals of the currency. To make the currency credible, and to make its introduction as smooth as possible, member countries were required to keep inflation, interest rates, and debt below certain levels. Lastly, they were also required to maintain an exchange rate that was basically a banded peg, allowing their currency to fluctuate only within a narrow band.

3. In 1999 the European Central Bank was established and the eleven countries listed here began to use the Euro in electronic format only.

A Trader's Introduction to the Euro, Part II

One of the most powerful tools that countries have to try and manage their business cycle is monetary policy, a tool which those adopting the Euro were essentially giving up. Although we have not seen a real test of this yet, you can imagine a situation where the economy of one of the major countries in the EMU such as Germany, goes into recession, but overall growth in the rest of the EMU is steady. If Germany were not part of the EMU, they could cut interest rates to try and bring their economy out of recession. Since they are however, their hands would be tied in this situation from a monetary policy standpoint, which may drive their economy deeper into recession than would otherwise be the case.

As we also learned about in module 8 of our free basics of trading course, countries have a second tool to manage the business cycle, which is Fiscal policy. As the EMU nations are still primarily independent from a fiscal policy standpoint, they do still have this in their toolbox. The issue here however, is that one of the ongoing requirements established in the Massstricht treaty for countries which join the EMU, is that member country's budget deficits must be less than 3% of GDP. So here again member nations are someone limited in what they can do to help their own economies, should it falter.

Of all the things to understand about the Euro from a fundamentals standpoint, it is this that is the most important, as it is here that a true test of the Euro, will eventually come.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Please upload forex video you consider as interesting one. No direct advertising and no offtopic please.

The comments without video will be deleted.