Dollar Index: End Of Week Technicals - daily bearish breakdown

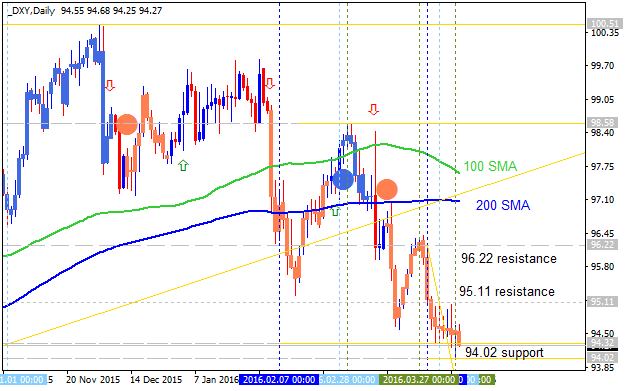

Daily price

is on primary bearish market condition: the price is on bearish breakdown for testing 94.32 support level for the bearish trend to be continuing with 94.02 support level as the next target to re-enter.

If the price breaks 94.02

support level so the primary bearish will be continuing.

If the price breaks 95.11 resistance level so the local uptrend as the bear market rally will be started up to 96.22 resistance level as the next target to re-enter.

If the price breaks 96.22

resistance level so the reversal of the price movement from the primary bearish to the primary bullish trend may be started with the secondary ranging.

If not so the price will be ranging within the levels.

- Recommendation for long: watch close the price to break 95.11 for possible buy trade

- Recommendation

to go short: watch the price to break 94.02 support level for possible sell trade

- Trading Summary: bearish

| Resistance | Support |

|---|---|

| 95.11 | 94.32 |

| 96.22 | 94.02 |

SUMMARY : bearish

Dollar Index Intra-Day Technical Analysis - bearish ranging near bullish reversal

H4 price is located below 100 period SMA (200 SMA) and near 100 period SMA 9100 SMA) on the border between the primary bearish and the primary bullish trend on the chart. The price is ranging within key support/resistance reversal levels for the ranging bullish reversal to be started or to the bearish trend to be continuing.

- If the price will break 95.20 resistance level so the reversal of the price movement from the primary bearish to the ranging bullish market condition will be started.

- If price will break 94.32 support so the bearish trend will be continuing with 94.02 level as the next bearish target.

- If not so the price will be ranging within the levels.

| Resistance | Support |

|---|---|

| 95.20 | 94.32 |

| N/A | 94.02 |

- Recommendation to go short: watch the price to break 94.32 support level for possible sell trade

- Recommendation to go long: watch the price to break 95.20 resistance level for possible buy trade

- Trading Summary: ranging

SUMMARY : ranging

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.23 08:53

Fundamental Weekly Forecasts for Dollar Index, USD/JPY, USD/CNH, NZD/USD, AUD/USD and GOLD (based on the article)

Dollar Index - "There is no doubt that the 1Q GDP reading due Thursday will be capable of stoking serious volatility, but its influence may further prove more systemic. Relative growth and stability is increasingly important to the distribution of global funds. If the United States’ looks more robust, it will draw capital from faltering Eurozone and Japanese markets; while stability will encourage funds from China and the emerging markets. It should be mentioned that speculation for this data is very scattered. The Atlanta Fed’s forecast was 0.1 percent, the New Fed’s new forecast set it at 1.1 percent and the economists’ consensus is for 0.6 percent annualized growth."

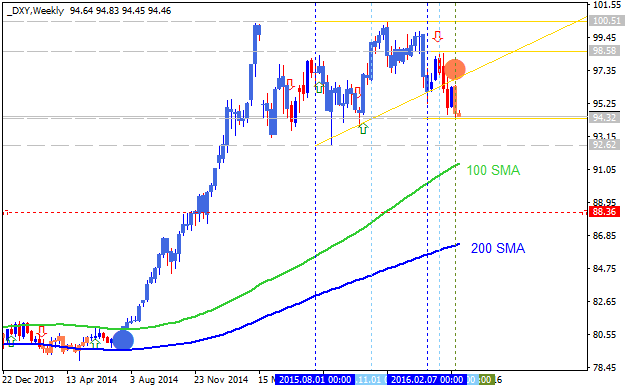

Dollar Index Future - Long-Term Forecast: correction to be started with 88.36 bearish reversal level

Weekly price is located to be above 100 period SMA (100 SMA) and 200 period SMA (200 SMA) for the primary bullish market condition: the secondary correction was started in the beginning of March this year with descending triangle pattern to be broken to below with 94.32 key support level for the secondary correction to be continuing.

If the price breaks 94.32

support level so the secondary correction will be continuing up to 92.62 target to re-enter.

If the price breaks 88.36

support level so the reversal of the price movement from the primary bullish to the primary bearish market condition will be started with the secondary ranging: the price will be located inside 100/200 SMA ranging area.

If the price breaks 100.51 resistance level so the primary bullish trend will be continuing.

If not so the price will be ranging within the levels.

- Recommendation for long: watch close the price to break 98.58 for possible buy trade

- Recommendation

to go short: watch the price to break 92.62 support level for possible sell trade

- Trading Summary: correction

| Resistance | Support |

|---|---|

| 98.58 | 94.32 |

| 100.51 | 92.62 |

| N/A | 88.36 |

SUMMARY : bullish

The key support level at 94.32 was broken by the weekly price and 92.62 level is going to be tested for now. So, this is the global correction to be continuing. If the price breaks 92.62 level to below so the secondary correction will be continuing with the ranging condition: the price will be located within 100 SMA/200 SMA ranging reversal area of the chart.

The most likely scenarios for the next week are the following:

- the secondary correction will be continuing with 92.62 level to be broken, and the price is started to be ranging up tp bearish reversal level, or

- the correction will be started, and the price will be on ranging bullish market condition 'without any hope' for the bearish reversal in the near future for example.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.04.30 08:58

Fundamental Weekly Forecasts for Dollar Index, EUR/USD, GBP/USD, USD/CNH, USD/CAD, AUD/USD and GOLD (based on the article)

Dollar Index - "The fading interest in the US monetary policy

advantage can be recharged if the event risk can override the market’s

skepticism. Both data and Fedspeak will offer an opportunity to shake

rate speculation to life. There is a long list of data including

sentiment surveys, trade, factory and service activity, housing and

credit; but the real weight rests with the April labor report on Friday.

The wage figure is where the data still has room to lift the hawks. Fed

officials may also maintain their effort to bridge the gap of market

skepticism."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.05.07 09:29

Week Ahead: Dollar Index Technical Analysis - daily ranging bearish, weekly ranging near reversal; what's next? (based on the article)

- "The USD is stuck at the bottom of the so-called ‘dollar smile’, which links its path to the performance of the US and global economy as well as the risk sentiment of investors."

- "We therefore expect USD to appreciate again against G10 commodity currencies as investors start questioning the Fed's ability to fall further behind the curve and the sustainability of the commodity-price rally in the presence of persistent downside risks to the global recovery. EUR and JPY should also remain more resilient against this background."

- "Among the key events next week will be the BoE’s May inflation report. Investors

will want to know whether the MPC sees the latest economic slowdown as

temporary, driven by Brexit fears, or persistent and thus likely to

affect the policy outlook. With the EU referendum approaching, the MPC

should stress the asymmetric risks to the outlook. This coupled with

more evidence that the support for Brexit remains unabated should keep

GBP on the defensive across the board."

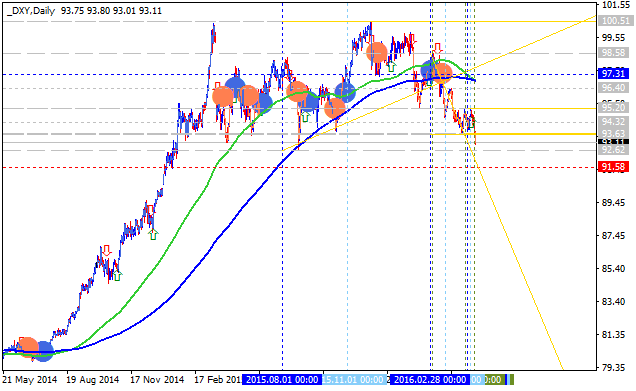

---

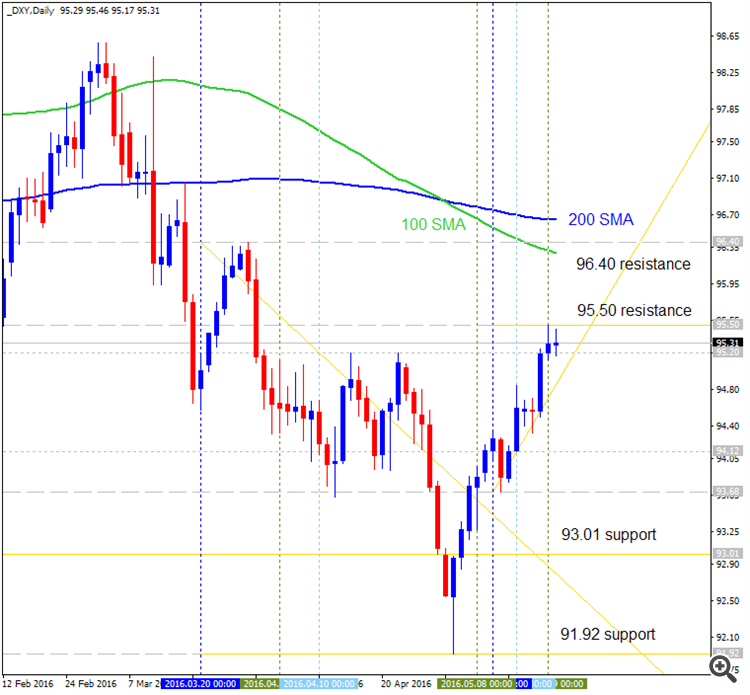

Daily price is located below SMA with period 100 (100 SMA) and SMA with the period 200 (200 SMA) for the bearish market condition: the price is ranging within 91.92 support level and 94.81 resistance level with RSI indicator estimating the ranging bearish trend to be continuing in the near future. Bullish reversal resistance level is 96.40, and if the price breaks this level to above so the reversal of the price movement to the primary bullish market condition will be started.

- If the price will break 94.81 resistance level so we may see the local uptrend as the bear market rally.

- If price will break 91.92 support so the bearish trend will be continuing.

- If not so the price will be ranging within the levels.

| Resistance | Support |

|---|---|

| 94.81 | 91.92 |

| 96.40 | N/A |

---

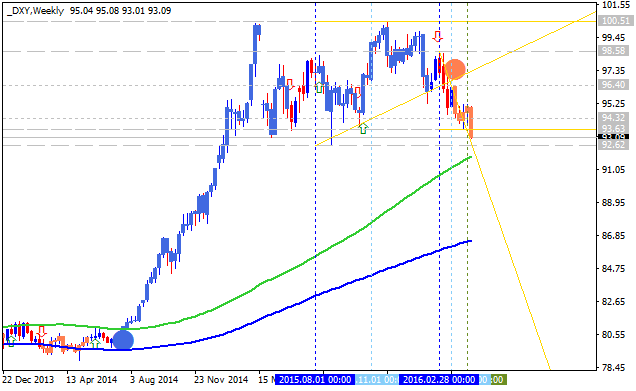

Weekly price

is on secondary correction within the primary bullish trend: the price is testing 93.01 support level together with 100 SMA to below on close weekly bar for the secondary correction to be continuing and with 82.51 as the next bearish reversal target. But if the price breaks 100.51 resistance to above on close weekly bar so the primary bullish trend will be continuing, otherwise - ranging near reversal levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.05.13 10:03

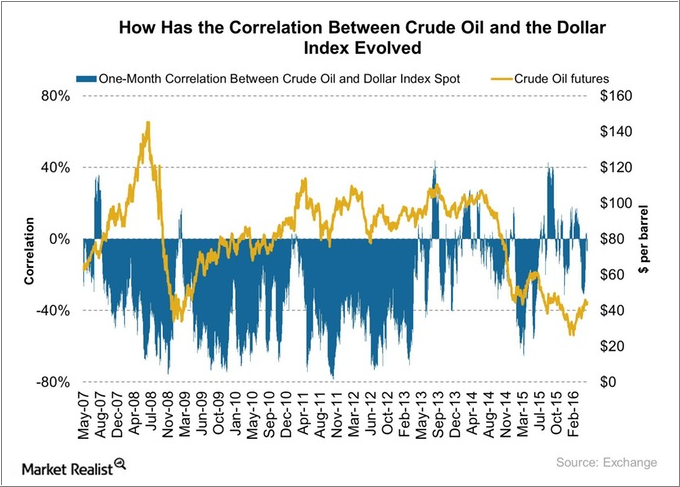

The correlation between Dollar Index and Brent Crude Oil

There is good article describing the correlation between Dollar Index and Crude Oil so let's evaluation the situation related to those prices.

---------

Dollar Index Weekly Outlook: secondary correction within the primary bullish.

Weekly price is testing 93.01 support level for the correction to be continuing with 91.92 as the nearest target to re-enter. If the price breaks 1-year low at 86.88 so the bearish reversal will be started, otherwise the price will be on ranging within the primary bullish condition.

---------

Brent Crude Oil Weekly Outlook: secondary rally within the primary bearish.

Weekly

price is testing 48.25 resistance level to above for the bear market rally to be

continuing with 53.95 level as the nearest target to re-enter. If the price

breaks 1-year low at 69.57 so the bullish reversal will be started,

otherwise the price will be on ranging within the primary bearish

condition.

---------

And for now - please look at those two charts below just to make an idea about the correlation between Dollar Index and Brent Crude Oil:

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.05.21 10:35

Fundamental Weekly Forecasts for Dollar Index, GBP/USD, USD/CNH, AUD/USD, USD/CAD, NZD/USD and GOLD (based on the article)

Dollar Index - "There are 9, officially-scheduled speeches on the docket through the coming week, and some of their content will be particularly palatable to rate speculators. St. Louis Fed President Bullard will speak about policy normalization on Monday, Minneapolis Fed President Kashkari (to this point vague on policy standing) will discuss energy and monetary policy Wednesday, and Fed Chair Yellen is set to speak on Friday. Expect rate forecasts to swing on key words – hawkish and dovish – while the Dollar follows along."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.05.28 15:43

Fundamental Weekly Forecasts for Dollar Index, GBP/USD, USD/JPY, AUD/USD, USD/CAD and GOLD (based on the article)

Dollar Index - "Meaningful fundamental impetus is needed to

force critical technical Dollar breaks and forge follow through on an

already impressive trend. Quiet is not a foregone conclusion – in fact is unlikely. Not only will Fed debate of a hike carry global repercussions; but we will see broad waves with the Brexit, oil

prices, monetary policy accommodation failing to prop growth (ECB,

BoJ), China capital flight and a host of other issues threaten to swell

in the foreseeable future."

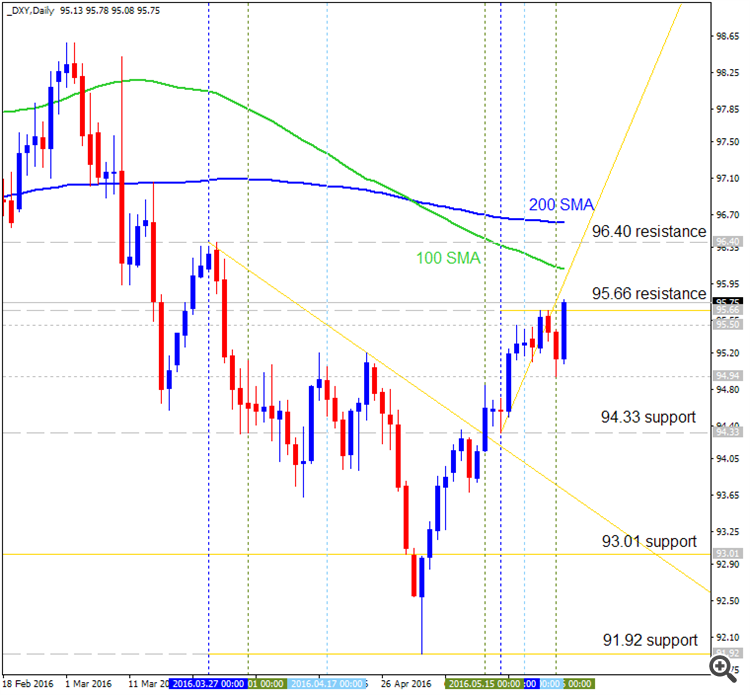

Daily price is on bear market rally with 95.66 resistance level to be crossed to above for the rally to be continuing. The reversal of the daily price movement to the primary bullish market condition will be started if the price breaks 96.40 resistance level. Alternative, breaking 93.01 support will lead to the bearish trend to be resumed.

Most likely scenario for the daily price for the week: bearish ranging within 95.66 bullish reversal level and 03.01 bearish continuation level.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.06.04 12:06

Fundamental Weekly Forecasts for Dollar Index, EUR/USD, GBP/USD, USD/JPY, AUD/USD, and GOLD (based on the article)

Dollar Index - "Chairwoman Yellen’s speech Monday is the last opportunity to realign the market to a probability of a near-term hike. She is the only person – and event – with the authority to change market sentiment. After that, the Fed’s blackout of media silence pre-FOMC starts Wednesday. She not likely to refute skepticism of a June hike. However, if she doesn’t offer perspective to line up a July possibility, the Dollar will certainly have further premium to bleed."

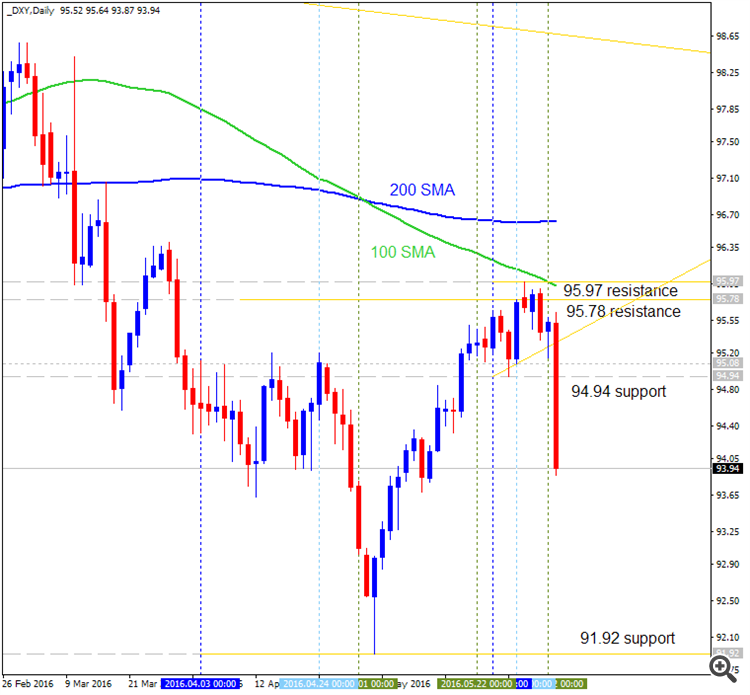

Daily price is located below 200-day SMA/100-day SMA for the ranging within 2-week high at 95.97 and 2-week low at 93.87.

If the price breaks 95.97

resistance to above on daily close bar so the reversal of the price

movement to the primary bullish will be started.

If the price breaks 93.87 support level to below on close bar so the primary bearish trend will be continuing with 91.02 possible bearish target.

If not so the price will be on ranging bearish condition.

H4 price broke 100 SMA/200 SMA reversal area to below for the primary bearish market condition.

If the price breaks 95.64

resistance to above on close H4 bar so the primary bullish trend will be resumed with 95.97 level as a target.

If the price breaks 93.87 support level to below on close H4 bar so the primary bearish trend will be continuing.

If not so the price will be on ranging condition within the levels.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Dollar Index Future - Long-Term Forecast: correction to be started with 88.36 bearish reversal level

Weekly price is located to be above 100 period SMA (100 SMA) and 200 period SMA (200 SMA) for the primary bullish market condition: the secondary correction was started in the beginning of March this year with descending triangle pattern to be broken to below with 94.32 key support level for the secondary correction to be continuing.

If the price breaks 94.32 support level so the secondary correction will be continuing up to 92.62 target to re-enter.

If the price breaks 88.36 support level so the reversal of the price movement from the primary bullish to the primary bearish market condition will be started with the secondary ranging: the price will be located inside 100/200 SMA ranging area.

If the price breaks 100.51 resistance level so the primary bullish trend will be continuing.

If not so the price will be ranging within the levels.

SUMMARY : bullish

TREND : correction