You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.05.27 10:36

Intra-Day Levels

EURUSD H1

The price is located below 200 SMA for the bearish market condition - price is on ranging around 100 SMA waiting for direction of the trend:

If the price breaks 1.1174 support level on close hourly bar so the primary bearish trend will be continuing up to 1.1138 as a good target to re-enter.

If the price breaks 1.1236 resistance level on close hourly bar so the reversal of the price movement from the ranging bearish to the primary bullish trend will be started.

If not so the price will be on ranging within the levels waiting for direction.

EUR/USD M5: 20 pips price movement by U.S. Gross Domestic Product news event :

H1 price broke 1.1174 support level to below on close H1 bar for the bearish trend to be continuing: the price is breaking 1.1152 level for breakdown with 1.1128 bearish target. Alternative, if the price crossed 1.1200 resistance to above so the reversal of the price movement to the bullish condition will be started.

Forex Weekly Outlook May 30 - Jun 3 (based on the article)

The US dollar had a positive week despite a lack of really convincing data. GDP from Canada and Australia, a buildup to the Non-Farm Payrolls, OPEC Meetings and the ECB decision stand out in a very busy week.

Fundamental Weekly Forecasts for Dollar Index, GBP/USD, USD/JPY, AUD/USD, USD/CAD and GOLD (based on the article)

Dollar Index - "Meaningful fundamental impetus is needed to force critical technical Dollar breaks and forge follow through on an already impressive trend. Quiet is not a foregone conclusion – in fact is unlikely. Not only will Fed debate of a hike carry global repercussions; but we will see broad waves with the Brexit, oil prices, monetary policy accommodation failing to prop growth (ECB, BoJ), China capital flight and a host of other issues threaten to swell in the foreseeable future."

GBP/USD - "Due to the extreme opacity surrounding the upcoming referendum; with most polls showing a relatively even split amongst votes to ‘leave’ or ‘stay,’ and considering the profound economic impact that either decision may have on the economic future of the United Kingdom, the fundamental forecast for the British Pound will remain at neutral until one of the underlying facts change."

USD/JPY - "The key question is straightforward: will the US Federal Reserve raise interest rates for only the second time in 10 years at their June 15 meeting? Current interest rate pricing shows an approximate 35 percent likelihood of a 25bps rate hike—up substantially from a less than 5 percent chance shown just two weeks ago. It is perhaps unsurprising to note the interest-rate-sensitive USD/JPY exchange rate has rallied noticeably as odds have improved for a Fed hike. And we expect that any strong positive surprises in inflation and labor data could only help Fed expectations - moving the USD/JPY in kind."

AUD/USD - "On balance, the combination of an increasingly dovish policy outlook at home and an ever-more confidently hawkish one in the US seem likely to make for continued Aussie weakness. Jitters surrounding the “Brexit” referendum represent a wild card. As the June 23 vote approaches, polls have widened somewhat in favor of the “remain” campaign. More of the same may bolster risk appetite as worries about an unprecedented rupture within the EU core unravel. This may prove supportive for the sentiment-linked Australian unit."

USD/CAD - "With USD/CAD largely failing to preserve the upward trend from early May, the near-term advance in the exchange rate may ultimately turn out to be a failed attempt to test the April high (1.3218), and the pair may continue to give back the rebound from 1.2460 should the key data prints out of the U.S. and Canada spur a further shift in the monetary policy outlook."

GOLD (XAU/USD) - "Interim resistance stands at the 1242/46 with our bearish invalidation level at 1256. A rally surpassing the upper median-line parallel (~1270) would be needed to shift the broader focus back to the long-side. A break lower targets subsequent support objectives at the 1191 pivot & the 50% retracement of the advance off the December lows at 1175."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2014.01.23 11:01

Margin Call (adapted from dailyfx.com article)

To get a grasp on what a margin call is, you should understand the purpose and use of Margin & Leverage. Margin & Leverage are two sides of the same coin. The purpose of either is to help you control a contract larger than your account balance. Simply put, margin is the amount required to hold the trade open. Leverage is the multiple of exposure to account equity. Therefore, if you have an account with a value of $10,000 but you would like to buy a 100,000 contract for EURUSD, you would be required to put up $800 for margin in an account leaving $9,200 in usable margin. Usable Margin should be seen as a safety net and you should protect your usable margin at all costs.

Causes of a Margin Call

To understand the cause of a margin call is the first step. The second and more beneficial step is learning understanding how to stay far away from a potential margin call. The short answer as to understand what causes a margin call is simple, you’ve run out of usable margin.

The second and promised more beneficial step is to understand what depletes your usable margin and stay away from those activities. In risk of oversimplifying the causes, here are the top causes for margin calls which you should avoid like the plague (presented in no specific order):

What Happens When A Margin Call Takes Place?

When a margin call takes place, you are liquidated or closed out of your trades. The purpose is two-fold: you no longer have the money in your account to hold the losing positions and the broker is now on the line for your losses which is equally bad for the broker.

How to Avoid Margin Calls

Leverage is often and fittingly referred to as a double-edged sword. The purpose of that statement is that the larger leverage you use to hold a trade greater than some large multiple of your account, the less usable margin you have to absorb any losses. The sword only cuts deeper if an over-leveraged trade goes against you as the gains can quickly deplete your account and when your usable margin % hits, zero, you will receive a margin call. This only gives further credence to the reason of using protective stops while cutting your losses as short as possible.

AUD/USD Intra-Day Fundamentals: Company Gross Operating Profits and 24 pips price movement

2016-05-30 01:30 GMT | [AUD - Company Operating Profits]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Company Operating Profits] = Change in the total value of profits earned by corporations.

==========

==========

AUD/USD M5: 24 pips price movement by Company Gross Operating Profits news event

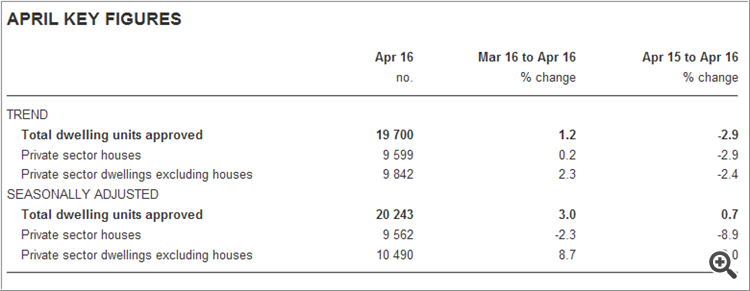

AUD/USD Intra-Day Fundamentals: Australian Building Approvals and 63 pips price movement

2016-05-31 01:30 GMT | [AUD - Building Approvals]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Building Approvals] = Change in the number of new building approvals issued.

==========

==========

AUD/USD M5: 63 pips price movement by Australia Building Approvals news event

USD/CAD Intra-Day Fundamentals: Canada's Gross Domestic Product and 46 pips price movement

2016-05-31 12:30 GMT | [CAD - GDP]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

==========

USD/CAD M5: 46 pips price movement by Canada's Gross Domestic Product news event

EUR/USD Intra-Day Fundamentals: The Conference Board Consumer Confidence and 48 pips price movement

2016-05-31 14:00 GMT | [USD - CB Consumer Confidence]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Change in the total value of profits earned by corporations.

==========

"Consumer confidence declined slightly in May, primarily due to consumers rating current conditions less favorably than in April," said Lynn Franco, Director of Economic Indicators at The Conference Board. "Expectations declined further, as consumers remain cautious about the outlook for business and labor market conditions. Thus, they continue to expect little change in economic activity in the months ahead."==========

EUR/USD M5: 48 pips price movement by The Conference Board Consumer Confidence news event

AUD/USD Intra-Day Fundamentals: Australia's Gross Domestic Product and 57 pips price movement

2016-06-01 01:30 GMT | [AUD - GDP]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

==========

AUD/USD M5: 57 pips price movement by Australia's Gross Domestic Product news event

USD/CNH Intra-Day Fundamentals: Caixin Manufacturing PMI and 92 pips price movement

2016-06-01 01:45 GMT | [CNY - Caixin Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Caixin Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

USD/CNH M30: 92 pips price movement by Caixin Manufacturing PMI news event