You have only four choices:

-

Search for it (CodeBase or Market). Do you expect us to do your research for you?

- Try asking at:

- Coding help - MQL4 programming forum

- Make It No Repaint Please! - MQL4 programming forum

- MT4 to MT5 code converter - MQL5 programming forum

- Please fix this indicator or EA - General - MQL5 programming forum

- Requests & Ideas (MQL5 only!) - Expert Advisors and Automated Trading - MQL5 programming forum

- Indicator to EA Free Service - General - MQL5 programming forum

-

MT4: Learn to code it.

MT5: Begin learning to code it.If you don't learn MQL4/5, there is no common language for us to communicate. If we tell you what you need, you can't code it. If we give you the code, you don't know how to integrate it into your code.

-

Or pay (Freelance) someone to code it. Top of every page is the link Freelance.

Hiring to write script - General - MQL5 programming forum (2019)

We're not going to code it for you (although it could happen if you are lucky or the problem is interesting.) We are willing to help you when you post your attempt (using CODE button) and state the nature of your problem.

No free help (2017)

How do I make an EA from an elephant bar setup? and how can i handle the candle size issue? for example consider a 100p or 50p elephant bar vary depending on the chart I am using

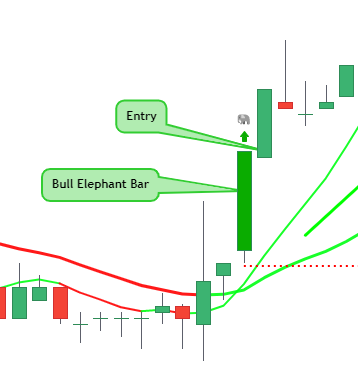

Refers to this (candlestick pattern):

Elephant Bars

Elephant bars are significantly larger bars than the previous bars. Red elephant bars suggest downward price pressure and an indication that smaller red bars are to be expected. Green elephant bars indicate upward price movement and additional smaller green bars to come.

Action tips when you see green elephant bars

Try to get in at the top of a green elephant bar once you have spotted an elephant bar forming. If you miss the green elephant bar, get in on the next bar at a price at or slightly above the top of the green elephant bar. The following bar must be above the previous high.

– Your first buy must be only half of the money you have.

– Also, place a put at the bottom of the green elephant bar. This put is essential to limit your loss if the price moves down. This put allows you to avoid significant losses and stay in business!

– the opposite action is recommended when you spot a red elephant bars

Elephant Bars

Elephant bars are significantly larger bars than the previous bars. Red elephant bars suggest downward price pressure and an indication that smaller red bars are to be expected. Green elephant bars indicate upward price movement and additional smaller green bars to come.

Action tips when you see green elephant bars

Try to get in at the top of a green elephant bar once you have spotted an elephant bar forming. If you miss the green elephant bar, get in on the next bar at a price at or slightly above the top of the green elephant bar. The following bar must be above the previous high.

– Your first buy must be only half of the money you have.

– Also, place a put at the bottom of the green elephant bar. This put is essential to limit your loss if the price moves down. This put allows you to avoid significant losses and stay in business!

– the opposite action is recommended when you spot a red elephant bars

😁 thanks

and info about elephant pattern is helpful, spotted few examples too on latest chart. it can be coded by comparing the previous few bars range (high-low) and volume comparison.

Exactly, you always have to find some kind of confirmation. The pattern itself does not give an accurate input.

It can be high/low range bars or any indicator. Let's say it's something "to the consumer's taste" and whatever is easiest for you to interpret.

Elephant Bars

Elephant bars are significantly larger bars than the previous bars. Red elephant bars suggest downward price pressure and an indication that smaller red bars are to be expected. Green elephant bars indicate upward price movement and additional smaller green bars to come.

Action tips when you see green elephant bars

Try to get in at the top of a green elephant bar once you have spotted an elephant bar forming. If you miss the green elephant bar, get in on the next bar at a price at or slightly above the top of the green elephant bar. The following bar must be above the previous high.

– Your first buy must be only half of the money you have.

– Also, place a put at the bottom of the green elephant bar. This put is essential to limit your loss if the price moves down. This put allows you to avoid significant losses and stay in business!

– the opposite action is recommended when you spot a red elephant bars

Must be something from Spanish ? (and Portuguese), I don't think it exists in English (?).

The OP was posting in Portuguese and I used automatic translation to English to edit it.

Must be something from Spanish ? (and Portuguese), I don't think it exists in English (?).

The OP was posting in Portuguese and I used automatic translation to English to edit it.

No, it is a new pattern that became fashionable in TradingView.

There are several articles about it.

Exactly, you always have to find some kind of confirmation. The pattern itself does not give an accurate input.

It can be high/low range bars or any indicator. Let's say it's something "to the consumer's taste" and whatever is easiest for you to interpret.

A useful indicator to identify Elephant Bars is the ms-Candle-index (this isn't my original work; you can find it here: https://www.mql5.com/en/code/24232). This indicator normalizes the sizes of candles, allowing you to use it in any market. Typically, an Elephant Bar registers above 0.800 on this indicator, though this value may need optimization.

It's also crucial to check certain conditions:

-

The previous candles should be above/below (depends on the candle signal) the mid-price of the Elephant Bar. A strong Elephant Bar effectively "eliminates" prior candles. Therefore, ensure that the mid-price of the Elephant Bar is higher than the highest price of the N preceding candles.

-

It's preferable to trade only the first Elephant Bar in a movement or wave to avoid confusion between Elephant Bars at the beginning of movements and those at exhaustion points.

-

In my view, trade management is even more vital than the initial trigger in these scenarios. You need to check if the subsequent candle, after opening a position, continues the trend. In most cases, you should close the position if no continuation of the movement is detected.

- www.mql5.com

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

How do I make an EA from an elephant bar setup? and how can i handle the candle size issue? for example consider a 100p or 50p elephant bar vary depending on the chart I am using