Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2019.01.21 10:46

Forex Quotes Explained (based on the article) What are forex quotes?

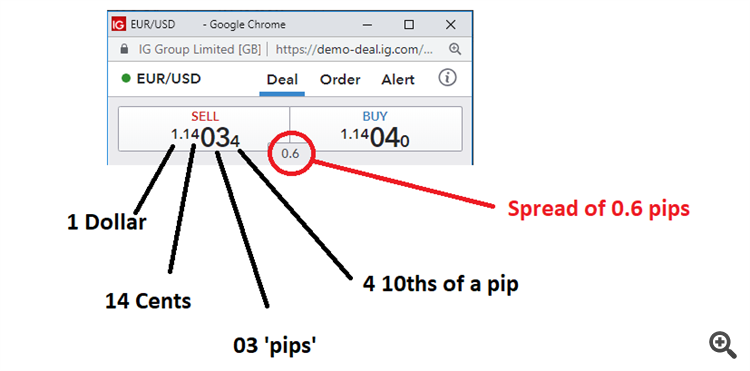

A forex quote is the price of one currency in terms of another currency. These quotes always involve currency pairs because you are buying one currency by selling another. For example, the price of one Euro may cost $1.1404 when viewing the EUR/USD currency pair. Brokers will typically quote two prices for any currency pair and receive the difference (spread) between the two prices, under normal market conditions.

Example of EUR/USD forex quote

Understanding Forex Quote Basics

In order to read currency pairs correctly, traders should be aware of the following fundamentals of a forex quote:

ISO code: The International Organization for Standardization (ISO) develop and publish international standards and have applied this to global currencies. This means each country's currency is abbreviated to three letters. For example, the Euro is shortened to EUR and the US dollar to USD.

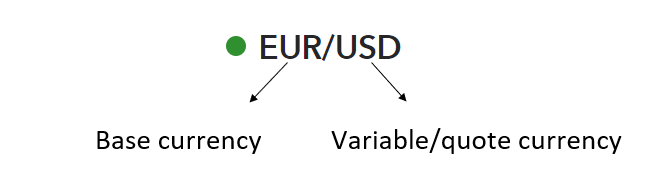

Base currency and variable currency: Forex quotes show two currencies, the base currency, which appears first and the quote or variable currency, which appears last. The price of the first currency is always reflected in units of the second currency. Sticking with the earlier EUR/USD example, it is clear to see that one Euro will cost one dollar, 14 cents and 04 pips. This is unusual as you cannot physically hold fractions of one cent but this is a common feature of the foreign exchange market.

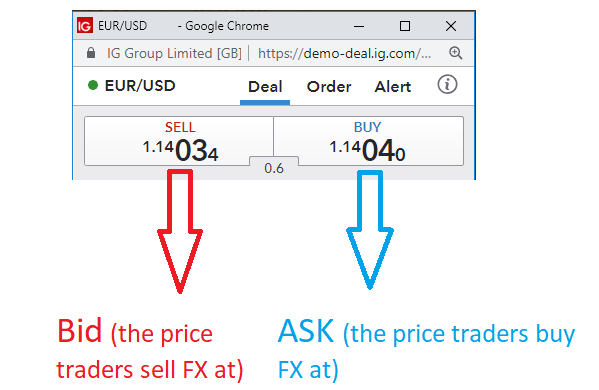

Bid and ask price

When trading forex, a currency pair will always quote two different prices as shown below:

The bid(SELL) price is the price that traders can sell currency at, and the ask(BUY) price is the price that traders can buy currency at. Traders will always be looking to buy forex when the price is low and sell when the price rises; or sell forex in anticipation that the currency will depreciate and buy it back at a lower price in the future.

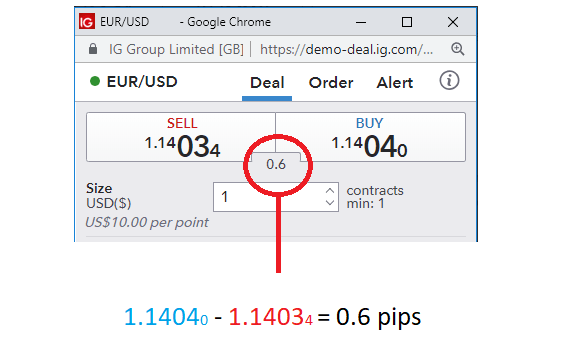

Spreads

The price to buy a currency will typically be more than the price to sell the currency. This difference is called the spread and is where the broker earns money for executing the trade. Spreads tend to be tighter (less) for major currency pairs due to their high trading volume and liquidity. The EUR/USD is the most widely traded currency pair, so it is no surprise that the spread in this example is 0.6 pips.

Direct vs Indirect Quotes

Quotes are often displayed in accordance with the "home currency" in mind i.e. the country you reside in. A direct quote for traders in the US, looking to buy Euros, will read EUR/USD and will be relevant to US citizens as the quote is in USD. This direct quote will provide US citizens with the price of one Euro, in terms of their home currency which is 1.1404.

The indirect quote is essentially the inverse of the direct currency (1/direct quote = 0.8769). It shows the value of one unit of domestic currency in terms of foreign currency. Indirect quotes can be useful to convert foreign currency purchases abroad into domestic currency.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2014.01.06 18:38

What is the Pip Cost for Gold and Silver?- Gold: Symbol XAU/USD

The pip cost for 1 ounce of Gold (minimum trade size) is $0.01 per pip. - Silver: Symbol XAG/USD

The pip cost for 50 ounces of Silver (minimum trade size) is $0.50 per pip

Forum on trading, automated trading systems and testing trading strategies

Forecast for Q1'16 - levels for GOLD (XAU/USD)

Sergey Golubev, 2016.03.23 17:12

Example with GOLD (XAU/USD): 1221.39 - 1218.02 = 337 pips

Hi Sergey,

That all makes sense to me above and does lead me to another question I have in a moment but can you explain why, on my app, some currencies have 5 decimal places such as in your example while some only have three? I have attached a screenshot to illustrate what I am seeing.

GBP/USD (High) = 1.16607 (5 decimal places)

USD/JPY (High) = 138.837 (3 decimal places)

It appears to only be pairs including JPY. Do these pairs only move in 10 pip moves if they don't have the 4th decimal place?

--------------------------------------------------------------------------------------------------------------------------------------------------------

My new question.

In your example, I can see every pair has a Bid(Sell) price and an Ask(Buy) price. When back-testing, I assume I should be using these as such:

Going long = Opening price = Ask, Closing price = Bid

Going short = Opening price = Bid, Closing price = Ask?

Hoping I can get this cleared up, thank you for helping me learn,

CPerry.

Hi Sergey,

That all makes sense to me above and does lead me to another question I have in a moment but can you explain why, on my app, some currencies have 5 decimal places such as in your example while some only have three? I have attached a screenshot to illustrate what I am seeing.

GBP/USD (High) = 1.16607 (5 decimal places)

USD/JPY (High) = 138.837 (3 decimal places)

It appears to only be pairs including JPY. Do these pairs only move in 10 pip moves if they don't have the 4th decimal place?

--------------------------------------------------------------------------------------------------------------------------------------------------------

...I think it is same for JPY pairs (same as for EURUSD for example): 1 pip = one 4-digit pont (for EURUSD).

Example for EURUSD:

1.0280 - 1.2050 = 30 points (4-digit points) or 3 pips

For USDJPY:

138.440 - 138.410 = 30 points or 3 pips

------------------

It was many years ago when 1 point = 1 pip. But later on the brokers added the oter decimal ... and we have 5 decimal for many forex pairs (it was 4 decimal before) and 3 decimal places for USDJPY for example (it was 2 decimal before for USDJPY).

Look at the post below for decimals for USDJPY - it is my MT4, and it was 16 years ago:

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2006.01.11 13:34

An other half an hour.

Situation is almost the same one.

USDJPY wants to be closed on T3 Trix crossing but we must wait. Because we are acting on the closed bar. So I am waiting until the bar will be closed.

Hi @Sergey Golubev,

That makes sense, I’ll continue to do my own playing with the numbers, to get it perfectly making sense in my head. Very interesting that 1 pip used to be equal to point and the brokers added the extra decimal place, I never knew that!

Wow, 16 years! At the risk of asking you individually too many questions, may I just ask, are you still using MT4 or are you on MT5? From my research, a lot of traders use MT4. I’m not sure if I’m just looking at dated sources or did a large portion of the industry never bother transitioning from MT4 to MT5, in your opinion?

Also, do MT4/MT5 (I use MT5) set their own leverage rates or is this set by the broker? (I use IG). If it is set by MT5, do you know if there is any way to trade without any leverage or is this not possible? Just thought I’d try to minimalize my risk as much as possible while I’m learning.

CPerry.

Wow, 16 years! At the risk of asking you individually too many questions, may I just ask, are you still using MT4 or are you on MT5? From my research, a lot of traders use MT4. I’m not sure if I’m just looking at dated sources or did a large portion of the industry never bother transitioning from MT4 to MT5, in your opinion?

I started with Metatrader 3 many years ago: I was invited to participate in "Metatrader yahoo group" (there were no forums in that time), and we tested Elder's Triple Screen EA created for MT3 (small discussion thread from 2005 is here), after that Metatrader 3 was stopped working for everybody, and we (traders and coders) had to move to Metatrader 4. And for now - I am using MT4 and MT5 (both).

About "MT4 vs MT5" - read this summary post #792

Also, do MT4/MT5 (I use MT5) set their own leverage rates or is this set by the broker? (I use IG). If it is set by MT5, do you know if there is any way to trade without any leverage or is this not possible? Just thought I’d try to minimalize my risk as much as possible while I’m learning.

By brokers. Because the chart, the price on the chart, the time of the price on the chart, the trading accounts and money for trading (withdrawal/deposit), name of the symbols to trade, the symbols proposed to trade, and more - all of them related to the brokers only.

- 2005.09.16

- www.mql5.com

That’s really interesting. How cool that you’ve grown and adapted with MT3, MT4 and now MT5. Thank you for answering my questions, I still have a load more but I’ll open up new threads for those.

I hope I can have a career spanning more than a decade such as yourself, very nice to meet you and I hope you are more and more profitable every year.

Thanks again,

CPerry.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi forum,

Why do some forex currencies have 5 decimal places and some only have three? Using the app, I can see the following for the first 6 currency pairs:

EUR/USD - 5 digits after the decimal point

USD/JPY - 3 digits after the decimal point

GBP/USD - 5 digits after the decimal point

AUD/USD - 5 digits after the decimal point

EUR/JPY - 3 digits after the decimal point

USD/CAD - 5 digits after the decimal point

Am I correct in thinking a pip goes up or down based on the 4th decimal place i.e. 1.00015 -> 1.00025 is an increase of one pip? What's the point of the fifth decimal place? Will my profit/loss fluctuate based on a fraction of a pip move i.e. 1.00012 -> 1.00017. If I use one lot (£10) Will half a pip move change my existing position +/- £5 or will it only go up/down each time there has been a whole pip in movement?

What on Earth happens with the ones that only have 3 decimal places? Do my positions only move in 10 pip increments?

Thank you for the advice,

CPerry.