- problem at programing TP & SP

- Coding help

- Simple Help: Take Profit Moving Average

Yes, it is possible to code and backtest.

In MT4/MT5 there is a bollinger band library (iBands) you can use to code.

-

Search for it. Do you expect us to do your research for you?

-

Beg at:

- Coding help - MQL4 programming forum

- Make It No Repaint Please! - MQL4 programming forum

- MT4 to MT5 code converter - MQL5 programming forum

- Please fix this indicator or EA - General - MQL5 programming forum - Page 193 #1027

- Requests & Ideas (MQL5 only!) - Expert Advisors and Automated Trading - MQL5 programming forum

-

MT4: Learn to code it.

MT5: Begin learning to code it.

If you don't learn MQL4/5, there is no common language for us to communicate. If we tell you what you need, you can't code it. If we give you the code, you don't know how to integrate it into your code. -

or pay (Freelance) someone to code it.

Hiring to write script - General - MQL5 programming forum 2019.08.21

We're not going to code it for you (although it could happen if you are lucky or the problem is interesting.) We are willing to help you when you post your attempt (using CODE button) and state the nature of your problem.

No free help 2017.04.21

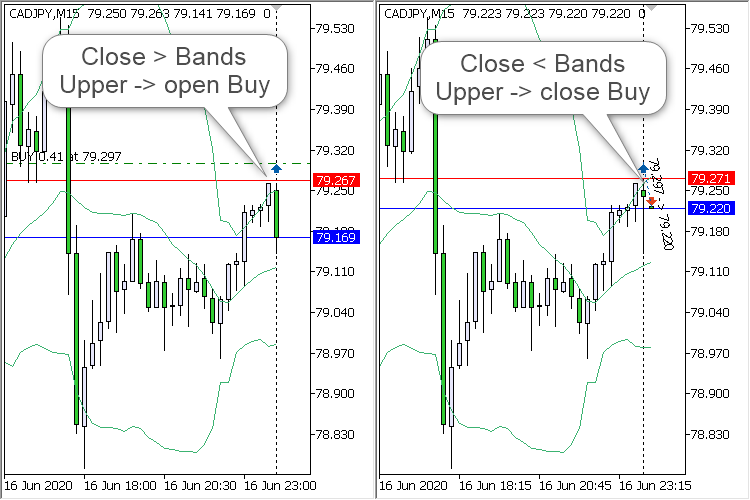

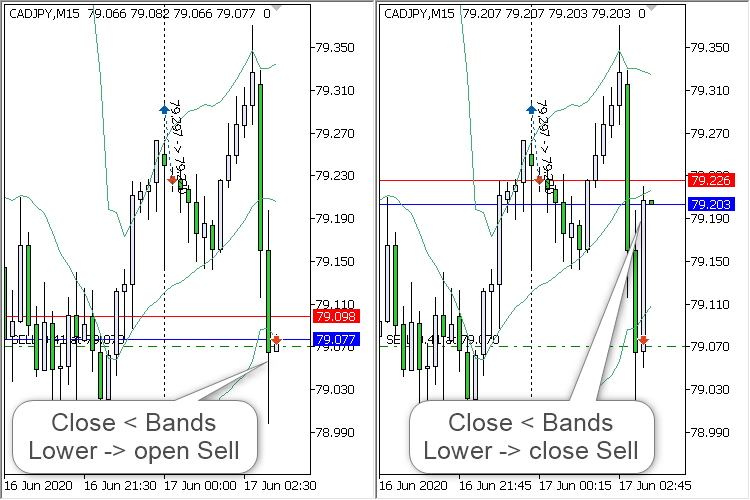

Use: iBands Crossing and Returning :

Fig. 1. iBands Crossing and Returning - opening and closing a position BUY

Fig. 2. iBands Crossing and Returning - opening and closing a SELL position

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use