Happy start, Gleb Georgievich!

I will definitely read it. ))

I liked the style of the article - no vague expressions

The ultimate goal of the article - to use the thresher where there is a profit, seems to be worthy of attention, but... we were not taught to do that!

We all want to do it scientifically - here is technical analysis, here is the ZigZag break, here is the pattern we were looking for, here is a takeout of at least 30 pips and .... and a beautiful tester's report, but...but only on history! - i.e. without intellectual "sado-maso", one feels uncomfortable ))))

Thanks for the article and for a fresh look at the goals of trading, we will think.

Interesting stuff, thanks to the author.

There is a link to a comment in the article:

...Поэтому хочется обойти эту навязчивость/несовершенство MetaTrader 5 тестера. В MetaTrader 4 это сделать легко - там есть возможность поменять валюту счета прямо в тестере. MetaTrader 5 же лишен такой возможности.

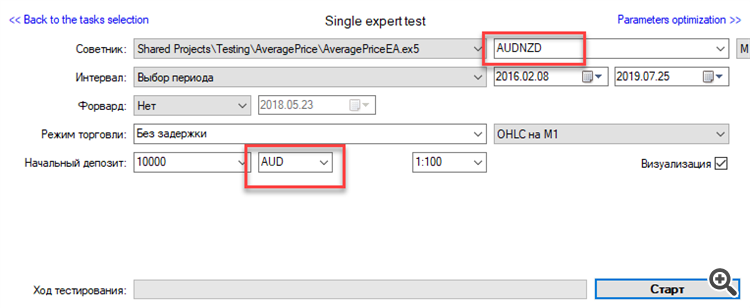

It may have been stripped, but somewhere in past builds. It is not the case now. You can manually enter any symbol name (in the field following the "Initial Deposit" field) in the Tester settings. For example:

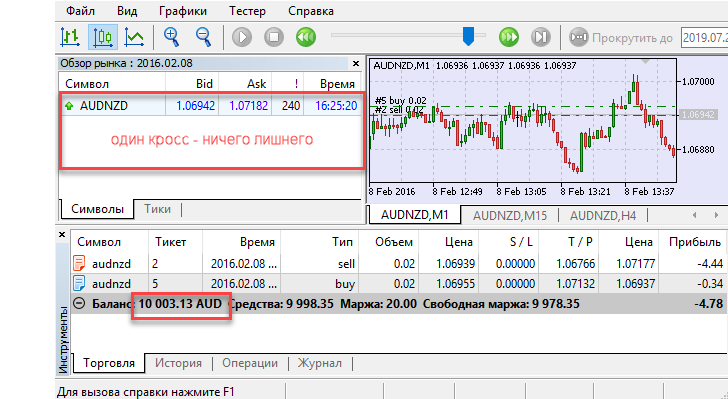

And then work only with quotes of the cross itself, without sucking quotes related to the currency of the account. For example:

Great article that shows how difficult it is to take a profit out of quotes.

In order to do that you have to:

1. go through dts by trading conditions (not every dts has non-slip limits, rather such dts are the exception)

2. To search for symbols, so that they meet the criteria of TC (in this case it is mean reversion). Very few symbols satisfy.

3. to fight with the strategy tester, which incorrectly calculates profits and gives positive slippages.

4. The regularity borders on the spread/swap/commission/slippages, which can kill such a profitable TS. Therefore, you have to constantly monitor the quality of execution, so that it does not spoil (for example, through a virtual tester like the author).

5. Well, even excellent results of testing on OOS do not guarantee that the system will not break one day, and when it will happen - it is unknown.

We can say that this is practically the highest pilotage in trading, demonstrated by the author, and almost the maximum of what can be squeezed out of raw data (ticks) at Forex.

The following points are worth considering:

1. The article analyses indicative quotes of the best prices of the stack.

2. It is worth to familiarise yourself with the regulations of sending limit orders to PL. If you have placed a limit order, it does not mean that it is immediately placed at the PL.

Hence, the real execution can be very different from the simulation on indicative quotes.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

New article Extract profit down to the last pip has been published:

The article describes an attempt to combine theory with practice in the algorithmic trading field. Most of discussions concerning the creation of Trading Systems is connected with the use of historic bars and various indicators applied thereon. This is the most well covered field and thus we will not consider it. Bars represent a very artificial entity; therefore we will work with something closer to proto-data, namely the price ticks.

Source

Where can we get price data for research? There are many sources of ticks. Let us choose one of them.

Chances of finding a gold nugget are probably higher when you are dealing with the rock having higher concentration of gold. Therefore, we will use tick source with a higher potential profit. The method of determining such a comparative criterion was described in a forum comment (in Russian, use built-in translation option). Based on this method, I selected multi-gigabyte this archive of tick data. Billions of ticks.

Custom ticks

Ticks can be fed into the MetaTrader 5 tester using custom symbols. This may be too complicated for fast understanding, therefore we will use a ready script ThirdPartyTicks, which creates such symbols based on data from the selected archive of quotes.

Author: fxsaber