Any great idea about HEDGING positions welcome here - page 35

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

34 pages and still don't sent any expert post that analyze my questions in post #198

I replied but you didn't like my answer.

"It surprises me that any seasoned trader would even consider this. If the TP is hit on the 3rd Buy without any of the Sell TPs hit,There will be a small profiit on the 1st Buy, a larger profit on the 2nd and larger still on the 3rd. But the obvious thing is that the sum of these profits will not come near to balancing the total loss of the 0.06 lots on the Sell trades. Any chance of recovering will rely on price dropping to put the sell trades in a position where their losses are balanced by the profit on the buy trades. Of course there is no guarantee as price could just keep going up.

The surefire strategy that this is loosely based on relies on martingale entries and price breaking out of a range. When price hits a TP it also activates the SL on the losing trades. At least this makes some sort of sense, but it is still risky.

The above strategy is just based on wishful thinking."

Maybe they don't want to.

What would it gain them to do so ?

Unless of course, you pay them...

their effort pay them not me.

Forum on trading, automated trading systems and testing trading strategies

Any great idea about HEDGING positions welcome here

Seyedmajid Masharian, 2018.09.26 10:06

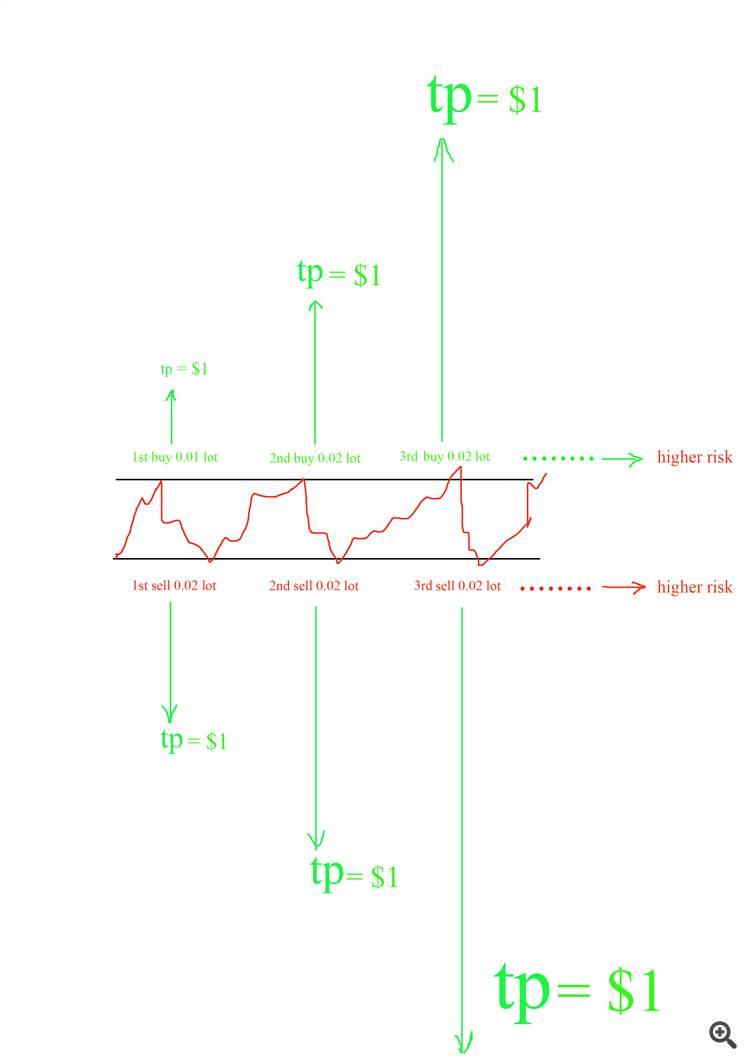

see the picture please.

this is a sure fire hedging strategy ...

the 1st problem is 1.this system only works on trending markets and in middle term or long term choppy market it will fail if will not blow up your trading account.

question: which strategy is better for that to don't fail in choppy markets and even make money in such conditions .?

the 2nd problem is by opening each new position you have to bring your tp point further to make the same amount of profit as initial trade.

question: what to do to decrease trade opening number in long term choppy market.?

the 3rd problem is spread and its widening by broker.

question: what to do if broker widened its spread so recovery zone will be wider . so some opposite trades in both directions will be closer to each other

here is the image

and some of them will be further from each other.

the 4th problem is fast market movement and price gaps that causes opposite orders open further that trader wanted.

question:what to do if between 1st buy and 1st sell or 2nd buy and 2nd sell or any other consecutive trades market will make a huge price gap ?because this causes 2 consecutive orders placing far from each other while another orders are close to each other.

how to manage such situations?

these are not all problems that we must resolve them but an important part of them i will add further question later...

don't forget using trailing stops can improve you success by increasing your winners and decreasing your risks.

please answer each question on its place.

come here and give your opinions only about this post.

I replied but you didn't like my answer.

"It surprises me that any seasoned trader would even consider this. If the TP is hit on the 3rd Buy without any of the Sell TPs hit,There will be a small profiit on the 1st Buy, a larger profit on the 2nd and larger still on the 3rd. But the obvious thing is that the sum of these profits will not come near to balancing the total loss of the 0.06 lots on the Sell trades. Any chance of recovering will rely on price dropping to put the sell trades in a position where their losses are balanced by the profit on the buy trades. Of course there is no guarantee as price could just keep going up.

The surefire strategy that this is loosely based on relies on martingale entries and price breaking out of a range. When price hits a TP it also activates the SL on the losing trades. At least this makes some sort of sense, but it is still risky.

The above strategy is just based on wishful thinking."

you replied me several times but you are against hedging

but my goal to establish this thread was to find a group that agree with my opinion so we could start work on it focusing on just one strategy to develop that.

but maybe i made a bad decision to share my idea here.

Maybe they don't want to make a bad decision to share their idea's with you.

Or more shockingly, they have shared their ideas but you didn't realize it, or rejected them.

I thought it was another chatroom thread. So sorry. What was the post 198 about please ?

#138 here you are.

Maybe they don't want to make a bad decision to share their idea's with you.

its up to them they are free.

from now i don't reply any non related posts here.

if someone willing to work on my strategy come here and go to post #138 and reply that .

i will be glad to exchange our opinions focusing on that strategy only.

this is the only way to make a progress ...$$$

lets finish useless debates and start focusing on hedging systems...

see the picture please.

this is a sure fire hedging strategy ...

the 1st problem is 1.this system only works on trending markets and in middle term or long term choppy market it will fail if will not blow up your trading account.

question: which strategy is better for that to don't fail in choppy markets and even make money in such conditions .?

the 2nd problem is by opening each new position you have to bring your tp point further to make the same amount of profit as initial trade.

question: what to do to decrease trade opening number in long term choppy market.?

the 3rd problem is spread and its widening by broker.

question: what to do if broker widened its spread so recovery zone will be wider . so some opposite trades in both directions will be closer to each other

here is the image

and some of them will be further from each other.

the 4th problem is fast market movement and price gaps that causes opposite orders open further that trader wanted.

question:what to do if between 1st buy and 1st sell or 2nd buy and 2nd sell or any other consecutive trades market will make a huge price gap ?because this causes 2 consecutive orders placing far from each other while another orders are close to each other.

how to manage such situations?

these are not all problems that we must resolve them but an important part of them i will add further question later...

don't forget using trailing stops can improve you success by increasing your winners and decreasing your risks.

please answer each question on its place.

#1 you need to be able to detect a ranging market before thinking on how could you adapt, are you ?

#2 the more you'll move your tp far from the bands, the more you gonna miss tps - logical.

#3 if it's not spread it's slippage, have you thought about a recalculation of the appropriate tp/sl levels ?

#4 use pending orders <--- unsure i understood this one