You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

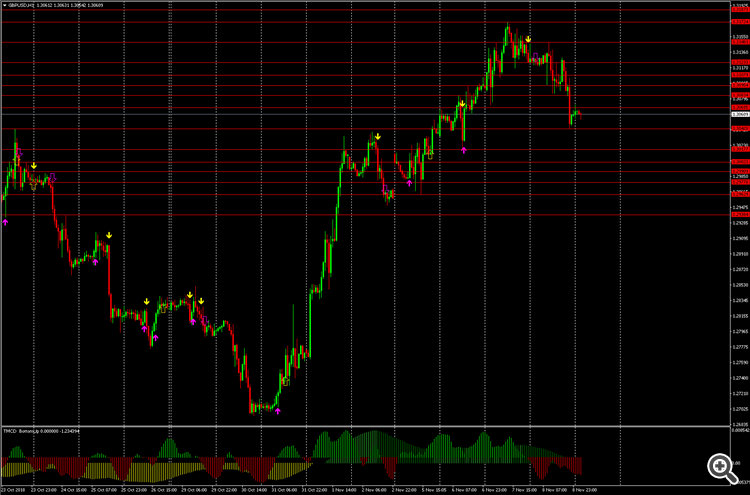

Day start S&R levels for 9/nov/18

Sellers are in control & Cable will be looking to test 1.3000

Levels for day starting 11/nov/18

On Friday we saw cable drop to 1.2990 as expected before bouncing and testing the 1.3050. A further drop from there to take out the days low and closed just above the 1.2963 level.

Sunday opened with a gap and currently sitting on the 1.2929 level as I write. Buyers are lined up @ 1.2912 with more @ 1.2898. Should the sellers absorb the volume there, I don't see them getting through 1.2840 by end of day.

A bounce of some sort is expected & I will be looking for a buy signal . Sellers may kick back in @ 1.3000 all the way to 1.3044 where I will look for a reverse signal

End of day

Monday trading saw cable carry on dropping after it opened on sunday with a gap down. As expected, it tested the 1.2840 level and buying volume sent it back to test the 1.2928 level. A 2nd test of 1.2840 is where we see the day close.

Below is the chart with S&R levels for 13/nov/18

Cable is still in a down trend. The bounce from 1.2840 was not strong enough to even fill the weekend gap. Sellers are now sitting tight @ 1.2945 & 1.2973 through to 1.2990.

On the down side we have stops sitting below the low of 1.2825 & more scattered all the way down to the 1.2705 level.