It has been a while since a posted anything here but felt the need because your experience was my own.

Here are my thoughts that your may want to consider;

1. You must get your head right, meaning this is a business. It is not personal so kicking yourself after every trade must stop.

2. MACD lags so bad when the traditional signals appear the trade is over. Every time. The indicators, if used, should be secondary to price action.

3. Learn to Fibo properly. Learn to use some Gann properly.

4. If watching the screen drives you nuts move to higher time frames.

Continue with your strengths.

Hope that helps. If you really focus on these considerations your trading will improve.

It has been a while since a posted anything here but felt the need because your experience was my own.

Here are my thoughts that your may want to consider;

1. You must get your head right, meaning this is a business. It is not personal so kicking yourself after every trade must stop.

2. MACD lags so bad when the traditional signals appear the trade is over. Every time. The indicators, if used, should be secondary to price action.

3. Learn to Fibo properly. Learn to use some Gann properly.

4. If watching the screen drives you nuts move to higher time frames.

Continue with your strengths.

Hope that helps. If you really focus on these considerations your trading will improve.Thank you for your response. I was starting to wonder if anybody would reply

In regards to your first point....I'm working on it. I think recent events are starting to click with me, I'm not taking this as seriously and mechanically as I should.

I am a Fibo addict, I like to throw it on all the time frames to see what I can find. Gann? I have never used that before. Maybe I will look into it.

a very passionate diary on forex learning curve -- recommend to everyone to read your article

SOLUTION

how about EA and Demo

-----

I still on DEMO -- but demo on micro lot, i.e. each pip cost 0.1 USD, this does reduce my sensitivity to the transaction profit and loss -- e.g. now, when it reach loss of -50 (i.e. normal account for -500) then I feel that I have to react -- hedge, close some, reduce loss

-----

I also share your feeling on DEMO has been really good in summer 2011

I could tell you , during summer, no matter how I start with (maybe I stump on some magically method that act on instinct), I either get out break-even or gain some i.e. over 90% seldom loss

--- but these few weeks, pretty bad, the magic formula does not work, it is clear we should not make first bet before DOW open in USA, otherwise, we are chasing our losses and try to figure out what is the next leg

i.e. market condition has JUST CHANGED, probably timing and sometime the market will go extra flat due to EUROPEAN

=== another way to go with it, is to realise forex is the hardest thing, like NSA prevent you to hack into their datastream system, actually, the price is progressive, rather than fluctuating in the blink of the eye -- forex is already easier than last few years

------

try to figure out how to write IApps, androidapps, ipTV javaApps -- those could be more rewarding, while watching MT4 (don't rush in, when traders seem to have a 45 minute sugar rush, is quite a good suggestion, don't play with eur/usd and don't touch anything that got GBP in it -- it could make life easier, try cad/chf -- and you must continue to be on DEMO, even move to real account , play with micro real account - just x10 for everything

-- you could also show us your screen capture for your entry and exit based on 1 hr chart, thenmaybe we could give you some valuable comment on the indicators that you used

I group same type of indicator in 1 single template -- TP for 45 to 85 pips, I think it is appropriate enough and also has to stick to your guideline for SL - hedging that does not lead to overtrading is good way to get your mind off the MT4 for a day or about 15 hour time gap before your next bet

======

could try to determine the currency pair yourself, let you grandma give a call on buy /sell and put the MT4 on her computer

these few terms could be food for thought

-- premature entry : like the different part of a innovative product life cycle, do you enter during growth period

-- did you really follow the sign or gut feeling or expertise on an indicator

-- betting money like wedding gift, you shall never expect it to get a return

the following dig, we suppose to buy when above double line, we suppose to sell when below double line

will we stick to our plan when we open the MT4 and find the candle color start to change ?? (then enter too early)

Naked trading, I have heard of that but never given it a try. Perhaps will consider doing so. Today was a better day for me. My mind was clear and my trade signals clearer. I made 50 pips easy pie but kicked myself for watching the charts too much.....this caused me to lose out on an additional 50 pips in my trade. I exited for no reason other than fear and impatience even when price was screaming to me that it was continuing in favor. I broke my rule not to exit before top of hour. So now I am convinced the problem isn't the system, the problem is me. I do well when I don't sit and hawk the charts. Just let the markets do its thing.

Thanks again to everyone who has contributed to this thread so far. I look forward to reading more creative ideas and feedback.

Hi,

I can appreciate how difficult trading is and I was in a similar position for a while, came very close to quitting after many loses.

Profitable trading can be achieved, don't look for the holy grail - concentrate on a risk/reward ratio of at least 1:1 or above and look to the longer timeframes, remove most of your indicators (they all lag) and go back to the basics of price action - trade a very small micro account or demo liveuntil you build up more confidence and don't overleverage. This may seem simple but this comes from years of experience, hope it helps and good luck.

Don't Give Up!

Hi You sound just like I was. The problem is that discipline is very, very difficult. And only the most disciplined traders make consistent gains.

I solved mine by blogging all my trades, and found myself really wanting to skip over the times when I did something stupid. That is because our brains are wired to seek the thrill of the chase. The same part of our brains light up when placing trades as they do when high on intoxicating drugs. Just remembering that little thing helped me hesitate before placing a trade against my trading plan. Because then I had to share with the world how stupid and greedy I was, chasing the high and not the certainty!

The truth is this is not a get rich quick scheme. Sure you can make huge gains in a single trade, but if that is the way you trade, you are equally as likely to give it all back the next trade! And more!

I have found trading in small lots means I can smile when it goes against me because it is not touching more than 0.05% of my equity. That means I can afford to wait until the reversal inevitably happens, and therefore I win more than I lose. Previously I was cutting a lot of trades short to cut my losses, only to have them rapidly reverse for what would have been a profit. At some point I sat down and analysed what was going wrong and concluded I was panicking because I was trading with lot sizes that were too large.

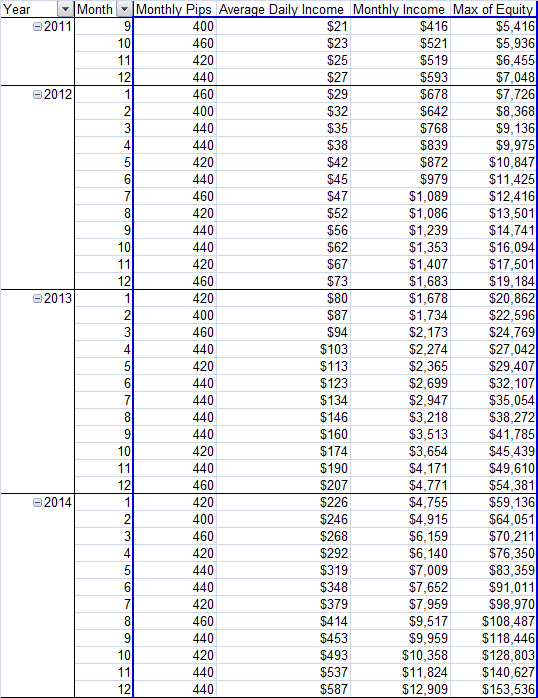

If you don't have the patience to watch your equity grow slowly then you shouldn't be trading with real money. If you want to trade with real money then do yourself a plan like I have attached here (based on 20 pips a day, 2% risk). Track your progress, and when you go wrong, take the time to write out exactly what you did wrong, and what you did right. Make sure you manually write it out, because doing so engages a part of your brain that means that the lesson is more likely to 'stick'.

Good luck!

CADCHF look like falling on tuesday - but timing for entry ..... ...

so you have to decide to enter now or when confirmation take place first, then enter

it is also stick to the midline of previous day principle, find a bouncy pair, buy or sell around the midline of previous day

you should definitely get off the real account (do demo as market condition changed recently) , and find some hobbies while practice trading -- a non-stressful method could suit you === and it is not really 50/50 when you consider pip cost and even cost more during volatile buzzing moment

YUK

earlier today, I said CAD CHF should be falling

and then I set up an OCO (2 pending LO, only 1 will get executed) on FXCM micro

look at the LEFT , green one, for the price level (it does not seem to be fast or volatile today]

then see RIGHT, my BUY -- priced at 0.88830 -- I set sell price (OCO) A BIT FURTHER (so I can be sure it is a downturn if I set the price further down) to that moment spot market price -- WHAT A SURPRiSE, the buy price get HIT first and then downturn

and from the blue green thing , there is today high and low, high shown was 0.88830

but with MT4 and normal pip spread, there should be still about 2 to 3 pip before it should have reached 0.88830 i.e. 0.88800 for the highest daily -- is what I expected

the broker could think -- if the customer is winning, then it is ABNORMAL RETURN

but one thing good about fxcm demo account now, it is very real -- the price, the speed when volatile and rip a few more pip during volatile , so we could do very accurate TESTING

== what can you do about that ?! anyway -- even if my down guess on demo is correct ?!

I will try to sell 1 more later on if trend shall continue

======

I think the author, is sincere enough to tell us the STORY,

so maybe if he show us -- where does he entered , which price level does he exit, we could SHOW HIM a thing or 2 about better entry/ exit with our indicator or knowledge

fores is the hardest thing to make profit, when you do, you can't believe your eyes, that is the norm

and your indicator and your chosen pair, may not be for you -- take everyone ages to filter what is good indicator for them or what the traders will believe in -- myself, I don't like fibo or MACD, those are the first few lessons that I learned

TONIGHT (THURS), I think GBPAUD will be LONG (my view) -- only 65 to 70% certainty

despite there was a down needle couple of hour earlier, but after DOW open for 40 minute, the trend shall continue

I learn this lesson from last week, I sell, it go up and up afterward -- so the timing should be more correct this time -- only if trading floor pepople see the same as myself

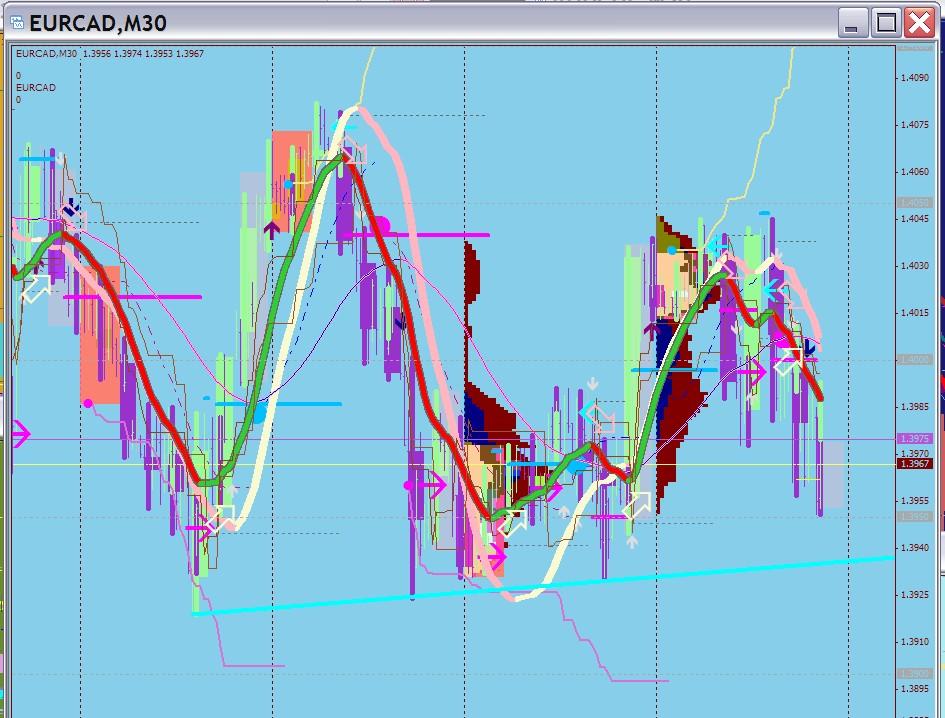

this week friday morning -- we should watch out for the aqua blue straight line price level

we could place a buy on $eurcad after the price level is reached

but see the few pink L line at the bottom

if price fall below those pink L -- level , then shoot a few sell orders

panic (watching our open trans balance) vs thrill (when we make an entry as we thought we have seen behavior of current candle with the indicators on the template -- seem that we have seen that before , so my suggestion is create a template for best-ever entry price -- i.e. that price is good to enter either if it will go with us -or- go against my intended direction -- as I will be watching MT4 during next 2 to 3 hours, so if it go against, I can still react, rather than sleep with the open trans)

==== for these 2 week or even next week ---

the daily swing during summer is gone ( we have to know what OURSELVES would like to believe i.e. is the market condition fit into our expectation for forex movement)

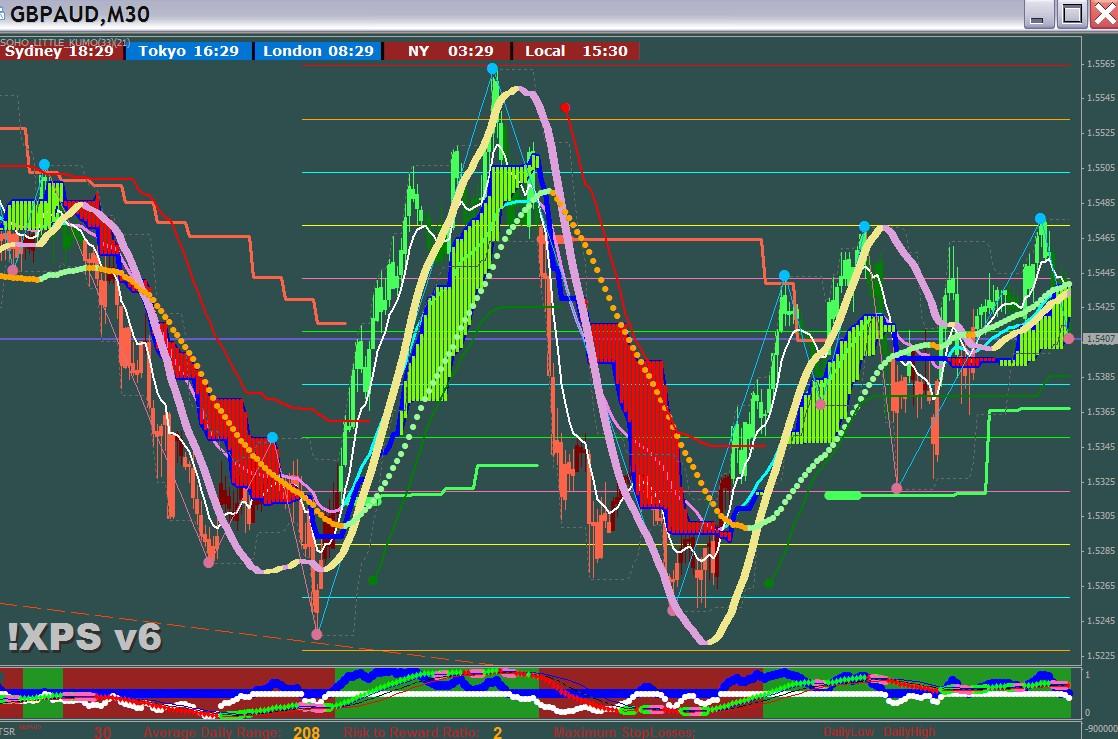

hehehe, xard777 could come up with some new system for the new market, I am still watching his Version 6 to see how good that it fits into the behavior of the big boys in the market

tough to find a template that explain GBPAUD well this week

does this one look easier, -- it said (charting view) buy $gbpaud when it hit 1-5365 but better hedge it if it fall below, better hold on to a hedge lock loss, rather than set up SL during WEEKEND

-- got a suggestion too

you could notice who are the real experts in trading in this forum, there are about 10 or so

maybe you can learn more about andriod (appinventor) or iapps programming

show us your learning curve and some good sample project

those are quite proprietary, apple will only open those code for few VENDORS who write business application apps

then maybe programmers / trader will give you something to get you kick-start

I take a long time to perfect my templates too , so I seldom share (but my goal is still having progressive profit -- watch the movie title call LIMITLESS, you could understand traders dream in that movie)

--- I am not try to make fun for the following spreadsheet, how about if the spreadsheet is the target for lossing transaction, so blink wink wink, we could always follow the reverse of our intended direction

2 stmt for us to think about

-- "are we the prophet (biblical term) for the forex next leg movement"

-- " when we are betting the direction , could we be better than author gramdma random guessing direction "---- i.e. collect statistics for our bet to turn out to be correct versus his grandma random bet [ could do this excel to improve our urges for thrill"

==== eye movement observation

when I look at a historical chart

I notice color change, for indicator and candle , our eyes move left to right, right to left

but with some thinking, suppose we don't know the future, should our eyes move up and down with refernce to the timing of that day (or we could cover up the right side of the chart, and see whether we would make an entry when the candle above or below an indicator or when indicator change ) --- i.e. we are over-confident that we NOTICE something about an indicator, rather than notice the statistics of profit and loss for our previous transaction (that could be good way to tell whether we SHALL make profit / or make losses for more tradings)

everyone reading this thread, take a look at the above dig, compared with the dig (purple too) on this page

does GBP/AUD look easy

time now is 17:00 GMT friday

I would strongly suggest a BUY, unless next few 30M candle fall below the GREEN bottoming line at 1-5365

my intention is not to GIVE everyone a recommended SIGNAL (right now, this moment)

but to show to the struggle fx newbie that , trading could be EASY (sometimes)

getting constant profit -- is another thing though (may not be that easy of progressive continue profiting)

---- if you read it closely, there is double yellow and pink line

this week, seems to be 3 outburst out of these double line, then there will be a reverse

the template is from xard777 v6 and we probably have downloaded it

how to read it, does it need to change the INPUT for each of our favorite currency pair

the things, I notice THIS WEEK, will it still fit the Market conditions next week

well, sometimes, when xard777 release a new system

either he research a lot into it, (program it, make it perfect)

or --- he got TRADERS who really follow his lead - in the template === this is just a HYPOTHESIS , but it might be true (just like our template might be CORRECT for today market condition)

so if we do not USE EA, then we should not focus on pure profit/ loss of the balance

for manual trading, we are suppose to make the prediction more perfect, and ourselves, stick to the guidelines for entry point or placing LO (limit order, we could place it within +/- 15 pips when it is approaching our target ideal price)Nice colors. Are you Piccaso or forex trader????

You are not programmer...

Very deep and good analysis for your own weaknesses and strengths.

Do you think you are expecting a unreasonable high return?

I think this is the reason that you can almost end up the winner many time.

You can earn much money very often and may lost them all overnight, even with your principal.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I have been in Forex for over 2 years now and discovered I am regressing rather than progressing!

The last few weeks have been especially hard on me...I keep losing trades and it is just beating me down further and further. This has happened once before, about a year ago, and then I got so fed up that I took out all my money and quit trading for a few months. I don't want to be a quitter again, I really want to succeed at this. I know that not everyone is cut out to be a trader, but I'm confident that it is right for me.

I am here just to get some feedback and also ask for any suggestions or recommendations.

Here are my primary weaknesses:

Also, I have never had a trading "mentor" or any mentor for that matter so may be one of my issues as well.

Here are my primary strengths:

Having blown accounts in the past, I am determined not to fail again. The entire summer I spent re-educating myself and trading demo. About a month ago I *thought* I was ready to go live again. I had taken 2 demo accounts (close/same balance of what my new live account would contain) to 40% profit in short number of trades with conservative money management. The system just worked and I was looking forward to going live again.

But immediately after going live, things fell apart and have been getting worse ever since. The past month has been nothing but losses for me. I am now down 25%. Fortunately I have good money management or else I would be totally dead in the water! This really starts getting to you after awhile. I know everybody has good weeks and bad weeks, but it's no fun to keep having bad weeks. I visit my grandmother once a week and every time she asks how much money did I make this week and I have to tell her "none" I feel like a total failure. And I know it's not good to trade under pressures, but for my situation, trading is the most efficient way to make money.

This really starts getting to you after awhile. I know everybody has good weeks and bad weeks, but it's no fun to keep having bad weeks. I visit my grandmother once a week and every time she asks how much money did I make this week and I have to tell her "none" I feel like a total failure. And I know it's not good to trade under pressures, but for my situation, trading is the most efficient way to make money.

The trading systems (s) that I have grown to love and trust don't seem to be working anymore. They are what got me into Forex in the first place. And I know that sounds crazy, but all the volatility lately (f*** European banks!) is wiping the dirt with them. (For those who want to know, I trade James de Wet's older material.....G7 and E75....his new stuff is too scalp-directed for me).

So basically right now I just want to take a *pause* from trading and evaluate myself to start being successful again. I am willing to stop and build a complete trading system from scratch but honestly don't know where to start. I have been so used to using what works for other traders that I don't do so well with developing my own systems. My favorite indicators are Stochastics (14, 3, 7), Bollinger bands (100 & 200 period), and moving averages (various). I have seen the profit potential in MACD but every time I use it, I lose. Histograms in general are not my friend. It gets frustrating after awhile. And I am not too skilled at recognizing divergence.

Anybody want to lend a hand or direct me to where I should go? And please don't just tell me to go read "Such-and-Such" by So-and-So. I need a little more guidance than that.

And please don't just tell me to go read "Such-and-Such" by So-and-So. I need a little more guidance than that.

Thanks so much.