You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Mladen,

Thanks a lot...Try them on EU and GU M15-H1 with DeviationsPeriod=30-40 and SwingCount=1-2

Regards

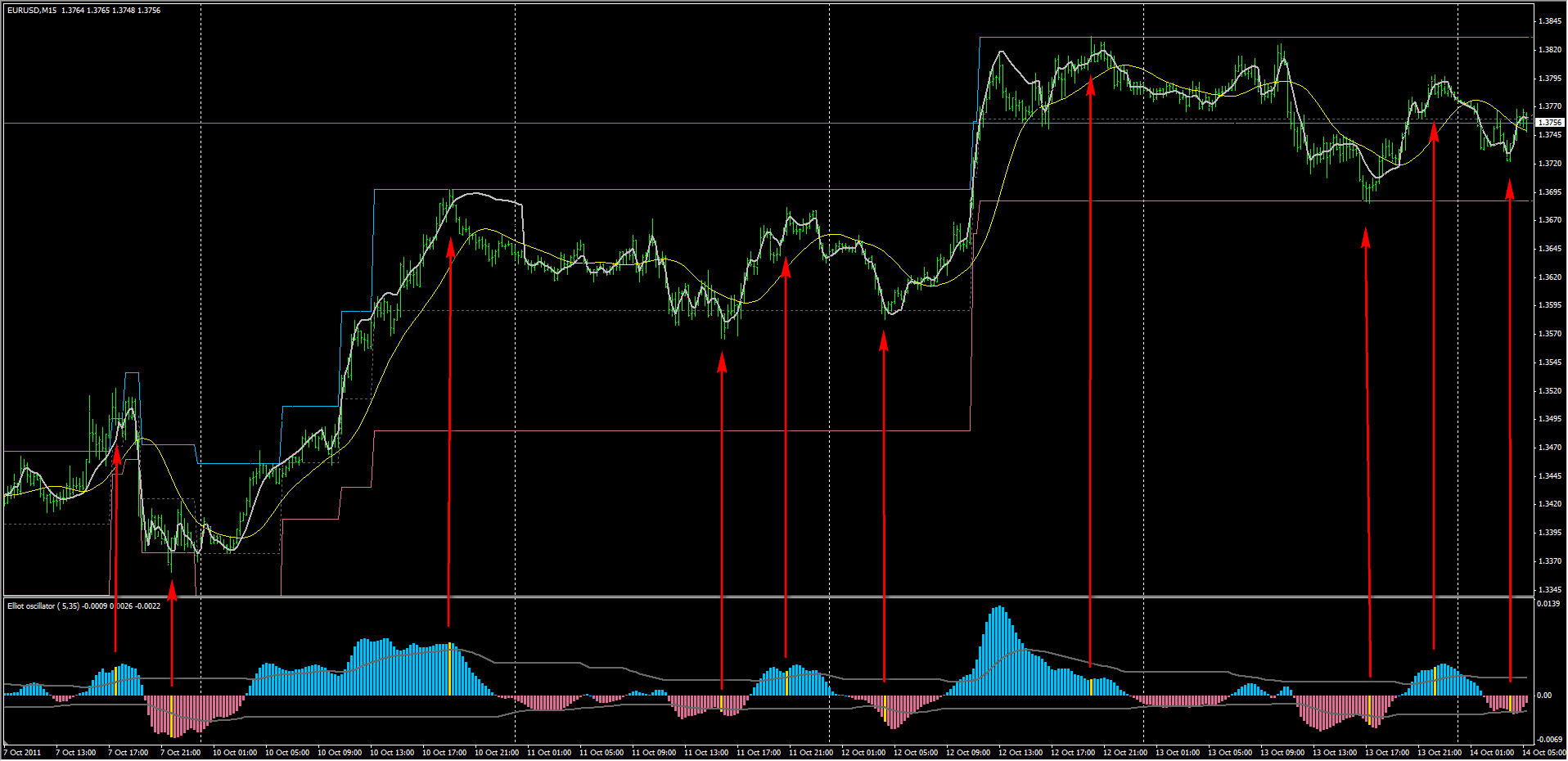

SDeviationsperiod=40 SwingCount=1 on EURUSD M15....See pic...picture perfect

Regards

S

:):)

It is a pity that tomorrow it will be Friday and then 2 days nothing

Deviationsperiod=40 SwingCount=1 on EURUSD M15....See pic...picture perfect

Regards

SDeviationsperiod=40 SwingCount=1 on EURUSD M15....See pic...picture perfect

Regards

SHi Simba,

One thing i noticed on brokers that has odd start of the week eg forex.com (it has 3 hour windows additional on the window separator) it will be different totally.

:):) It is a pity that tomorrow it will be Friday and then 2 days nothing

Same settings update...frigging unbelievable,it signalled the high and,for the moment, a low....Please see attachment

I need a weekend at the beach to absorbe this info,so weekend is fantastic

EDIT:There are 120 bars or so whithin the box,the settings were posted by me before the fact,among a very narrow range of options,only 2 bars hit the high and the low of the range,what is the probability of that ? ....I am not saying this is the HG,just that this is useful,and improvable.

Regards

S

Simba,

You are right. It looks interesting

But I am on a broker without Sunday data too. Will see what can be done to avoid that Sunday data and then we can check how does that data affect the overall "behavior". It seems that a pip or two in some places can mean a world of difference (for me, for example, best results are from price 7 (high+low+open+close)/4)

Hi Simba, One thing i noticed on brokers that has odd start of the week eg forex.com (it has 3 hour windows additional on the window separator) it will be different totally.

Hi,

Yes ,you may be right and I see that Mladen is trying to solve this issue,in the meantime,may I suggest you apply the 40 DeviationsPeriod,1 SwingCount settings to EURUSD M15 chart,instead of an H1 one?This way we can all check the differences due to different brokers.

Thanks in advance and Regards.

S

kokleongch

Try out this version. One option added : SkipSunday. If it is set to true, it will skip Sunday data in calculations (linear regression and deviations) and you should see a straight lines through Sunday data (in the example picture, see how the linear regression value continues to be a straight line regardless of the change in data). If it is set to false, it work the same as before.

PS: making all calculations (adaptive look back + linear regression + deviations) skip Sunday in this indicator was a rather interesting experience, I must say (it caused me a couple of head scratching hours ) But, it really seems that the indicator depends a lot on broker data (as far as I see, mainly the problem is where brokers makes swings, and they are not as similar as it seems on a first glance)

) But, it really seems that the indicator depends a lot on broker data (as far as I see, mainly the problem is where brokers makes swings, and they are not as similar as it seems on a first glance)

regards

Mladen

Seems to be one

Oh yes grils,

seems to be really one

Thanks Malden, Thanks Simba

An idea

Hi Mladen,

Many times after an unsuccessful trading, analizing the reasons I came to the conclusion that I didn't took in cosideration something important.

I don't know how exactly to explain this, but there are good trends (with almost regular and not very big size candles, w/o long shadows and with many same direction candles) and the bad ones when the shadows are long, the corps of the candles are long, there are much often neighborhood candles with opposite direction (up/down) etc.

I choose some "good" ones

and "bad" ones

in the both cases there is a movement but the "good" ones are much more easyer tp follow as the "bad" ones with their irregular movements.

Here I make an appeal to you not only as programmer, but also as an experienced in maths person.

It will be nice to create an "indicator" that will tell us what are the very short time proce behavior. I see it like 7 squares high column with 3red - 1 grey and 3 green squares.

Maybe the base has to be a predefined bar number from the current-1, the absolute difference between open price in the most left and the close one frot the cirren-1 and somehow thet divided by summary lenght of the corps of the containig bars, maybe the proportion of the the sumary length of the shadows to the sumary length of the corps, the frequency of the direction changing (number of "buy" and number of "sell" bars etc.)

It will be nice when the people here give more proposition, so with common efforts we can create a filter, just to make attention that the trend is not so "easy tradable" or vice versa.

Sorry I post this in the bad topic. Must be in the requests & ideas.

kokleongch

Try out this version. One option added : SkipSunday. If it is set to true, it will skip Sunday data in calculations (linear regression and deviations) and you should see a straight lines through Sunday data (in the example picture, see how the linear regression value continues to be a straight line regardless of the change in data). If it is set to false, it work the same as before.

PS: making all calculations (adaptive look back + linear regression + deviations) skip Sunday in this indicator was a rather interesting experience, I must say (it caused me a couple of head scratching hours ) But, it really seems that the indicator depends a lot on broker data (as far as I see, mainly the problem is where brokers makes swings, and they are not as similar as it seems on a first glance)

) But, it really seems that the indicator depends a lot on broker data (as far as I see, mainly the problem is where brokers makes swings, and they are not as similar as it seems on a first glance)

regards

MladenThanks Mladen ! Appreciate your effort and time on this. I will try it out.

Another thing which I experimented and trying to figure what will the decision on trade when price reach 50%(middle). So I use elliotoscillator1.02 as confirmation. It is not 100% accurate but it will help and also elliotoscillator yellow bar will 'shift' when new low/high is achieved close to or when it has not completed the full 1-5 cycle count. But it is a good guide. If snr members hv better idea, it would be interesting to hear this.

regards

KL