Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.12.25 08:38

USD/CNH Q1 2017 Forecast (based on the article)

Dollar to Chinese Yuan forecast for January 2017.

"The forecast for beginning of January 6.94. Maximum rate 7.19,

while minimum 6.91. Averaged rate for month 7.02. The

exchange rate at the end 7.05, change for January

1.59%."

Dollar to Chinese Yuan forecast for February 2017.

"The

forecast for beginning of February 7.05. Maximum rate 7.18,

while minimum 6.90. Averaged rate for month 7.04. The exchange

rate at the end 7.04, change for February -0.14%."

Dollar to Chinese Yuan forecast for March 2017.

"The forecast for beginning of March 7.04. Maximum rate 7.22,

while minimum 6.94. Averaged rate for month 7.07. The

exchange rate at the end 7.08, change for March 0.57%."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.05 06:46

USD/CNH Intra-Day Fundamentals: Caixin Services PMI and 171 pips range price movement

2017-01-05 01:45 GMT | [CNY - Caixin Services PMI]

- past data is 53.1

- forecast data is 53.3

- actual data is 53.4 according to the latest press release

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Caixin Services PMI] = Level of a diffusion index based on surveyed purchasing managers in the services industry.

==========

From official report:

"China ended 2016 on a positive note, with both manufacturers and service providers seeing stronger increases in business activity compared to November. While manufacturers saw the quickest rate of output expansion for nearly six years, services companies reported the strongest rise in activity for 17 months. The latter was shown by the seasonally adjusted Caixin General Services Business Activity Index rising from 53.1 to 53.4 in December."

==========

USD/CNH M5: 171 pips price movement by Caixin Services PMI news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.03 04:50

USD/CNH Intra-Day Fundamentals: Caixin Manufacturing PMI and 90 pips range price movement

2017-01-02 01:45 GMT | [CNY - Caixin Manufacturing PMI]

- past data is 50.9

- forecast data is 50.9

- actual data is 51.9 according to the latest press release

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Caixin Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

From official report:

- "The seasonally adjusted Purchasing Managers’ Index™ (PMI™) – a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy – picked up from 50.9 in November to 51.9 at the end of 2016. Although modest overall, the latest reading pointed to the fastest rate of improvement in the health of the sector since January 2013."

==========

USD/CNH M5: 90 pips price movement by Caixin Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.07 10:03

Weekly Fundamental Forecast for USD/CNH (based on the article)

USD/CNH - "On China’s side, the calendar next week is packed with December Consumer Price Index (CPI), monetary supply, New Yuan Loans and trade gauges. The proportion of home loans to New Yuan loans soared once again in November, to 85.5%. The increased risk of price bubbles, especially seen in the housing market, is the key reason that China’s Central Bank tweaked its credit strategy from loosening to tightening and mainly uses open market operations to provide liquidity. A breakdown of the CPI print will also help to show which sectors expanded fast in prices and whether they are reasonable."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.10 07:06

USD/CNH Intra-Day Fundamentals: China Consumer Price Index and 261 pips range price movement

2017-01-10 01:30 GMT | [CNY - CPI]

- past data is 2.3%

- forecast data is 2.2%

- actual data is 2.1% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - CPI] = Released monthly, usually about 10 days after the month ends.

==========

From rttnews article:

- "Consumer prices in China were up 2.1 percent on year in December, the National Bureau of Statistics said on Tuesday."

- "The bureau also said that producer prices jumped an annual 5.5 percent versus expectations for 4.6 percent and up from 3.3 percent in the previous month."

==========

USD/CNH M5: 261 pips range price movement by China Consumer Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.13 06:51

Chinese Currency: Keeping the masses happy (based on the article)

- "The natural direction for the yuan, if it were allowed to float, would be significantly lower against the US dollar than it is today. The Chinese are manipulating their currency, but they are manipulating it to maintain its current value and allow it to slowly fall to its natural rate."

- "Further, some $2 trillion worth of Chinese currency has been converted into dollars and moved offshore in the last few years. Think about that in the context of quantitative easing and realize that individual Chinese sloshing money around the developed world impact the global economony to the same extent central banks do."

- "The US is the world’s largest economy because we create most of our own supply and demand. It took us many decades to reach that point; China is trying to do it in about two decades. Their export-heavy model can’t work much longer, but they don’t yet have a way to create sustainable internal demand."

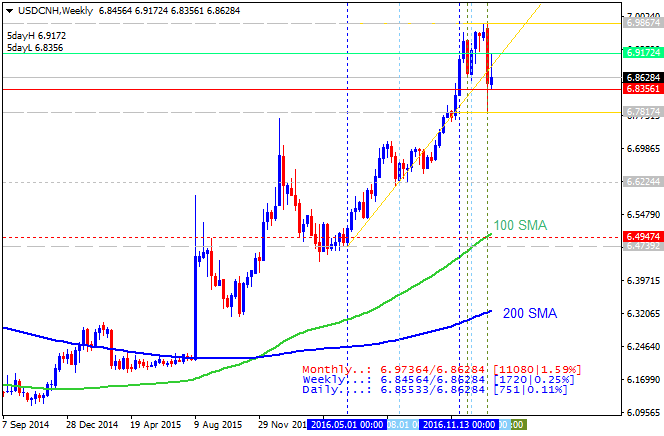

By the way, the weekly pric is still on bullish trend located above 200 period SMA: the price was bounced from 6.9867 resistance level to below for the secondary ranging within 6.98/6.78 levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.15 09:10

Weekly Fundamental Forecast for USD/CNH (based on the article)

USD/CNH - "Next week, Chinese President Xi will attend Davos’ Forum as the first Chinese president. When there is a major national event for China, Yuan volatility tends to drop, such as what was seen during the G20 meetings in China last September. Also, at the Davos’ meeting, President Xi may address major Chinese policies as well as comment on China’s global role, both worth keeping an eye on. Currently, the USD/CNH is waiting for justifications for a new trend; China’s economic outlook and policy in 2017 may provide more clues."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.19 14:56

Intra-Day Fundamentals - NZD/USD, USD/CNH and Dax Index: Philadelphia Fed Business Outlook Survey

2017-01-19 13:30 GMT | [USD - Philly Fed Manufacturing Index]

- past data is 21.5

- forecast data is 16.3

- actual data is 23.6 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Philly Fed Manufacturing Index] = Level of a diffusion index based on surveyed manufacturers in Philadelphia.

==========

From official report:

"The index for current manufacturing activity in the region increased from a revised reading of 19.7 in December to 23.6 this month.* Forty percent of the firms reported increases in activity this month; 17 percent reported decreases. The general activity index has remained positive for six consecutive months, and the activity index reading was the highest since November 2014 (see Chart 1). The other broad indicators suggest sustaining growth. The index for current new orders increased 11 points this month, with 41 percent of the firms reporting increases. The shipments index remained at a high reading but fell 1 point. Both the delivery times and unfilled orders indexes were positive for the third consecutive month, suggesting longer delivery times and an increase in unfilled orders."

==========

NZD/USD M5: 32 pips range price movement by Philadelphia Fed Business Outlook Survey news events

==========

Dax Index, M5: range price movement by Philadelphia Fed Business Outlook Survey news events

==========

USD/CNH M5: 116 pips range price movement by Philadelphia Fed Business Outlook Survey news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.27 15:45

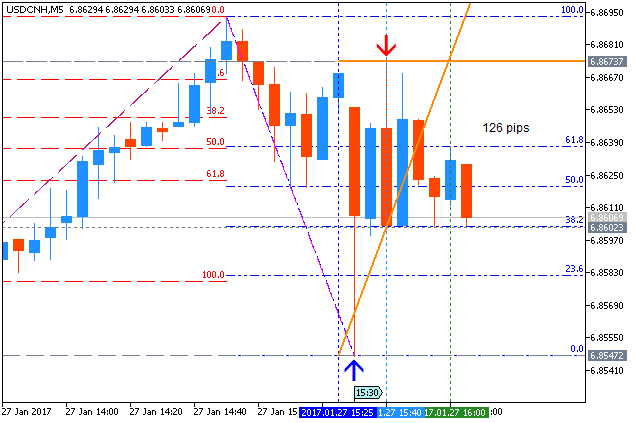

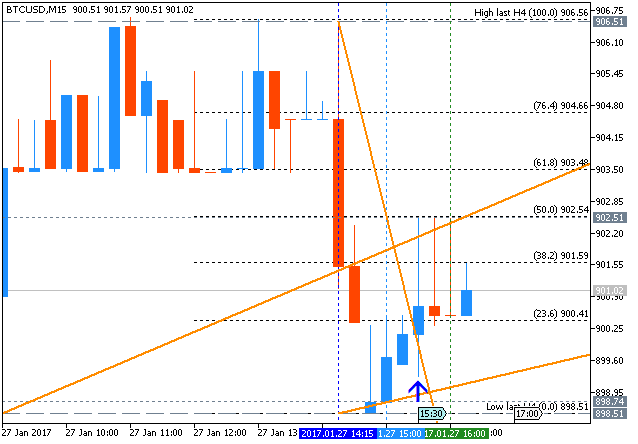

Intra-Day Fundamentals - EUR/USD, USD/CNH and Bitcoin/USD: U.S. Advance GDP

2017-01-27 13:30 GMT | [USD - GDP]

- past data is 3.5%

- forecast data is 2.1%

- actual data is 1.9% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - GDP] = Annualized change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report:

- "Real gross domestic product (GDP) increased at an annual rate of 1.9 percent in the fourth quarter of 2016 (table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.5 percent."

==========

EUR/USD M5: 44 pips range price movement by U.S. Advance GDP news events

==========

USD/CNH M5: 126 pips range price movement by U.S. Advance GDP news events

==========

BTC/USD M5: range price movement by U.S. Advance GDP news events

Forum on trading, automated trading systems and testing trading strategies

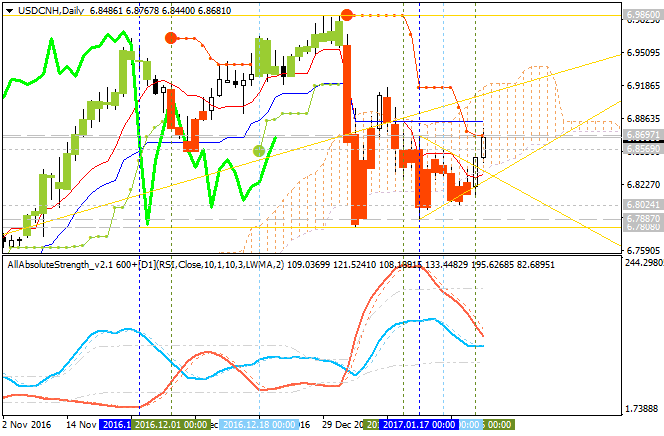

Sergey Golubev, 2017.01.28 12:18

China Economy Becoming More Strict (based on the article)

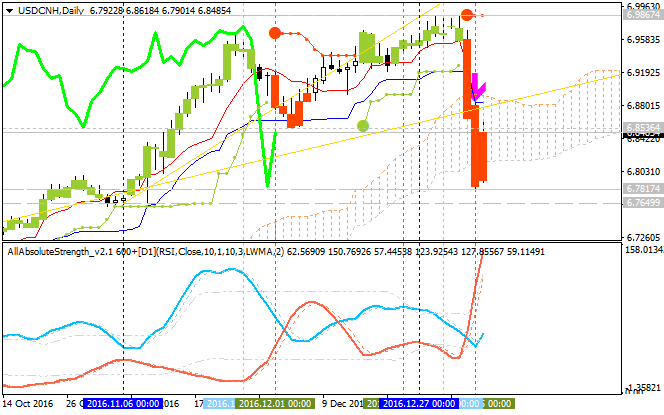

USD/CNH daily price was bounced from 6.7808/6.7887 support levels to above: the price is located inside Ichimoku cloud for the ranging market condition. If the price breaks 6.8697 resistance levels on close daily bar so the bulliush reversal of the daily prrice movement may be started, otherwise - ranging inside Ichimoku cloud for the waiting for direction.

- "Over the last two weeks, since the World Economic Forum in Davos, China has been heralded as the world's savior of globalization. The country's leader, Xi Jinping, was the first Chinese president to ever attend the Forum, where he was cheered for touting the wonders of open markets. To many investors, he was a refreshing reminder of the reliable rules of global capitalism at a time when Brexit and Donald Trump are busy rewriting those rules. Yet, according to a number of investors with money at work in China, and surveys by American corporations there, the world's No. 2 economy is as protective as ever. The herald of open market capitalism is hardly open."

- "China's markets, even though they have opened in some respects over the last decade, many things are not as open as they used to be," says Rob Lutts chief investment officer of Cabot Wealth Management, a $600 million family office in Salem, Mass. Lutts recently returned from a trip to Beijing and is more bullish than bearish on China. But from his recent talks with both Chinese and American CFOs in the country, the takeaway from both sides is that there is more protection in a number of key Chinese industries. "If you talk to American executives here, they all have a China strategy but are much more concerned today about not being treated fairly than they used to be. This openness that Xi is portraying in Davos...it's good for him to be there and shows China's importance to global trade and the global market, but I would not say that China is any more open today that it was a year ago. I'd say they are more protective of their own businesses than ever."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

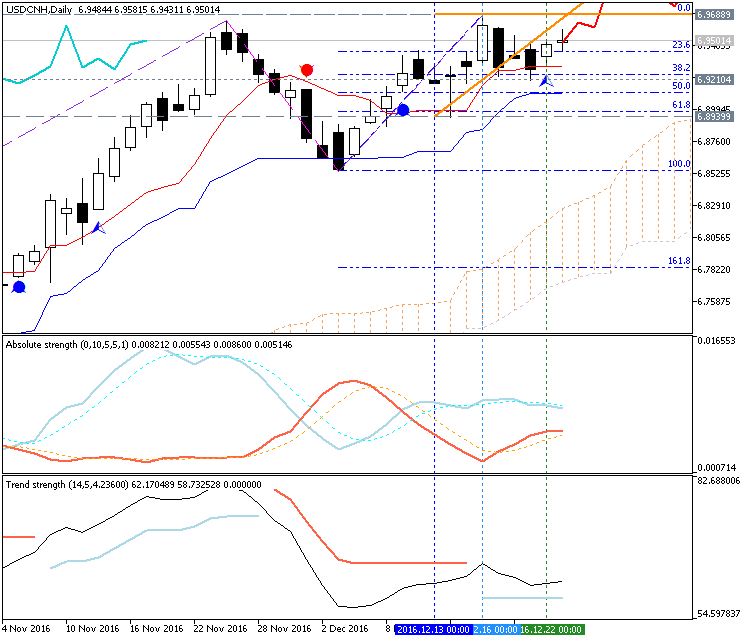

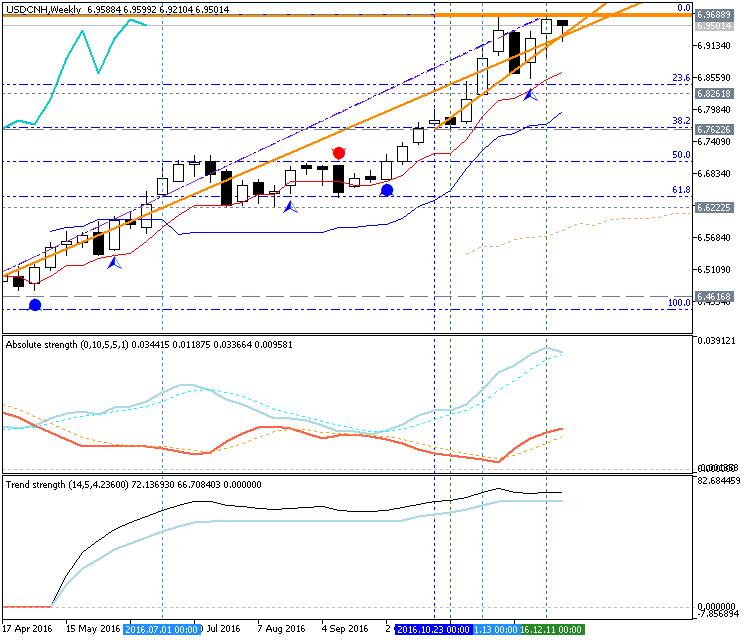

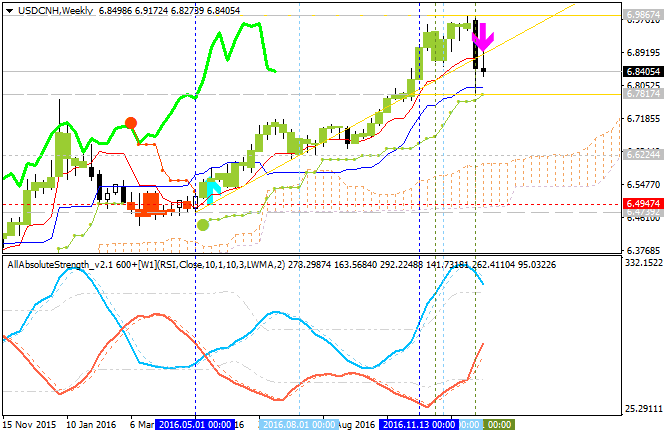

USD/CNH January-March 2017 Forecast: correction to be started

W1 price is above Ichimoku cloud in the bullish area of the chart: the price was bounced from 6.9868 resistance level to below for the secondary correction to be started on open weekly bar for now. The price is located within the following support/resistance levels:

- 6.9868 resistance leevel located about Ichimoku cloud in the bullish trend to be resumed, and

- 6.7733 support level located in the beginning of the correction to be started.

Chinkou Span line is located above the price indicating the correction within the bullish trend to be continuing, Trend Strength indicator is estimating the trend as the primary bullish, and Absolute Strength indicator is evaluating the trend as a correctional one.Trend:

W1 - correction