Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.04 10:57

USD/CNH Price Action Analysis - ranging within 6.70 'bullish continuation' resistance and 6.50 'bearish reversal' support (adapted from the article)

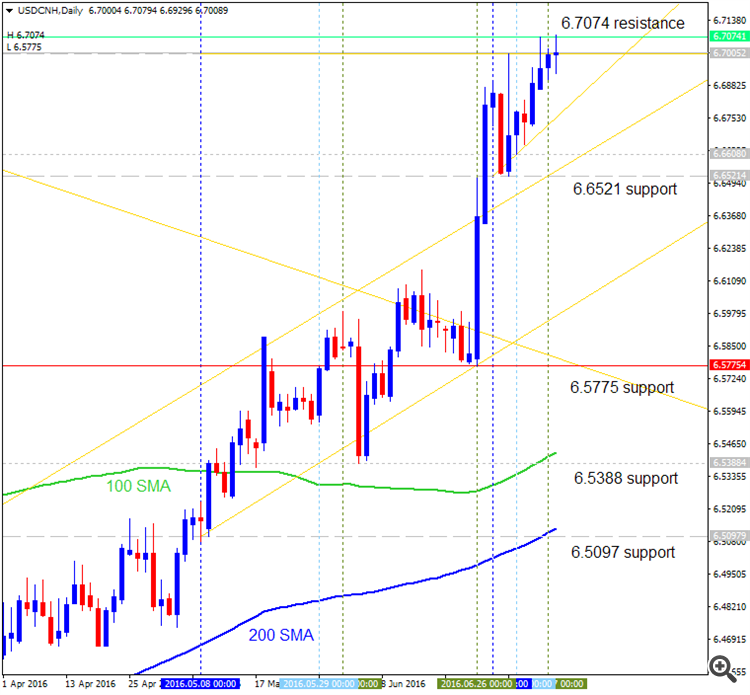

Daily price is located above 200 period SMA and 100 period SMA for the primary bullish with secondary ranging between Fibo support level at 6.5015 and Fibo resistance level at 6.7005:

- "The pair blasted through the 6.6 handle and the 6.6500 resistance following the vote, and have since traded between the 6.7 handle as resistance and the 6.5000 level on what appears to be “resistance turned support” basis."

- "The fact that the pair has managed to find support at 6.6500 in the context of an uptrend might imply focus will be out on the 6.7 figure, while the next resistance level may be found around the January high at the 6.7584 level."

If daily price breaks Fibo support level at 6.5015

to below together with 200 period SMA so the reversal of the price movement from the bullish to the primary bearish market condition will be started with 6.4698 possible target.

If daily price breaks Fibo resistance level at 6.7005 from below to above so the primary bullish trend will be continuing with good possible breakout of the price movement.

If not so the price will be on bullish ranging within the levels.

| Resistance | Support |

|---|---|

| 6.7005 | 6.5703 |

| N/A | 6.5015 |

- Recommendation to go short: watch the price to break 6.5015 support level for possible sell trade

- Recommendation to go long: watch the price to break 6.7005 resistance level for possible buy trade

- Trading Summary: ranging

SUMMARY : ranging

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.05 08:18

USD/CNH Intra-Day Fundamentals: Caixin Services PMI and 35 pips price movement

2016-07-05 01:45 GMT | [CNY - Caixin Services PMI]

- past data is 51.2

- forecast data is 52.3

- actual data is 52.7 according to the latest press release

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Caixin Services PMI] = Level of a diffusion index based on surveyed purchasing managers in the services industry.

==========

"Latest data signalled a further slowdown in over all Chinese business activity, with the rate of expansion slowing to the weakest in the current four-month sequence. There were differing trends at the sector level, however, with services companies reporting a stronger expansion of business activity in June, while manufacturing output declined at the sharpest pace since February. Notably, it was the quickest increase in services activity in 11 months, with the Caixin China General Services Business Activity Index posting 52.7, up from 51.2 in May."==========

USD/CNH M5: 35 pips price movement by Caixin Services PMI news event :

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.05 15:10

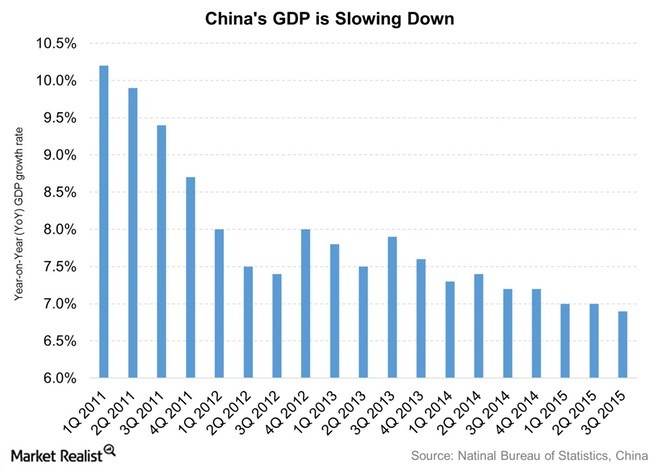

China revises GDP calculation method (based on the article)

- "China's National Bureau of Statistics (NBS) has begun using a new method of calculating GDP that it says "better reflects the contribution of innovation to economic growth."

- "Research and development expenditure that can bring economic benefit to companies will no longer be calculated as intermediate consumption, but as fixed capital formation, the NBS said in a statement."

- "It will use the method for future GDP calculations, and has also recalculated all the figures dating back to 1952."

- "Recorded GDP growth rates have changed slightly as a result. For instance, the growth rate for 2015 remained at 6.9 percent, revised up by 0.04 percentage point."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.09 13:46

Fundamental Weekly Forecasts for Dollar Index, GBP/USD, USD/JPY, AUD/USD, USD/CAD, USD/CNH and GOLD (based on the article)

USD/CNH - "The PBOC may continue to guide the Yuan lower against the US Dollar in the effort of maintaining the Chinese currency’s relative stability to the currency basket. The probability of the Bank of England cutting rates by 25bp is 18.2% according to Credit Suisse. If the British Pound continues to drop, such as it would if being driven by a rate cut, the PBOC has to devalue the Yuan against the US Dollar in the effort to evening-out changes in the Yuan basket. Or else, the PBOC needs to revise its exchange rate target, such as temporarily re-pegging the Yuan against the US Dollar and loosening reference to the currency basket. Either move could bring a huge impact to the Dollar/Yuan rate."The daily price is located above 100 SMA/200 SMA reversal in the primary bullish area of the chart: the price is breaking 6.7005 resistance level to above for the bullish trend to be continuing with 6.7074 nearest bullish target to re-enter.

If the daily price breaks 6.6521 support level to below on close bar so the local downtrend as the secondary correction within the primary bullish trend will be started.

If the daily price breaks 6.5097 support level to below so we may see the reversal of the price movement to the primary bearish market condition.

If the daily price breaks 6.7005 resistance level to above on close bar so the primary bullish trend will be continuing with 6.7074 nearest target to re-enter.

If not so the price will be on bullish ranging within the levels.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.13 09:49

USD/CNH Intra-Day Fundamentals: China Trade Balance and 46 pips price movement

2016-07-13 07:00 GMT | [CNY - Trade Balance]

- past data is 325B

- forecast data is 323B

- actual data is 311B according to the latest press release

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Trade Balance] = Difference in value between imported and exported goods during the previous month.

==========

- China June trade balance +CNY311.2 bln; May +CNY324.8 bln

- China June exports +1.3% Y/Y VS Median -4.5% Y/Y

- China June imports -2.3% Y/Y VS Median -4.2% Y/Y

==========

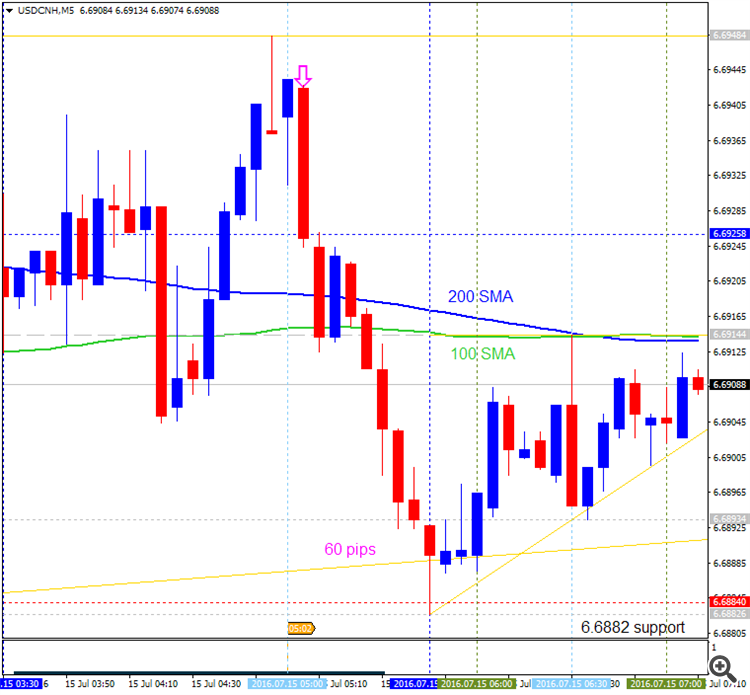

USD/CNH M5: 46 pips price movement by China Trade Balance news event :

M5 price broke 100 SMA/200 SMA area to be reversed to the primary bullish market condition. The price made 46 pips by breaking key resistance levels together with symmetric triangle patterns and it was bounced from 6.6958 resistance level to below for the intra-day ranging bullish within 6.6958 'bullish continuation' resistance level and 6.6917 'bearish reversal' support level.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.07.15 07:03

USD/CNH Intra-Day Fundamentals: China Gross Domestic Product and 60 pips price movement

2016-07-15 02:00 GMT | [CNY - GDP]

- past data is 6.7%

- forecast data is 6.6%

- actual data is 6.7% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From news.com.au article:

- "China's economy grew 6.7 per cent in the second quarter from a year earlier, steady from the first quarter and slightly better than expected as the government stepped up efforts to stabilise growth in the world's second-largest economy."

- "Analysts polled by Reuters had predicted gross domestic product (GDP) would ease to 6.6 per cent in the second quarter, which would have been the weakest since the global financial crisis, and had predicted a further loss of steam later this year."

- "Second quarter GDP rose 1.8 per cent quarter-on-quarter, also slightly better than expected, the statistics bureau said on Friday."

- "While fears of a hard landing have eased, investors fear a further slowdown in China and any major fallout from Brexit would leave the world even more vulnerable to the risk of a global recession."

- "China's statistics bureau said that the economy still faces downward pressure, but that economic growth in the first half lays a good foundation for achieving 2016 target."

- "Policymakers have said the economy remains largely steady, but analysts expect more support measures in the coming months as private investment falters, forcing the government to do more of the heavy lifting."

- "The government boosted spending by 19.9 per cent in June, the finance ministry said on Friday, picking up from a 17.6 per cent increase in May."

==========

USD/CNH M5: 60 pips price movement by China Gross Domestic Product news event :

Forum on trading, automated trading systems and testing trading strategies

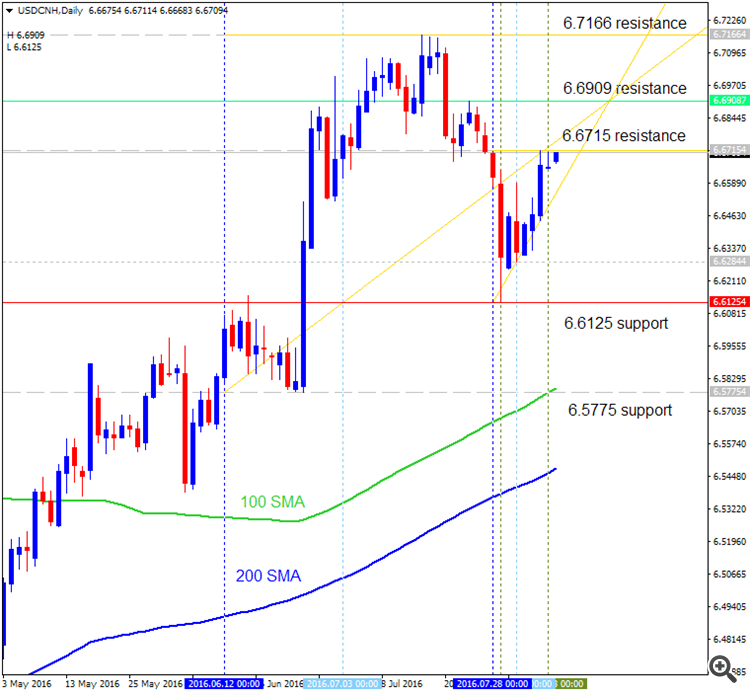

Sergey Golubev, 2016.07.18 12:10

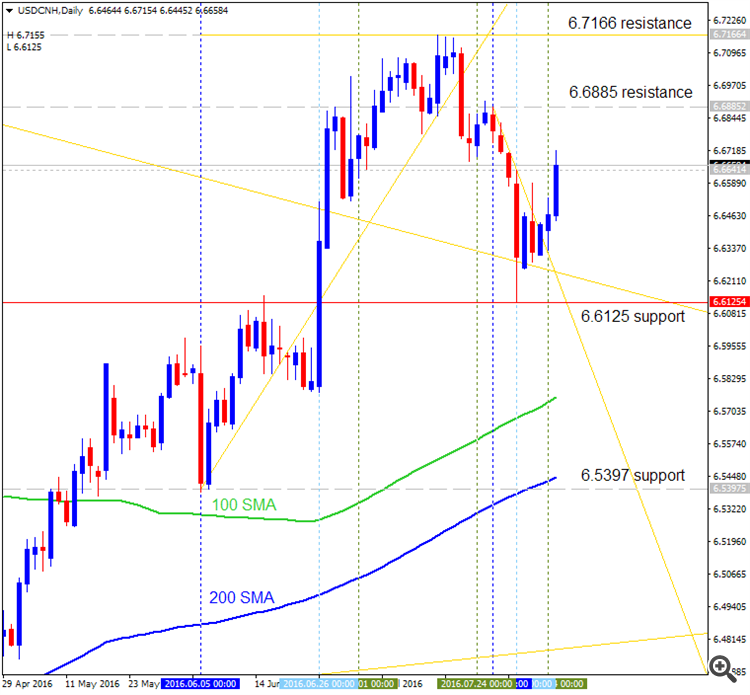

Daily price

is located above Ichimoku cloud and Senkou Span line which is the

virtual border between the primary bearish and the primary bullish trend

on the chart. The price is testing 6.7166 resistance level to above for

the bullish trend to be continuing with 6.7705 bullish daily target to

re-enter.

- If the price breaks 6.7166 resistance level on close daily bar so the primary bullish trend will be continuing with 6.7705 nearest bullish target.

- If the daily price breaks 6.6242 support on close bar to below so the local downtrend as the secondary correction within the primary bullish trend will be started.

- If price breaks 6.5775

support so we may see the reversal of the price movement to the primary bearish market condition.

- If not so the price will be ranging within the levels.

| Resistance | Support |

|---|---|

| 6.7166 | 6.6242 |

| 6.7705 | 6.5775 |

- Recommendation to go short: watch the price to break 6.6242 support level for possible sell trade

- Recommendation to go long: watch the price to break 6.7166 resistance level for possible buy trade

- Trading Summary: bullish

SUMMARY : bullish

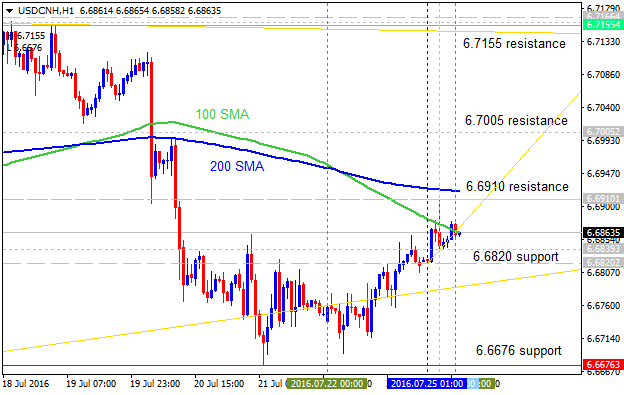

USD/CNH Intra-Day Technical Analysis - ranging within 100 SMA/200 SMA 'reversal' area for direction

H1 price

is located below SMA with period 200 (200 SMA) and above SMA with the period 100 (100 SMA) for the ranging bearish market condition. The price is testing 6.6910 resistance together with 200 SMA to above for the bullish reversal, or the support level at 6.6820 to below for the bearish trend to be continuing.

- If the price breaks 6.6910 resistance level on close H1 bar so the reversal of the price movement to the primary bullish market condition will be started with 6.7005 target to re-enter.

- If H1 price breaks 6.6820 support so the bearish trend will be continuing with 6.6676 possible bearish target.

- If not so the price will be ranging within the levels.

| Resistance | Support |

|---|---|

| 6.6910 | 6.6820 |

| 6.7005 | 6.6676 |

- Recommendation to go short: watch the price to break 6.6820 support level for possible sell trade

- Recommendation to go long: watch the price to break 6.6910 resistance level for possible buy trade

- Trading Summary: ranging for direction

SUMMARY : ranging

Forum on trading, automated trading systems and testing trading strategies

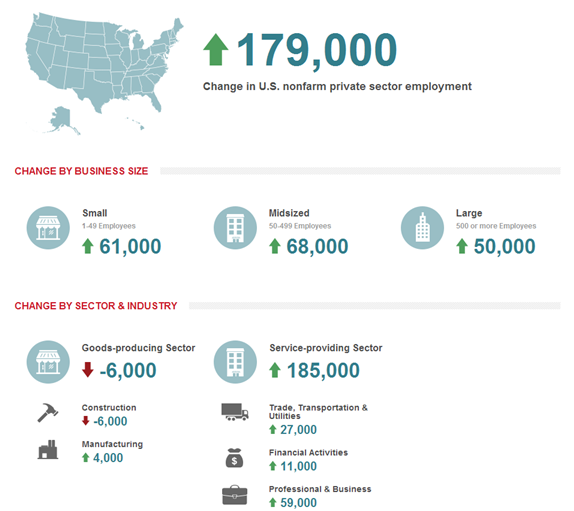

Sergey Golubev, 2016.08.03 15:31

Intra-Day Fundamentals - EUR/USD, AUD/USD, NZD/USD and USD/CNH: ADP Non-Farm Employment Change

2016-08-03 12:15 GMT | [USD - ADP Non-Farm Employment Change]

- past data is 176K

- forecast data is 171K

- actual data is 179K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ADP Non-Farm Employment Change] = Estimated change in the number of employed people during the previous month, excluding the farming industry and government.

==========

USD/CNH M5: 41 pips price movement by ADP Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.08.06 15:44

Fundamental Weekly Forecasts for Dollar Index, GBP/USD, USD/JPY, AUD/USD, USD/CNH and GOLD (based on the article)

USD/CNH - "Consumer Price Index (CPI) is one of the most important gauges for China’s economy, as a low read may increase the odds of the PBOC adopting a more dovish monetary policy. Although China may be contending with an increasing risk of asset bubbles with China’s Central Bank less likely to cut benchmark rates or introduce aggressive easing measures, a weak CPI reading could open room for PBOC to make policy tweaks in the future when investment conditions improve. The CPI read for July is expected to drop to 1.8% according to Bloomberg, or even lower to 1.7% according to Chinese institutions; both distant from the target-level for CPI of 3.0%."Daily price located above 100 SMA/200 SMA in the bullish area of the chart. The price is testing 6.6715 resistance level to above for the bullish trend to be continuing with 6.6909 nearest daily target to re-enter. Alternative, if the price breaks 6.6125 support ot below so the correction will be started, otherwise ranging bullish.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.07.01 07:31

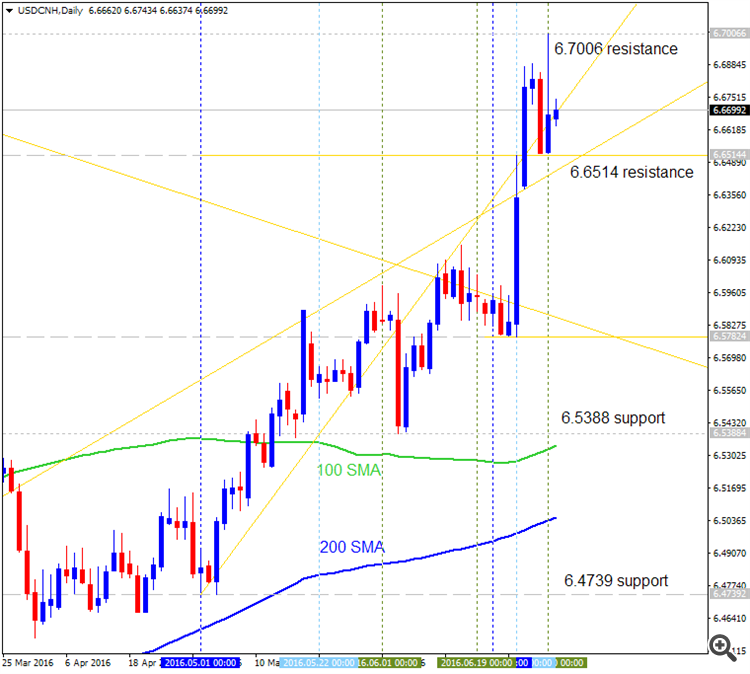

USD/CNH Intra-Day Fundamentals: Caixin Manufacturing PMI and 50 pips price movement

2016-07-01 01:45 GMT | [CNY - Caixin Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Caixin Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

==========

USD/CNH M5: 50 pips price movement by Caixin Manufacturing PMI news event :

Daily price is located to be above 100 SMA/200 SMA on the primary bullish area of the chart: the price is ranging within 6.7006 resistance level and 6.6514 support level.

If daily price breaks 6.7006 resistance level to above so the primary bullish trend will be continuing.

If daily price breaks 6.6514 support level to below so the local downtrend as the secondary correction within the primary bullish trend will be started.

If not so the price will be on bullish ranging within the levels.

By the way, the bearish reversal level at 6.4739 is too far from the market price which makes the bearish reversal to be very unlikely in the near future for example.