You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

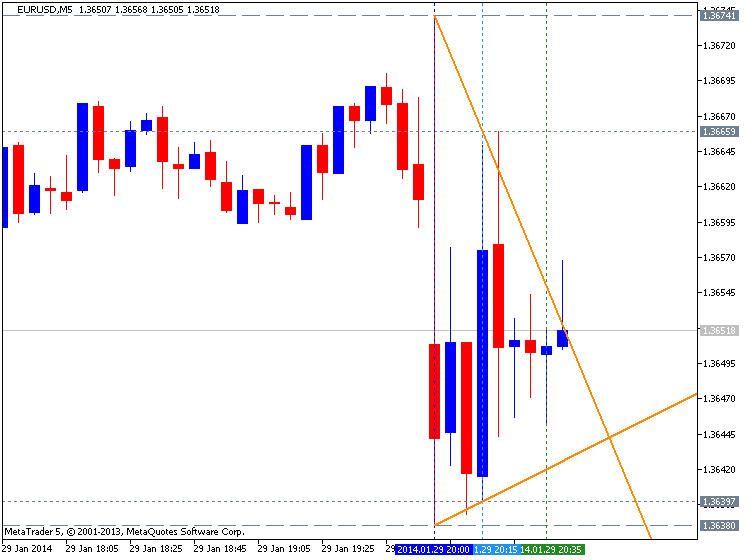

2013-01-29 19:00 GMT (or 20:00 MQ MT5 time) | [USD - Federal Funds Rate]

if actual > forecast = good for currency (for USD in our case)

==========

2013-01-29 19:00 GMT (or 20:00 MQ MT5 time) | [NZD - Official Cash Rate]

if actual > forecast = good for currency (for NZD in our case)

==========

RBNZ Holds OCR Steady At 2.50%

The Reserve Bank of New Zealand said on Thursday that it was leaving the country's Official Cash Rate unchanged at 2.50 percent.

This was in line with expectations, and it also marked the 24th consecutive meeting in which the RBNZ had left the rate on hold.

"New Zealand's economic expansion has considerable momentum. Prices for New Zealand's export commodities remain very high, especially for dairy products. Consumer and business confidence are strong and the rapid rise in net inward migration over the past year has added to consumption and housing demand," the bank said in a statement accompanying the decision.

Gold and Silver Ready To Rumble Higher? (based on themarkettrendforecast article)

Aggressive investors can look at UGLD ETF, which is a 3x long Gold product that will give you upside leverage as Gold moves into elliott wave 3 up. Other more aggressive plays we already recommend a lot lower include GLDX, JNUG, NUGT and others. Picking individual stocks can be even better and we have recommended a few to our subscribers that are already doing very well.

What will trigger this next rally up is sentiment shifts to favor Gold and Silver over currency alternatives. The precious metals move on sentiment, much more so than interest rates or GDP reports or anything else in our opinion. Sentiment remains neutral to bearish as evidenced by the larger brokerage houses running around in January telling everyone to sell Gold, so we see that as a buy signal on top of our other indicators.

2013-01-30 13:30 GMT (or 14:30 MQ MT5 time) | [USD - GDP]

if actual > forecast = good for currency (for USD in our case)

==========

U.S. GDP Growth Slow To 3.2% In Q4 But Matches Estimates

While the Commerce Department released a report on Thursday showing a slowdown in the pace of U.S. economic growth in the final three months of 2013, the increase still matched economist estimates.

The Commerce Department said gross domestic product increased by 3.2 percent in the fourth quarter compared to the 4.1 percent growth seen in the third quarter. The GDP growth came in line with the expectations of most economists.

Paul Ashworth, Chief U.S. Economist at Capital Economics, said the most encouraging element of the report was a pick-up in the growth rate of domestic demand.

Turkey Shocks Forex Market As Fed Decision Looms (based on Forbes article)

his year was always going to be about the central banks and their interest rate decisions. So far, no asset class can be disappointed, because tagging along with central bank decisions is volatility, a word that could not be applied to the foreign exchange (forex market) over the past 18-months. With mirrored monetary policies, central banks had managed to handcuff the forex market, deadening volatility and opportunity. But in early 2014 that’s all changed; volatility is back with a vengeance, bringing trading opportunities with it. There never was going to be a “follow thy leader campaign” – that was yesteryear. Rate divergence is the name of the new game and the mighty dollar is expected to benefit greatly from it before this year ends.

Analysts: Gold Premiums Diverging In China, India (based on Kitco News)

Indian and Chinese gold premiums have diverged somewhat in recent days, analysts said.

The premium in China slipped since much of the buying in the country already occurred ahead of New Year celebrations that begin Thursday, they said. Meanwhile, the Indian premium edged higher again as market participants realized while there is some pressure within in the nation to scale back import restrictions on gold, such a move won’t happen right away.

“Each country is a special situation unto itself,” said Jeffrey Nichols, managing director of American Precious Metals Advisers and publisher of the blog NicholsOnGold.com.

Paradoxically, lower premiums probably mean different things in the two countries at the moment, some observers said. In China, falling premiums mean an abatement of demand. But since high Indian premiums were due to shortages of metal, lower premiums imports there would be expected whenever imports pick up again – meaning increased overall consumption of gold that would be price supportive.

Volumes on the Shanghai Gold Exchange fell noticeably ahead of New Year festivities, said MKS (Switzerland) SA’s Jason Cerisola. UBS analyst Joni Teves said Wednesday’s volume of 10 metric tons was the lowest since the end of 2013, and it appeared even lighter during the early part of Thursday’s session as the premium hit a three-month low.

“The premium has now fallen to around $1-2 -- was around $6-7 yesterday -- and well down on the lofty $20 we saw late December,” Cerisola said.

=============

India raised duties on gold imports several times last year, and they currently stand at 10%. Other measures were passed as well, including an 80-20 rule that stipulates that a minimum of 20% of all gold imported must be exported before further imports can be made.

This all resulted in a “precipitous” fall in Indian buying in the second half of last year, Nichols said. Gold imports fell from an annual rate of roughly 1,000 metric tons early in the year to only 250-300 tons by late in the year, he said.

“In reaction to the widespread irritation with these anti-gold policies, there is now some talk in the gold industry and among politicians about easing these restrictions prior to national elections in May, effective possibly at the start of the new fiscal year beginning on April 1st,” Nichols said. His view is that import taxes will be rolled back and the 80-20 rule might even be scrapped.

“In short, India has the potential to spice up the gold economy in the months ahead,” Nichols said.

Table of potential trader types by James Stanley, Trading Instructor at DailyFX

Forum on trading, automated trading systems and testing trading strategies

Indicators: Fibonacci retracement

newdigital, 2014.01.31 11:05

The 3 Step Retracement Strategy (adapted from dailyfx article)

Find A Trendline

Before we can consider trading a pricing swing, we need to first be able to find market direction as well as support or resistance. This issue can be solved by creating a trendline. These areas can be found on a chart by either connecting to highs or lows, then extrapolating their direction on the chart. In a downtrend traders should look for price action to be declining under trendline resistance, while in uptrend prices should be advancing above trendline support.

Fibonacci Retracements

Once market direction and trendline resistance is identified, we need to identify an area to enter into the market. This can be done by finding a confluence of resistance using a Fibonacci retracement. These retracement values are displayed as a percentage of the previous move as measured from swing high/low in a downtrend. Much like our previously drawn trendline, these retracements can pinpoint areas where the market may turn. Traders should look to see where these two values converge and then plan to enter the market.

Exiting Positions

Now that we have a plan to enter the market on a price swing, traders will need to identify when it is time to exit the market. This is always the third and final step of any successful strategy! In order to manage risk, traders should first consider where to set a stop order. In a downtrend like the USDJPY daily chart, traders should consider placing this value above resistance. On the chart below stop orders have been placed outside of resistance, above our current trendline and previous swing high.

2013-01-31 10:00 GMT (or 11:00 MQ MT5 time) | [EUR - Consumer Price Index]

if actual > forecast = good for currency (for EUR in our case)

==========

Eurozone Inflation Slows Unexpectedly; Jobless Rate Stable At 12%

Eurozone inflation slowed for the second consecutive month in January, flash estimate released by Eurostat showed Friday.

Another report showed that the jobless rate in the currency bloc remained unchanged in December.

Inflation fell unexpectedly to 0.7 percent in January from 0.8 percent in December. Economists had forecast the rate to accelerate to 0.9 percent.