You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

2013-01-20 21:45 GMT (or 22:45 MQ MT5 time) | [NZD - CPI]

if actual > forecast = good for currency (for NZD in our case)

==========

New Zealand CPI Adds 0.1% In Q4

Consumer prices in New Zealand were up a seasonally adjusted 0.1 percent in the fourth quarter of 2013 compared to the previous three months, Statistics New Zealand said on Tuesday.

That surpassed forecasts for a flat reading following the 0.9 percent jump in the third quarter.

Higher international air fares and rising housing and dairy prices were partly countered by lower vegetable prices and cheaper petrol in Q4, the statistics bureau said.

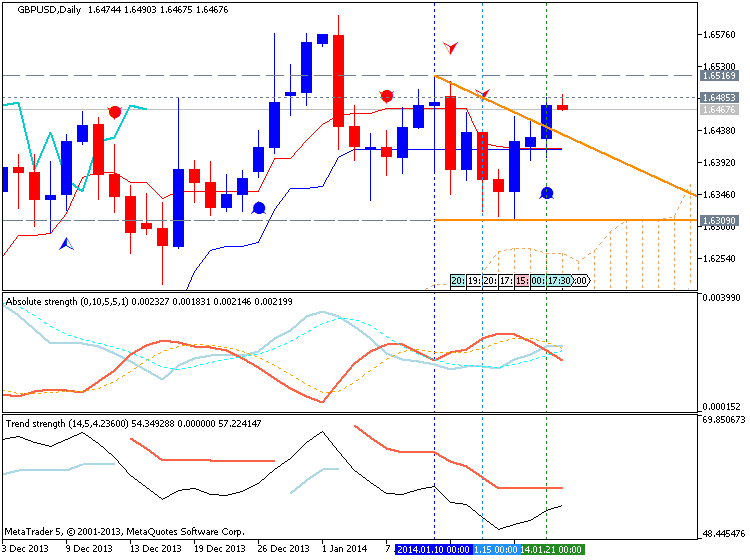

GBP/USD survived after Hilsenrath’s comments

GBP/USD was injured in the morning by the WSJ Hilsenrath predictions of further tapering during the January FOMC meeting, though the pair lost only 16 pips from 1.6426 at open to 1.6410 low.

Market has some good expectations on UK data

Hilsenrath’s story was not able to trigger big moves, as the comments are largely in line with expectations. The scheduled for today UK CBI Industrial Order Expectations has limited potential to trigger any currency moves, though positive development will only fuel the interest to the Pound. The rumored revision of UK GDP growth forecasts to 2.4% (from 1.9%) by the IMF may give additional support to the pair, if confirmed during the American session. We also expect the early positioning of the pair before the Wednesday’s key labor data release which is potentially GBP-bullish with the initial target at 1.6463 resistance level.

What are today’s key GBP/USD levels?

Today's central pivot point can be found at 1.6429, with support below at 1.6404 (S1), 1.6370 (S2) and 1.6345 (S3), with resistance above at 1.6463 (R1), 1.6488 (R2), and 1.6522 (R3). Hourly Moving Averages are largely bullish, with the 200SMA at 1.6419 and the daily 20EMA flat at 1.6413. Hourly RSI is neutral at 52.

2013-01-21 11:00 GMT (or 12:00 MQ MT5 time) | [GBP - CBI Industrial Order Expectations]

if actual > forecast = good for currency (for GBP in our case)

==========

U.K. Manufacturing Order Growth Strongest Since 2011

British manufacturing order growth during three months to January hit the highest since April 2011, survey data from the Confederation of British Industry showed Tuesday.

Moreover, manufacturers are optimistic about continued expansion in the next quarter and they are increasingly confident in the recovery.

The balance for new domestic orders came in at 11 percent, the strongest since 2011, but the new export orders balance fell to zero, the Industrial Trends Survey showed. About 38 percent of firms reported a rise in output volumes and 20 percent a decline, giving a balance of +18 percent.

Further, around 38 percent of manufacturers expect total new orders to increase and 16 percent expect them to fall, resulting in a balance of +22 percent, the highest since April 2012.

Manufacturers' investment intentions improved sharply and firms citing uncertainty about demand as a constraint on investment fell to the lowest since October 2010.

However, in January, the order book balance fell to -2 from 12 in December. The expected level for January was 10 percent.

2013-01-21 13:30 GMT (or 14:30 MQ MT5 time) | [CAD - Manufacturing Sales]

if actual > forecast = good for currency (for CAD in our case)

==========

Canada November Factory Shipments Advance 1%

Canadian factory shipments in November rose at a stronger-than-expected pace and the level of sales hit a nearly two-year high on the strength of transport equipment and industrial machinery, Statistics Canada said Tuesday.

Factory sales rose 1.0% to 50.51 billion Canadian dollars ($46.12 billion), which was above market expectations for a November gain of 0.3%, according to economists Royal Bank of Canada. The October data were revised downward, and indicate factory sales rose month-over-month by a less robust 0.7% to C$49.99 billion versus the earlier estimate of a 1% gain to C$50.09 billion.

EUR/USD holds steady on optimistic IMF forecast

The dollar strengthened against the euro earlier Tuesday after the International Monetary Fund hiked its 2014 global growth forecast, while expectations for further cuts to Federal Reserve stimulus programs this month also bolstered the greenback before profit taking wiped out its gains.

Pound gains on IMF forecast, U.K. data

The pound rose against the dollar earlier Tuedsday after the International Monetary Fund said it was hiking the U.K.'s 2014 growth forecast by more percentage points than any other major European country, while mixed-but-solid British data also bolstered the pair.

In U.S. trading on Tuesday, GBP/USD was trading at 1.6467, up 0.24%, up from a session low of 1.6400 and off a high of 1.6486.

Cable was likely to find support at 1.6396, Monday's low, and resistance at 1.6508, the high from Jan. 13.

The pound enjoyed support after the IMF hiked Britain’s 2014 growth forecast to 2.4% from 1.9% in October, more than any other major European economy.

Also in the U.K., the Confederation of British Industry said its index of industrial order expectations fell to -2 this month from 12 in December, well below expectations of a reading of 10.

2013-01-22 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - CPI]

if actual > forecast = good for currency (for AUD in our case)

==========

Australia Inflation Rises 0.8% In Q4

Consumer prices in Australia were up a seasonally adjusted 0.8 percent in the fourth quarter of 2013 compared to the previous three months, the Australian Bureau of Statistics said on Wednesday.

Trading the News: U.K. Jobless Claims Change (based on dailyfx.com article)

U.K. jobless claims are projected to fall another 32.0K in December and the ongoing improvement in the labor market may trigger fresh highs in the GBPUSD as it raises the outlook for growth and inflation.

What’s Expected:

Time of release: 01/22/20149:30 GMT, 4:30 EST

Primary Pair Impact: GBPUSD

Expected: -32.0K

Previous: -36.7K

Forecast: -30.0K to -35.0K

Why Is This Event Important:

Indeed, the stronger recovery in the U.K. raises the scope of seeing the Bank of England’s (BoE) 7% unemployment threshold being breached later this year, and the central bank may implement a dovish twist for its forward-guidance on monetary policy as the real economy remains far from full-capacity.

How To Trade This Event RiskBullish GBP Trade: U.K. Jobless Claims Fall 32.0K or Greater

- Need green, five-minute candle following the print to consider a long GBPUSD trade

- If reaction favors a buy trade, long GBPUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish GBP Trade: Unemployment Report DisappointsIMF Upgrades Global Growth Forecast

The International Monetary Fund on Tuesday upgraded its global growth outlook as economic conditions in advanced economies continued to improve, while urging rich nations to maintain accommodative monetary policy stance, given significant downside risks.

Releasing the World Economic Outlook (WEO) Update, the Washington-based lender said it now expects the world economy to grow 3.7 percent this year, stronger than the 3.6 percent expansion projected in the October report. Growth is seen rising to 3.9 percent in 2015, broadly unchanged from the October outlook.

2013-01-22 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Claimant Count Change]

if actual < forecast = good for currency (for GBP in our case)

==========

UK Unemployment Rate Falls More Than Forecast

The jobless rate for the September-November period was 7.1 percent, just a tad above the Bank of England's threshold for increasing interest rates.

This was the lowest rate ever recorded since December-February period of 2009. In June-August, the jobless rate stood at 7.7 percent. Economists had forecast a decrease to 7.3 percent.

The claimant count or the number of persons seeking jobless benefits in the U.K. declined by 24,000 month-on-month in December to 1.25 million. This was the lowest level since January 2009.