Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.18 10:47

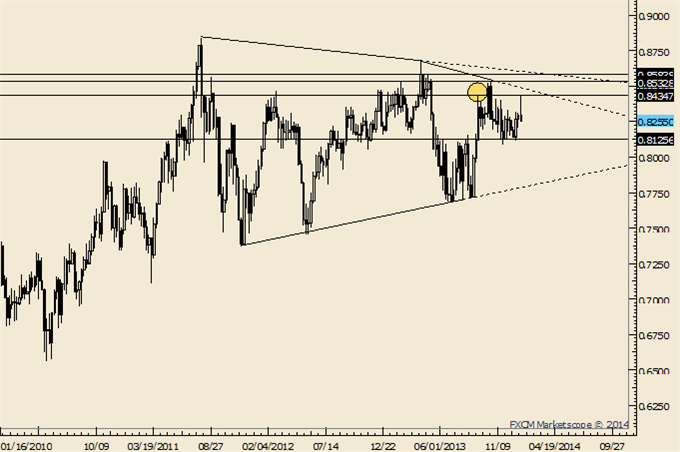

NZD/USD Technical Analysis (adapted from this article)

- NZDUSD spiked through the November high and reversed just shy of the

September high. .8450-.8550 has been an area that ‘created’ a number of

important tops in recent years.

- Longer term trend remains sideways, possibly within the confines of a triangle (since 2011). In general, the market has entered longer term resistance (highs in March 2012, December 2012, February 2013, and October 2013).

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.19 12:52

NZDUSD Fundamentals (based on fxempire.com article)

The NZD/USD tumbled this week to trade at 0.8260 but continued to outpace its Tasmanian cousin the Aussie. The kiwi eased on the strength of the US dollar and concerns over China. Traders will wait to see what Graham Wheeler has to say at the RNZ meeting. The kiwi is heading for a 2% weekly gain against its trans-Tasman counterpart after data showed the divergent neighboring economies which will likely see interest rates move in New Zealand’s favor.

The kiwi rose to eight-year high 94.80 Australian cents this week, trading at 94.11. The NZD fell to 82.99. New Zealand’s economy is looking increasingly attractive to investors, with a survey this week showing business confidence at a 20-year high and house prices continuing to rise, while Australian jobs data surprised analysts with a drop in employment in December. Investors will watch New Zealand inflation figures next week to get a sense on how early central bank Governor Graeme Wheeler will start hiking rates.

Forex traders put the odds in favor that the New Zealand Reserve bank will lift interest rates 118 basis points over the coming 12 months, while the Reserve Bank of Australia is expected to cut its key rate by 7 basis points over the same period, according to the Overnight Index Swap curve.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.20 09:40

NZD/USD outlook down this week

Weak NZ inflation and housing data plus broad US dollar strength should

hurt NZD/USD this week, notes Imre Speizer, FX Strategist at Westpac.

Key Quotes

"NZ’s

Q4 CPI release may alarm some with its low headline quarterly rate,

although familiar observers will note Q4 is seasonally weak."

"Similarly, a fall in the pace of house sales may cause a rethink regarding the expected date of the first RBNZ rate hike."

"We expect housing weakness to be temporary and not dissuade the RBNZ from proceeding."

"Still,

NZD markets may take a negative view of the above and sell NZD/USD,

particularly against a backdrop of US dollar strength."

"The

0.8400 area last week provided a formidable obstacle, unlikely to be

broken in the near term. Rather it should provide the launching pad for a

multi-day period of NZD selling, down to 0.8165 and possibly 0.8110."

"Looking

further ahead, though, by mid-2014 NZ’s strong fundamentals should be

even more evident, increasing interest rate differentials taking NZD/USD

towards 0.8600. The main risk to this outlook is that US fundamentals

exceed our expectations, causing the US dollar to outperform instead."

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.20 10:26

2013-01-20 02:00 GMT (or 03:00 MQ MT5 time) | [CNY - GDP]

- past data is 7.8%

- forecast data is 7.6%

- actual data is 7.7% according to the latest press release

if actual > forecast = good for currency (for CNY in our case)

==========

China's Economic Growth Slows to 7.7%

The nation's economy grew 7.7% in the fourth quarter from a year ago, slower than the 7.8% it posted in the third quarter, according to data released Monday by China's National Bureau of Statistics. For the year it also posted 7.7% growth, matching the revised pace it recorded in 2012.

"There was steady economic progress [last year] and this was no small achievement," the bureau said in a statement. But it added that the Chinese economy still faces imbalances, while "fundamentals of the economic recovery are still not stable."

The fourth-quarter increase was higher than a median 7.6% gain forecast by 13 economists in a Wall Street Journal survey.

"We don't see any areas that would support an economic rebound in the first quarter," said Ma Xiaoping, economist with HSBC Holdings PLC.

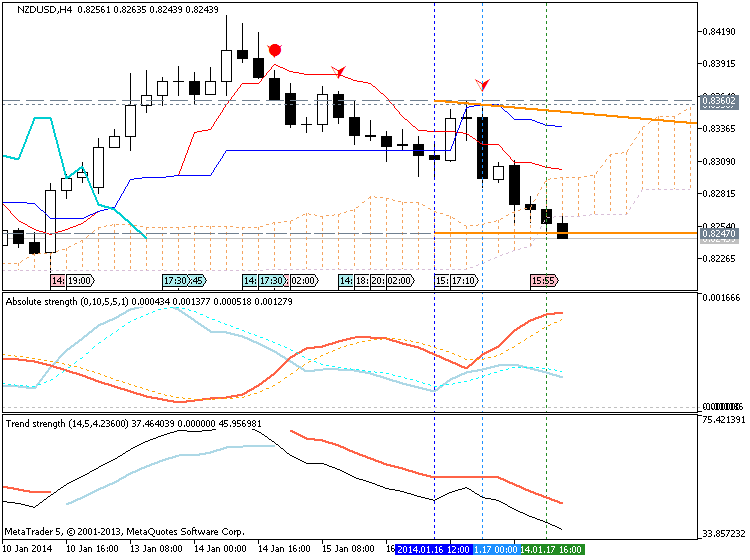

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5 : 15 pips price movement by CNY - GDP news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.21 06:17

2013-01-20 21:45 GMT (or 22:45 MQ MT5 time) | [NZD - CPI]

- past data is 0.9%

- forecast data is -0.1%

- actual data is 0.1% according to the latest press release

if actual > forecast = good for currency (for NZD in our case)

==========

New Zealand CPI Adds 0.1% In Q4

Consumer prices in New Zealand were up a seasonally adjusted 0.1 percent in the fourth quarter of 2013 compared to the previous three months, Statistics New Zealand said on Tuesday.

That surpassed forecasts for a flat reading following the 0.9 percent jump in the third quarter.

Higher international air fares and rising housing and dairy prices were partly countered by lower vegetable prices and cheaper petrol in Q4, the statistics bureau said.

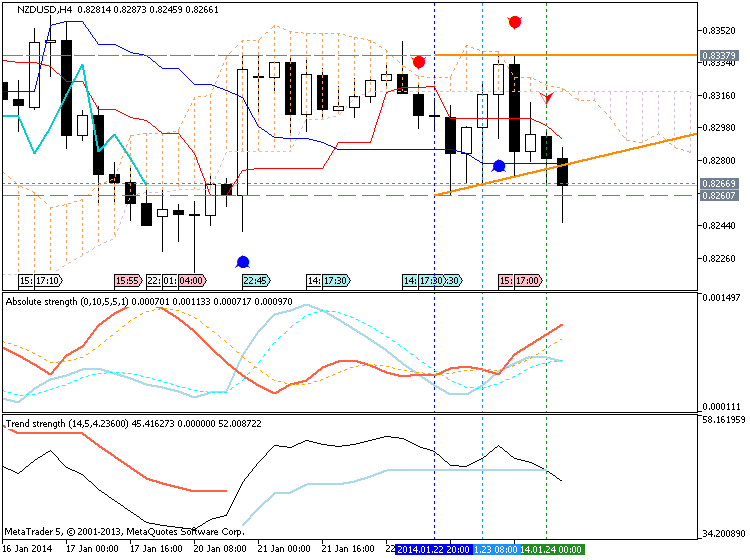

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5 : 75 pips price movement by NZD - CPI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.23 07:57

2013-01-23 01:45 GMT (or 02:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

- past data is 50.5

- forecast data is 50.6

- actual data is 49.6 according to the latest press release

if actual > forecast = good for currency (for CNY in our case)

==========

HSBC flash PMI fell to 49.6, said the investment bank is no need to worry too much seasonal effects

HSBC China Manufacturing January purchasing managers' index (PMI) fell to 49.6 in the initial accident six months low, and is also the first time in six months below 50, below market expectations, triggering two to stock market volatility. HSBC considers presetting macro policy fine-tuning space for steady growth, but the investment bank Merrill Lynch believes, PMI initial decline may be related to the Spring Festival approaching, small businesses have begun to leave about, I believe a quarter GDP growth will remain stable.

==========

China HSBC Manufacturing PMI Dips Into Contraction

"The marginal contraction of January's headline HSBC Flash China Manufacturing PMI was mainly dragged by cooling domestic demand conditions. This implies softening growth momentum for manufacturing sectors, which has already weighed on employment growth," said Hongbin Qu, Chief Economist, China and Co- Head of Asian Economic Research at HSBC.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5 : 22 pips price movement by CNY - HSBC Manufacturing PMI news event

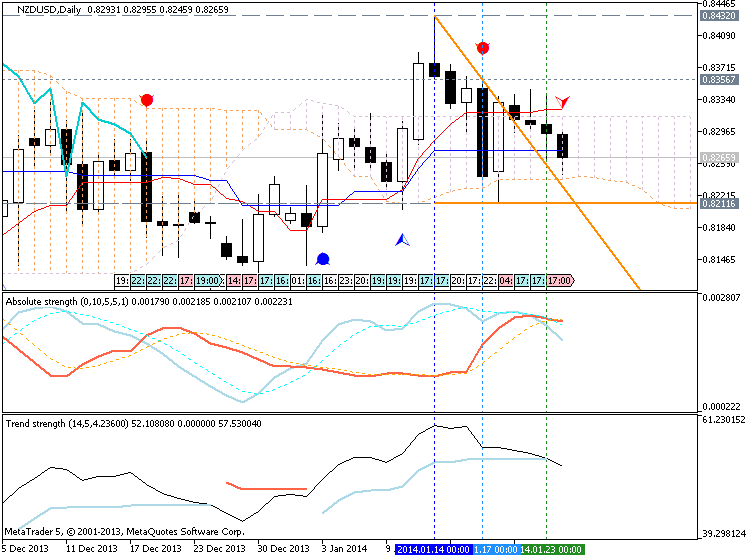

If H4 price will cross 0.8247 support, and if Chinkou Span line will cross D1 price on open bar so we may see good breakdown (good to open sell trade).

The situation is not changed so much for NZDUSD - the price for H4 timeframe did not break 0.8247 support on close H4 bar, and Chinkou Span line did not cross the price on D1 close bar. I think - we may see something next week

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The price on D1 timeframe is trying to cross Sinkou Span A line of Ichimoku indicator to be reversed from bullish to bearish market condition. besides, Chinkou Span line crossed the price on open bar for possible breakdown on the near future.

The price on H4 timeframe was fully reversed to primary bearish trying to break 0.8247 support from above to below for breakdown to be continuing (good to open sell trade).

W1 timeframe - flat within bullish.

If H4 price will cross 0.8247 support, and if Chinkou Span line will cross D1 price on open bar so we may see good breakdown (good to open sell trade).

If not so the price will be ranging between 0.8204 support and 0.8432 resistance

UPCOMING EVENTS (high/medium impacted news events which may be affected on NZDUSD price movement for this coming week)

2013-01-20 02:00 GMT (or 03:00 MQ MT5 time) | [CNY - GDP]

2013-01-20 21:45 GMT (or 22:45 MQ MT5 time) | [NZD - CPI]

2013-01-22 21:30 GMT (or 22:30 MQ MT5 time) | [NZD - Business NZ Manufacturing Index]

2013-01-23 01:45 GMT (or 02:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2013-01-23 15:00 GMT (or 16:00 MQ MT5 time) | [USD - Existing Home Sales]

2013-01-24 02:00 GMT (or 03:00 MQ MT5 time) | [NZD - Credit Card Spending]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on NZDUSD price movement

SUMMARY : ranging

TREND : possible breakdown

Intraday Chart