I love trading gold. may this thread be used by all gold and silver traders.

Be courteous , follow posting rules.

I use renko . 20 pip bricks to day trade Gold.

Success to us all.

I love trading gold to,

forecast for the day after tommorow, the graphic will start on above my position.

Success us!!

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

newdigital, 2013.07.24 10:00

I just want to remind about how to insert the images to the post - read this small article

=========

2. Messages Editor

All your texts in Forum, Articles and Code Base are edited in a single environment with a convenient and easy-to-use interface. Let us take a look at its capabilities.

- You can switch between the visual and HTML text representations by clicking the

button. This button changes its name to

button. This button changes its name to  while viewing the HTML, and it returns you to the visual view of the

text. This function allows you to make your text most structured and

formalized.

while viewing the HTML, and it returns you to the visual view of the

text. This function allows you to make your text most structured and

formalized. -

The drop-down list where you can select one of the three languages in which your message will be automatically translated by the Google Translate service.

- The

(Ctrl+Z) and

(Ctrl+Z) and  (Ctrl+Y) buttons are intended for canceling the last action and redoing the last canceled action, respectively.

(Ctrl+Y) buttons are intended for canceling the last action and redoing the last canceled action, respectively. - The

button is intended to make a bulleted list. (Every item in the list starts with a bullet.)

button is intended to make a bulleted list. (Every item in the list starts with a bullet.) - The

button is intended to make a numerical list. (Every item in the list has an index number.)

button is intended to make a numerical list. (Every item in the list has an index number.) - The

button is intended to decrease the rank of the element in the list.

button is intended to decrease the rank of the element in the list. - The

button is intended to increase the rank of the element in the list.

button is intended to increase the rank of the element in the list. - The

button (Ctrl+H) is intended for inserting a horizontal line into text.

button (Ctrl+H) is intended for inserting a horizontal line into text. -

The

button (Ctrl+Alt+L) is used for adding links into messages. The Link window appears as soon as you click this button (shown next).

button (Ctrl+Alt+L) is used for adding links into messages. The Link window appears as soon as you click this button (shown next).

In the Link field, you should specify the address of the link and then click the Insert button.

-

The

button (Ctrl+Alt+I) is used for inserting pictures into messages. The Image window appears as soon as you click the button (shown next).

button (Ctrl+Alt+I) is used for inserting pictures into messages. The Image window appears as soon as you click the button (shown next).

In the Upload image field, you should specify the picture file. To do it, click the Browse button that opens the standard window to choose files. Select the necessary file and click the Insert button to confirm the choice, or click the Cancel button to end without uploading a file. In the Title field, you can specify the comment that will be displayed as a pop-up help if you move the mouse cursor over the picture.

In HTML mode, it is prohibited to insert external links to images (HTML tag "src"). It is also prohibited to insert text, containing such images.

When you try to save text that contains external links to images, such links will be automatically deleted. This is done to ensure safety of MQL5.community members.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.10 13:52

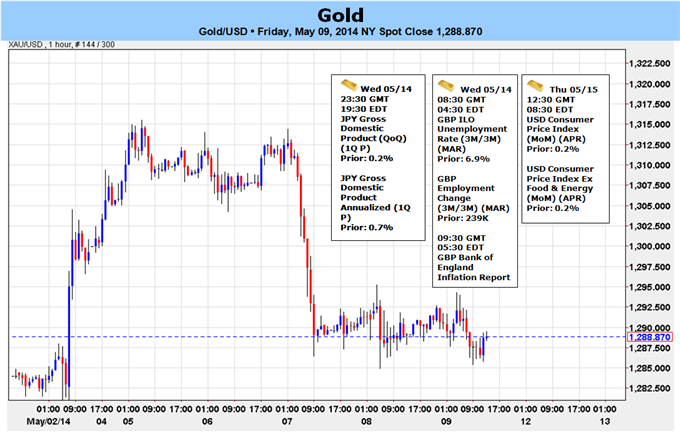

GOLD (XAUUSD) Fundamentals (based on dailyfx article)

Fundamental Forecast for Gold: Neutral- Gold Churns on Near Term Fibonacci Retracement

- Gold Exposed To Easing Ukrainian Concerns, Crude Oil Cracks $100

Gold prices are softer for the second consecutive week with the precious

metal off by nearly 1% to trade at $1287 ahead of the New York close on

Friday. The losses come on the back of a broad-based USD rally that saw

the Dow Jones FXCM USDOLLAR index reverse off fresh 6-month lows,

paring the entire April decline by the end of the week. The index is now

virtually unchanged since the monthly open and traders will be looking

ahead to next week’s docket as the US data front picks back up.

The calendar was light for the US this week with gold prices giving up

early gains after Fed Chair Janet Yellen noted in her testimony before

congress that the central bank’s accommodative stance was warranted

given the relative strength of the labor markets and subdued inflation

metrics. The greenback regained its footing with a rather dovish ECB

President Mario Draghi on Thursday further supporting the dollar

rebound. The subsequent rally has continued to weigh on gold prices

which look to close the week just off the low.

Looking ahead to next week, US data will be back in focus on the heels

of this week’s Yellen testimony with Retail Sales, the Consumer Price

Index (CPI) and Industrial Production on tap. Inflation figures on

Thursday may prove pivotal for bullion with consensus estimates calling

for a slight increase in the y/y and m/m prints with core CPI expected

to fall to 0.1% from 0.2% m/m and hold at 1.7% y/y. Should the data show

a faster-than-expected pace of price growth, look for gold prices to

come under pressure as expectations for a 2015 Fed rate-hike take root.

From a technical standpoint, gold completed a 100% Fibonacci extension

off the April lows with this week’s push into the $1310 barrier. The

subsequent reversal has continued to be supported by the 100-day moving

average, currently around $1287 and a break below this level puts back

into focus key support at $1260/70 (bullish invalidation). That said, we

cannot discount another assault on the highs as we continue to hold

within the initial May opening range with a breach above $1310

suggesting that a more significant low may have been put in last month.

Such a scenario looks back to a region defined by last month’s high and

the 50% retracement of the March sell-off at $1327/34. With the current

positioning and key US inflation data on tap next week, we will maintain

a neutral stance into the open with the Sunday/Monday opening range

likely to offer further clarity on a near-term directional bias.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I love trading gold. may this thread be used by all gold and silver traders.

Be courteous , follow posting rules.

I use renko . 20 pip bricks to day trade Gold.

Success to us all.