You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Trading Video: EURUSD and GBPUSD Break Higher, USDollar at Critical Support

The FX market is doing its best to fight the seasonal liquidity drain's crash into historically low volatility measures. Both EURUSD and GBPUSD marked notable bullish breaks Monday. While the immediate follow through on the moves was limited, the former breaks against a prominent divergence in fundamental forecasts (monetary policy and interest rates) and the latter is now trading at level last seen since 2008. If these pairs are to gain a foothold, we will likely see the USDollar slip below support that has stood for 16-months - difficult in these conditions. There is plenty of event risk to make this a risk. In other news, the Bank of International Settlements (BIS) has issued the most prominent warning of complacency and financial market risk of any regulatory institution to this point. What does all of this mean for traders? We discuss that in today's Trading Video.

2014-07-01 04:30 GMT (or 06:30 MQ MT5 time) | [AUD - Cash Rate]

if actual > forecast = good for currency (for AUD in our case)

[AUD - Cash Rate] = Interest rate for overnight money market deposits. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

==========

RBA Leaves Key Rate Unchanged At Record Low

The Reserve Bank of Australia left its key interest rate unchanged at a record-low level as widely expected by economists.

The monetary policy board maintained the cash rate at 2.50 percent. The rate has been at the current level since August 2013.

The board assessed that the monetary policy is appropriately configured to foster sustainable growth in demand and inflation outcomes consistent with the target, Governor Glenn Stevens said in a statement.

"On present indications, the most prudent course is likely to be a period of stability in interest rates," he said.

Looking ahead, continued accommodative monetary policy should provide support to demand and help growth to strengthen over time. Further, inflation is expected to be consistent with the 2-3 percent target over the next two years.

2014-07-01 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Unemployment Rate]

if actual < forecast = good for currency (for EUR in our case)

[EUR - Unemployment Rate] = Percentage of the total work force that is unemployed and actively seeking employment during the previous month. Although it's generally viewed as a lagging indicator, the number of unemployed people is an important signal of overall economic health because consumer spending is highly correlated with labor-market conditions.

==========

Eurozone May Jobless Rate Stable At 11.6%

The Eurozone unemployment rate remained unchanged in May, latest figures from Eurostat showed Tuesday.

The jobless rate held steady at seasonally adjusted 11.6 percent in May after April's figure was revised down from 11.7 percent. Economists had forecast the unemployment rate to remain at 11.7 percent.

The number of unemployed decreased by 28,000 from April to 18.55 million. Compared to last May, unemployment declined by 636,000.

The EU28 jobless rate fell to 10.3 percent in May from 10.4 percent in April.

2014-07-01 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

if actual > forecast = good for currency (for EUR in our case)

[USD - ISM Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy

==========

U.S. Manufacturing Index Indicates Slightly Slower Growth In June

Activity in the U.S. manufacturing sector unexpectedly grew at a slightly slower rate in the month of June, according to a report released by the Institute for Supply Management on Tuesday.

The ISM said its purchasing managers index edged down to 55.3 in June from 55.4 in May, although a reading above 50 still indicates growth in the manufacturing sector.

The modest decrease came as a surprise to economists, who had expected the index to inch up to a reading of 55.8.

Despite the modest decrease, Rob Carnell, chief international economist at ING, noted that the index continues to point to robust growth.

"Such a headline manufacturing ISM figure is consistent with GDP growth of 3.5%, and in all likelihood, the U.S. will grow a good deal faster than that in 2Q14 following the execrable 1Q14 GDP result," Carnell said.

The modest decrease by the headline index was partly due to a slowdown in production growth, as the production index dipped to 60.0 in June from 61.0 in May.

On the other hand, growth in new orders accelerated compared to the previous month, with the new orders index climbing to 58.9 in June from 56.9 in May.

The report also showed that the employment index came in unchanged at 52.8, indicating the twelfth consecutive month of job growth in the manufacturing sector.

While recent inflation data has pointed to prices rising at a faster rate, the ISM said its prices index fell to 58.0 in June from 60.0 in May.

Thursday morning, the ISM is scheduled to release a separate report on activity in the service sector in the month of June.

Economists expect the index of activity in the service sector to edge down to 56.2 in June after climbing to 56.3 in May.

EUR/USD Technical Analysis – Rally Stalls Below 1.37 Mark (based on dailyfx article)

The Euro paused to digest gains following an expected rally against the US Dollar, failing to overcome resistance below the 1.37 figure. A daily close above the 38.2% Fibonacci retracement at 1.3689 initially exposes the 50% level at 1.3747. Alternatively, a move below resistance-turned-support marked by a falling trend line set from mid-May, now at 1.3620, clears the way for a challenge of the May 29 low at 1.3585.

2014-07-02 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Trade Balance]

if actual > forecast = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month. Export demand and currency demand are directly linked because foreigners must buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers.

==========

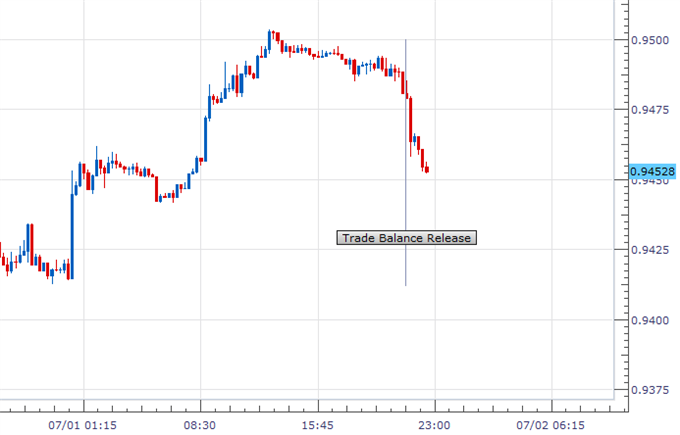

Australian Dollar Drops as Trade Balance Figures Disappoint

Australia’s Trade Balance for the month of May came in at –A$1911M today,whichmarks the largest trade deficit for the country since November 2012. This data was well below the market expectations of -A$200M. The prior month’s figures were also significantly revised to reflect a trade deficit of -A$780M, a downgrade from the previously reported -A$122M shortfall.

Numbers released by the Bureau of Statistics showed that imports fell by 1 percent while exports fell by 5 percent. A deeper look into these numbers revealed a significant drop in exports of energy commodities like coal and natural gas as well as metals like copper and aluminum.

The Australian Dollar fell sharply against the USDollar after the data was released. Traders typically interpret a trade deficit as negative for the relevant currency, speculating that the underlying outflow of capital that the gap implies will put downward pressure on the exchange rate.

EUR/USD consolidates after Monday's risec

EUR/USD started the new quarter with a dull trading session. The pair hovered directionless in a 20 pips range between 1.3680 and 1.37. The EMU data were second tier and thus ignored. The US manufacturing ISM was slightly weaker than expected, but close to expectations and thus also unable to support the greenback. Rallying equities were also unable to give EUR/USD direction. The pair closed the dull session at 1.3679, down 13 pips from Monday’s close at 1.3679..

Overnight, Asian equities trade with a bullish touch, after the S&P and Dow set closed at new records yesterday. The dollar is flat versus euro and yen. US Treasuries trade little changed, while the Bund opened just below 147 this morning. So, FX trading starts the European session ina neutral mode.

Later today, the euro zone eco calendar is thin with only the PPI inflation data. These data are however rather outdated (May) and shouldn’t have a lasting impact on trading. In the US, the focus will be on the ADP employment report, ahead of tomorrow’s payrolls. We see risks for a slightly weaker outcome, which might be slightly negative for the US dollar. Nevertheless, a significant deviation from the consensus is probably needed to have a lasting impact on markets, especially ahead of tomorrow’s payrolls and ECB meeting. The dollar probably needs a strong payrolls report to make a meaningful comeback against the euro and/or the yen.

Aussie found renewed buying interest at 0.9354 last week and has finally resumed recent upmove as price broke above resistance at 0.9461, bullishness remains for further gain to previous resistance at 0.9543, above there would encourage for headway to 0.9620-25 (50% Fibonacci retracement of the intermediate fall from 1.0582-0.8660), however, near term overbought condition should limit upside to 0.9690-00 and reckon 0.9750 would hold from here, bring retreat later.

Global Currency Markets

Big market moves to the upside, pushing some indexes to all time highs today! Exuberance or Justified? Merlin takes a look at today’s moves in the major indexes then shifts focus to the Dollar indexes (yes, both DXY and USDOLLAR). Negativity plagued the dollar while sending other currencies higher. This has broader implications for currency markets and Merlin sifts through this using charts of each currency. He also shares his thoughts on how economic announcements should be played.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video July 2014

newdigital, 2014.07.02 13:37

US Dollar Looks to ADP Data, Yellen Speech to Set the Stage for NFP

The economic calendar is quiet in European trading hours, with June’s UK Construction PMI reading amounting to the only bit of noteworthy event risk. The measure is expected to decline for the fifth consecutive period, dropping to an eight-month low of 59.8. An upside surprise similar to yesterday’s Manufacturing PMI outcome is likely to feed BOE rate hike speculation and drive the British Pound higher after prices rose to the strongest level in nearly six years yesterday. Needless to say, an underwhelming result stands to produce the opposite effect.

Later in the day, US news-flow returns to the spotlight as June’s ADP Employment figures cross the wires. Markets have a sort of love-hate relationship with the report. On one hand, it is analogous to the closely-watched Nonfarm Payrolls reading and traders can’t seem to help but look at it as a leading indicator. On the other, its predictive powers are highly inconsistent from month to month. Still, the outcome does seem to set a tone ahead of the official jobs figures’ publication. With that in mind, a print north of the expected 205k reading may offer a boost to the US Dollar, and vice versa.

Also of note, Fed Chair Janet Yellen is scheduled to speak at the International Monetary Fund. Her comments will be followed by a conversation with IMF Managing Director Christine Lagarde. Investors will closely monitor the central bank chief’s rhetoric to gauge the likely time gap between the end of the QE3 stimulus program – expected later this year – and the onset of interest rate hikes. Rhetoric suggesting outright tightening may come relatively soon on the heels of the end of asset purchases is likely to boost the greenback, while a cautious tone may inspire continued selling.

The Australian Dollar underperformed in overnight trade, sliding as much as 0.4 percent on average against its leading counterparts. The move followed a disappointing set of Trade Balance figures that revealed a trade deficit of –A$1911 million in May. This amounted to a far larger shortfall than the –A$200 million gap expected by economists ahead of the release. April’s trade deficit figure was also revised down to –A$780 million from the initially reported –A$122 million result.