You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

GBP/USD Promises Push Higher Post Morning Star Candlestick Pattern (based on dailyfx article)

GBP/USD’s promises a further push higher following a Morning Star formation on the daily. With current levels not witnessed since 2008, definitive areas of resistance are not easily identifiable. This suggests traders may defer to psychologically-significant handles to look at taking profits and puts 1.7200 on the radar.

Dollar supported before jobs data, Aussie slides after RBA comments

The dollar held firm above a recent eight-week low on Thursday, supported by hopes for a healthy rise in nonfarm payrolls, while the Aussie fell after Australia's central bank chief warned that markets are underestimating the risk of a sharp fall in the currency.

Figures from U.S. payrolls processor ADP released on Wednesday added to a string of bullish U.S. data ranging from manufacturing to auto sales, supporting the view that the U.S. economy has bounced back smartly after a first-quarter slump.

Benchmark U.S. Treasury yields rose to the highest in over a week at 2.63 percent on Wednesday in reaction to the data, which in turned helped lift the dollar against a basket of major currencies.

The dollar index inched up about 0.1 percent to 79.999 , having pulled up from an eight-week trough of 79.740 plumbed on Tuesday.

Against the yen, the greenback rose 0.1 percent to 101.87 yen, having only recently hit a six-week low near 101.23.

ADP said private employers added 281,000 workers to payrolls last month, the largest since November 2012, offering hopes for a healthy rise in nonfarm payrolls when the data is released later on Thursday.

"Our economists agree with market consensus looking for non-farm payrolls to rise by more than 200,000 for a fifth consecutive month," analysts at BNP Paribas wrote in a note to clients.

"If the forecast turns out to be correct, this will mark the first five-month run of above 200,000 prints since January 2000."

The euro eased 0.1 percent to $1.3648. The single currency hovered below a six-week high of $1.3701 set earlier this week, as the market turned its focus to a meeting by the European Central Bank later on Thursday, as well as the U.S. jobs data.

The ECB is unlikely to take fresh policy action at its July gathering after cutting interest rates to record lows last month - the deposit rate to below zero - and revealing a 400 billion-euro ($545.62 billion) loan programme.

"Although no action is expected from the ECB at its meeting today, we anticipate that it will maintain its dovish tone in the face of weak PMI prints, low inflation, and weak bank lending," said analysts at BNP Paribas.

AUSSIE STUNG

The Australian dollar fell 0.7 percent to $0.9377. The Aussie pulled further away from an eight-month peak of $0.9505 set on Tuesday, coming under pressure after Reserve Bank of Australia Governor Glenn Stevens warned investors they were underestimating the risk of a significant fall in the Australian dollar.

A weak reading on Australian retail sales also added to the already soft tone of the Aussie dollar, which had retreated on Wednesday on profit-taking in the wake of disappointing Australian trade data.

The Aussie's drop below $0.9400 triggered stop-loss selling, said Jeffrey Halley, FX trader for Saxo Capital Markets in Singapore.

"Basically, Governor Stevens timed his talking down of the Australian dollar perfectly to coincide with a soft market," Halley said.

While the Aussie may find some support at levels around $0.9370 and $0.9355, a drop to $0.9300 is now on the cards, Halley added.

2014-07-03 01:00 GMT (or 03:00 MQ MT5 time) | [AUD - RBA Gov Speech]

[AUD - RBA Gov Speech] = Due to speak at the Australian Conference of Economists and the Econometric Society of Australasian Meeting, in Hobart. As head of the central bank, which controls short term interest rates, he has more influence over the nation's currency value than any other person. Traders scrutinize his public engagements as they are often used to drop subtle clues regarding future monetary policy.

==========

RBA Stevens: Repeats AUD high by historical standards

Comments from Reserve Bank of Australia (RBA) Governor Stevens, to the Australian Conference of Economists (ACE) and the Econometric Society Australasian Meeting (ESAM), Hobart:

Trading the News: European Central Bank (ECB) Interest Rate Decision

The EUR/USD may struggle to maintain the rebound from June should the European Central Bank (ECB) adopt a more dovish tone for monetary policy.

What’s Expected:

Why Is This Event Important:

Indeed, ECB President Mario Draghi make a greater effort to weaken the Euro as the resilience in the single-currency heightens the threat for deflation, but the central bank may refrain from laying out a more detailed easing schedule as the central bank monitors the impact of negative deposit rates.

We may get more of the same from the ECB as the pickup in private sector consumption paired with the downtick in unemployment raises the fundamental outlook for the monetary union, and the EUR/USD may continue to appreciate in July should the Governing Council adopt a more neutral tone for monetary policy.

Nevertheless, the ECB may sounds increasingly dovish this time around amid the persistent weakness in private sector lending along with the downturn in confidence, and the Euro may come under increased pressure in the second-half of the year should the central bank show a greater willingness to implement the non-standard measures (T-LTRO & QE) ahead of schedule.

How To Trade This Event Risk

Bullish EUR Trade: ECB Softens Dovish Tone & Sticks to Current Policy

- Need green, five-minute candle following the policy statement to consider a long EUR/USD position

- If market reaction favors a long trade, buy EUR/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bearish EUR Trade: Governing Council Provides Further Details on Non-Standard Measures- Need red, five-minute candle to favor a short EUR/USD trade

- Implement same strategy as the bullish euro trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Watching Opening Monthly Range as Ascending Channel Takes Shape

- Interim Resistance: 1.3770 (38.2% expansion) to 1.3780 (38.2% retracement)

- Interim Support: 1.3490 (50.0% retracement) to 1.3500 Pivot

Impact that the ECB rate decision has had on EUR/USD during the last meeting(1 Hour post event )

(End of Day post event)

June 2014 European Central Bank Interest Rate Decision

EURUSD M5 : 82 pips range price movement by EUR - Interest Rate news event :

The European Central Bank pushed into uncharted territory as the Governing Council cut the benchmark interest rate to 0.15%, pushed deposit rates into negative territory, and saw scope for more non-standard measures (T-LTRO & QE) in an effort to stem the risk for deflation, while encouraging private-sector lending to small and medium-sized enterprises (SME). The EUR/USD tumbled to 1.3501 following the initial announcement, but the single currency traded higher following the press conference with President Mario Draghi as the central bank refrained from announced a detailed schedule for its easing cycle.

Trading the News: U.S. Non-Farm Payrolls

U.S. Non-Farm Payrolls (NFP) are projected to increase another 215K in June, but the European Central Bank (ECB) interest rate decision may spark a mixed reaction in the EUR/USD as market participants weigh the outlook for monetary policy.

What’s Expected:

Why Is This Event Important:

Despite expectations of seeing the longest stretch of 200K+ prints since 1999-2000, it seems as though we would need a more meaningful pickup in job growth for the Federal Open Market Committee (FOMC) to soften its dovish tune for monetary policy, and the bearish sentiment surrounding the greenback may continue to take shape going into the Fed’s July 30 as Chair Janet Yellen remains reluctant to move away from the highly accommodative policy stance.

The pickup in private sector hiring along with the ongoing improvement in business confidence raises the scope for a better-than-expected NFP print, and a strong employment read may mitigate the bearish sentiment surrounding the USD as it puts increased pressure on the Fed to move away from its easing cycle.

However, the slowdown in private sector consumption paired with the persistent slack in the real economy may continue to drag on job growth, and a weak NFP figure may trigger selloff in the greenback as it raises the Fed’s scope to retain the zero-interest rate policy (ZIRP) beyond 2015.

How To Trade This Event Risk

Bullish USD Trade: NFPs Rises 215K+; Unemployment Holds Steady

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Employment Report Disappoints- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Preserve Ascending Channel for Now While RSI Retains Long-Term Bearish Trend

- Interim Resistance: 1.3770 (38.2% expansion) to 1.3790 (38.2% retracement)

- Interim Support: 1.3490 (50.0% retracement) to 1.3500 Pivot

Impact that the U.S. Non-Farm Payrolls report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

May 2014 U.S. Non-Farm Payrolls

The U.S. economy added another 217K jobs in May following a revised 282K expansion the month prior, while the jobless rate unexpectedly held steady at an annualized 6.3% amid forecasts for a 6.4% print. Despite the downtick in unemployment, the EUR/USD climbed back above the 1.3650 region following the release, but the market reaction was short-lived as the pair ended the day at 1.3640.

Trade Setups in EUR/USD, USD/JPY, AUD/USD for NFPs

Traders lulled into a daze by the low volatility ought to grab a coffee for this morning - volatility should be back with a vengeance. Thanks to the holiday-shortened week for the July 4 US Independence Day, market participants have been gifted with the European Central Bank rate decision and the release of the US Nonfarm Payrolls report coming within less than an hour of one another.

Of the two, the ECB rate decision will be the less exciting, given the likelihood that the ECB sits pat after unveiling a plethora of measures last month; simply not enough time has passed for policymakers to determine if said measures have proven effective. ECB President Draghi's press conference, in lieu of substantive action, will carry additional weight.

With the June US ADP Employment report showing jobs growth north of +280K (which only tallies private payrolls, not government jobs), there is a distinct possibility that the June US NFP figure comes in above +250K. Considering that the Federal Reserve's tone has started to diverge from incoming economic data (the Fed is behind the curve, as they say), a strong June jobs report could be the spark the buck needs to move off of its lowest levels since October.

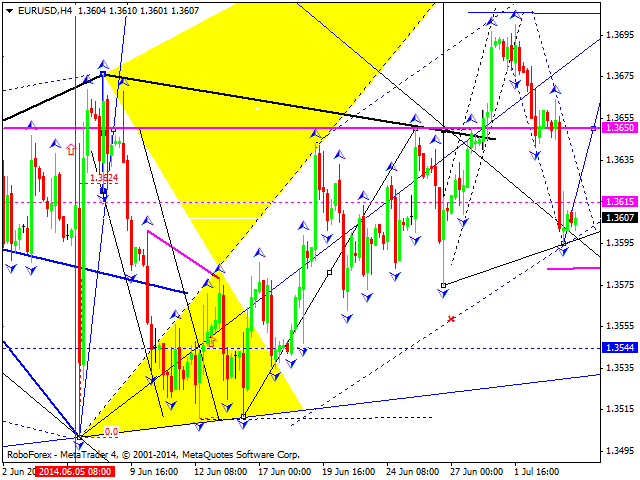

See the video above for details on trade setups in EURUSD, EURGBP, AUDUSD, and USDJPYEUR/USD Forecast July 4, 2014, Technical Analysis

The EUR/USD pair fell during the course of the day on Thursday, as the jobs number out of the United States came out better than originally anticipated, so this of course grow the value of the US dollar higher against most currencies. The European Central Bank course has suggested that it was ready to do whatever it took to keep the market and economy afloat, and as a result it appears that the ECB could keep monetary policy loose, and perhaps even add to that loosened monetary policy. However, there is a significant amount of noise below, so really this market still looks as if it’s ready to bounce around.

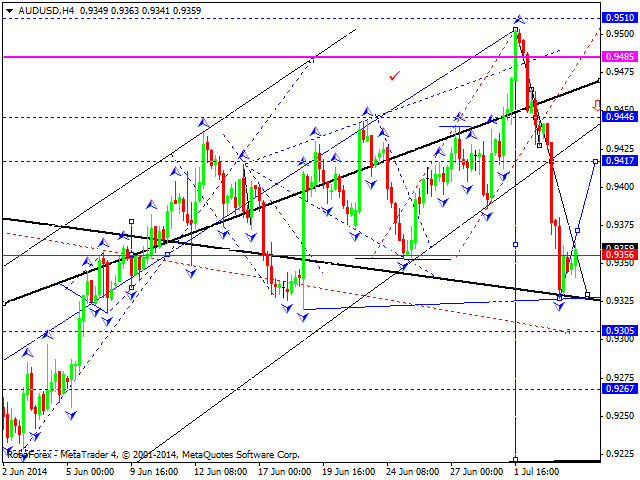

AUD/USD Forecast July 4, 2014, Technical Analysis

The AUD/USD pair fell during the session on Thursday, dropping to the 0.9350 level. That being the case, the market certainly looks like it could fall from here, but there is a significant amount of support down at the 0.93 level, meaning that possibly the market continues lower but only after a significant breakdown. On the other hand, if we get a supportive candle here, we could start buying as well as the market could head back towards the 0.95 handle. The market breaking above the 0.95 handle would in fact be very bullish, and would be more of a buy-and-hold type of situation. However, the last two sessions have been rather brutal against the Australian dollar, so it’s hard to imagine that there isn’t something going on here.

Breaking down from here would send this market down to the 0.92 handle, an area that is massively supportive. Because of that, we do think that there are a couple of possible trades coming up, and we are somewhat ambivalent about which direction the market goes, and will simply wait until we get some type of move in one direction or the other in order to be involved. We believe that either direction will work, but it’s very likely that we could stay between the 0.92 level on the bottom, and the 0.95 level on the top for the time being, and possibly even as long as the summer as the Forex markets could get fairly quiet.

Ultimately, we will have to pay attention to the gold markets as well, as the correlation is well-known between the two markets. On top of that, we have to pay attention to the idea of whether or not the Federal Reserve will be able to taper off of quantitative easing going forward, which of course should boost the value of the US dollar. On top of that, it really puts a beating on the value of the Australian dollar, as it is considered to be a “risky” asset. The markets are at a bit of an inflection point right now, so we will certainly be watching.

Forex Technical Analysis: EUR/USD (based on fxstreet article)

EUR USD, “Euro vs US Dollar”

Influenced by the news, Euro is forming consolidation channel. We think, today price may leave its descending channel and continue growing up to break level of 1.3650 again and then reach level of 1.3700. We remind you that instrument is forming the third ascending wave with target at level of 1.3790.

Forex Technical Analysis: EUR/USD (based on fxstreet article)

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar completed its descending wave and broke level of 0.9417. We think, today price may return to level of 0.9417. After reaching it, we’ll see whether price is going to continue falling down or growing up. If falling down – it may reach level of 0.9270; if growing up – reach new high. Later, in our opinion, instrument may continue moving inside descending trend.