You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

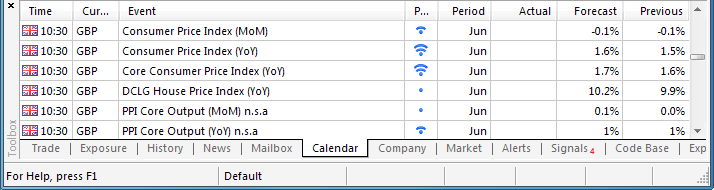

Trading the News: U.K. Consumer Price Index

A pickup in the U.K.’s Consumer Price Index (CPI) may generate fresh monthly highs in the GBP/USD as it fuels expectations for a Bank of England (BoE) rate hike later this year.

What’s Expected:

Why Is This Event Important:

The bullish sentiment surrounding the British Pound should gather pace in the second-half of the year as the BoE looks normalize monetary policy sooner rather than later, and the fundamental developments coming out of the region may continue to prop up interest rate expectations as a growing number of central bank officials adopt a more hawkish tone for inflation.

Expectations for a faster recovery paired with the ongoing improvement in the labor market may prompt a stronger-than-expected CPI print, and a marked pickup in the headline reading for inflation may generate a bullish reaction in the GBP/USD as it boosts interest rate expectations.

However, subdued wages along with the slowdown in private sector credit may drag on consumer prices, and a dismal inflation report may spur a larger correction in the GBP/USD as it dampens bets of seeing a rate hike later this year.

How To Trade This Event Risk

Bullish GBP Trade: U.K. Inflation Climbs to 1.6% or Higher

- Need green, five-minute candle following the release to consider a long British Pound trade

- If market reaction favors buying sterling, go long GBP/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish GBP Trade: CPI Falls Short of Market Forecast- Need red, five-minute candle to favor a short GBP/USD trade

- Implement same setup as the bullish British Pound trade, just in reverse

Potential Price Targets For The ReleaseGBP/USD Daily

- Topside Targets Remain Favorable as Price & RSI Retain Bullish Trend

- Interim Resistance: 1.7200 Pivot to 1.7220 (100.0% expansion)

- Interim Support: 1.6890 (38.2% expansion) to 1.6900 (61.8% expansion)

Impact that the U.K. CPI report has had on GBP during the last release(1 Hour post event )

(End of Day post event)

May 2014 U.K. Consumer Price Index

GBPUSD M5 : 38 pips price movement by GBP - CPI news event

U.K. consumer prices slowed to an annualized 1.5% in May from 1.8% the month prior, while the core rate of inflation narrowed to 1.6% during the same period after expanding 2.0% in April, which marked the fastest pace of growth since August 2013. The British Pound struggled to hold its ground following the weaker-than-expected CPI print, with the GBP/USD slipping back below the 1.6950 region, but the sterling regained its footing during the North American trade, with the pair ending the day at 1.6990.

2014-07-15 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]

if actual > forecast = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level. It's the primary gauge of consumer spending, which accounts for the majority of overall economic activity

==========

U.S. Retail Sales Inch Higher In June But Core Sales Growth Solid

Retail sales in the U.S. rose by much less than expected in the month of June, according to a report released by the Commerce Department on Tuesday, although the report also showed upward revisions to the sales growth in the two previous months.

The Commerce Department said retail sales edged up by 0.2 percent in June compared to economist estimates for an increase of about 0.6 percent.

While the sale growth came in well below estimates, the report also showed that retail sales rose by an upwardly revised 0.5 percent and 0.6 percent in May and April, respectively.

The weaker than expected sales growth in June was partly due to a drop in auto sales, which fell by 0.3 percent after climbing by 0.8 percent in the previous month.

Excluding the drop in auto sales, retail sales rose by 0.4 percent in June, matching the revised increase seen in the previous month. Ex-auto sales had been expected to increase by 0.5 percent.

The report also showed that sales by building materials and supplies dealers pulled back by 1.0 percent in June after rising by 0.6 percent in May.

On the other hand, sales by general merchandise stores jumped by 1.1 percent in June after edging down by 0.1 percent in the previous month.

Notable sales growth was also shown by health and personal care stores, clothing and accessories stores, and non-store retailers.

Closely watched core retail sales, which exclude autos, gasoline, and building materials, increased by a solid 0.6 percent in June after inching up by 0.2 percent in May.

Christoph Balz, an economist at Commerzbank, said, "Don't be misguided by the weak 0.2% increase in U.S. retail sales in June. The offsetting good news is that sales in April and in May rose stronger than previously reported."

"Moreover, even the June figures are more encouraging than they appeared to be at first sight as sales rose by a solid 0.6% in the core business," he added. "All in all, the steady recovery in the labor market increases consumers' willingness and power to spend."

The Commerce Department noted that total retail sales in the month of June were up by 4.3 percent compared to the same month a year ago.

2014-07-15 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Fed Chair Yellen Testifies]

[USD - Fed Chair Yellen Testifies] = Due to testify on the Semiannual Monetary Policy Report before the Senate Banking Committee, in Washington DC. As head of the central bank, which controls short term interest rates, she has more influence over the nation's currency value than any other person. Traders scrutinize her public engagements as they are often used to drop subtle clues regarding future monetary policy

==========

4 top takeaways from Fed chair Janet Yellen’s testimony to Senate Banking Committee

YELLEN ON POLICY OUTLOOK

“In sum, since the February Monetary Policy Report, further important progress has been made in restoring the economy to health and in strengthening the financial system. Yet too many Americans remain unemployed, inflation remains below our longer-run objective, and not all of the necessary financial reform initiatives have been completed. The Federal Reserve remains committed to employing all of its resources and tools to achieve its macroeconomic objectives and to foster a stronger and more resilient financial system.”

YELLEN ON LABOR MARKET CONDITIONS

“The FOMC is committed to policies that promote maximum employment and price stability, consistent with our dual mandate from the Congress. Given the economic situation that I just described, we judge that a high degree of monetary policy accommodation remains appropriate.

Labor force participation appears weaker than one would expect based on the aging of the population and the level of unemployment. These and other indications that significant slack remains in labor markets are corroborated by the continued slow pace of growth in most measures of hourly compensation.”

YELLEN ON INFLATION

“Consistent with the anticipated further recovery in the labor market, and given that longer-term inflation expectations appear to be well anchored, we expect inflation to move back toward our 2% objective over coming years.”

YELLEN ON ECONOMIC GROWTH

“Although the decline in GDP in the first quarter led to some downgrading of our growth projections for this year, I and other FOMC participants continue to anticipate that economic activity will expand at a moderate pace over the next several years, supported by accommodative monetary policy, a waning drag from fiscal policy, the lagged effects of higher home prices and equity values, and strengthening foreign growth.”Trading the News: New Zealand Consumer Price Index

Heightening price pressures in New Zealand may push the NZD/USD to fresh record-highs as it puts increased pressure on the Reserve Bank of New Zealand (RBNZ) to take a more aggressive approach in normalizing monetary policy.

What’s Expected:

Why Is This Event Important:

Indeed, RBNZ Governor Glenn Stevens may sound increasingly hawkish at the July 23 policy meeting as the faster recovery raises the risk for inflation, and the central bank may do little to halt the ongoing appreciation in the local currency as it helps to achieve price stability.

Rising input prices along with the pickup in household confidence may encourage New Zealand firms to pass on higher costs, and a stronger-than-expected CPI print may heighten the bullish sentiment surrounding the kiwi as it fuels bets for additional rate hikes in the second-half of 2014.

Nevertheless, the headline reading for inflation may disappoint amid subdued wage growth paired with the slowdown in private consumption, and a dismal inflation print may spark a larger correction in the NZD/USD as it drags on interest rate expectations.

How To Trade This Event Risk

Bullish NZD Trade: 2Q CPI Climbs 1.8% or Greater

- Need green, five-minute candle following the release to consider a long New Zealand dollar trade

- If market reaction favors buying sterling, go long NZD/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish NZD Trade: Headline Reading for Inflation Disappoints- Need red, five-minute candle to favor a short NZD/USD trade

- Implement same setup as the bullish New Zealand dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseNZD/USD Daily

- Outlook Remains Bullish as Price Continues to Carve Higher Highs & Lows

- Interim Resistance: 0.8841 (2011 High) to 0.8850 (61.8% expansion)

- Interim Support: 0.8600 (23.6% retracement) to 0.8630 (61.8% expansion)

Impact that the New Zealand CPI report has had on NZD during the last release(1 Hour post event )

(End of Day post event)

The headline reading for New Zealand inflation unexpectedly slowed during the first three-months of 2014, with the CPI figure slipping to an annualized 1.5% from 1.6% in the fourth quarter. The New Zealand dollar struggled to hold its ground following the dismal print, with the NZD/USD moving back below the 0.8600 handle, but the higher-yielding currency pared the losses during the North American trade to close at 0.8622.

NZ Dollar Falls on CPI Miss, Aussie Dollar Down After China GDP Data

The New Zealand Dollar underperformed in overnight trade, sliding as much as 0.7 percent on average against its leading counterparts. The move followed softer-than-expected CPI figures for the second quarter. The baseline year-on-year inflation rate registered at 1.6 percent, falling short of consensus forecasts calling for a 1.8 percent result. That seemingly undermined RBNZ rate hike expectations, with the slide in the Kiwi tracking a parallel move lower in the New Zealand’s benchmark 10-year bond yield.

The Australian Dollar likewise traded lower, losing as much as 0.24 percent against the majors. Curiously, the move followed an upbeat set of Chinese GDP figures. Output grew 2.0 percent in the second quarter, topping bets calling for a 1.8 percent increase. Supportive Chinese data might have been expected to boost the Aussie considering the East Asian giant is Australia’s top trading partner, meaning firming performance there bodes for the latter country’s pivotal export sector.

The newswires chalked up this apparent disparity to concerns that the Chinese economy’s recovery was unsustainable, suggesting seemingly sharp credit expansion rather than hard growth is behind the rosy headline GDP reading. Fading stimulus expansion bets were likewise cited, with investors apparently worried that the second-quarter data set will discourage further expansionary policy. Needless to say, it is all but impossible to tell with absolute certainty why the markets were unimpressed and the Aussie fell. In any case, we remain short AUDUSD.

June’s UK Jobless Claims figures headline the economic calendar in European hours. Expectations call for a 27,000 drop in new applications for unemployment benefits, which would mark the smallest drawdown in 13 months. Absent a dramatic deviation from expectations, the outcome may pass with little fanfare considering its relatively limited implications for BOE monetary policy bets and thereby for the British Pound. Meanwhile, technical positioning warns GBPUSD may be carving out a top below the 1.72 figure.

The spotlight then shifts to US policy concerns as Fed Chair Janet Yellen testifies before Congress for a second day, this time appearing before the House of Representatives having talked to the Senate yesterday. The central bank chief’s prepared remarks are likely to sound familiar and offer little impetus for volatility. The Q&A session that follows might produce some fireworks if lawmakers manage to squeeze out anything about the likely timing of interest rate hikes however, prompting a response from the US Dollar.

Asia Session

GMT

CCY

EVENT

ACT

EXP

PREV

22:45

NZD

Consumer Prices Index (QoQ) (2Q)

0.3%

0.4%

0.3%

0:30

AUD

Westpac Leading Index (MoM) (JUN)

0.1%

-

0.1%

2:00

CNY

GDP (QoQ) (2Q)

2.0%

1.8%

1.5%

2:00

CNY

GDP (YoY) (2Q)

7.5%

7.4%

7.4%

2:00

CNY

GDP YTD (YoY) (2Q)

7.4%

7.4%

7.4%

2:00

CNY

Retail Sales (YoY) (JUN)

12.4%

12.5%

12.5%

2:00

CNY

Retail Sales YTD (YoY) (JUN)

12.1%

12.2%

12.1%

2:00

CNY

Industrial Production (YoY) (JUN)

9.2%

9.0%

8.8%

2:00

CNY

Industrial Production YTD (YoY) (JUN)

8.8%

8.8%

8.7%

2:00

CNY

Fixed Assets Ex Rural YTD (YoY) (JUN)

17.3%

17.2%

17.2%

European Session

8:30

GBP

Jobless Claims Change (JUN)

-27.0K

-27.4K

High

8:30

GBP

Claimant Count Rate (JUN)

3.1%

3.2%

Medium

8:30

GBP

ILO Unemployment Rate (3Mths) (MAY)

6.5%

6.6%

Medium

8:30

GBP

Employment Change (3M/3M) (MAY)

243K

345K

Low

8:30

GBP

Avg Weekly Earnings (3M/(YoY) (MAY)

0.5%

0.7%

Low

8:30

GBP

Weekly Earnings ex Bonus (3M/(YoY) (MAY)

0.8%

0.9%

Low

9:00

EUR

Euro-Zone Trade Balance (€) (MAY)

16.5B

15.7B

Low

9:00

EUR

Euro-Zone Trade Balance s.a. (€) (MAY)

16.0B

15.8B

Low

9:00

CHF

ZEW Survey (Expectations) (JUL)

-

4.8

Medium

Critical Levels

EURUSD

1.3454

1.3520

1.3544

1.3586

1.3610

1.3652

1.3718

GBPUSD

1.6868

1.7000

1.7072

1.7132

1.7204

1.7264

1.7396

Trading Currencies with Sunil Mangwani

Every trader has to start somewhere! Sunil Mangwani shares, with Merlin, his rocky road from book learning, to understanding the fundamentals of Supply and Demand. Sunil also takes a look into how commodities influence currency action and can be used as an odds enhancer. The duo also look at a variety of yen pairs including AUDUSD, USDJPY and GBPJPY.

2014-07-17 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - CPI]

if actual > forecast = good for currency (for EUR in our case)

[EUR - CPI] = Change in the price of goods and services purchased by consumers, excluding food, energy, alcohol, and tobacco.

==========

Eurozone June Inflation Stable At 0.5%

Eurozone inflation held steady at 0.5 percent as initially estimated in June, final data from Eurostat showed Thursday.

Month-on-month, prices gained only 0.1 percent.

Headline inflation continues to remain below the European Central Bank's target of 'below, but close to 2 percent'.

Core inflation that excludes energy, food, alcohol and tobacco, rose marginally to 0.8 percent in June from 0.7 percent in May. The final figure matched the flash estimate released on June 30.

Cost of services and energy advanced 1.3 percent and 0.1 percent, respectively. Meanwhile, food, alcohol and tobacco prices dropped 0.2 percent and non-energy industrial goods prices were down 0.1 percent.

Inflation in European Union was 0.7 percent, up from 0.6 percent in May.

Trading Video: EURUSD Back to 1.3500, Dow Closes at a Record High

Despite a mix of data that offered a distinct favor for the sterling, GBPUSD failed to overtake 1.7200. Meanwhile, a more mixed picture for EURUSD wouldn't keep it from pulling into 1.3500. Both majors are at key technical levels that no doubt have FX traders projecting serious trend developments, but the analysis isn't adding up favorably. Scheduled event risk, underlying fundamental themes, general volatility conditions are not solidifying into the same mold that technicals alone seem to take. With a number of great looking technical opportunities on hand, we discuss the bigger picture for these trade setups in today's Trading Video.

2014-07-17 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Building Permits]

if actual > forecast = good for currency (for USD in our case)

[USD - Building Permits] = Annualized number of new residential building permits issued during the previous month. It's an excellent gauge of future construction activity because obtaining a permit is among the first steps in constructing a new building

==========

U.S. Housing Starts Unexpectedly Show Sharp Drop In June

New residential construction in the U.S. unexpectedly showed a steep drop in the month of June, the Commerce Department revealed in a report on Thursday, with housing starts falling to a nine-month low.

The Commerce Department said housing starts tumbled 9.3 percent to an annual rate of 893,000 in June from the revised May estimate of 985,000.

The sharp drop came as a surprise to economists, who had expected housing starts to climb to 1.020 million from the 1.001 million originally reported for the previous month.

Building permits, an indicator future housing demand, also fell 4.2 percent to an annual rate of 963,000 in June from the revised May rate of 1.005 million.

Trading the News: Canada Consumer Price Index (CPI)

- Canada Headline Inflation to Hold at 2.3%- Fastest Pace of growth Since 2012.

- Core Consumer Price Index to Expand 1.7% for Second Straight Month.

Canada’s Consumer Price Index (CPI) may generate a key turn in the USD/CAD as heightening price pressures puts increased pressure on the Bank of Canada (BoC) to adopt a more hawkish tone for monetary policy.What’s Expected:

Why Is This Event Important:

Even though BoC Governor Stephen Poloz talked down the risk for inflation, sticky prices in Canada may continue to prop up interest rate expectations as the central bank adopts a more balanced view for the economy.

The pickup in private sector consumption may encourage faster price growth in Canada as the BoC looks to achieve a ‘soft landing’ in the housing market, and a stronger-than-expected CPI print may spur a more material shift in the policy outlook as the central bank softens its dovish tune.

Nevertheless, the ongoing slack in the real economy may continue to dampen the outlook for inflation, and an unexpected slowdown in price growth may generate a further advance in the USD/CAD as it drags on interest rate expectations.How To Trade This Event Risk

Bullish CAD Trade: Canada CPI Rises an Annulized 2.3% or Higher- Need red, five-minute candle following the CPI report to consider short USD/CAD entry

- If the market reaction favors a bullish Canadian dollar trade, establish short with two position

- Set stop at the near-by swing high/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish CAD Trade: Headline Reading for Inflation Disappoints- Need green, five-minute candle following the release to look at a long USD/CAD trade

- Carry out the same setup as the bullish loonie trade, just in the opposite direction

Potential Price Targets For The ReleaseUSD/CAD Daily

- Despite bullish break in RSI, downside remains favored given series of lower highs & lows.

- Interim Resistance: 1.0820 (61.8% retracement) to 1.0850 (38.2% retracement)

- Interim Support: 1.0580 (61.8% retracement) to 1.0600 (61.8% retracement)

Impact that the Canada CPI report has had on CAD during the last month(1 Hour post event )

(End of Day post event)

2014

The headline reading for Canada inflation climbed to an annualized 2.3% in May to mark the fastest pace of growth since February 2011, while the core CPI increased 1.7% during the same period amid forecasts for a 1.5% print. The stronger-than-expected prints spurred a bullish reaction in the Canadian dollar, with the USD/CAD slipping below the 1.0800 handle, and the pair traded lower throughout the North American trade as the pair ended the day at 1.0751.

MetaTrader Trading Platform Screenshots

USDCAD, M5, 2014.07.18

MetaQuotes Software Corp., MetaTrader 5, Demo

USDCAD M5 : 46 pips price movement by CAD - CPI news event