Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.03 10:19

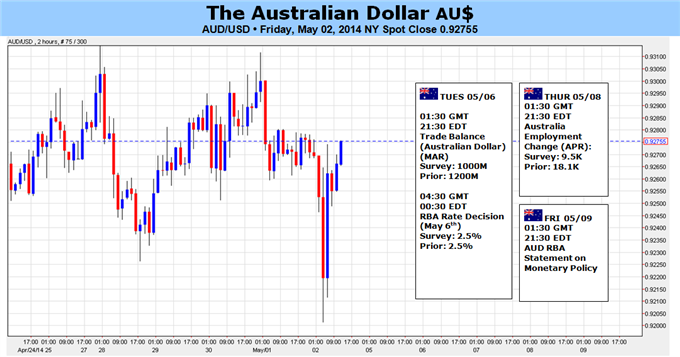

Forex Weekly Outlook May 5-9A very busy week ended with a drama around the Non-Farm Payrolls and left some uncertainty about the next market moves. The list of events for the coming week includes: US ISM Non-Manufacturing PMI, Trade Balance, Janet Yellen’s testimony, and rate decisions in Australia, the UK and the Eurozone, with the latter promising a lot of action. Here is an outlook on the main market-movers awaiting usr this week.

European inflation numbers came out worse than expected, but is it enough for action from the ECB? Draghi’s headache is probably worsening. In the US, we can see a distinction between the weak GDP in Q1, and the promising data from Q2. Is the bounce strong enough? The Fed acknowledged the gap and in any case, continued tapering for the fourth time. The Non Farm Payrolls provided a great show: the US gained 288K jobs and this certainly boosted the US dollar. However, within an hour, the tables turned and the greenback lost its shine. Is volatility making a comeback?

- US ISM Non-Manufacturing PMI: Monday, 14:00. The US service sector rebounded mildly in March reading 53.1 after a sharp drop to 51.6 in February. Economists expected a slightly higher reading of 53.5% in March. The employment index registered the biggest climb rising 6.1 points to 53.6, from 47.5 in February. Furthermore, other components such as new orders and export orders increased, indicating the US economy continues to expand. US service sector is expected to advance further to 54.3.

- Australian rate decision: Tuesday, 4:30. The Reserve bank of Australia decided to maintain its cash rate at 2.5% in light of stronger than expected job figures as well as a climb in domestic demand and improvement in household finance. Furthermore, the ABS reported a surge in retail sales, rising 1.2% in January, beating market consensus. No change in rates is expected this time.

- US Trade Balance: Tuesday, 12:30 The U.S. trade deficit increased in February to $42.3 billion, reaching its highest level in five months due to lower demand for American exports. U.S. exports plunged 1.1% to $190.4 billion as sales of commercial aircraft, computers and farm goods fell. Imports climbed 0.4% to $232.7 billion, mainly autos and clothing. The increase in deficit caused some economists to reduce their estimate for overall economic growth for the January-March quarter. However analysts believe deficit will shrink this year with the help of exports. The U.S. trade deficit is expected to narrow to $40.1 billion.

- NZ employment data: Tuesday, 22:45. The jobless rate in New Zealand edged down to 6.0% in the fourth quarter of 2013 from 6.2% in the third quarter, in line with market forecast. New Zealand’s job market expanded by 1.1% in the final quarter of 2013, exceeding forecasts for a 0.6% increase. On a yearly basis, employment picked up 3.0%, far better than the 2.4% estimated. The employment rate reached 64.7 % with 2,297,000 people in the work force. The participation rate reached 68.9%, beating expectations for 68.6 %. New Zealand’s job market is expected to advance by 0.7% in the first quarter, while the unemployment rate is predicted to decline to 5.8%.

- Janet Yellen speaks: Wednesday, 14:00. Federal Reserve Chair Janet Yellen will speak in Washington D.C. before the Joint Economic Committee of Congress. The question and answer session may provide info about important monetary policy issues. Market volatility is expected. It will be interesting to hear her view on more tapering in light of the fourth such move and the recent jobs report.

- Australian employment data: Thursday, 1:30. The Australian unemployment rate edged down to a four-month low of 5.8% in March, following 6.1% in February. An addition of 18,100 jobs in March and 48,200 in February, helped lower the rate, suggesting a growth trend in the Australian economy. Full-time positions fell 22,100 in the month and part-time employment was up 40,200. However, the federal employment minister, Eric Abetz, cautioned against reading too much into one month’s numbers because of a decline in the labor force participation rate. Australian job market is expected to add 9,600 jobs while the unemployment rate is expected to reach 5.9%.

- UK rate decision: Thursday, 11:00. The Bank of England kept its key interest rate unchanged at a record low of 0.50%, amid a continuous growth trend in Britain’s economy. The bank also maintained the stimulus program of 375 billion pounds, in government bonds that it has purchased over the past five years. The BOE is not expected to change rates until next year according to analysts. GDP increased 0.8% in the first quarter of 2014. Growth in the first quarter is expected to reach 0.9% with lower unemployment and increased economic activity. The Bank of England is expected to maintain rates and monetary policy.

- Eurozone rate decision: Thursday, 11:45, press conference at 12:30. The ECB could cut the main lending rate by 0.10% and leave the deposit rate at 0% in an attempt to lower the value of the euro without using the heavier tools. Draghi’s dilemma is becoming a big headache. He would prefer to have a lower value of the euro against both the dollar and the Chinese yuan without having to take action. It worked amazingly well with the OMT. However, even his stronger and more explicit verbal interventions to lower the exchange rate are having a diminishing effect. The excellent US NFP was not enough to do the job for Draghi. More words without action could damage his credibility. Inflation is low and well below the 2% target, but not below 0.5% – a level that would probably force the ECB to act. With core inflation standing at 1%, it will be hard for Draghi to convince his German colleagues to use the “nuclear option” of setting a negative deposit rate. Regarding QE, it is quite complicated in the euro-zone and probably left as the last option. Cutting only the main lending rate has a very marginal effect on the EZ economies, but still shows that the ECB can act and not only talk. With such a move, Draghi can hope for a lower exchange rate and leave the other, bigger tools as big bazookas and nothing else.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits increased last week to 344,000 from 330,000 in the previous week. The reading was higher than the 317,000 anticipated by analysts. However this rise may be attributed to seasonal adjustment issues caused by the Easter holiday. Analysts believe that the real measure of claims is much lower. Another good sign is the ADP non-farm employment change report released a day before showing a rise of 220,000 jobs in April following 209,000 in the previous month. US Jobless claims is expected to rise by 328,000 this time.

- Canadian employment data: Friday, 12:30. Canada’s labor market expanded by 42,900 in March driven by jobs for Canadian youths aged 15 to 24. This rise helped push down the unemployment rate by 0.1% to 6.9%, beating forecast of 7.0%. The majority of job addition is part-time. Employment in health care and social assistance edged up, while the agriculture sector continued to shrink. Canada’s labor market is expected to expand by 21,400 jobs, while the unemployment rate is expected to remain at 6.9%.

- US JOLTS Job Openings: Friday, 14:00. The JOLT Job Openings jumped to a 6 year high in February, reaching 4.17 million. This rise indicates a growth trend in the US economy as employers hire more people due to meet rising consumer demand. However, the quit rate remained unchanged at 1.7% a higher quit rate means employees are confident that they can find a new jobs. Chair Yellen, cited these indicators as important indicators for the Job market strength. The JOLT Job Openings is expected to reach 4.21 million.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.03 10:31

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: Neutral- AUD/USD Holds 0.9200 Support- Dovish RBA to Trigger Key Reversal

- Australian Dollar Downtrend Intact, We Like Selling

The long-term outlook for the AUD/USD remains bearish as the pair

carves a lower high in April, and the Australian dollar remains at risk

of facing a larger decline in the week ahead should the Reserve Bank

of Australia (RBA) adopt a more dovish tone for monetary policy.

Even though the RBA is widely expected to keep the benchmark interest

rate at 2.50%, the persistent strength in the local currency may

undermine the central bank’s upbeat assessment for the $1T economy, and

Governor Glenn Stevens may continue to highlight the ongoing slack in private sector activity as the soft 1Q Consumer Price report

limits the scope to normalize monetary policy ahead of schedule. With

that said, the RBA may take a more aggressive approach in talking down

the local currency, but central bank’s verbal intervention may continue

to have a limited impact on the exchange rate as the ongoing pickup in

market sentiment heightens the appeal of the higher-yielding currency.

As a result, a further pickup in Australia Retail Sales paired with a

9.5K rise in employment may continue fuel expectations of seeing a RBA

rate hike sooner rather than later, and a slew of positive developments

may keep the AUD/USD afloat should the central bank show a greater

willingness to move away from its easing cycle.

In turn, the 0.9200 handle may continue to provide support in the days

ahead, and we would need to see a break and a close below this region

to favor a bearish outlook for the AUD/USD as the Relative Strength

Index preserves the bullish momentum from earlier this year.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.06 05:45

2014-05-06 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Trade Balance]

- past data is 1.26B

- forecast data is 1.20B

- actual data is 0.73B according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

==========

Australia March Trade Surplus A$731 Million

Australia posted a seasonally adjusted merchandise trade surplus of A$731 million in March, the Australian Bureau of Statistics said on Tuesday - down A$526 million or 42 percent on month.

The headline figure was well shy of forecasts for a surplus of A$1.2 billion and down from the surplus of A$1.257 billion in February.

Exports were down 2.0 percent on month in March to A$29.033 billion

Non-rural goods dipped A$578 million (3 percent) and non-monetary gold shed A$56 million (4 percent).

Rural goods added A$47 million (1 percent) and net exports of goods under merchanting spiked A$1 million (7 percent). Services credits gained A$40 million (1 percent).

Imports were roughly flat on month at A$28.302 billion, easing A$21 million from the previous month.

Capital goods shed A$119 million (2 percent), while consumption goods lost A$48 million (1 percent) and non-monetary gold tumbled A$41 million (12 percent).

Intermediate and other merchandise goods added A$224 million (2 percent). Services debits lost A$36 million (1 percent).

Upon the release of the data, the Australian dollar eased from early highs against other major currencies, trading at 0.9279 against the greenback, 94.77 against the yen, 1.4951 against the euro and 1.0677 against the kiwi.

AUDUSD M5 : 10 pips range price movement by AUD - Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.06 07:47

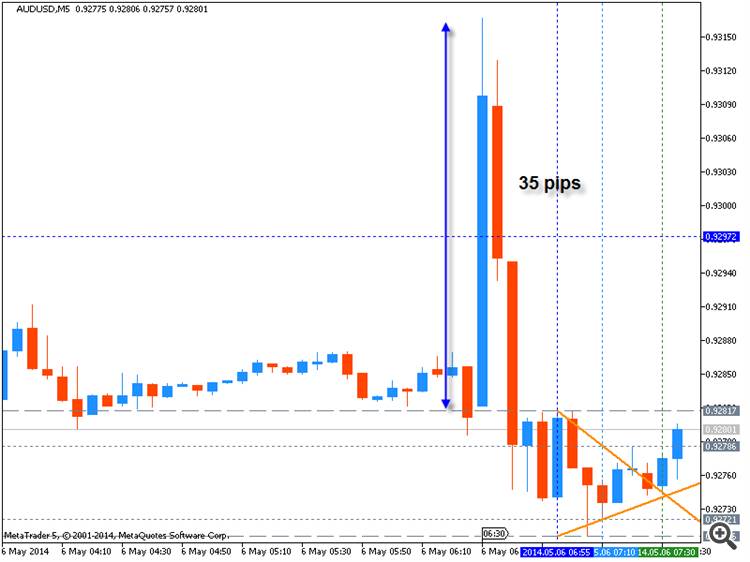

2014-05-06 04:30 GMT (or 06:30 MQ MT5 time) | [AUD - Cash Rate]

- past data is 2.50%

- forecast data is 2.50%

- actual data is 2.50% according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

==========

Australia Keeps Rates Unchanged At 2.50%

The Reserve Bank of Australia on Tuesday left its key interest rate unchanged as widely expected by economists.

The monetary board governed by Glenn Stevens decided to maintain the cash rate at 2.50 percent. The board assessed that monetary policy is appropriately configured to foster sustainable growth in demand and inflation outcomes consistent with the target.

On present indications, the most prudent course is likely to be a period of stability in interest rates, the central bank said in a statement.

Looking ahead, members said continued accommodative monetary policy should provide support to demand, and help growth to strengthen over time. Further, inflation is expected to be consistent with the 2-3 percent target over the next two years.

AUDUSD M5 : 35 pips price range movement by AUD - Cash Rate news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.06 17:45

RBA Holds Rates Steady at 2.5%, AUDUSD Little-Changed

- RBA Keeps Headline Rate Unchanged at 2.50 Percent

- Australian Dollar Rises versus US Dollar Following Data Release

- Neutral Monetary Policy Tone

The Reserve Bank of Australia (RBA) kept its headline rate unchanged at 2.50 percent, and the policy statement accompanying the interest rate decision exuded a broadly upbeat tone.

“At the December and February meetings, the Board judged that, given the substantial degree of policy stimulus that had been imparted and evidence of its effects, it was prudent to hold the cash rate steady,” said the RBA in its monetary policy statement released earlier today, “market pricing suggests no change to the cash rate is expected for about a year.”

The RBA says the risks surrounding the forecasts for the global economy appear broadly balanced, and amidst China’s economic slowdown growth forecast remains broadly in-line.

“Over the past few months, there have been further

signs that very stimulatory monetary policy is working to support

economic activity,” said the RBA, “nevertheless, it is likely that the

unemployment rate will continue to edge higher for a few quarters, and

turn down only after growth rises to an above-trend pace.” Inflation is

expected to remain consistent with the target.

AUDUSD M5 : 35 pips price range movement by AUD - Cash Rate news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.07 15:30

2014-05-07 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Retail Sales]

- past data is 0.3%

- forecast data is 0.4%

- actual data is 0.1% according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

==========

Australia Retail Sales Gain 0.1% In March

Total retail sales in Australia added a seasonally adjusted 0.1 percent on month in March, the Australian Bureau of Statistics said on Wednesday - coming in at A$23.149 billion.

That was shy of forecasts for a gain of 0.4 percent following the upwardly revised gain of 0.3 percent in February (originally 0.2 percent) and the 1.1 percent spike in January.

By individual component, food retailing was up 0.5 percent, while household goods retailing added 1.1 percent, cafes, restaurants and takeaway food services gained 1.0 percent and other retailing was up 0.2 percent.

Sales at department stores fell 0.6 percent, while clothing, footwear and personal accessory retailing eased 0.2 percent.

By region, sales were up 0.9 percent in New South Wales, along with Victoria (0.5 percent), Queensland (0.4 percent), Tasmania (0.6 percent) and the Northern Territory (0.4 percent).

South Australia and Western Australia were relatively unchanged, while sales in the Australian Capital Territory fell 0.5 percent.

For the first quarter of 2014, retail sales climbed 1.2 percent on quarter to A$67.519 billion - in line with expectations, but missing forecasts for 1.6 percent after gaining 1.1 percent in the three months prior.

Upon the release of the data, the Australian dollar dropped against other major currencies, trading near 0.9340 against the greenback, 94.88 against the yen, 1.4918 against the euro and 1.0733 against the kiwi.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 10 pips price movement by AUD - Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.07 21:00

AUDUSD Technical Analysis (based on dailyfx article)

- At Risk for Further Losses as Bearish RSI Momentum Gathers Pace

- Interim Resistance: 0.9460-70 (23.6 expansion)

- Interim Support: 0.9200 (100.0 expansion) to 0.9220 (61.8 retracement)

he greenback advanced against all four components, led by a 0.14 percent drop in the Australian dollar, and the AUD/USD may face a larger decline over the near-term as the bearish RSI momentum takes shape. However, another 8.8K rise in Australia Employment may prop up the higher-yielding currency as it raises the growth outlook for the $1T economy, and the AUD/USD may trade on a firmer footing in the second-half of the year as the positive developments coming out of the region boosts interest rate expectations.

Nevertheless, the Reserve Bank of Australia (RBA) may come under increased pressure to weaken the local currency as it undermines the central bank’s upbeat assessment for 2014, and Governor Glenn Stevens may have little choice but to act against the Australian dollar as market participants no longer react to the verbal intervention.

With that said, wewill closely monitor the RSI as the oscillator highlights a lower high in the exchange rate, but we need a break and a close below the 0.9200 handle to adopt a more bearish forecast for the AUD/USD as it continues to hold up as near-term support.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.08 07:20

2014-05-08 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Employment Change]

- past data is 21.9K

- forecast data is 6.7K

- actual data is 14.2K according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

==========

Australia April Unemployment Rate 5.8%

The unemployment rate in Australia was a seasonally adjusted 5.8 percent in April, the Australian Bureau of Statistics said on Thursday.

That was unchanged from the previous month and beating forecasts for 5.9 percent.

The Australian economy added 14,200 jobs to 11,572,900 in April. That topped expectations for 8,750 following the addition of 18,146 a month earlier.

Full-time employment increased 14,200 to 8,045,100 following the downwardly revised loss of 22,700 jobs in March.

Part-time employment was roughly unchanged following the upwardly revised gain of 44,600 jobs in the month prior.

Unemployment decreased 400 to 713,400. The number of unemployed persons looking for full-time work increased 8,700 to 519,500, while the number of unemployed persons looking for part-time work decreased 9,000 to 193,900.

The participation rate was 64.7 percent, unchanged and in line with expectations.

Aggregate monthly hours worked decreased 39.9 million hours (2.5 percent) to 1,572.6 million hours.

Upon the release of the data, the Australian dollar advanced against other major currencies, trading near 0.9356 against the greenback, 95.28 against the yen, 1.4865 against the euro and 1.0811 against the kiwi.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 35 pips price movement by AUD - Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.08 19:54

AUD/USD’s steam dissipating ahead of 0.9400

AUD/USD is trading at 0.9384, up 0.61% on the day, having posted a daily high at 0.9397 and low at 0.9318.

AUD/USD

is held up ahead of the 0.94 handle after a positive trading session

overnight in Asia. AUD/USD attracted bids after better labour markets in

April and much better that expected trade numbers from China. Jane

Foley, Senior Currency Strategist at Rabobank explained that the strong

Australian employment release provides further support for the opinion

that the next policy move from the RBA will be a hike.

AUD/USD Levels

With

spot trading at 0.9385, we can see next resistance ahead at 0.9391

(Daily Classic R3), 0.9397 (Daily High), 0.9424 (Monthly High), 0.9424

(YTD High) and 0.9448 (Weekly Classic R3). Support below can be found at

0.9384 (Weekly Classic R2), 0.9374 (Daily Classic R2), 0.9371 (Hourly

20 EMA), 0.9357 (Yesterday's High) and 0.9351 (Daily Classic R1).

AUD/USD chart formations

Looking to candlestick patterns, we can see a Doji formation on the 4-hour chart.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is located above Ichimoku cloud/kumo with flat market condition floating between 0.9227 support and 0.9377 resistance.

Chinkou Span like is crossing H4 price on open bar for possible breakout. But H4 price is located below Ichimoku cloud/kumo with primary bearish so we can expect ranging or market rally within primary bearish.

If D1 price will break 0.9227 support level on close bar - we will see the secondary correction within primary bullish market condition.If D1 price will break 0.9377 resistance level from below to above so the primary bullish will be continuing (good to open buy trade).

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2014-05-05 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Building Approvals]

2014-05-05 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - Manufacturing PMI]

2014-05-06 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Trade Balance]

2014-05-06 04:30 GMT (or 06:30 MQ MT5 time) | [AUD - Cash Rate]

2014-05-06 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

2014-05-07 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Retail Sales]

2014-05-07 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2014-05-08 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Employment Change]

2014-05-09 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - RBA Monetary Policy Statement]

2014-05-09 01:30 GMT (or 03:30 MQ MT5 time) | [CNY - CPI]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movementSUMMARY : bullish

TREND : ranging

Intraday Chart