Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.30 15:19

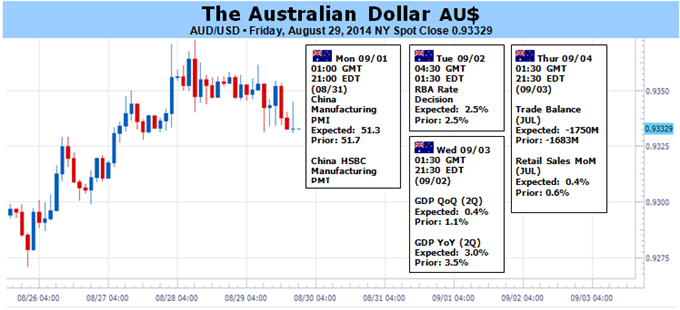

Forex Weekly Outlook September 1-5The euro was the big loser in a week that otherwise saw some profit taking on dollar longs. The first week of September is packed with top tier events as traders return from their vacations. Rate decisions in Australia, Canada, Japan, the UK, and most importantly the euro-zone, and US PMIs leading up to the all-important US NFP report; are the major events in our forex calendar. Check out these events on our weekly outlook.

It was yet another exciting week in markets, as currency action defied the summer heat. The echoes from Draghi’s Jackson Hole speech hit the euro with a gap, and it could never recover. Mediocre EZ data didn’t help. The US reported stronger growth than first estimated: 4.2% growth in Q2 (annualized). Nice consumer confidence and low jobless claims also helped the dollar. But as not all indicators were impressive, it allowed some currencies to recover: the Aussie showed resilience once again, and the loonie made a comeback. On the other hand, the yen suffered from unimpressive inflation data and the pound remained depressed.

- Australian rate decision: Tuesday, 4:30. Australia’s central bank maintained the cash rate at a record low of 2.5%, saying the nation’s economic outlook remains unclear. The slowdown in mining investment weighs on growth. Therefore, GDP expansion in the June quarter is expected to be weaker than in the previous quarter. Domestic demand is also subdued due to elevated currency. However, lenient monetary policy boosted the housing market. Global issues also contributed to uncertainty tensions in Ukraine and Gaza and the guessing game around the timing of the first rate increase in the US. No change in rats is expected now.

- US ISM Manufacturing PMI: Tuesday, 14:00. The U.S. manufacturing sector improved strongly in July reaching 57.1 points following 55.3 points in June. Economists expected a reading of 56.1. US Manufacturing remained in expansion territory for 14 consecutive months. New orders advanced to 63.4, rising 4. points from June’s reading of 58.9. Production edged up to 61.2, from 60 and the employment soared to 58.2, up 5.4 points from June’s reading of 53. A slight drop to 57 is forecasted this time.

- Australian GDP: Wednesday, 1:30. Australia’s economy expanded 1.1% in the first quarter beating expectations for a 0.9% growth rate. The high rise was explained by the unexpected growth to the mining, financial and insurance services and the construction boom. The rate of expansion in the last 12 months to March reached 3.5% indicating the economy is resilient. The RBA projects a growth rate of 2.75% for this year and a rise of 2.5% for 2015. Australia’s economy is predicted to expand 0.4% in the second quarter.

- Canadian rate decision: Wednesday, 14:00. Canada’s central bank maintained its overnight rate target at 1% as it had been since September 2010. The Bank of Canada said global economic growth was subdued until April Monetary Policy Report, but is expected to pick up in the following months. In light of the lukewarm global outlook, Canada’s GDP is expected to be weaker than previously expected. However, the softer Canadian dollar and forecast for increases in global demand, are expected to expand exports leading to higher growth rate. Real GDP growth in Canada was expected to average around 2 ¼ % in 2014-16. Rates are expected to remain unchanged.

- Rate decision in Japan: Thursday. The Bank of Japan kept its record stimulus measures to increase the monetary base at an annual pace of 60 trillion yen to 70 trillion yen, after weak releases of production and export data. Exports weakened in June as well as retail sales. Japan’s economy shrank at an annual pace of 6.8% in the second quarter due to by a sales tax hike introduced in April and GDP contracted 1.7% from the first quarter.

- Rate decision in the UK: Thursday, 11:00. Bank of England policymakers decided to leave interest rates at 0.5% in their August meeting, however, for the first time in three years, two members unexpectedly voted to tighten policy and raise interest rates to 0.75%. The BoE lowered its forecasts for wage growth for 2014 saying it did not want to raise rates until stronger wage rises occur despite a decline in the unemployment rate which may lead to wage growth. Most of the MPC members said the inflation outlook was too weak to justify a rate hike despite a positive growth rate forecast in 2014.No change is expected now.

- Rate decision in the Eurozone: Thursday 11:45, press conference at 12:30. Mario Draghi dropped the bomb in Jackson Hole, by acknowledging that low inflation is not only temporary, and that inflation expectations are falling. This raises expectations for action in September’s meeting. However, Draghi is likely to look for a wider consensus, especially from his German colleagues. In addition, the TLTROs come into effect this month, and this could lead the governing council to wait. The not too horrible inflation numbers are also a reason to wait now. Nevertheless, we can expect heavier hints about QE and more pressure to keep the euro down, if not even lower. Some also expect another rate cut, but this is unlikely now. Draghi’s words are set to rock the markets.

- US ADP Non-Farm Employment Change: Thursday, 12:15. U.S. employers hired 218,000 workers in July, posting the fourth months of private job growth beyond 200,000. However July’s reading was lower than the 234,000 reading anticipated by analysts and considerable bellow June’s rise of 281,000. Economists believe the economy will return to full employment by late 2016 if the pace of growth continues. Jobs in professional and business services increased by 61,000 in July, down from 79,000 in June, while positions in the trade, transportation and utilities category grew by 52,000 versus 56,000 in June. An addition of 216,000 jobs is expected now.

- US Trade Balance: Thursday, 12:30. The U.S. trade deficit narrowed in June to its lowest level since January contracting to a seasonally adjusted $41.5 billion, from $44.7 billion in May. The improvement occurred due to a fall in imports, led by lower shipments of cellphones, petroleum, and cars. Exports climbed 0.1% to $195.9 billion, a record high. While imports fell 1.2%, the most in a year, to $237.4 billion. The unexpected drop implies that growth was stronger in the second quarter than initially estimated. Americans are buying more U.S. products, increasing economic expansion. The economy grew at a 4% annual rate in the second quarter, but this estimate included higher trade deficit than was eventually registered in June. The U.S. trade deficit is expected to reach 42.5.

- US Unemployment Claims: Thursday, 12:30. The number of Americans applying for unemployment benefits declined by 1,000 last week to a seasonally adjusted 298,000, indicating fewer layoffs and strong hiring. The four-week average, a less volatile measure, fell to 299,750. Employers are more confident in the economy therefore reduce dismissals. Employers added an average of 230,000 jobs a month this year, above the average of 195,000 in 2013. Average job gains since February have been the best in eight years. The number of jobless claims is expected tro increase by 298,000 this week.

- US ISM Non-Manufacturing PMI: Thursday, 14:00. Service sector activity in the U.S. soared in July to 58.7 from a reading of 56.0 in June, rising at the fastest rate in more than three years. The reading was better than the 56.6 estimated by analysts, suggesting a growth trend in the US economy and a positive outlook for the coming months. The Non-Manufacturing Business Activity Index climbed to 62.4, from 57.5 posted in June, The New Orders Index registered 64.9, from 61.2 registered in June. The Employment Index edged up 1.6 points to 56 from the June reading of 54.4 and indicates growth for the fifth consecutive month. Service sector activity is expected to decline to 57.3.

- Canadian employment data: Friday, 12:30. Canadian job market rebounded in July with a 42,000 job increase, following a 10,000 decline in the previous month. The reading nearly doubled estimates for a 25,400 job addition. July’s labor market figures were distorted by an “isolated incident” due to “human error” at Statistics Canada. Meanwhile, the unemployment rate declined to 7% in July, from 7.1% reading in the previous month. Canada’s workforce is expected to expand by 10,300 positions while the unemployment rate is predicted to remain at 7%.

- US Non-Farm Payrolls and Unemployment rate: Friday, 12:30. US nonfarm payrolls edged up 209,000 in July after an upwardly revised increase of 298K in June. The reading was worse than the 231,000 rise projected by analysts. However job growth remained above 200,000 in the last six months. The unemployment rate edged up to 6.2% from 6.1% a month earlier, due to an increase in the labor force. US nonfarm payrolls is expected to gain 222,000 jobs while the unemployment rate is expected to decline to 6.1%.

D1 price is on primary bearish with secondary rally for trying to break trend line for the rally to be finished.

W1 price was on ranging market condition between 0.9503 resistance and 0.9235 support levels.

H4 price is secondary ranging within primary bullish - the price is floating between 0.9364 resistance and 0.9331 support levels.

If

D1 price will break 0.9373 resistance level for the rally to be continuing so it may indicate the possible reversal of the price movement from bearish to primary bullish on D1 timeframe.

If not so we may see the ranging market condition within primary bearish.

- Recommendation for long: watch D1 price for breaking 0.9373 resistance level on close bar for possible buy trade

- Recommendation to go short: n/a

- Trading Summary: bearish

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2014-08-31 23:30 GMT (or 01:30 MQ MT5 time) | [EUR - AIG Manufacturing Index]

2014-09-01 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Manufacturing PMI]

2014-09-01 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Company Operating Profits]

2014-09-01 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Final Manufacturing PMI]

2014-09-01 06:30 GMT (or 08:30 MQ MT5 time) | [AUD - Commodity Prices]

2014-09-01 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Building Approvals]

2014-09-01 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Current Account]

2014-09-02 04:30 GMT (or 06:30 MQ MT5 time) | [AUD - Cash Rate]

2014-09-02 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2014-09-03 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Non-Manufacturing PMI]

2014-09-03 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - GDP]

2014-09-03 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Services PMI]

2014-09-03 03:20 GMT (or 05:20 MQ MT5 time) | [AUD - RBA Gov Stevens Speech]

2014-09-04 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Retail Sales]

2014-09-04 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Trade Balance]

2014-09-04 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

2014-09-05 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movement| Resistance | Support |

|---|---|

| 0.9364 | 0.9331 |

| 0.9373 | 0.9271 |

| 0.9503 | 0.9235 |

SUMMARY : bearish

TREND : ranging

I'm looking to buy AUD/USD after the correction

it's now going down but it in strong up trend

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.01 06:36

2014-09-01 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Manufacturing PMI]- past data is 51.7

- forecast data is 51.2

- actual data is 51.1 according to the latest press release

if actual > forecast = good for currency (for CNY in our case)

[CNY - Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

==========

China August Manufacturing PMI Revised Down

China's manufacturing sector expanded at a slower than expected rate in August, less than the flash estimate, latest results of a survey by Markit Economics and HSBC Bank showed Monday.

The HSBC manufacturing purchasing managers' index came in at 50.2 in August. This was less than the 50.3 flash reading and the 51.7 score in July. Economists had expected the final index to remain at 50.3.

This marked the weakest rate of expansion in three months. A reading above 50 signals expansion.

Manufacturing output and new orders grew at a slower rate in August, after the 16-month high in July.

Meanwhile, employment levels continued to decline as the rate of job shedding accelerated to the fastest in three months. This marked the tenth consecutive month of drop in employment.

On the prices front, input costs fell in August, though at a slow rate. Output costs also decreased marginally.

Earlier, the official manufacturing PMI from China came in at 51.1 in August, less than the 51.7 reading in July. Economists had expected the index to fall to 51.2.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 7 pips price movement by CNY - Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.01 09:58

2014-09-01 06:30 GMT (or 08:30 MQ MT5 time) | [AUD - Commodity Prices]- past data is -13.8%

- forecast data is 51.2

- actual data is -11.5% according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

[AUD - Commodity Prices] = Change in the selling price of exported commodities. It's a leading indicator of the nation's trade balance with other countries because rising commodity prices boost export incomeю

==========

Preliminary estimates for August indicate that the index rose by

1.6 per cent (on a monthly average basis) in SDR terms, after declining

by 1.3 per cent in July (revised). The largest contributor to the

increase in August was the price of iron ore. The base metals subindex

rose in the month while the rural commodities subindex declined. In

Australian dollar terms, the index increased by 1.5 per cent in August.

Over the past year, the index has declined by 11.5 per cent in SDR terms, largely driven by declines in the prices of bulk commodities. The index has declined by 13.6 per cent in Australian dollar terms over the past year.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 11 pips price movement by AUD - Commodity Prices news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.01 19:23

AUD/USD: bearish long term outlook

AUD/USD is trading at 0.9343, up 0.03% on the day, having posted a daily high at 0.9354 and low at 0.9324.

AUD/USD

has been quite resilient of late, how every, while official Capex data

should bolster the mood of the policy makers, Jane Foley Senior Currency

Strategist at Rabobank suggested that it is clear that headwinds still

cloud the outlook and this suggests risk that the RBA

could again attempt to jawbone the AUD to lower levels. “That said, the

AUD is still seen as offering positive carry and we expect that this

will limit downside potential in AUD/USD near-term. Over the coming 3

mth we expect the AUD/USD 0.92 to 0.93 to contain most activity. On a

12 mth view, we look for a move towards 0.86. This assumes a broad

based recovery for the USD as the first hike in the Fed funds rate

near”.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.02 17:51

2014-09-02 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]- past data is 57.1

- forecast data is 56.8

- actual data is 59.0 according to the latest press release

if actual > forecast = good for currency (for USD in our case)

[USD - ISM Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

==========

U.S. Manufacturing Index Unexpectedly Climbs To Three-Year High In August

Activity in the U.S. manufacturing sector unexpectedly grew at an accelerated rate in the month of August, according to a report released by the Institute for Supply Management on Tuesday, with the index of activity in the sector climbing to a three-year high.

The ISM said its purchasing managers index climbed to 59.0 in August from 57.1 in July, with a reading above 50 indicating growth in the manufacturing sector.

The increase by the manufacturing index came as a surprise to economists, who had expected the index to edge down to 56.8.

With the unexpected increase, the ISM said the manufacturing index rose to its highest level since reaching 59.1 in March of 2011.

The unexpected increase by the headline index was partly due notably faster growth in new orders, as the new orders index climbed to 66.7 in August from 63.4 in July.

The production index also advanced to 64.5 in August from 61.2 in July, while the backlog of orders index rose to 52.5 from 49.5.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 20 pips price movement by USD - ISM Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.03 07:23

2014-09-03 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - GDP]- past data is 1.1%

- forecast data is 0.4%

- actual data is 0.5% according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

[AUD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy. It's the broadest measure of economic activity and the primary gauge of the economy's health.

==========

Australia GDP Expands 0.5% In Q2

Australia's gross domestic product climbed a seasonally adjusted 0.5 percent on quarter in the second quarter of 2014, the Australian Bureau of Statistics said on Wednesday.

That beat forecasts for an increase of 0.4 percent following the 1.1 percent gain in the previous three months.

The terms of trade fell 4.1 percent on quarter, while real gross domestic income decreased 0.3 percent.

The contributors to the increase in expenditure on GDP were changes in inventories (0.9 percentage points), final consumption expenditure (0.3 percentage points) and private gross fixed capital formation (0.3 percentage points).

The main detractors were net exports (-0.9 percentage points) and public gross fixed capital formation (-0.2 percentage points).

The main contributors to GDP growth were manufacturing (up 2.1 percent), construction (up 1.4 percent) and accommodation and food services (up 4.5 percent) each contributing 0.1 percentage points to the increase in GDP.

The main detractor was mining (down 1.4 percent) detracting 0.2 percentage points from growth in GDP.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 23 pips price movement by AUD - GDP news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.04 06:45

2014-09-04 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Trade Balance]- past data is -1.56B

- forecast data is -1.77B

- actual data is -1.36B according to the latest press release

if actual > forecast = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month. Export demand and currency demand are directly linked because foreigners must buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers.

==========

Australia Has A$1.359 Billion Trade Deficit

Australia posted a seasonally adjusted merchandise trade deficit of A$1.359 billion in July, the Australian Bureau of Statistics said on Thursday.

That topped forecasts for a shortfall of A$1.750 billion following the upwardly revised A$1.564 billion deficit in June (originally A$-1.683 billion).

Exports were up 1.0 percent on month or A$280 million to A$27.022 billion.

Non-monetary gold surged A$150 million (14 percent), while rural goods climbed A$75 million (2 percent), non-rural goods added A$44 million and net exports of goods under merchanting gained A$1 million (100 percent).

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 11 pips price movement by AUD - Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.08.30 15:22

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: Neutral- AUDUSD Remains Resilient In The Face Of Geopolitical Turmoil

- String of Major Domestic Economic Events On The Radar This Week

- Range May Remain In Play If Fresh Data Fails To Shift RBA Policy Bets

The Australian Dollar faced heavy selling pressure last week, with

prices dropping through the bottom of a range that contained price

action since the beginning of June. The force behind the move lower

came from external factors: an impressively strong second-quarter US

GDP figure and an easing of the FOMC’s concern about persistently low

inflation hinted Janet Yellen and company may move swiftly to raise

rates after the QE3 asset purchase program is wound down in October.

The recovery may prove short-lived however as domestic factors return

to the spotlight. The RBA monetary policy announcement seemingly ought

to take top billing, but officials are unlikely to offer up anything

unheard of in recent months. Another restatement of the commitment to

hold rates unchanged for the foreseeable future may force a pause in

the Aussie’s recovery, but the likelihood of another strong push lower

will probably hinge on July’s employment figures. A net jobs gain of

13,200 is expected, marking a slowdown from the previous month’s 15,900

increase. Furthermore, Australian economic data has increasingly

underperformed relative to consensus forecasts since mid-April, opening

the door for a downside surprise. Such a result is likely to extend

the perceived length of the standstill on the monetary policy front,

undermining yield-based support for the Aussie and forcing prices lower

in earnest.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.04 17:13

2014-09-04 12:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]- past data is 212K

- forecast data is 218K

- actual data is 204K according to the latest press release

if actual > forecast = good for currency (for USD in our case)

[USD - ADP Non-Farm Employment Change] = Estimated change in the number of employed people during the previous month, excluding the farming industry and government. Job creation is an important leading indicator of consumer spending, which accounts for a majority of overall economic activity.

==========

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 30 pips price movement by USD - ADP Non-Farm Employment Change news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bearish with secondary rally for trying to break trend line for the rally to be finished.

W1 price was on ranging market condition between 0.9503 resistance and 0.9235 support levels.

H4 price is secondary ranging within primary bullish - the price is floating between 0.9364 resistance and 0.9331 support levels.

If D1 price will break 0.9373 resistance level for the rally to be continuing so it may indicate the possible reversal of the price movement from bearish to primary bullish on D1 timeframe.

If not so we may see the ranging market condition within primary bearish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2014-08-31 23:30 GMT (or 01:30 MQ MT5 time) | [EUR - AIG Manufacturing Index]

2014-09-01 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Manufacturing PMI]

2014-09-01 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Company Operating Profits]

2014-09-01 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Final Manufacturing PMI]

2014-09-01 06:30 GMT (or 08:30 MQ MT5 time) | [AUD - Commodity Prices]

2014-09-01 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Building Approvals]

2014-09-01 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Current Account]

2014-09-02 04:30 GMT (or 06:30 MQ MT5 time) | [AUD - Cash Rate]

2014-09-02 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2014-09-03 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Non-Manufacturing PMI]

2014-09-03 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - GDP]

2014-09-03 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Services PMI]

2014-09-03 03:20 GMT (or 05:20 MQ MT5 time) | [AUD - RBA Gov Stevens Speech]

2014-09-04 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Retail Sales]

2014-09-04 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Trade Balance]

2014-09-04 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

2014-09-05 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movementSUMMARY : bearish

TREND : ranging

Intraday Chart